(Premium) FICC in Focus: Interest Rates and Commodities Warn of Recession

Jerome Powell and his friends raised rates for a tenth consecutive meeting yesterday. That wasn’t a surprise. Neither was it surprising when Powell laid the groundwork for a pause in hikes, removing language from the prior meeting’s press release that indicated additional policy firming would be necessary, and replacing it with more flexible language that highlights the Fed’s data dependence going forward.

After raising rates by 5% in just over a year, Powell believes policy is near a sufficiently restrictive level. Ever the pragmatic pivoter, he now wants to assess the extent to which their cumulative tightening actions, ongoing QT, and recent bank failures will affect credit creation and stymie demand.

He continued to push back against the idea of rate cuts later this year, though, saying his base case expectation is that we avoid an economic recession this year. The market seems to disagree on both fronts.

2-year Treasury yields tend to be a good leading indicator for the Federal Funds Rate. They rose in anticipation of rate hikes throughout 2022, but then collapsed following the failure of SVB. They remain 100 basis points below the March highs.

Short-term rates are saying an economic downturn is on the way, and the Fed will be forced to respond with looser policy. That’s not great news for the US Dollar. The Dollar Index roared 25% higher in just 18 months following its May 2021 low, as interest rates moved up and the US economy offered a safe haven from the turmoil in Europe and the lockdowns in China.

Now the US Dollar Index has dropped back into its 2015-2021 range.

There are signs of distress in corporate yields, too. When investors start to fear rising defaults, they trade risky bonds for safer ones. We’re seeing that now. If we compare high yield bonds to investment grade, the uptrend line that began in the summer of 2022 is now broken and acting as a ceiling on rallies.

Compared to Treasurys, high yield bonds are facing similar pressures. They’re stuck below a falling 200-day moving average and nearing multi-month lows.

One area that hasn’t confirmed the weakness is long-term bonds. Despite interest rate volatility that pushed the MOVE Index to its highest level since 2008, 30-year Treasurys haven’t gone anywhere. If a recession arrives, history would say that risk-free rates across the curve should fall, and long-term bond prices should rise the most. Perhaps they aren’t rising now because investors are skeptical that inflation will continue to fall towards the Fed’s 2% target. Core CPI is still running at 5.6%, well above the 3.75% yield on a 30-year note.

It’s not just the fixed income market. Commodities are flashing warning signs, as well. Recessions are deflationary – or at the very least, disinflationary – and prices for inputs are falling.

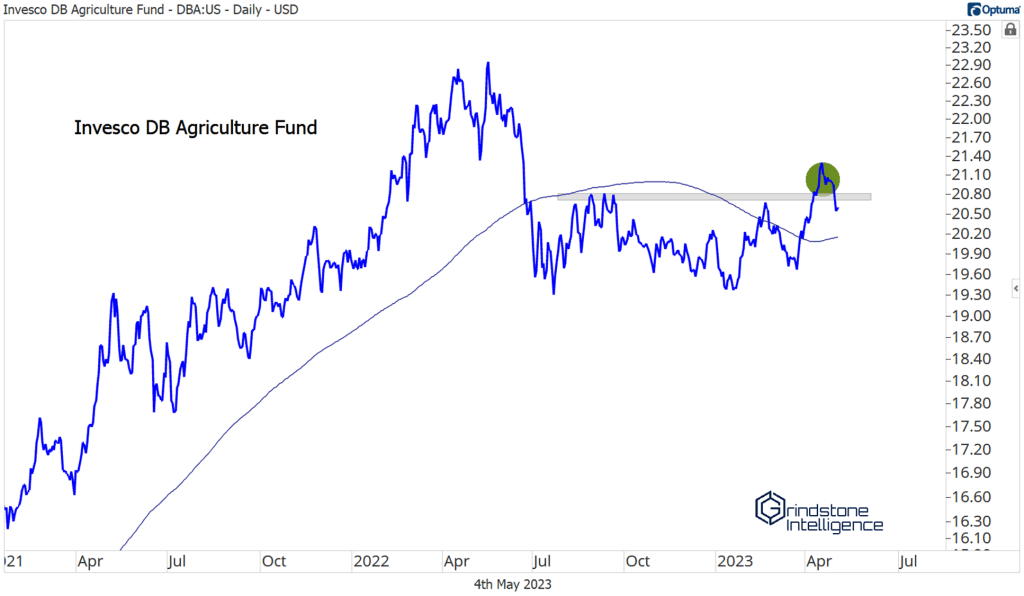

The Invesco DB Agriculture Fund tried to break out last month, but it’s failed to hold that move.

Wheat and Oats futures were big drivers of the weakness. They both dropped to new 52-week lows last week.

