(Premium) Financials Sector Update – June

We’ve taken a cautious approach to Financials since the banking turmoil in March took the sector from ‘breakout watch’ to multi-year relative lows in just a few days’ time. They haven’t been able to staunch the bleeding since then – Financials keep drifting closer and closer to their 2020 lows when compared to the S&P 500 index.

On the bright side, 14-day RSI has not yet re-approached the lows it set at the height of the banking crisis. Unfortunately, prices have done nothing to confirm that potential bullish momentum divergence. The ratio keeps drifting lower, and we have no reason to bet on a big bullish reversal until we see clear evidence otherwise.

On an absolute basis, we’re encouraged by the sector’s ability to remain above support from the pre-COVID highs. If you’ve been reading our reports, you know that those highs coincided with peaks set in 2007 and 2018. We can’t think of a more important level to hold.

That doesn’t change our view about avoiding an overweight position in the Financials, but it does give us faith that the equity market overall can continue its rise. If we’re below this key support level, though, that has big implications for all of US stocks. We’d need to reassess our bullish stance.

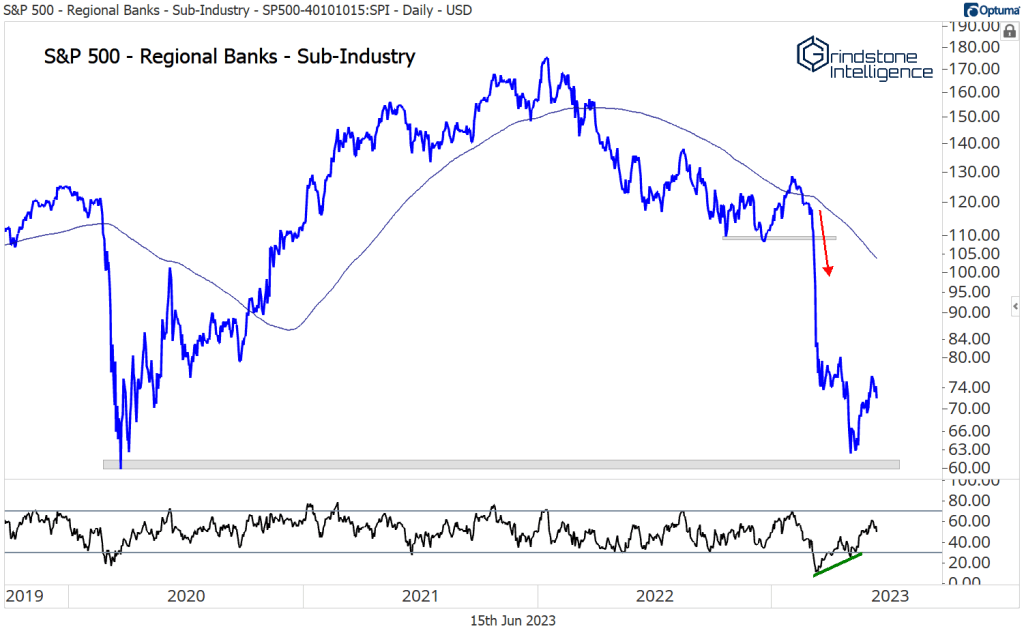

The regional banks are still the weakest link. The sub-industry got cut in half from its year-to-date highs to its May lows, and even though momentum put in a bullish divergence, we’ve seen a pretty lackluster rally. The group is still below the March trough on an absolute and a relative basis. We want no part of them.

Luckily, there are things in the Financials sector we can own that aren’t banks. Insurance stocks have been relative winners within the space.

Look at the Insurance Brokers sub-industry relative to the rest of the sector. They broke out of a 3-year base earlier this spring, then went up and touched the 138.2% retracement from the 2020-2021 decline. They’ve pulled back over the last month, but pullbacks within longer-term uptrends are not something to be feared.

Arthur J. Gallagher is halfway to our target of 250 after setting new all-time highs last month. We’ve gotten a nice pullback to the December highs that gives us a new level to manage risk against for new entries. We like it long above 200.

Marsh & McLennan successfully backtested a breakout of its own after going nowhere for 18 months. Our risk is very well defined at 175, and we’ve got a near-term target above 190. The next level to watch after that would be 225.

