(Premium) Energy Stocks Struggling to Find Their Footing

Our concerns about Energy have proved to be well-founded.

Frankly, we can’t think of many good things to say about the Energy sector. We suppose we can take heart in the fact that most of the sector’s constituents are still in a regime of new 52-week highs, meaning they set a new high more recently than a new low?

Unfortunately, we don’t believe that will last. None of its members are above a 200-day moving average. The vast majority are getting oversold during declines. And the sector continues to show relative weakness.

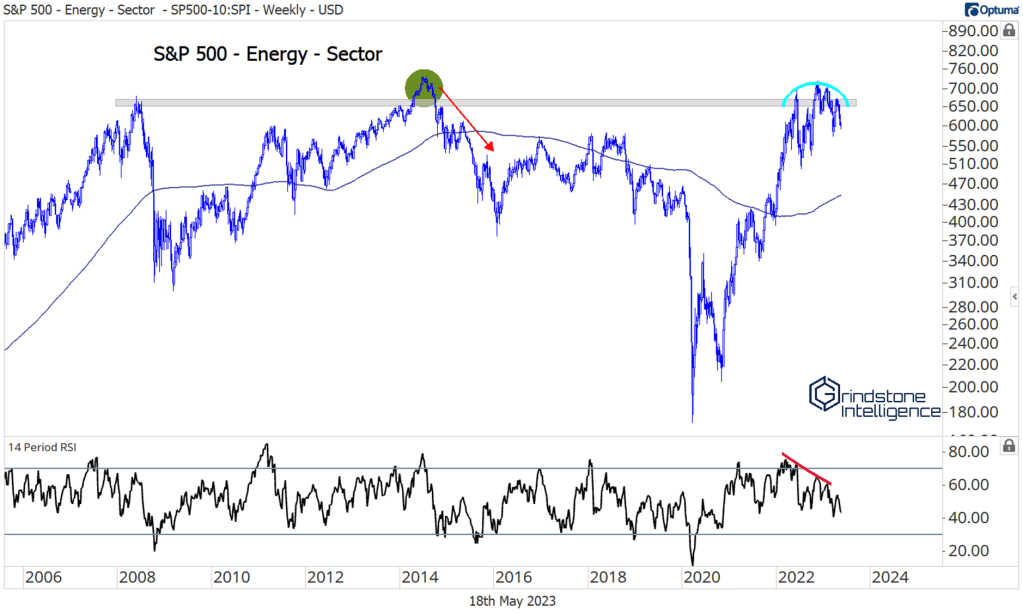

We haven’t forgotten how strong Energy was in 2021 and 2022. In the early days of these publications, the sector was our favorite overweight. But we became concerned late last year because of weekly bearish momentum divergences on both the absolute and relative charts. Compared to the S&P 500, we saw a bullish divergence in 2020 spark the two-year rally. We were wary of another reversal this time around. With each passing day, our concerns have been validated.

Since its 2008 peak, the S&P 500 Energy sector has experienced 12-month declines of 48%, 38% and 63%. In other 12-month periods, the group has doubled. It’s by far the most volatile of the eleven S&P 500 sectors, yet if we look past all the noise of huge gains and devastating selloffs, Energy has done nothing for the past 15 years.

At some point, Energy may be able to absorb all this overhead supply and break out to fresh highs. In that case, we’ll be looking at big bullish implications. After all, what could be better than breaking out of a multi-decade base? Unfortunately, that’s not what we’re seeing. We can’t rule out another big decline.

Coterra remains a name that we can look at from the short side (though we’d prefer to just avoid the space altogether and focus on relative strength). It’s below a falling 200-day moving average and stuck below overhead supply from a couple of swing lows in 2022. Momentum is stuck in a bearish range as well. If CTRA is below $25, we’re targeting the year-to-date lows, and that could be just the start.

A breakdown in APA Corp would also offer an attractive short opportunity for those interested. On a break below $30, we’d look for a test of the summer 2021 highs near $24.

The post (Premium) Energy Stocks Struggling to Find Their Footing first appeared on Grindstone Intelligence.