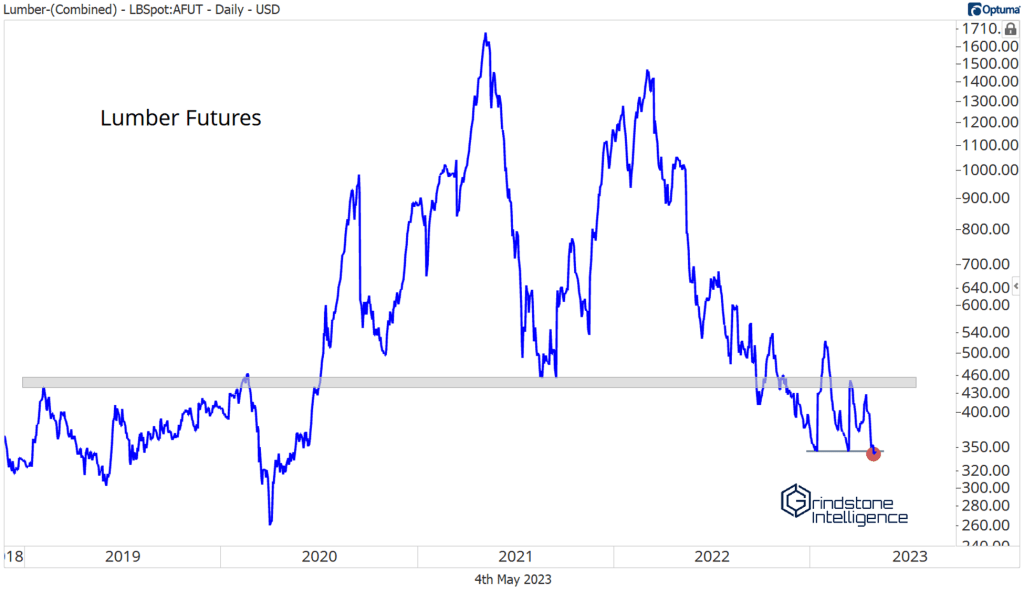

Lumber futures just fell through support to their worst level since 2020. They’re now 80% below the 2021 peak that occurred in the COVID aftermath.

It hasn’t been all bad. Sugar just broke out of a big multi-year base, and is only halfway to the Fibonacci target of 31.90.

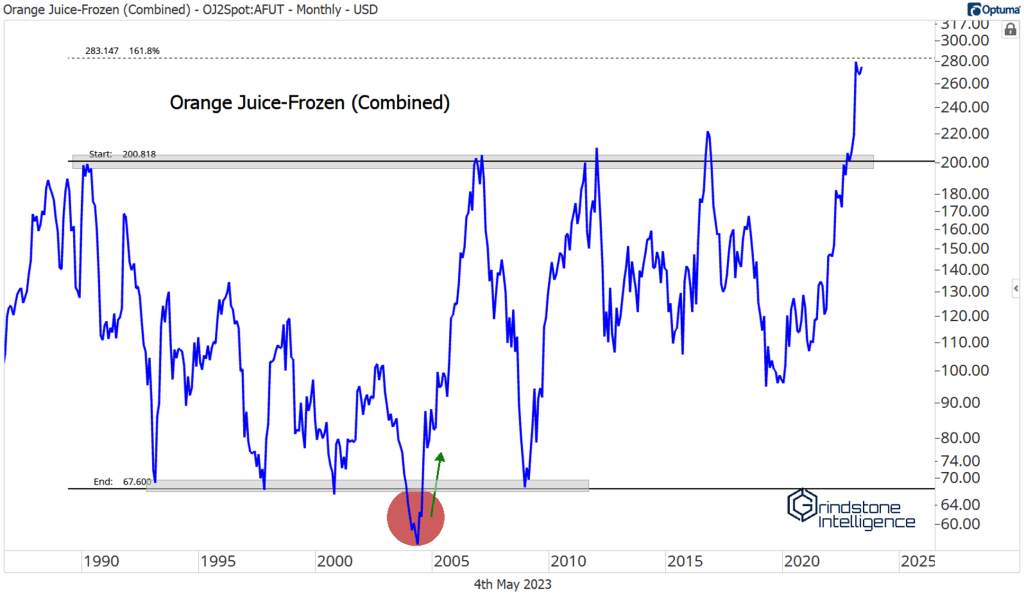

But other commodity leaders are at logical areas of resistance. Orange juice broke out of a 30-year base to unprecedented heights last year. Now it’s reached the 161.8% retracement from that big base. It wouldn’t be surprising to see it top out there.

Live Cattle prices have been unstoppable for the last 3 years, but they’ve run into trouble at the 2014 highs. We’re looking at a textbook failed breakout, and failed moves are often followed by fast moves in the opposite direction.

