(Premium) Health Care Sector Deep Dive – August

Health Care stocks have caught a bid lately relative to the rest of the market. Since mid-July, the sector has outperformed the S&P 500 by 6%.

Unfortunately for Health Care bulls, the leadership has come not because of a surge in the price of Health Care stocks, but because growth stocks have been leading the S&P 500 lower in August.

The sector is still a hot mess, much like it has been for the last year:

Will this big, messy consolidation resolve higher? Yea, probably. Eventually.

But has it been a waste of time for everyone sitting around waiting for a breakout? Definitely.

That doesn’t mean we need to be shorting Health Care – we’ve kept an equalweight rating on the sector all year. We just need to be very selective with which members we choose to own. F

or most of the year, the odds were stacked in the favor of stock pickers. The equally weighted sector was outperforming the market cap weighted one, so the ‘average’ Health Care stock was outperforming.

That trend reversed in August after a failed breakout.

One big reason for that reversal is Eli Lilly. Lilly is the third-largest stock in the sector, and it’s jumped more than 20% so far in August. That’s after it completely ignored the bear market of 2022, and has given investors few opportunities to buy on pullbacks.

Meanwhile, former leaders within the sector have run into logical areas of resistance. Amerisource Bergen has stalled since hitting our target of $190, which was the 261.8% retracement from the entire 2015-2021 range.

Health Care Equipment stocks have pulled back as well after the sub-industry completed a bearish-to-bullish reversal earlier this year. The June lows are key for this group. If we’re below that, we need to be rethinking the Health Care equipment stocks.

Boston Scientific has been one of our favorites within that space since it broke out last fall, and we’ve had a target of $60 since then. It’s stalled out in recent weeks at the 138.2% retracement from the 2020 decline near $55. That offers a new level to manage risk against for new entrants. Longer-term, the uptrend is intact as long as BSX can stay above $46.

Stryker has struggled to gain traction after breaking above last year’s highs, but it’s still consolidating above support. We want to own SYK above $280 with a target of $380, which is the 261.8% retracement from the COVID decline. Near-term, there’s some overhead supply at $305 that the stock will need to absorb before the uptrend can resume.

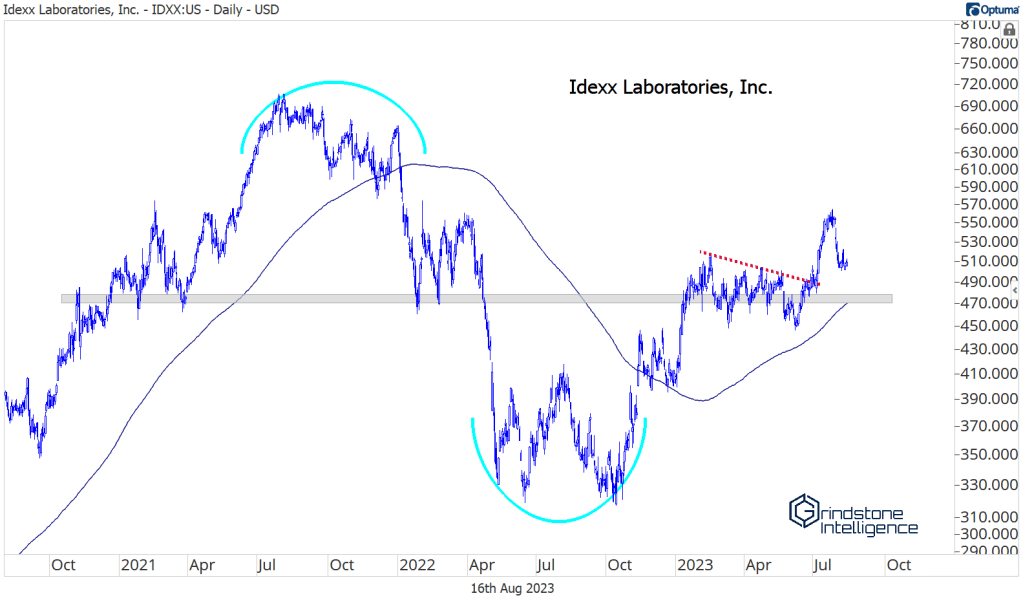

Idexx Laboratories has pulled back toward support after a big move in the prior month. That greatly improves the risk/reward setup for new entries. As long as the stock is above $470, we can own it with a target of $700, which is near the former all-time highs.

