(Premium) Consumer Staples Sector Update – June

If a bear market is defined as a 20% drawdown, then the Consumer Staples sector managed to avoid the bear entirely in 2022. While the S&P 500 peaked in January of last year before embarking on a steep 25% decline, the Staples managed to keep climbing until April. They were also leaders out of the October lows, climbing 15% by the end of November and getting within 5% of new all-time highs. The S&P 500, for context, still hasn’t gotten that close to its own former highs.

Since that November peak, though, Staples have been completely left behind by the rally. The sector isn’t in a downtrend – it’s above its 200-day average and has set two higher lows since the October bottom – but it’s not in an uptrend either. Their January 2022 highs have been stiff resistance for more than a year.

There’s no reason to have a strong opinion on the future direction of the Staples. What we do know is that they’re in a relative downtrend, and there are better places to invest. Compared to the S&P 500, the sector is at multi-year lows, and momentum is in a bearish range.

That isn’t necessarily a bad thing. Consumer Staples usually underperform during bull markets, and that’s a healthy indicator of risk appetite, which is what drives prices higher.

The equally weighted comparison tells us the same story. The ratio of EW Consumer Staples sector vs. EW S&P 500 index peaked in March 2020, at the same time stocks hit their COVID lows. Over the next 18 months, Staples underperformed as the broader market rallied. Then, the Staples began to lead again in the final month of 2021, setting the stage for last year’s bear market. And ever since last summer when the Russell 2000 troughed and value sectors began to find their footing, the ratio has been working on a reversal back lower.

So if we’re in a bull market for stocks, it’s not that we want to be shorting Consumer Staples. We just want to be very selective in which ones we’re buying, because we should expect the sector as a whole to lag.

Hershey is one that’s shown relative strength for a few years now, and it stands near the top of our list for the sector. Our target is the 423.6% retracement from the COVID decline, which is near $325. We’d change our view if the stock fell below $240, but for now, we view the recent pullback as an opportunity that offers better risk-reward than we’ve had since the initial breakout happened in March.

Lamb Weston is halfway to our target near $128, which is the 161.8% retracement from the COVID decline. This is what relative strength looks like. When the rest of Consumer Staples stopped going up last November, LW kept trending higher. And trends are more likely to continue than reverse.

Unfortunately, Lamb Weston doesn’t offer much in the way of risk-reward for a new position, since it’s risen so far above the initial breakout level. A more favorable setup can be found in Monster Beverage. This stock hit our target of $58 in April, and we wanted to see how it responded to potential resistance from the 161.8% retracement level. It’s been consolidating above that level, which we consider a healthy reaction. We can be long MNST above $57 with a target of $71.

Walmart is a no-touch below $156, as it continues to try and absorb supply from the top end of this three-year consolidation range. A breakout from here would be very bullish, though, and we’d want to be long with a target of $200.

Remember when we said we needed to be selective, though? We want to avoid the names that are breaking down and setting new lows. Campbell Soup is one. After being a leader last year and even setting new highs in December, it broke the uptrend line from its 2021 lows in May, and then proceeded to gap lower. We’re not in the business of catching falling can openers.

Dollar General, a recent Consumer Discretionary transplant, tried to set new highs of its own last year, but failed. It gapped lower on a disappointing earnings report last month and just hit multi-year lows.

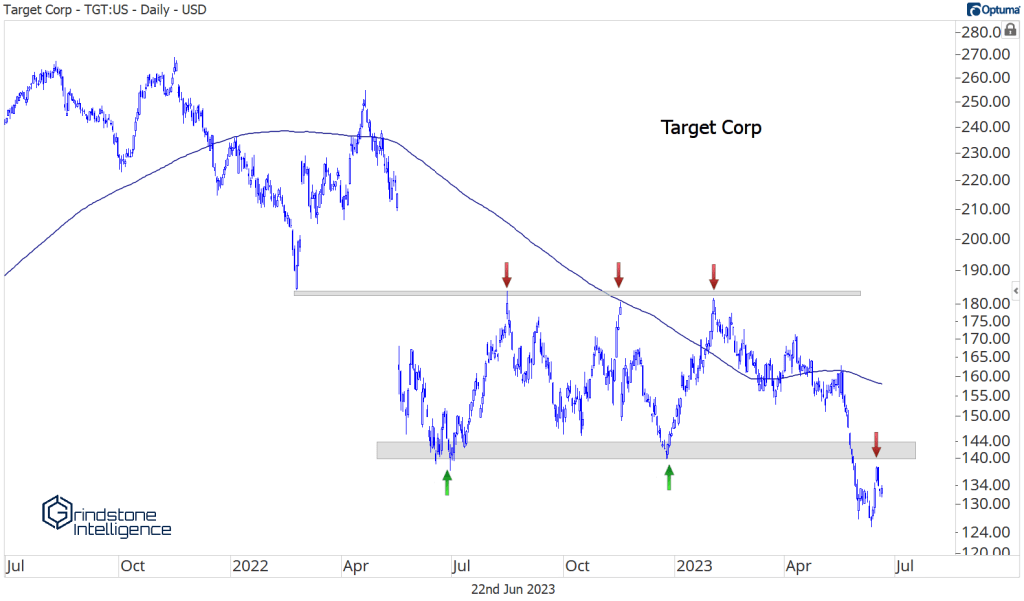

And Target has been declining for more than a year. The high end of last year’s range was a former low. The stock just broke down to new lows, and now its ceiling is the lows from last summer. This is a downtrend to avoid.

The post (Premium) Consumer Staples Sector Update – June first appeared on Grindstone Intelligence.