Still not convinced that an economic downturn is at hand? Let’s ask the metal with a PhD in economics.

Yesterday, Dr. Copper fell to the lowest level since early January. Copper is now convincingly below former support created by the 2021 lows, and we wouldn’t be surprised to see a retest of last year’s trough.

Even with the long-awaited reopening of China, the world’s most important copper consumer, prices for the metal are trending lower. What’s that say about the economic outlook?

It says the same thing as April’s surprise output cut from OPEC.

OPEC production cuts have an inconsistent track record when it comes to propping up oil prices. This time, the announcement served to push crude higher for a few weeks, but now we’re back to where we started. Their cut was in response to the risk of weakening global demand and macroeconomic uncertainty. If that pessimistic outlook proves correct, though, no amount of collusion will be able to offset the decline in consumption. Lower oil prices over the past few weeks reflect that risk.

Crude oil is back below the 2018 highs, and last night it briefly collapsed to $63, a multi-year low.

Fixed income, currencies, and commodities are all telling us to be wary of recession. So where can we hide? As always, in the place we’re seeing relative strength.

Right now, that’s precious metals.

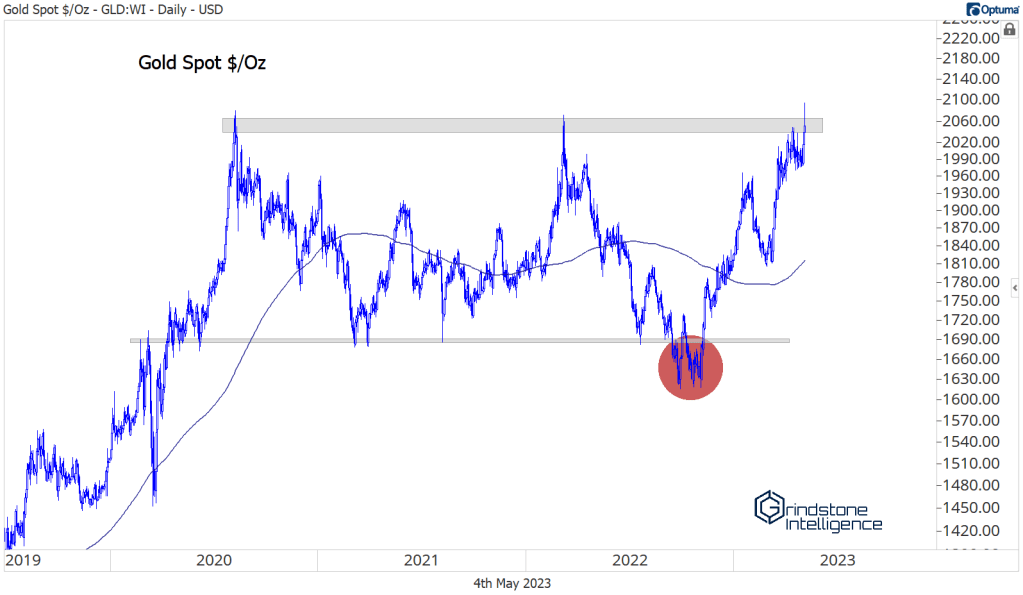

Gold prices are a whisper away from new all-time highs, after they’ve spent the last 3 years digesting the 2018-2020 run-up.

The trend here is not down. Prices just set new 52-week highs, and that’s not something you see in downtrends. But we can’t signal the all-clear with prices still just below resistance from those 2020-2022 highs.

This is the third attempt to break 2100 – why should this time be any different? For one, the more times a level is tested the more likely it is to break. Each time buyers push prices up to that level, they absorb more supply. Eventually, there’s no one left to sell.

If we compare gold to stocks, we find another instance of gold trying to break out. Relative to the S&P 500, gold has been basing for just over a year. We think a breakout is imminent.

We’ve already seen that same breakout for silver. We like to look at silver compared to the Russell 2000 instead of the S&P 500. Silver bulls and small cap bulls are a lot alike. When small caps lead large caps, it’s evidence of risk appetite for equities. When silver leads gold, it’s evidence of appetite for precious metals. You can find some real zealots in both the small cap and silver camps, so comparing the two offers an insight into asset class preferences. Right now, silver is crushing the small caps.

We think gold is next.

We’re targeting 3170 on a breakout above 2100. That’s the 1794% Fibonacci retracement from the 1990s decline. Prices have respected these retracement levels all the way up: The hiccups in 2006 and 2008 occurred near Fib levels, the ceiling from 2013-2019 was the 684.4% retracement, and right now, were stuck below the 1109% retracement. It would make a lot of sense to go up and touch the next one.

The post (Premium) FICC in Focus: Interest Rates and Commodities Warn of Recession first appeared on Grindstone Intelligence.