(Premium) Energy Sector Deep Dive – September

Trends in the Energy sector are strong and getting stronger.

Already, the number of Energy stocks trading above their 200 day moving average outpaces that of every other sector in the index. On a shorter-term basis, though, uptrend breadth is even stronger. Should the recent strength persist, it will drag more of the sector into long-term, technical uptrend territory.

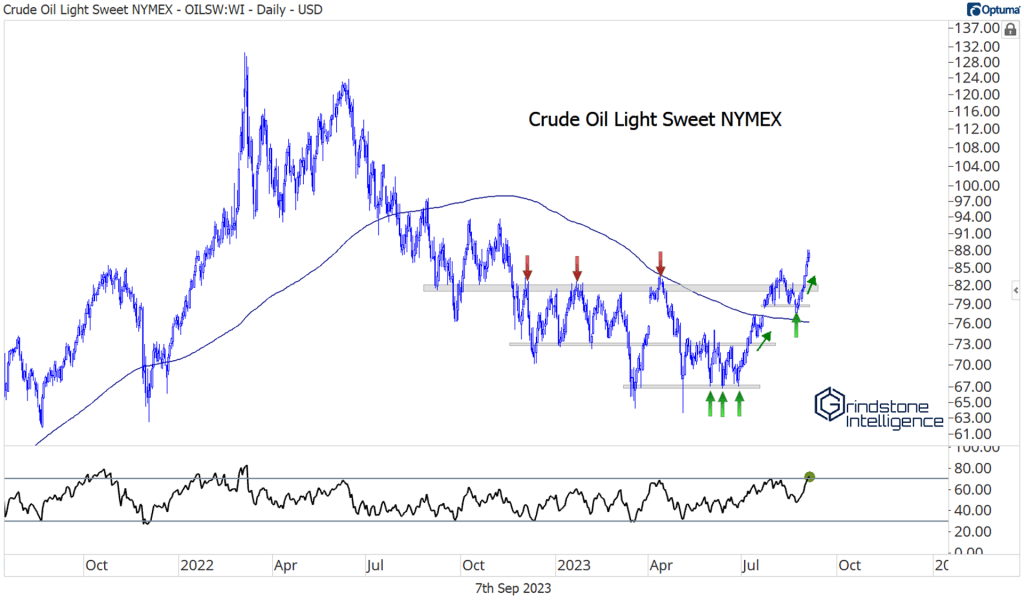

It’s not hard to imagine what’s driving the recent rally. Crude oil is at its highest level since last November.

Recently announced extensions of voluntary production cuts by Saudi Arabia and Russia drove the most recent move, but the strength in crude prices began when the bears fumbled their opportunity to take control last in June. We talked about it first in our July sector note.

As if the tailwind from higher crude wasn’t enough, the sector is also facing among its most favorable seasonal periods of the year. Since 1990, Energy has outperformed the S&P 500 by an average of almost 1% in the month of September.

Perhaps that favorable backdrop can help Energy finally push past resistance that’s been in place for 15 years. After outperforming the S&P 500 index by 200% in the 2 years from November 2020 to November 2022, it’s tempting to think Energy has gone too far, too fast. But the sector has gone nowhere since 2008. And even after jumping 20% since June, the sector has gone nowhere for the last year. An upside resolution from these bases would just be the start.

The oil services stocks have been showing us that relative strength for months. Our favorite has been Schlumberger. Here it is trying to break out of a 4 year base relative to the rest of the sector.

SLB is breaking out on an absolute basis, too. We’ve wanted to be long above the 2022 highs near $46 with a target of $80, and there’s no reason to change that now.

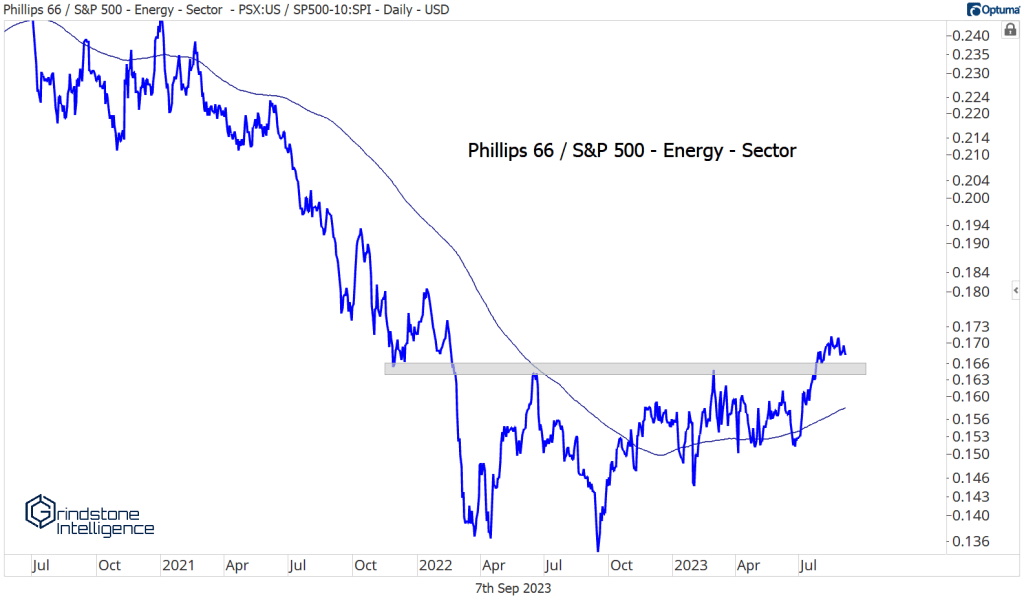

The refiners are also showing a ton of relative strength. Check out Phillips 66 completing a bearish-to-bullish reversal pattern relative to the rest of the Energy sector.

