(Premium) Energy Sector Deep Dive – October

Our downgrade of the Energy sector couldn’t have been more timely. It may turn out that our only mistake in doing so was that we downgraded the group just one notch, to Equalweight, instead of two. After our ratings update on Tuesday, Energy dropped more than 3% yesterday, even though the S&P 500 index closed higher.

A sharp reversal in crude oil is driving the recent spate of weakness. Prices were rejected at resistance from last fall’s swing highs, and now it looks like they’re set to backtest the summer breakout level near $82.

As long as support remains intact near that $82 level, it’s fair to characterize this weakness in crude as a pullback within an existing uptrend. However, a break below that level would signal that further weakness for commodity is ahead. For now, it’s best to take a wait and see approach.

The same goes for the Energy sector.

We downgraded the group after several months of outperformance that coincided with crude’s summer rally. Strength in September followed seasonal patterns, too: that month has historically been one of the best for Energy when compared to the S&P 500. But now we’re entering a period of seasonal weakness. There’s nothing saying that seasonal patterns need to be followed all the time – these are just long-term averages, and we’ve discussed the problems with ‘average’ returns – but with other headwinds appearing, we felt a neutral rating was more appropriate than the Overweight we’d had in place since early August.

Long-term resistance for the Energy sector has simply been too much to overcome. We’ve been dealing with the 2008 and 2014 highs since last June. At some point, maybe we’ll get the long-awaited breakout. Or we might not. But the risk isn’t really skewed in our favor unless buyers can assert control and push prices to new highs.

We ran into resistance on a relative basis, too. Here’s the ratio of the equally weighted Energy sector vs. the equally weighted S&P 500. This is the level we failed at last June and again in October. It makes sense that we’re having trouble again.

Another thing we like to see is the equally weighted sector outperforming the cap weighted sector. That’s the trend we saw throughout the latter half of 2020 until the middle of 2022, and it was one of the reasons we were optimistic about Energy in August and early September. But that trend has reversed sharply in recent weeks, and the ratio just got more oversold than its been at any point since the COVID selloff.

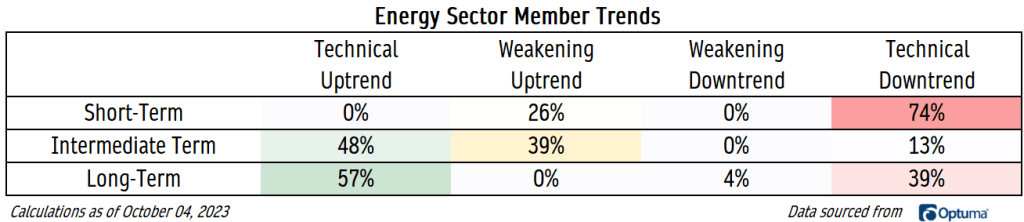

Long-term breadth is still among the best of any sector in the S&P 500. More than half of Energy stocks are above a rising 200-day moving average. A growing number, though, are shifting into technical downtrends. That’s a concerning development that’ll be worth keeping a close eye on over the coming months.

Digging Deeper

In late June, all 5 Energy sector sub-industries had similar year-to-date returns, and all were negative. Two groups stood out over the following months. Refining and Marketing stocks are now up nearly 20% and Equipment & Services is up 13%. The remaining sub-industries, meanwhile, are still near the flatline.

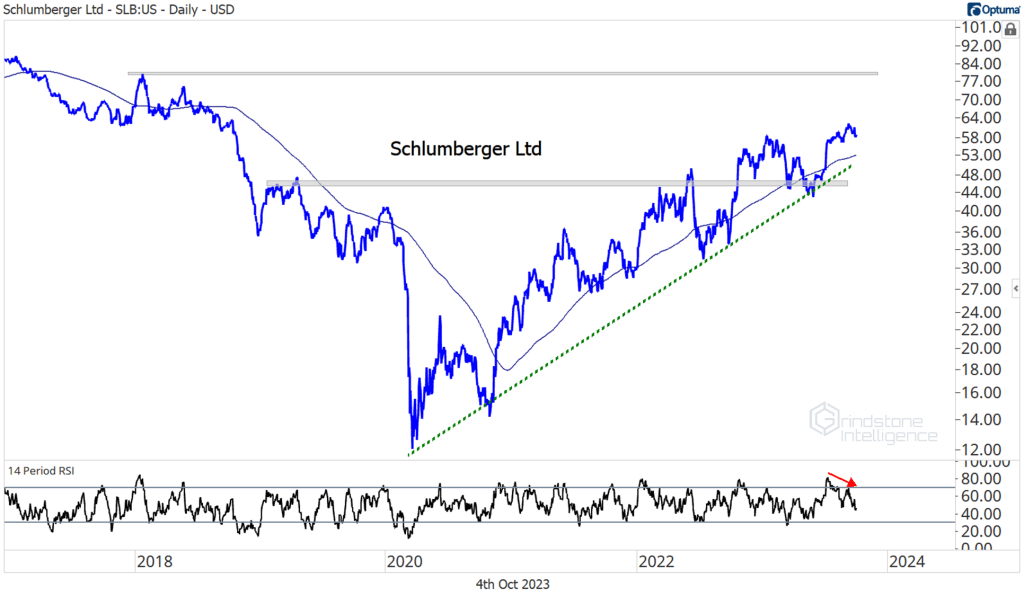

Our favorite oil services stock has been SLB. Here it is trying to break out of a huge 4 year base relative to the rest of the sector.

On an absolute basis, the stock has yet to violate its uptrend line from the 2020 lows. Momentum failed to confirm the most recent move higher, which could mean the near-term highs are in for this one. But it would take a break below support at $46 to damage the longer-term structure.

Leaders

Marathon Petroleum is the top-performing large cap Energy stock this year. It’s up 26.5%, and we think it can go all the way to $200. Our risk level is the 161.8% retracement from the 2018-2020 decline, which is down near $130.

We’re watching this potential bearish momentum divergence relative to the rest of the sector, too. If we see this ratio break below the spring highs, that would act as confirmation of the weak RSI trend, so we may be better off stepping to the side and finding somewhere else for our money.

Losers

Kinder Morgan stands out among the losers as it threatens to break down out of this descending triangle pattern. For those looking for short opportunities, this one is a good candidate if it falls below $16.

Growth Outlook

Analysts aren’t too optimistic about the prospect for Energy sector earnings growth. Earnings are expected to nearly 30% in 2023, followed by low single-digit declines in each of the next two years.

No other sector is expected to see sales or EPS declines in 2024-2025. Of course, any upside surprise in the price of oil will dramatically alter the outcome. We don’t know of any major Wall Street analysts that are predicting oil prices above $100 two years from now – let alone a rally back to the 2022 highs of $130.

The post (Premium) Energy Sector Deep Dive – October first appeared on Grindstone Intelligence.