(Premium) Financials Sector Deep Dive – August

We’re seeing rotation into the cyclicals this month, and no cyclical sector is larger or more important than the Financials.

It wasn’t so long ago that Financials were at the epicenter of a crisis, when Silicon Valley Bank and Signature Bank of New York both were taken into FDIC receivership. In the weeks before the banks failed, it looked as though the sector was set to lead the next stage of the stock price recovery. In the weeks that followed, though, Financials suddenly found themselves at multi-year lows compared to the S&P 500.

Now, the sector is finally challenging its pre-SVB highs again.

For us, the outlook for Financials is pretty simple.

This is a bull market for stocks. The S&P 500, NASDAQ, and Dow Jones Industrial Average are all in uptrends and all recently hit new 52-week highs. Financials are not in an uptrend. They’re stuck below last summer’s highs. We can’t be overweight a sector that isn’t going up while the rest of the market is. Why make things more complicated than they need to be?

Keep it simple, stupid.

What would make us re-evaluate that view? A breakout above the highs from last August. If we’re above that level of resistance, sure, then we can talk about whether a more bullish approach towards Financials is appropriate. But we’re not there yet.

That doesn’t mean we aren’t seeing some positive signs.

Last month we pointed out the improving momentum for the sector when compared to the S&P 500, even while the ratio itself continued to fall. Financials have since broken out of that falling wedge pattern.

That’s a good start, but it’s not enough to signal that a new uptrend is in place.

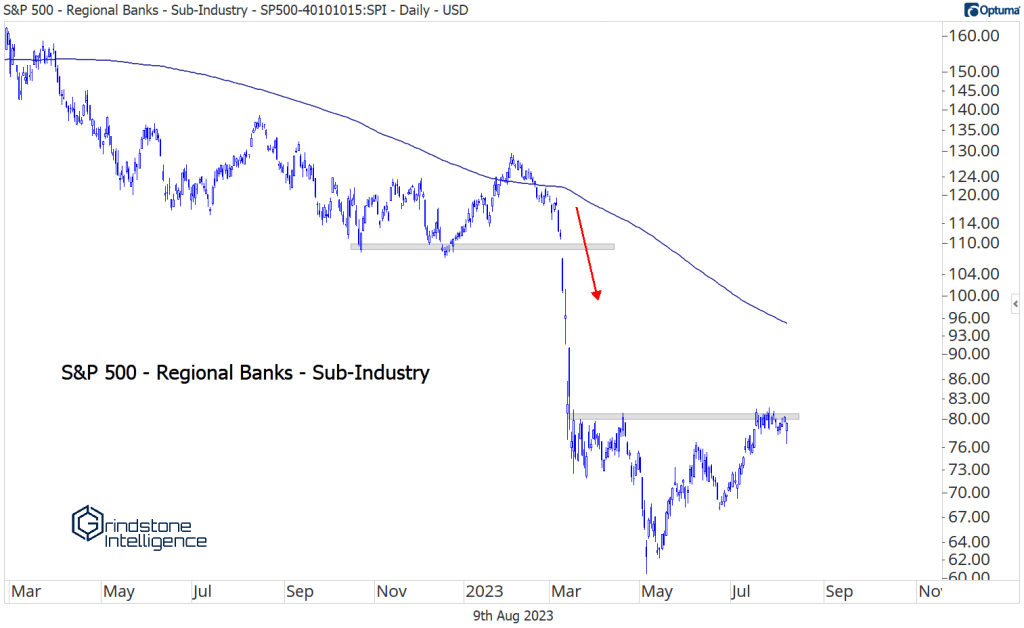

Here’s another place we haven’t yet seen signs of a new uptrend: Regional Banks. To be fair, the regional banks make up only a tiny sliver of the Financials at this point. Their direct impact on the sector’s price is fairly immaterial. But they are a good reflection of risk appetite for the group, and it’s hard to imagine the Financials staging prolonged outperformance if the regionals are falling.

We want to see the Regional Bank sub-industry break out above the April highs.

Until then, we want to be very selective with the Financials we’re looking to own.

We’ve favored names in the insurance space for awhile, especially some of the insurance brokers like Arthur J. Gallagher, which is still progressing to our target of $250.

Arch Capital ignored the banking failures and is trekking steadily toward $91, which we’re targeting since it represents the 261.8% Fibonacci retracement from the 2020 selloff. Momentum has stayed well out of oversold territory all year, showing just how strong the buying power has been for the stock.

Unfortunately, neither AJG or ACGL offers much in the way of risk management, so initiating new positions here is pretty difficult. Other insurance stocks have either reached our targets or have reached levels of logical resistance. Marsh & McLennan just reached our initial target of $190, and we don’t have a reason to own it as long as we’re below the 261.8% retracement from the 2020 decline.