It just set multi-year highs on an absolute basis, too. We want to be buying PSX with a target of $150. It’ll have to absorb some potential resistance near $120 to get there, but after going nowhere for the last year, we think it’s built up enough to push through that level.

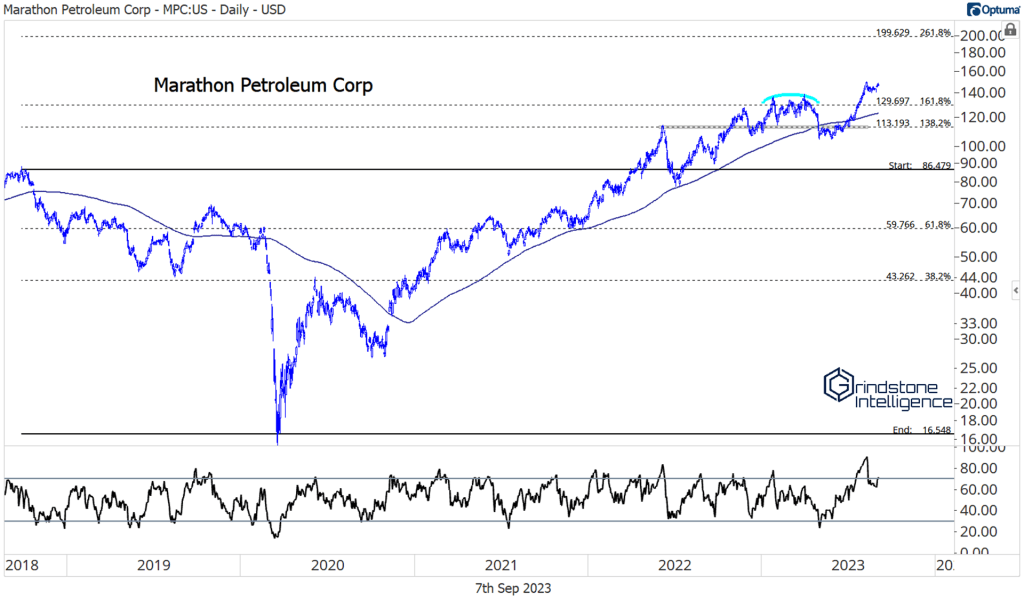

Fellow refiner Marathon Petroleum has been even stronger. MPC is at all time highs and we think it can go all the way to $200. Our risk level is the 161.8% retracement from the 2018-2020 decline, which is down near $130.

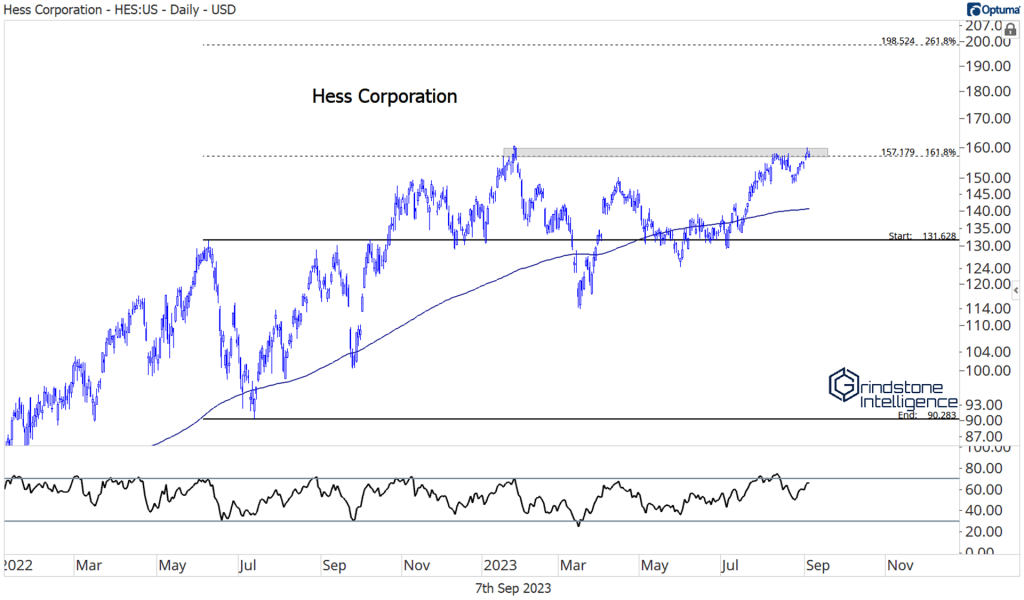

We also like Hess, We only want to be long Hess if it’s above the 2008 highs. If it’s breaking below that level, it’s probably not an environment where we want to be buying any Energy stocks.

Otherwise, though, we’re targeting $200, which is the 161.8% retracement from the 2008-2021 range.

The post (Premium) Energy Sector Deep Dive – September first appeared on Grindstone Intelligence.