(Premium) Consumer Staples Sector Deep Dive – July

It seems like an eternity ago, but Consumer Staples were the belle of the ball in December 2022. The sector was breaking out to 30-month highs relative the rest of the S&P 500, and that reign looked set to continue with a presumed recession on the horizon.

Then came January.

That breakout became a failed move, which sparked a steep selloff and, ultimately, a full-fledged trend reversal. Now Consumer Staples is at multi-year relative lows.

To be clear, Staples underperforming is a good thing for stocks. Consider the types of companies in the sector and the products they’re selling. Groceries, toothpaste, toilet paper, cigarettes, pet food, beer. If you’re buying those things, are you really going to buy a great deal less of them if the economic outlook darkens? Or if things brighten up and you get a raise, are you going to buy a bunch more? Probably not. Consumer Staples are the things you ‘need’, not the things you ‘want’.

The things you ‘want’ are in the Consumer Discretionary sector. A new car. A hotel stay while on vacation. A dinner away from home. A new riding mower or a grill for the backyard. Those are the types of purchases you pull back on when you’re uncertain about the future, and the things you splurge on after a bonus check.

Because there’s such a stark contrast between the types of companies in each sector, comparing the performance of Staples to Discretionary gives us insight into how investors view risk. When Staples outperform, it’s evidence of risk aversion, and vice versa. And when we compare that ratio to the S&P 500 index, the relationship is clear: Underperforming Staples are consistent with a bull market in stocks.

With that in mind, we want to be focused on looking for stocks to buy, not wasting time looking for ones to short. Prices tend to rise during bull markets. Don’t fight it.

Since Staples are lagging, though, we need to be very selective with the stocks we’re buying. There’s opportunity cost in holding a stock even when it’s rising if our benchmarks are rising faster.

