(Premium) Consumer Staples Sector Deep Dive – August

Stocks are in the midst of their largest selloff since March, so you might expect to see risk-off sectors catching a bid. Unfortunately, they aren’t getting much of one at all.

The Consumer Staples entered the month near the high end of a two-year trading range, but now they find themselves back below a 200-day moving average price and knocking on the door of two-month lows.

On a relative basis, the sector has been somewhat less-bad than the S&P 500 index, which has been weighed down in August by a steep selloff in growth sectors. But the rally for Staples hasn’t been enough to alter a downtrend that began with a failed breakout at the start of the year. The group is still down near multi-year relative lows.

Given how weak the Staples have been in 2023, it should come as no surprise that more than 80% of the stocks in the sector are below a 200-day moving average when compared to the benchmark S&P 500. In other words, buying most stocks in the sector is making a bet against the underlying trend.

The S&P 500 was at new one-year highs just a week ago. Meanwhile stocks like Walgreens, Conagra, and Estee Lauder all closed at multi-year lows yesterday. We don’t need to wrap words around these charts. They speak for themselves:

Perhaps more disappointing than the declines in some of the weakest names in the sector is the inability of the strongest names to continue rising.

Hershey Company showed relative strength all throughout 2022 and through the first 4 months of 2023. But what began as a pullback to former resistance has turned into a break of support and a drop below the long-term moving average. HSY is a no-touch until it can get back above $240.

After breaking out of a 3-year consolidation pattern, Lamb Weston found resistance at the 138.2% retracement from the 2020 decline. For a brief moment on the morning of July 25, it looked as though LW would surpass that tough area of overhead supply. Instead, the stock ended the day 10% off its highs, and it’s continued lower ever since. Yesterday, it closed below support from the 2020 peak – that’s not something you’d expect to see from a former leader.

Only a handful of uptrends remain. Molson Coors is one, after it broke to multi-year highs this summer. Even though prices have pulled back along with the rest of the market, TAP is still above the former resistance area.

What really catches our eye from Molson Coors is its attempt to complete a bearish-to-bullish reversal on a relative basis. TAP steadily lagged the SPX from 2016 through the end of 2020. Then it spent the next two years basing, before finally gaining some momentum this spring. We want to see this bout of relative strength continue, though given the relative weakness we’ve seen in the rest of the sector, we’re wary of a failed move. For the stock, we want to be cautiously buying this pullback towards $60, with a target of $78. If TAP is below $60 or if the ratio below fails to hold, though, it’s better left alone.

A few names are worth keeping an eye on.

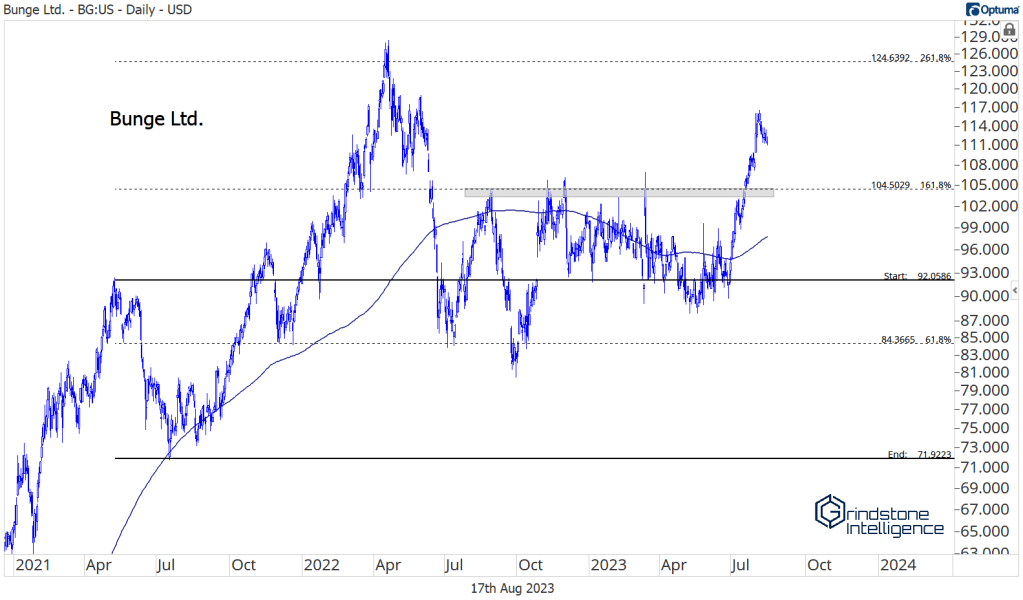

We got our breakout in Bunge shortly after last month’s note. The risk/reward setup isn’t great right now, but we can be buying pullbacks toward $105 with a target of $125.

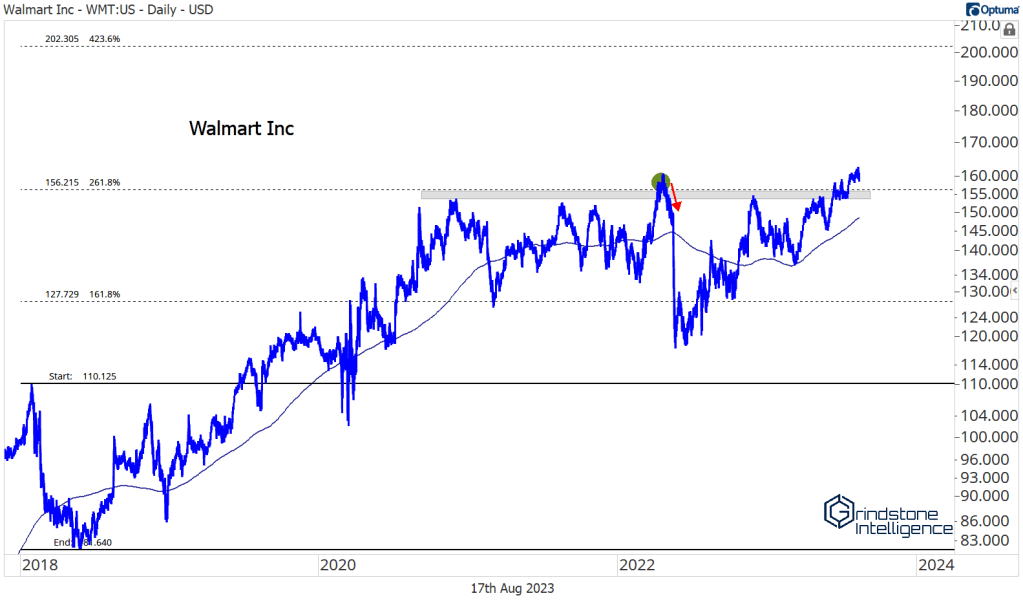

Walmart just broke out to all-time highs after absorbing supply from the top end of this three-year consolidation range. We want to be long with a target of $200, but only if WMT continues to stay above $156.

Similarly, we’ve got a great setup in Costco as it tries to break out to new 52-week highs. We want to buy a move above $570 with an initial target of $630. Longer-term, though, we think it can go all the way to $725.

What we like most about Costco is how it looks on a relative basis. Check out this bullish resolution we’ve gotten over the last few days.

That breakout could be the start of another big leg higher – Costco has outperformed the benchmark by 4x over the last 20 years.

The post (Premium) Consumer Staples Sector Deep Dive – August first appeared on Grindstone Intelligence.