On a break to new highs, we can set a new target of $225, which is the 261.8% retracement from the entire 2022 trading range, but for now, it’s best to wait and see how it reacts.

Berkshire Hathaway just surged to new 52-week highs and is testing its all-time peak from early last year. It could blow right past this level, and if it does, we think it can go all the way to $420, which is the 161.8% retracement from last year’s selloff. More than likely, though, we take some time to digest the recent rally.

The same goes for Aflac. We’re not going to rule out further gains, but this would be a logical place for the stock to find some near-term resistance.

Instead, we’re shifting our focus to the exchanges and to payments stocks.

Cboe just broke out of a 5-year base after building what looks like a big inverse head-and-shoulders continuation pattern . If this stock is above $137, we like it with a target of $175, which is the 161.8% retracement of the 2018-2020 decline.

Intercontinental Exchange has broken out, too, and just successfully backtested support. Now that it’s absorbed all that overhead supply, we think it can go all the way back to the former highs at $140.

Even CME Group, which we disparaged last month after it broke down to new relative lows, has shown signs of life. That’s looking like a clear failed breakdown, which could lead to an outright trend reversal.

Within payments, check out Fiserv. breaking out of a multi-year base. FI was one of the best uptrends you could find in the decade leading up to COVID, and now it’s had some time to digest all those gains. We don’t want to miss out on the next leg of that rally. We want to be long above $123 with a near-term target above $150.

What’s more is that the stock has clearly reversed the relative downtrend that was in place from 2020-2021. Now it’s in a new uptrend when compared to the S&P 500.

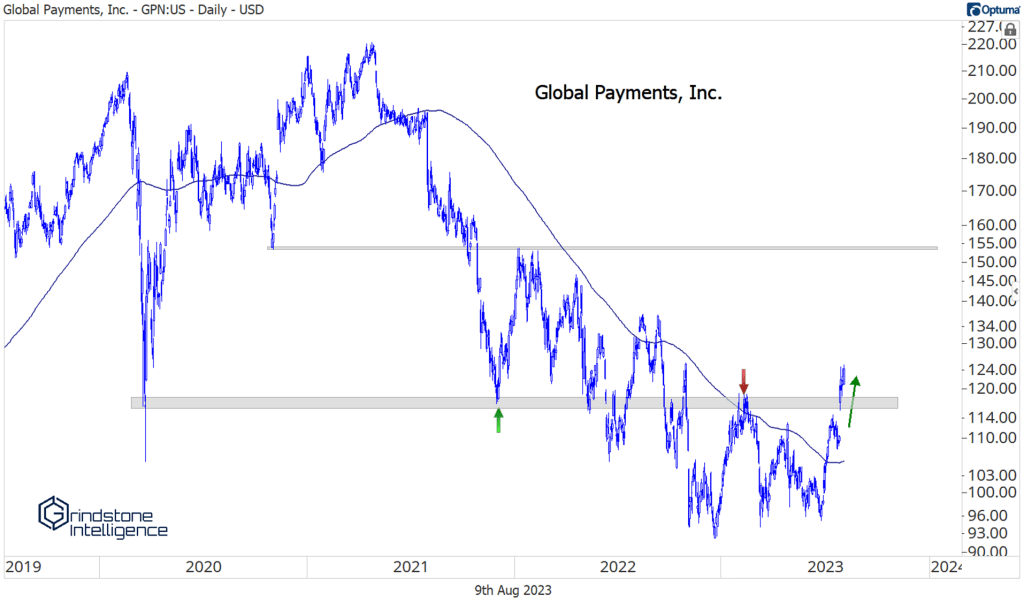

Speaking of downtrend reversals, how about Global Payments? It’s back above the COVID lows, which had been resistance all year. That level is now support, and we want to own it above $118 with a target of $150.

The next step for GPN is to reverse its relative downtrend. It’s made some progress by breaking the downtrend line and getting above the 200-day moving average, but now we want to see some higher highs. If the ratio is above the swing highs from February, we’ll have even more confidence in owning the stock.

Mastercard is threatening to break out of a big multi-year consolidation, too. It’s been stuck below the 138.2% retracement from the 2020 selloff, but on a break higher, we think it goes to $435, and eventually to $580.

Meanwhile, Paypal can’t sustain any rallies. It’s stocks like these that we want to avoid. Yes, IF Paypal ever gets going, it could be a huge winner. But it can’t be a huge winner if it’s below $70.

The post (Premium) Financials Sector Deep Dive – August first appeared on Grindstone Intelligence.