(Premium) Health Care Sector Deep Dive- July

Our job as technicians is to find trends, with the belief that trends are more likely to persist than reverse course.

One of the easiest ways to identify those trends is to look at a stock’s current price and compare it to the level and direction of a moving average of trailing prices. If the current price is above a rising moving average (MA), then prices are in an uptrend. Below a falling MA, a downtrend. Pretty simple, right?

Things are a little more difficult when you get mixed signals: the level says one thing, but the MA trend says another. What if price is above a falling MA? That’s key first step toward a new uptrend, but it doesn’t always mean prices have bottomed. The same logic holds for a price that’s below a rising MA.

So what do you call it when prices are directly on top of a flat moving average? We call it a bag of frustration. Or a hot mess. Or in this case, we call it Health Care.

The Health Care sector has gone absolutely nowhere for the better part of 18 months. Prices sit atop a flat 200-day and a flat 50-day moving average. There’s no trend to be found.

Unfortunately, the rest of the market has been setting new 52-week highs while Health Care’s been stuck in the mud. That means the sector’s been crushed on a relative basis. Just 7 months after the sector broke out to 7-year highs vs. the S&P 500, the group is now setting new 18-month lows.

Beneath the surface, there are clear winners and losers within the space. Health Care Equipment has been one of the winners. Check out the sub-industry, which completed a bearish-to-bullish reversal, successfully backtested former resistance, and just set new 52-week highs.

Boston Scientific has been one of our favorites within the Health Care Equipment space since it broke out last fall, and we’ve had a target of $60 since then. It’s stalled out in recent weeks at the 138.2% retracement from the 2020 decline near $55. That offers a new level to manage risk against for new entrants. Longer-term, the uptrend is intact as long as BSX can stay above $46.

Compared to the S&P 500, BSX is at risk of reversing it’s uptrend, though – the ratio just dropped below a rising 200-day moving average. We want to see the stock break out above that $55 resistance level sooner, rather than later, or else we’re missing out on the opportunity of investing elsewhere.

Stryker has been another leader. It briefly dropped below its former highs last month, but news of rebounding elective procedures at a June health care conference helped the stock gap higher. We want to own SYK above $280 with a target of $380, which is the 261.8% retracement from the COVID decline. Near-term, there’s some overhead supply at $305 that the stock will need to absorb.

We flagged Idexx Laboratories in last month’s note, saying we wanted to buy a break of the year-to-date downtrend line with a target of $700, near the former all-time highs. We’ve gotten a big move since then, which makes the risk-reward less attractive for new positions.

We don’t need to feel like we’ve missed out on Idexx completely, though. On a relative basis, the stock is just getting started. If it can break out to new 52-week highs compared to the S&P 500, we’d much rather own this stock than not going forward.

The next big break in the Health Care Equipment space could come from Align Technologies. This is one of the most volatile stocks in the sector, so we need to manage risk and size our positions with that in mind. But we want to be buying on a break above $370 with a target up at $600, which is where the stock’s downtrend began back in early 2022.

The Distributors have also been leaders over the past year, and we’ve checked in on Amerisource Bergen and McKesson regularly in these monthly sector notes. ABC hit our target of $190 within the last few weeks, and now we want to see how the group responds. Cardinal Health should give us a good read.

This one is trying to consolidate above its 2015 highs after more than doubling off the 2020 lows. Longer-term, a target of $124 makes sense for CAH as long as it holds above $90. But it would make some sense to see it digest these gains here over the next few months.

And we don’t want to hold a stock that’s digesting gains if the rest of the market is moving higher. Here’s CAH compared to the S&P 500. The ratio is stuck below resistance from last fall. Until it can resolve higher from this consolidation, we’re probably better off looking elsewhere for gains.

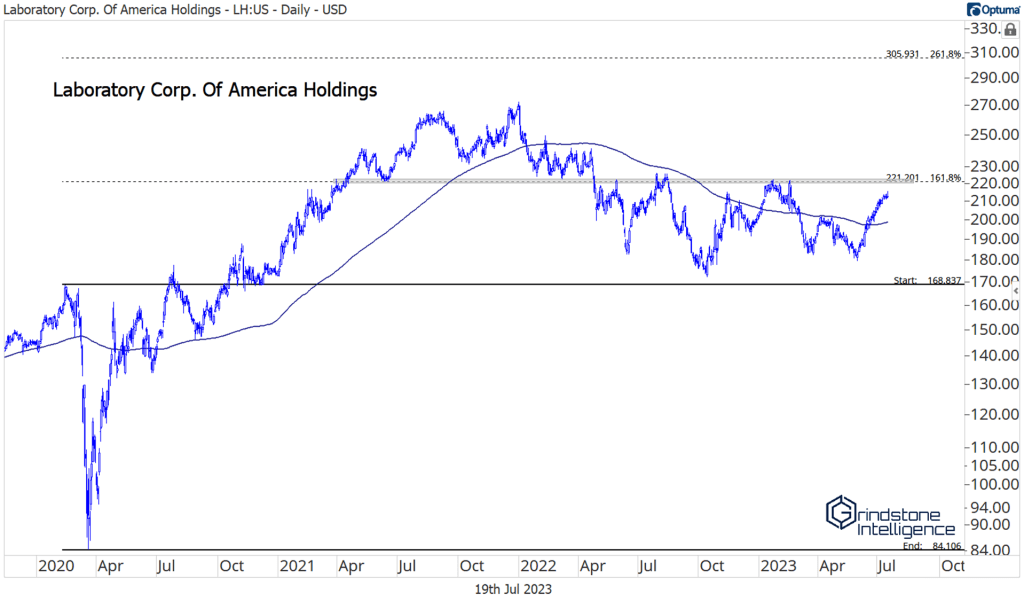

The setup in Lab Corp hasn’t improved lately. It’s not in a full-fledged uptrend yet, but if it can get above the 161.8% retracement level at $225, we think it goes to $300.

Bio-Techne is another we’re watching. If it’s above $86, we think it heads back to the former resistance level near $115.

For bottom-fishers, keep an eye on this potential bearish-to-bullish reversal in CVS. Buying CVS is a bet against the long-term trend, which isn’t our cup of tea. But even a rally back to the breakdown level near $88 would be a healthy gain from current levels, and the risk is well-defined. We don’t want to own it below $73.

Just as important as identifying the stocks we want to own is identifying the ones we want to avoid. Charles River Labs can’t seem to find its footing after a failed breakout from an inverse head and shoulders pattern.

On a relative basis, that means trouble. CRL just hit new 3-year lows compared to the SPX.

Incyte is consolidating below resistance after breaking down to new 52-week lows. This is a bull market for stocks, so we’d rather not waste our time trying to find things to short. But there’s no reason to even consider owning this below $64.

Illumina is what some might call a dumpster fire. For one, the stock is embroiled in a quarrel with activist investor Carl Icahn, who’s managed to oust the chairman of the board. At the same time, they’re facing litigation from the FTC over their acquisition of GRAIL. The stock price, meanwhile, just resolved lower from a wedge pattern.

And that resolution has it cratering relative to the S&P 500. You can save yourself a lot of grief if you avoid charts that look like this:

The post (Premium) Health Care Sector Deep Dive- July first appeared on Grindstone Intelligence.