(Premium) Energy Sector Deep Dive – August

Is there a sector right now that’s stronger than Energy? It seems every single stock in the group is rising – and that’s because every one of them is.

Our favorite way to quickly identify uptrends and downtrends is to compare a stock’s price to the level and slope of a moving average of trailing prices. If the current price is above a rising moving average, then that stock is in a technical uptrend. If a stock is trading below a falling moving average, it’s in a downtrend.

Right now, EVERY Energy stock in the S&P 500 is trading above a rising 50-day and a rising 100-day moving average. No other sector comes even close to matching that strength.

What makes Energy’s rebound so remarkable is that it was among the weakest sectors for the first half of the year. At the end of June, Energy’s 4% year-to-date decline was better only than the 7% drop in Utilities. But an S&P 500-leading 9% gain for the group since then has helped repair even long-term trends. Eighty-seven percent of Energy stocks are above their 200-day moving average, a number that again tops every other sector in the benchmark index.

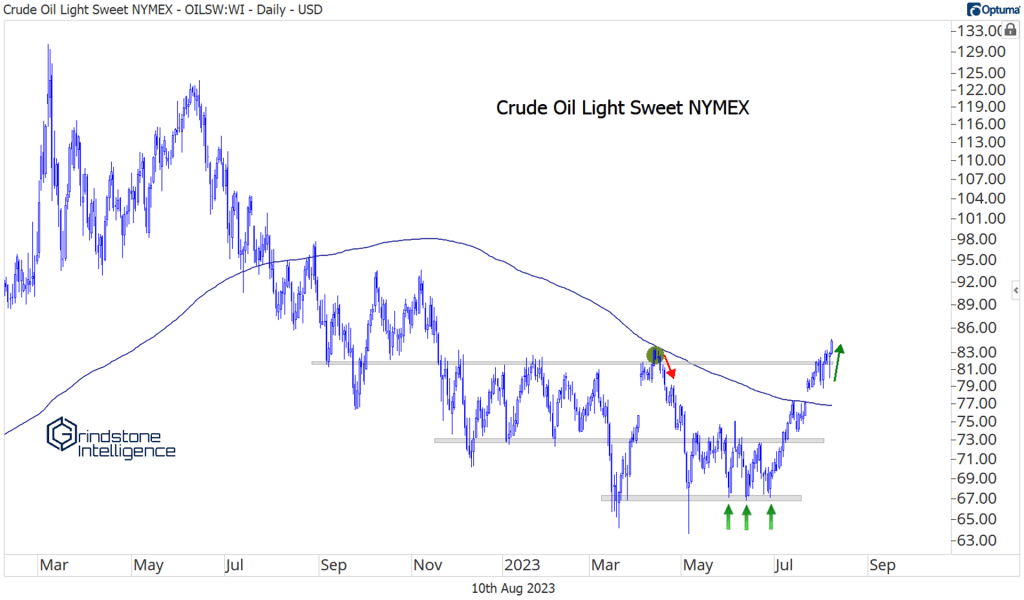

Thank a rebound in commodity prices for the rapid turnaround. We’ve been monitoring the reversal in crude oil for a month, now. Here’s what we wrote in last month’s Energy sector update.

The bears fumbled their opportunity.

Crude oil was vulnerable below $73. It even dropped as low as $63 one morning, before buyers stepped in to defend it. Now, prices are back above the first key level of resistance. That doesn’t mean we want to be aggressively buying oil here – at least not until we get above $83 and really show signs that a new uptrend is in place – but we can have confidence that the immediate threat of lower oil prices is now in the rearview mirror.

Crude strength has only continued in the weeks since. It gapped above the 200-day moving average, and yesterday it closed at the highest level since last November.

Natural gas prices have surged, too, rising 20% over the last 5 days.

Commodity strength came at an opportune time for equity prices – right when Energy was testing a key level relative to the S&P 500 index. The ratio of Energy/SPX had retraced to a logical level of support: the site of the 2020 breakdown, which acted as initial resistance in 2022 and then support.

That prompted us to upgrade Energy from Underweight to Equalweight in the first week of July, and we’ve since raised our rating to Overweight.

We know we want to be looking for stocks to buy. The only question now is which ones we want to focus our attention on. Since every company in the sector is in an uptrend, we need to look at more than just absolute prices – we need to find relative strength.

The oil services stocks have been showing us that relative strength for months. Our favorite has been Schlumberger. Here it is trying to break out of a 4 year base relative to the rest of the sector.

Momentum for that ratio just hit the highest level since March 2000.

SLB is breaking out on an absolute basis, too. We’ve wanted to be long above the 2022 highs near $46 with a target of $80, and there’s no reason to change that now.

Peer Halliburton is another one to watch. Here it is over the really long term. Those highs from 2008-2018 are a magnet, and we think the stock tests those levels again.

Here’s a closer look at HAL. We only want to be long if it’s breaking out of this trading range above $43, but then we’re targeting $55, which is both the 161.8% retracement from last year’s decline and the long-term resistance level we saw in the chart above.