We like stocks that are both rising and outperforming the benchmark. On a relative basis, we want to see a bit more from IDXX. A breakout to new 52-week highs for the stock vs. the S&P 500 would give us a lot more confidence in the uptrend.

Align Technologies has a reputation as one of the most volatile stocks in the sector, and it’s not hard to see why. It gapped 15% higher in July to reach new 52-week highs, but then fell back below support over the next few weeks. That pullback hasn’t done much to damage the longer-term trend. We want to be buying on a break back above $370 with a target up at $600, which is where the stock’s downtrend began back in early 2022.

We got a big bullish resolution from another Health Care Equipment stock at the end of July. Becton Dickinson just spend 5 years mired in a big, messy range. That was after it tripled from 2012 to 2018, making it one of the best performing stocks over that period. Now that it’s finally digested that huge run-up, we want to own BDX for the next leg.

Our level is $280. We only want to own it if we’re above that, with a target of $415.

The setup in Lab Corp is improving, and after completing the spin-off of Fortrea, it may start to get more love from fundamental analysts, too. It’s not in a full-fledged uptrend yet, but if it can get above the 161.8% retracement level at $225, we think it goes to $300.

Bio-Techne is another we’re watching. If it’s above $86, we think it heads back to the former resistance level near $115.

Just as important as identifying the stocks we want to own is identifying the ones we want to avoid.

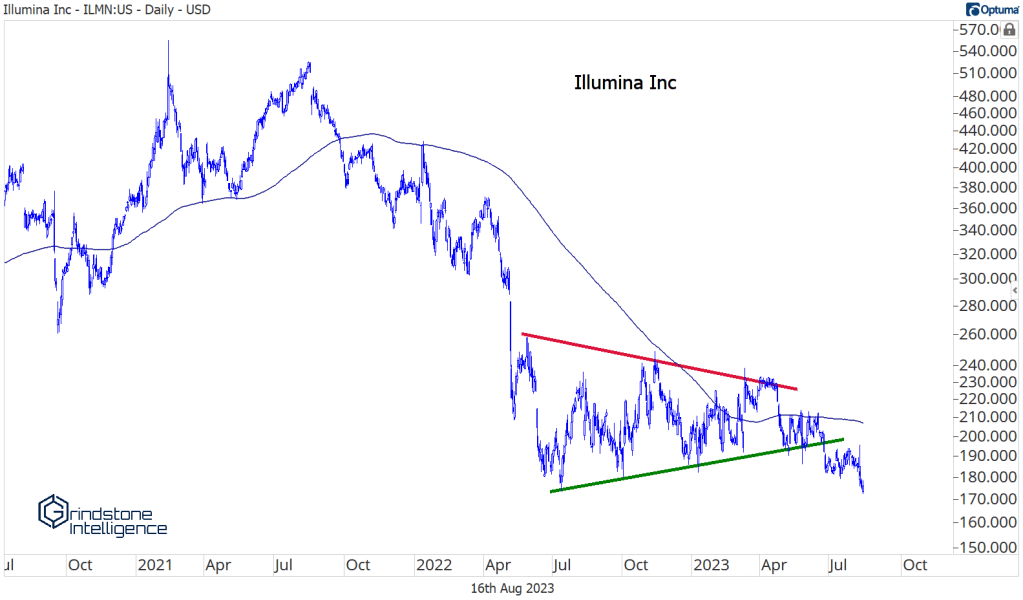

Illumina is what some (we) would call a dumpster fire. For one, the stock is embroiled in a quarrel with activist investor Carl Icahn, who’s managed to oust the chairman of the board. At the same time, they’re facing litigation from the FTC over their acquisition of GRAIL. The stock price, meanwhile, is at multi-year lows.

Moderna is breaking down, too.

As always, we acknowledge that today could be the low for stocks like Moderna and Illumina. But making that bet is making a bet against the continuation of the existing trend, which is always the lower probability outcome.

We prefer having the odds in our favor.

The post (Premium) Health Care Sector Deep Dive – August first appeared on Grindstone Intelligence.