(Premium) Consumer Staples Sector Deep Dive – October

Most of the market is off to a strong start in October. Just not the Consumer Staples sector.

Since the S&P 500 bottomed on October 3, it’s risen 3.5%. Over that time 10 of the index’s 11 sectors are up at least 2.4% from their respective lows. Consumer Staples meanwhile, has risen just 0.5%.

And if today’s trading holds, the sector will touch a new year-to-date low.

It’s a disappointing move considering the strong seasonal tailwinds for Staples. October has been the single best month of the year, with gains for the month averaging 2.5% since 1990. This year, they’re on pace to fall 2.5%.

That relative weakness keeps the Staples firmly trapped in the Lagging quadrant of the weekly Relative Rotation Graph. They’ve been unable to sustain rallies, and last year’s leading action seems a distant memory.

If the sector is going to stage a rally, this is a logical place to do it. On a relative basis, Staples are nearing the lows they set back at the end of 2021. Last time we were here, we saw Staples outperform the S&P 500 by 30% over the next 12 months.

And on an absolute basis, the setup is just as clean. The sector is down at last year’s October lows, which were also an important area of resistance in late 2020. What better place for the buyers to step in and stage a comeback rally?

But if they can’t? That might say more about the environment we’re in than it does about the Consumer Staples. Staples are supposed to lag during bull markets. We’ve said that time and again. But lagging a rising market is quite different than falling to multi-year lows.

Bears certainly have the upper hand right now. Uptrend breadth within the Consumer Staples sector couldn’t be much weaker. 97% of its members are in short-term technical downtrends, and 80% are below falling long-term moving averages.

What’s more, nearly half of the sector set new 52-week lows last week – that’s far worse than anything we’ve seen since the COVID lows.

The first step of a sector-level rally will be for its members to start showing signs of stabilization. So far, we haven’t gotten it.

Digging Deeper

The downside leadership within the Consumer Staples isn’t hard to find. The Personal Care Products sub-industry is down 48% for the year. Estee Lauder is the culprit here, as its dropped 60% from its 2022 peak. Like the sector overall, though, EL is at a logical area of support: its COVID lows. Momentum is showing some minor improvement, too.

More impressive is the momentum divergence for EL when compared to the rest of the Consumer Staples sector. That ratio dropped to multi-year lows at the end of September, but momentum managed to stay out of oversold territory on the decline.

We need to see prices confirm these momentum improvements first and foremost. But we think Estee Lauder is a prime candidate for mean reversion, one that could have it back to $170 in a hurry. We’re only interested if it’s above the 2020 lows.

Leaders

We generally try to avoid buy ideas for stocks that are in protracted downtrends, but if we did that today, we’d have very little to talk about. So check out Walgreens. We pointed out that the stock was nearing a potential area of support in last month’s sector note, and we were ‘rewarded’ with a 3.2% rally since over the last 4 weeks. Still, that was enough to top the leaderboard over that timeframe. We still think this is one worth watching, if only for a mean reversion opportunity. Our risk is clearly defined at $21, and a rally back to the recent breakdown level near $29 isn’t out of the question.

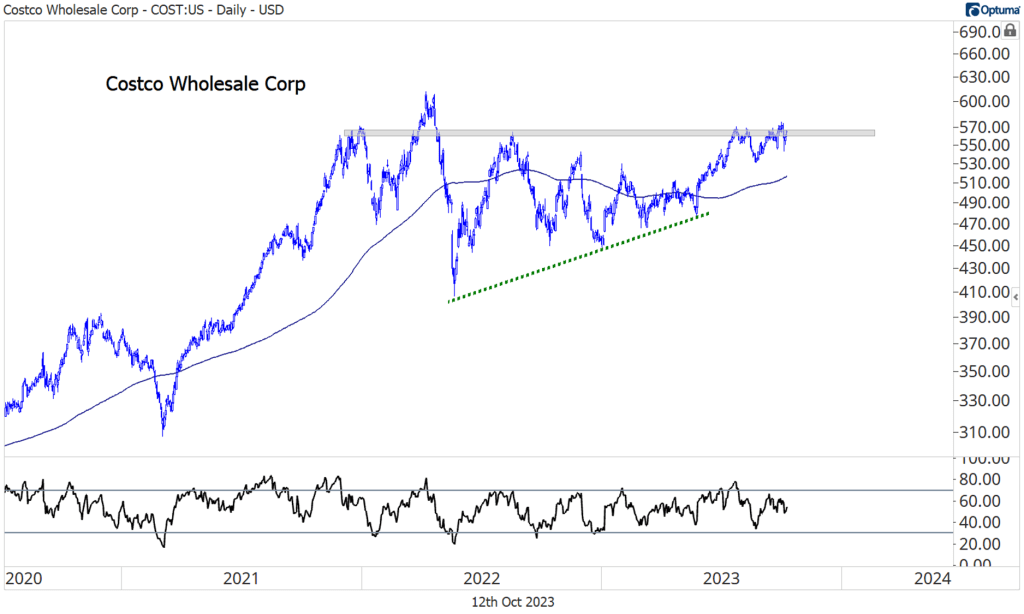

Costco continues to be one of our favorites. It’s weathered the recent storm and sits on the cusp of a huge breakout. This resistance area near $575 is the level. We can’t be anything but positive on Costco above that.

We already got the relative breakout. Compared to the rest of the sector, Costco just resolved higher from an 18-month consolidation.