Aon is testing 18-month highs for the fourth time. There have been a few false starts from here, but the more times a level is broken, the fewer sellers there are to push it back down. We want to be buying AON above resistance at 325, with a target of 390. That’s the 261.8% retracement from the COVID selloff, and represents a gain of 20% from current levels.

The Reinsurance space has seen a somewhat larger relative pullback after being one of the best performing areas during 2022. Now, the sub-industry will try to find some support at the 2020 peak, which it initially surpassed earlier this year. Again, pullbacks within longer-term uptrends are not something to be feared. Trend reversals are possible, but the higher probability outcome is for trend continuation.

Here’s the one we like in the reinsurance space: Arch Capital is trekking steadily toward 91, which we’re targeting since it represents the 261.8% Fibonacci retracement from the 2020 selloff. Our risk level is the 161.8% retracement from that decline, which is down at 65.

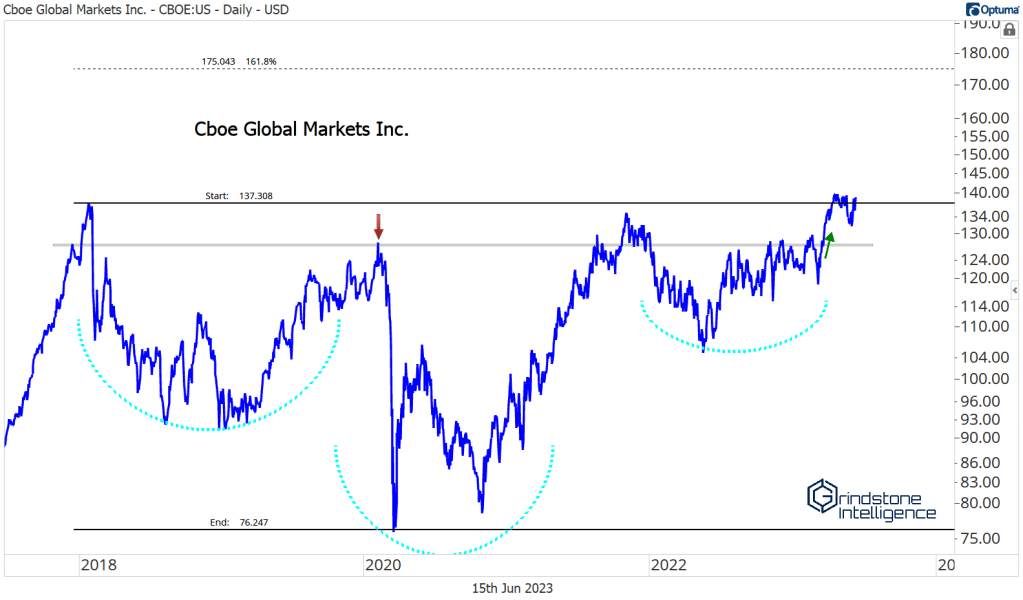

Outside of the insurance space, Cboe is trying to break out of a 5-year base after building what looks like a big inverse head-and-shoulders continuation pattern . If this stock is above 137, we like it with a target of 175, which is the 161.8% retracement of the 2018-2020 decline.

Intercontinental Exchange would most likely follow on any breakout from CBOE. The area between 110 and 112 has been an important rotational level for the past 2.5 years, and right now the stock is testing it from the lower end for the fifth time in 11 months. If it can ever absorb all that overhead supply, we’d look to get long ICE above 112 with a target up at 140, the former peaks.