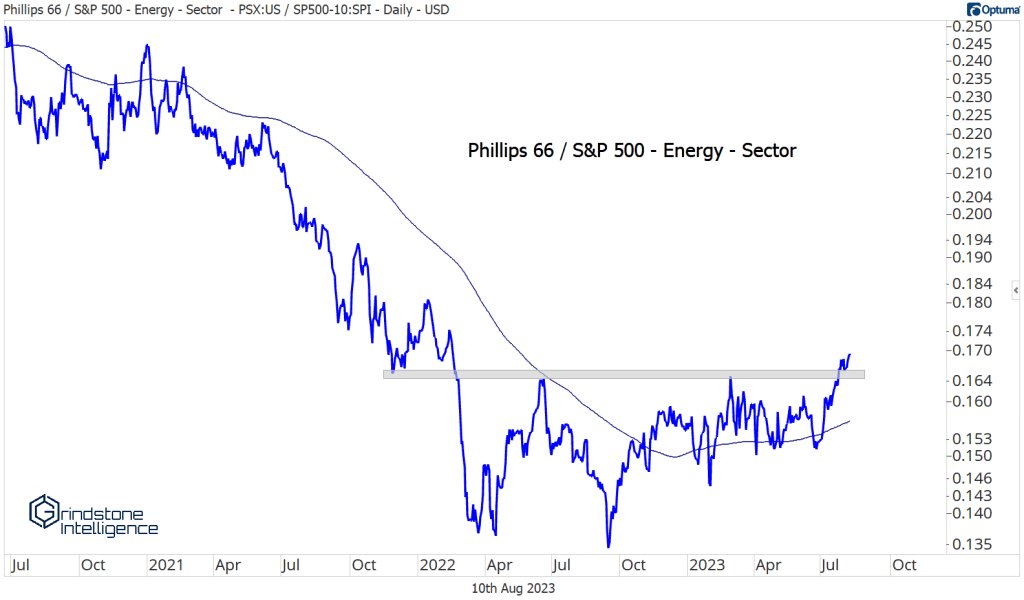

The refiners are also showing a ton of relative strength. Check out Phillips 66 completing a bearish-to-bullish reversal pattern relative to the rest of the Energy sector.

It just set multi-year highs on an absolute basis, too. We want to be buying PSX with a target of $150. It’ll have to absorb some potential resistance near $120 to get there, but after going nowhere for the last year, we think it’s built up enough to push through that level.

Fellow refiner Marathon Petroleum has been even stronger. MPC is at all time highs and we think it can go all the way to $200. Our risk level is the 161.8% retracement from the 2018-2020 decline, which is down near $130.

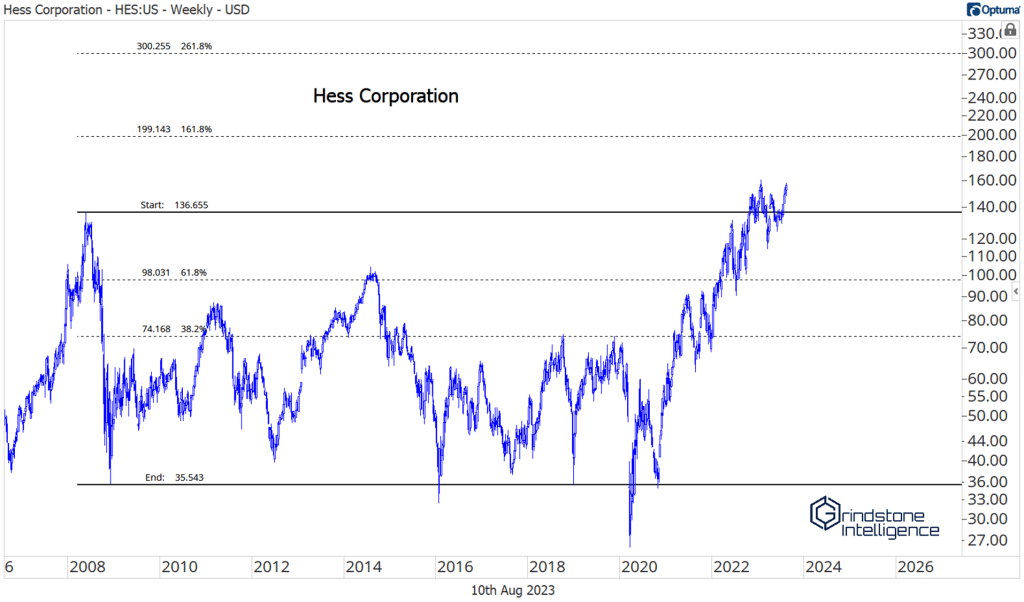

We also like Hess, which is setting new all-time highs relative to the Energy sector.

We only want to be long Hess if it’s above the 2008 highs. If it’s breaking below that level, it’s probably not an environment where we want to be buying any Energy stocks. Otherwise, though, we’re targeting $200, which is the 161.8% retracement from the 2008-2021 range.

We want to avoid owning the big integrated oil and gas companies. Check out Chevron. It’s setting new multi-year lows vs. the Energy sector.

It’s not so much that Chevron is going down, but the opportunity cost of owning stuff like this in lieu of some of the other names we’ve mentioned is huge.

The post (Premium) Energy Sector Deep Dive – August first appeared on Grindstone Intelligence.