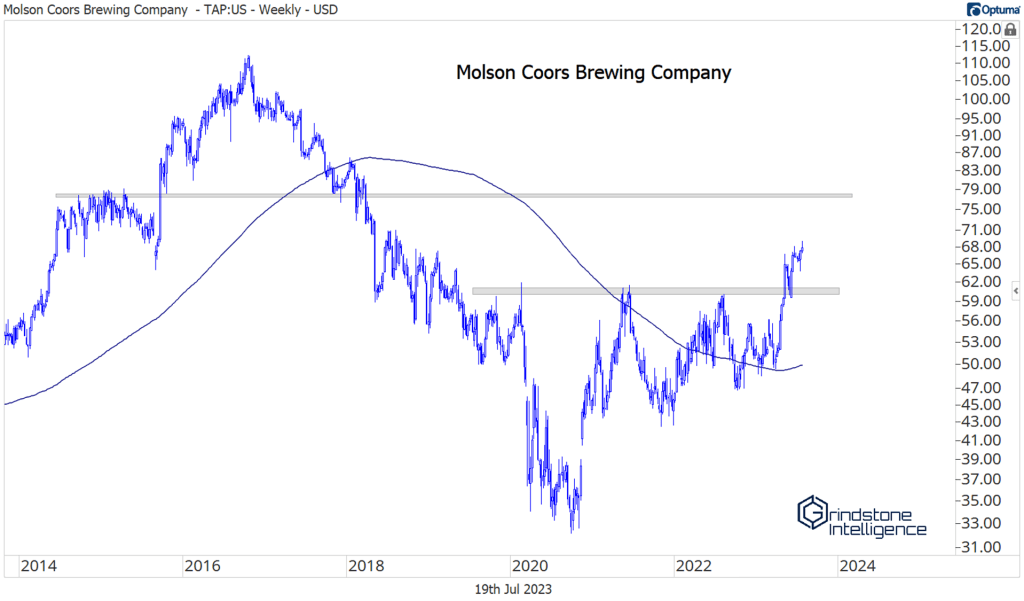

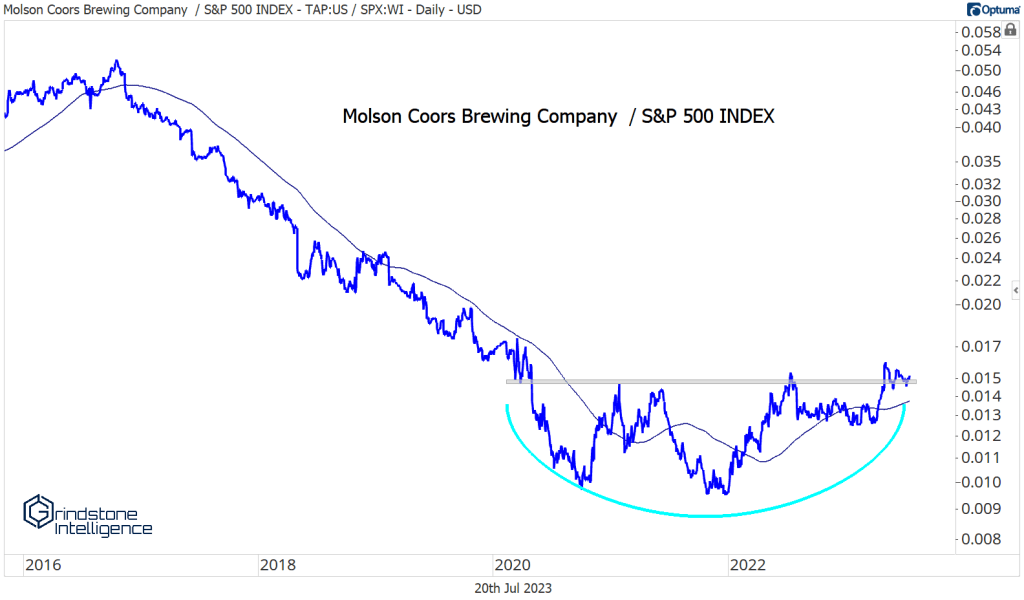

Molson Coors is one that’s on our radar. It just broke to new multi-year highs, completing a bearish-to-bullish trend reversal.

What’s more impressive is the reversal on a relative basis. TAP steadily lagged the SPX from 2016 through the end of 2020. Then it spent the next two years basing, before finally gaining some momentum this spring. With the stock showing real relative strength for the first time in nearly a decade, we’re setting an initial target of $78, with the idea that it could challenge those 2016 highs longer-term.

Lamb Weston is halfway to our target near $128, which is the 161.8% retracement from the COVID decline. It’s found some resistance here at the 138.2% retracement, but so far hasn’t violated any prior lows. This is what relative strength looks like. When the rest of Consumer Staples stopped going up last November, LW kept trending higher.

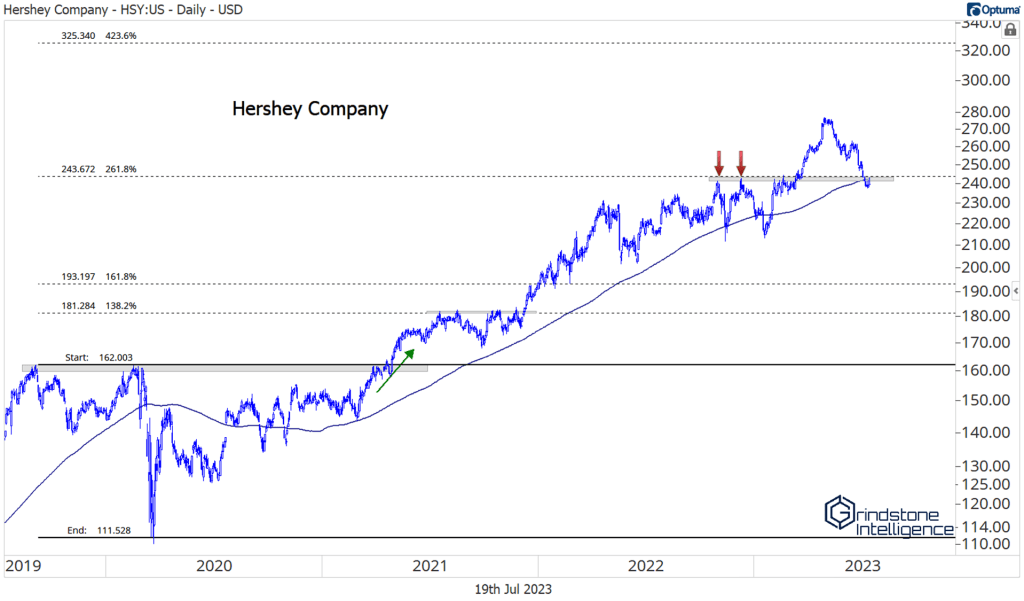

Hershey has pulled all the way back to the breakout point. The stock has shown almost unparalleled relative strength over the last few years, so we shouldn’t give up on it completely just because it’s pulled back from the highs. If anything, we should applaud the improved risk-reward proposition we’ve been given. That said, we don’t want to own HSY if it falls below $240. Barring a breakdown, we think it can go to $325, which is the 423.6% retracement from the COVID decline.

We’re eying a potential breakout in Bunge Ltd. We don’t have a clue how Bunge makes money, but we do know they’re on the verge of setting new 52-week highs after spending the last 2 years digesting a 300% rally from the COVID lows.

Walmart is a no-touch below $156, as it continues to try and absorb supply from the top end of this three-year consolidation range. A breakout from here would be very bullish, however, and we’d want to be long with a target of $200.

Keep in mind, though: most of the sector, is destined to underperform for as long as the bull market lasts. There may be periods lasting weeks, or even months, where the sector stages a rally, but betting on Staples for anything more than a mean reversion is betting against historical relationships.

The post (Premium) Consumer Staples Sector Deep Dive – July first appeared on Grindstone Intelligence.