(Premium) Energy Sector Update – June

After being the best performing sector in 2021 and 2022, Energy has been the worst of the risk-on sectors this year. Somehow, they’ve managed to underperform even the Financials, where we’ve dealt with the some of the largest bank failures of all-time. That’s quite the accomplishment when you think about it – especially since we’ve hear relatively little about fundamental stress within the sector.

Sure, oil prices have declined quite a bit from last year’s peak levels, but earnings for the group are still quite healthy and payouts are more shareholder friendly than they’ve been in years. The fundamental story hasn’t changed all that much, but the technical picture began to weaken in December.

That’s when the sector ran into former resistance at the 2007 and 2014 highs. Weekly momentum began to tail off as well, and we began writing about potential woes for the group shortly thereafter.

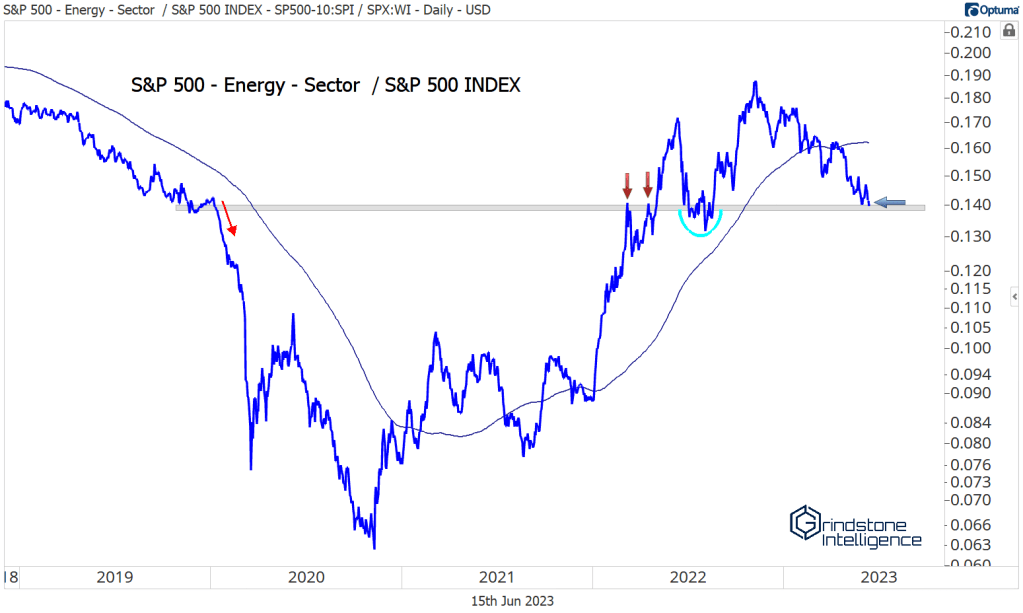

We were also quite concerned by a bearish momentum divergence that appeared when comparing Energy to the S&P 500 index. A bullish divergence sparked a reversal from the lows in 2020 – we didn’t want to be on the wrong side if we get a reversal back the other direction.

Our caution has paid off, and we haven’t shared many long-opportunities within Energy this year. We still see the risks for the sector weighted to the downside.

However, we believe a mean reversion is possible here, where Energy can outperform for a few weeks or months. Compared to the S&P 500, the current level is where the trouble really accelerated in 2020, and we saw good rotation around this area throughout 2022. To respect this level with a bounce would make sense.

Still, most trends beneath the surface are less than inspiring.

Coterra is in a clear downtrend. It’s below a falling 200-day moving average and stuck below overhead supply from a couple of swing lows in 2022. Momentum is stuck in a bearish range as well. If anything, we want to be approaching CTRA from the short side (though we’d prefer to just focus on owning relative strength. It’s a bull market you know).

Marathon Petroleum was a big-time leader from the 2020 lows to its peak this year, but it wasn’t able to get past resistance at the 161.8% retracement from the 2018-2020 decline. Now, it’s stuck below the 138.2% retracement and momentum is in a bearish regime. That’s not something you see in uptrends.

Apache Corp offers a favorable setup from either the long or the short side, depending on how you want to be positioned. Momentum has put in a potential bullish divergence, and we’re hanging above the 2020 highs. We can be long above there with such a clear risk level. If we’re below that level, though, we can take APA from the short side.

What if we’re wrong? What if this is just a healthy consolidation in the sector, and we break out above all that resistance from the 2007 and 2014 highs?

We want to be owning the names that are still showing some relative strength. Check out SLB, which is still hanging above a former resistance area now turned support. It also has yet to break the uptrend line from its 2020 lows. If Energy starts trending higher, we’re looking for SLB to go to 80.

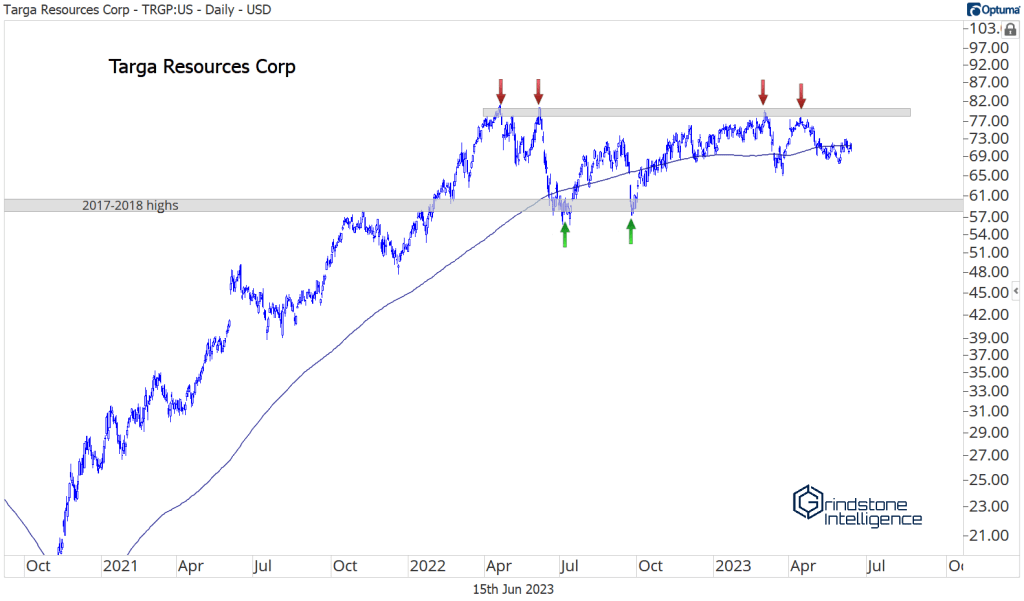

Targa Resources has barely pulled back at all. It’s been consolidating above its 2017-2018 highs for the last year, while simultaneously being unable to move past its early-2022 peak. On a breakout, we’d have little choice but to be bullish on the stock.

In that case, we’d be setting an initial target of 96, which is the 161.8% retracement from the 2017-2020 decline. After that, we’d be looking at the all-time highs up near 150. That’s a double from current levels.

The post (Premium) Energy Sector Update – June first appeared on Grindstone Intelligence.