(Premium) Financials Sector Update – July

It wasn’t that long ago that Financials were sitting near multi-year relative highs. Tech stocks led last year’s declines, and value plays led the rebound from the October lows. At year-end, the ground began to shift in favor of the beaten down growth names, and then SVB’s failure in March sparked a selloff that pushed Financials to the bottom of the performance derby.

The question is, when will the money rotate back to the Financials?

Momentum has been laying the groundwork for months, flagging a potential reversal in the ratio of Financials vs. the S&P 500 index. Momentum, though, doesn’t mean anything without price confirmation. Divergences can last for weeks or months before prices respond – they’re useful in identifying potential reversals, but they’re poor timing tools by themselves.

We think we’re finally seeing the first signs of price confirmation as Financials break higher from this falling wedge pattern.

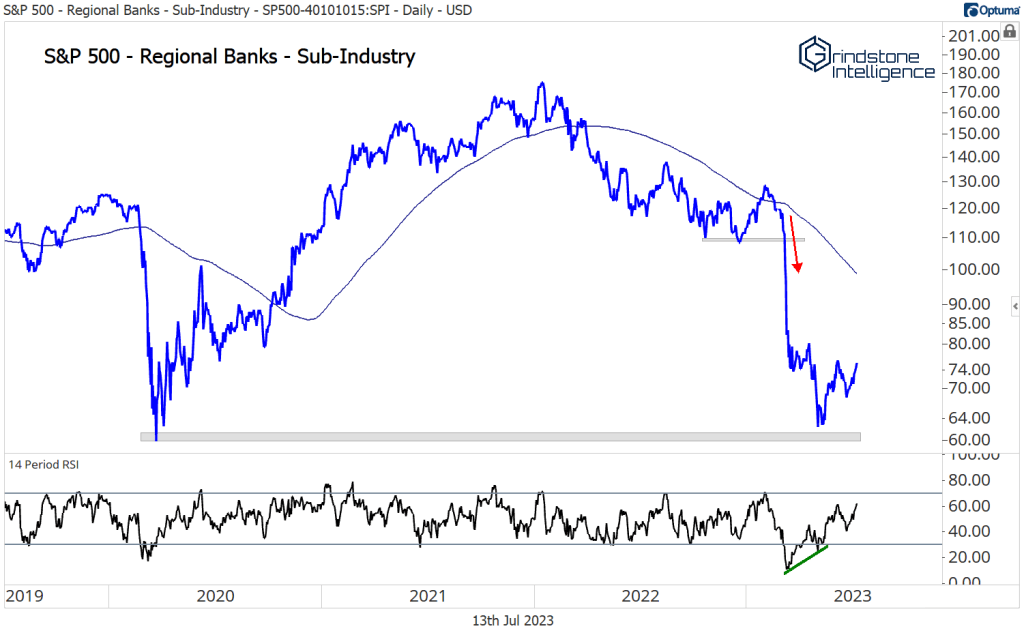

At the very least, the risk of lower prices for Financials has been kept at bay. The regional banks, which were the epicenter of the sector’s issues, have found support at their COVID lows and are moving higher after a bullish momentum divergence of their own. We still don’t want to own the regionals – they’re still showing relative weakness – but the fact that the worst stocks have stopped going down serves as evidence that we want to be looking for things to buy.