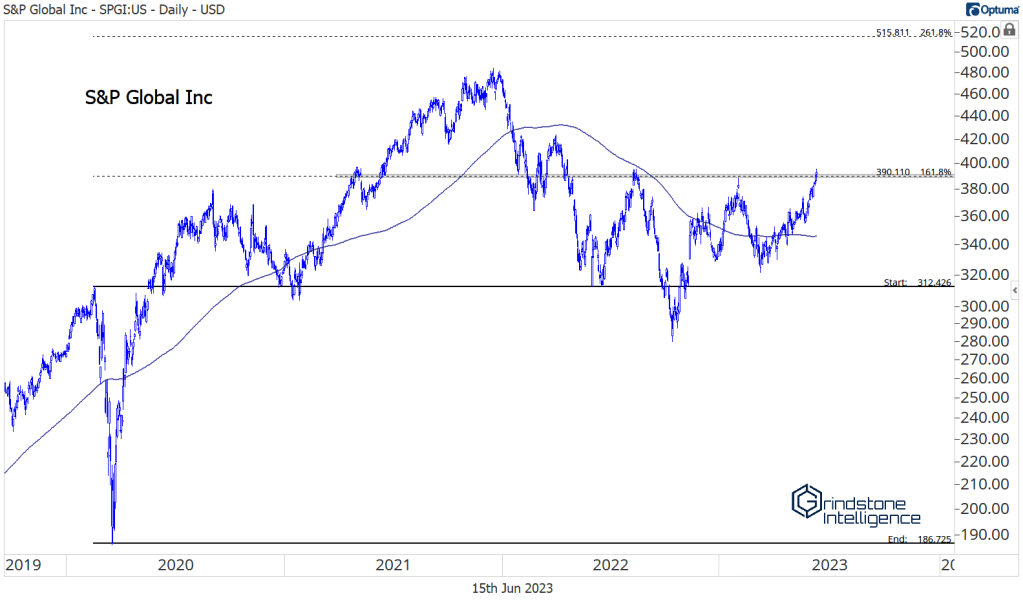

The rating agencies are working on new 52-week highs after struggling with stiff resistance for most of that year. Moody’s is already breaking out.

And S&P Global will most likely follow.

We don’t have much preference for one or the other. Over the last 6 years they’ve pretty much moved lock-step with one another.

Just look at the ratio between the two below – it’s gone absolutely nowhere. We think they both likely go and test their former highs if they can stay above their respective necklines.

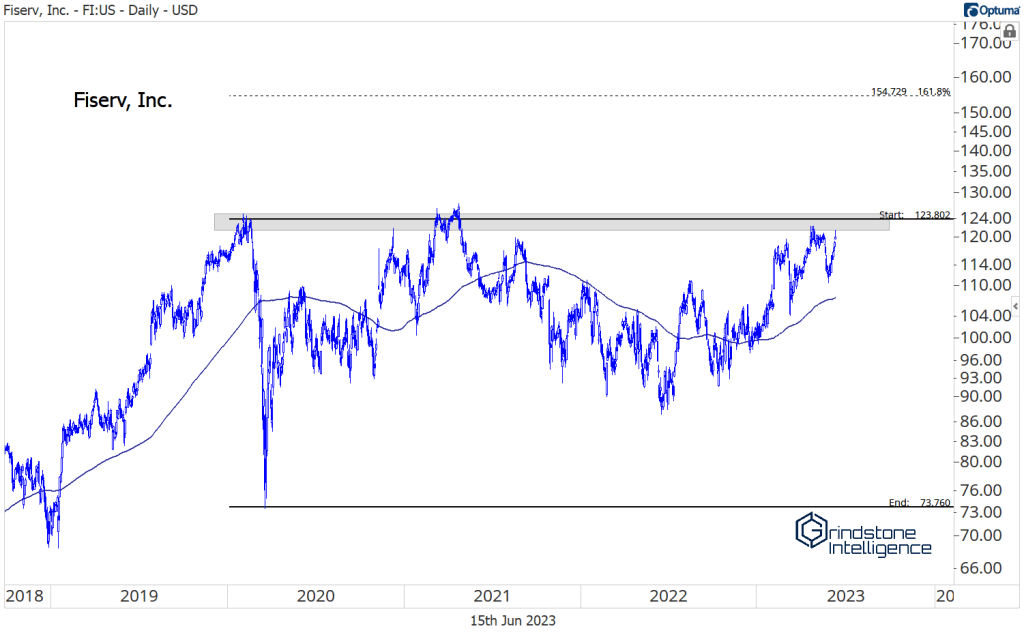

One of the sector’s new entrants is catching our eye, too. A recent transplant from Information Technology (along with Visa, Mastercard, Paypal, and a few other payments technology companies), Fiserv is threatening to resolve higher from a multi-year consolidation.

FI was one of the best uptrends you could find in the decade leading up to COVID, and now it’s had some time to digest all those gains. If we see signs that the next leg of the rally has started, we don’t want to miss out. We want to be long above 123 with a near-term target above 150.

If the next leg of the uptrend looks anything like the last, though, it will go a lot higher.

The post (Premium) Financials Sector Update – June first appeared on Grindstone Intelligence.