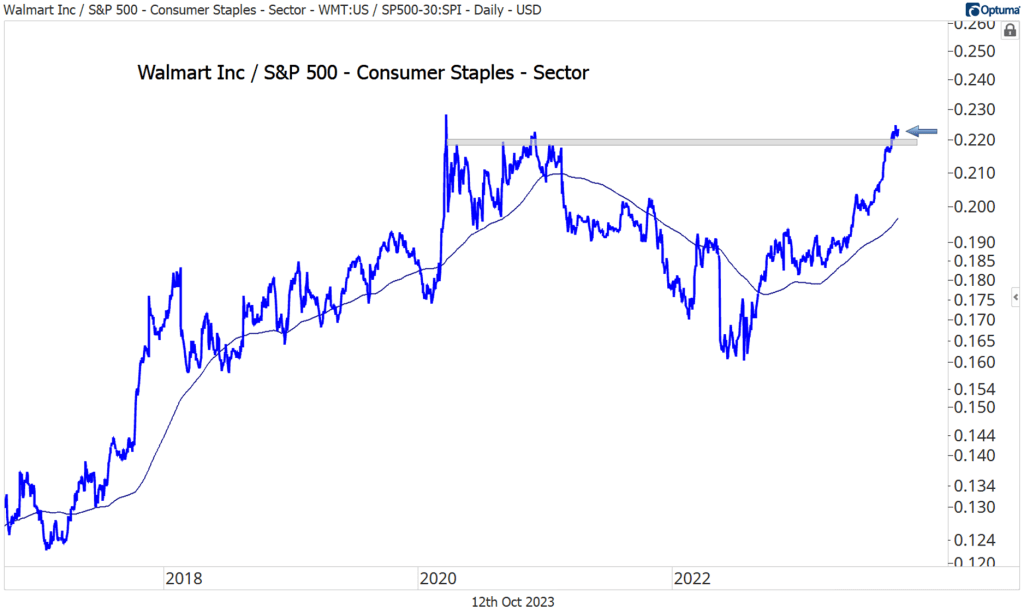

Walmart is trying to do the same. It hasn’t gone anywhere vs. the sector since early 2020.

On an absolute basis, though, we’ve already gotten the breakout. There’s no reason not to like this one if it’s above $155, and we’ve set our sights on $200, which is the 423.6% retracement from the sharp 2018 decline.

Losers

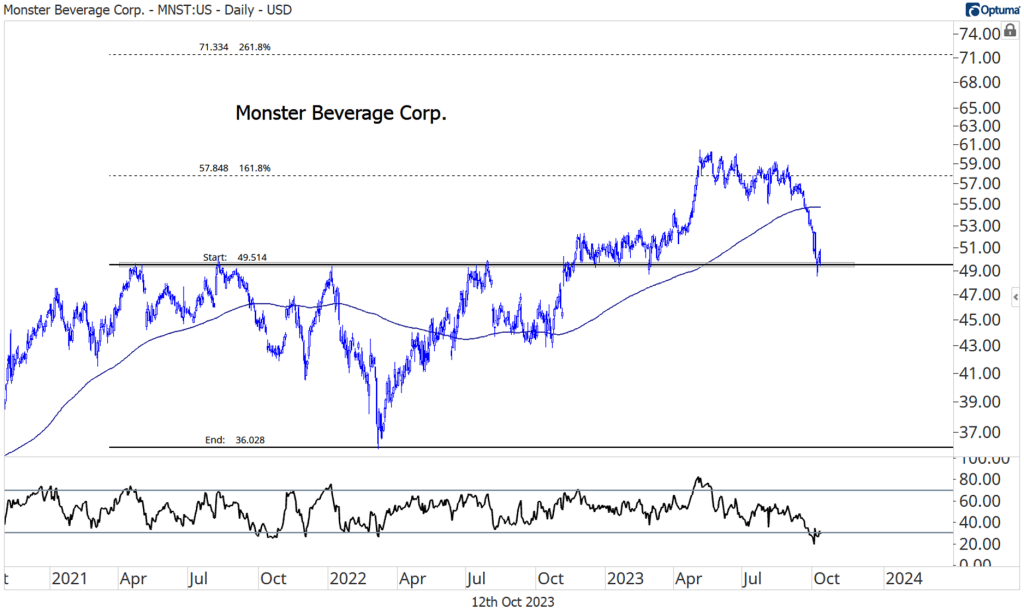

There are no shortage of new lows to choose from on the Losers list. Check out the ‘Yearly Range’ column in the table above. Most of the stocks on this list are at the bottom of their 52-week range. The two positive standouts are Monster Beverage and Mondelez.

For Monster, we like the clean risk-reward setup here. We can buy the stock above $50 with an initial target of $58, back near the highs. Longer-term, we think MNST can go to $70. Right now, though, we can only be long if it’s still above this key level of former resistance.

Mondelez, despite its somewhat superior year-to-date performance, is best left alone. We’ve liked this one in the past, primarily because of this multi-year relative breakout:

But now that MDLZ is back below those former relative highs, there’s no reason to expect outperformance in the near-term.

Growth Outlook

Consumer Staples revenue growth over 2024 and 2025 is expected to outpace just 3 other S&P 500 sectors: Utilities, Energy, and Materials. Barring an unexpected margin boost, that means the Staples will likely grow their bottom line at a below-benchmark rate over that period, too.

The sales slowdown comes after 3 banner years to start the 2020s, where revenue growth averaged 9.5%. That nearly tripled the average of the prior decade.

Pricing power was the primary driver of sales growth over that time, as companies reported low price elasticity in the era of excess savings and high economy-wide inflation. Those dynamics are fading, though, which analysts believe will result in more normal sales growth over the next two years.

The post (Premium) Consumer Staples Sector Deep Dive – October first appeared on Grindstone Intelligence.