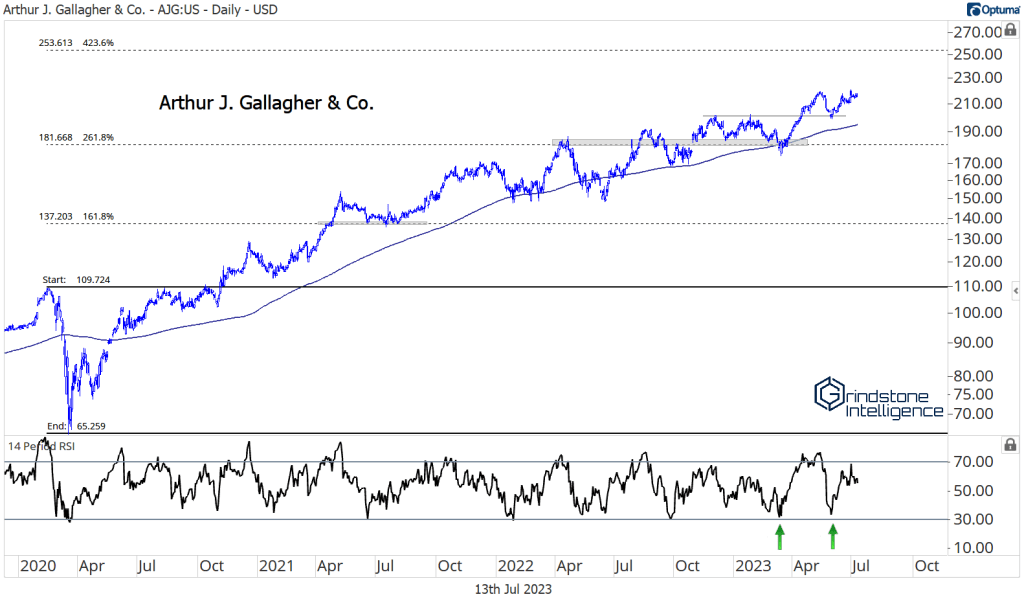

Insurance brokers have been showing relative strength all year, and they’re still the ones we want to focus our attention on. Arthur J. Gallagher is halfway to our target of $250 after setting new all-time highs earlier this year.

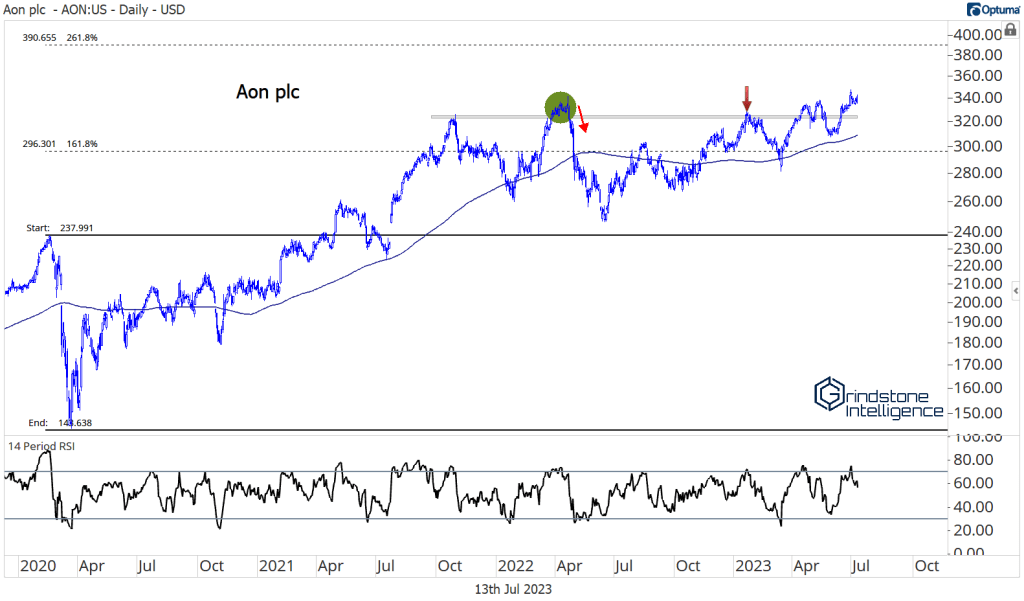

Aon just hit new all-time highs, and momentum confirmed the breakout when the stock got overbought. The 261.8% retracement from the COVID selloff is up at $390 and represents a gain of almost 20% from current levels.

Arch Capital ignored the banking failures and is trekking steadily toward $91, which we’re targeting since it represents the 261.8% Fibonacci retracement from the 2020 selloff. Momentum has stayed well out of oversold territory all year, showing just how strong the buying power has been for the stock.

Cboe is trying to break out of a 5-year base after building what looks like a big inverse head-and-shoulders continuation pattern . If this stock is above $137, we like it with a target of $175, which is the 161.8% retracement of the 2018-2020 decline.

Intercontinental Exchange has already moved past its own key resistance level. Now that it’s absorbed all that overhead supply, we think it can go all the way back to the former highs at $140.

The payments stocks – which are recent transplants from the Information Technology sector – are shaping up in a big way and have potential to be the best performing industry within Financials over the next year.

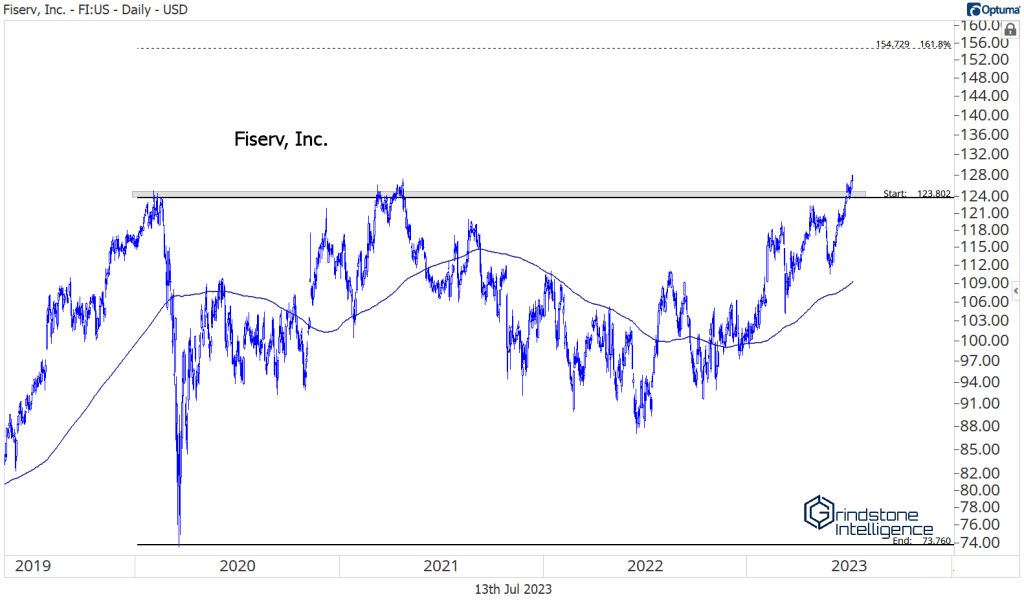

Fiserv just broke out from a multi-year consolidation. FI was one of the best uptrends you could find in the decade leading up to COVID, and now it’s had some time to digest all those gains. If we see signs that the next leg of the rally has started, we don’t want to miss out. We want to be long above $123 with a near-term target above $150.

What’s more is that the stock has clearly reversed the relative downtrend that was in place from 2020-2021. Now it’s in a new uptrend when compared to the S&P 500.

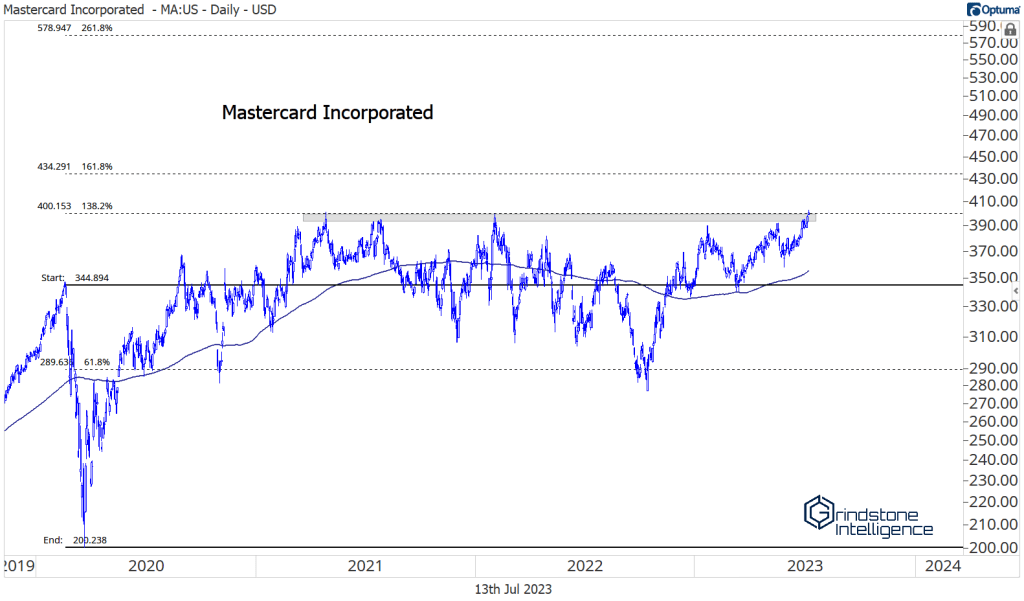

Mastercard is threatening to break out of a big multi-year consolidation, too. It’s been stuck below the 138.2% retracement from the 2020 selloff, but on a break higher, we think it goes to $435, and eventually to $580.

A reversal in Paypal could spark the move higher in payment processors. It’s been among the worst stocks in the world for the past 2 years, but if it can turn this move lower into a failed breakdown, break the downtrend line, and then set a few incremental highs? How could we be bearish the payment processors if the worst component is no longer falling?

It’s important to try and own the stocks that are leading, but it’s just as important to avoid the ones that aren’t. And you know who we don’t want to own? CME Group. They just hit new lows when compared to the S&P 500 Index.

The post (Premium) Financials Sector Update – July first appeared on Grindstone Intelligence.