(Premium) Health Care Sector Update – June

We were reminded as we began our regular review of risk-off sectors that the majority of S&P 500 sectors are still in negative territory for 2023.

Information Technology, Communication Services, and Consumer Discretionary are each on pace for a banner year. Meanwhile, investing in any other space would have yielded a return substantially less than the benchmark index. Here’s how the sectors have stacked up since year-end:

The Health Care sector is near the bottom of the pile. It’s not so much because Health Care stocks are falling, but more that they just aren’t doing much of anything. The sector has been rangebound for 2 years now, stuck between the 161.8% Fibonacci retracement from the COVID selloff and the 2022 peak. Its current price is also sitting directly atop a flat 200-day moving average.

In other words, Health Care is lost without a trend.

That means Health Care has been crushed on a relative basis, since growth stocks have been dragging the index higher while Health Care’s meandered along.

It all started late last year, when the sector failed to hold its breakout out to multi-year relative highs. From failed moves come fast moves in the opposite direction, and Health Care was no exception. Often times, those failed moves result in short-lived mean reversions. Other times, they mark the start of an outright trend reversal.

This time, we got the latter. Health Care just hit new 52-week relative lows.

For that reason, we think there are better places to be than Health Care. Should this relative trend stabilize and start setting higher lows, we might be inclined to change our opinion. Right now, though, that’s not what’s happening.

Still, this is a bull market. We need to be erring on the side of buying stocks, not selling them. Not all stocks within Health Care are performing poorly. In fact, if we compare the equally weighted sector to the cap weighted one, we see that the performance of the average stock is starting to improve.

After an extended falling wedge pattern since the February 2023 peak, this ratio is finally attempting to start a new leg higher. The move comes after we bounced off the 2019 highs, which were stiff resistance in 2020 before turning into support.

If the ratio above is rising, it means things are better below the surface in Health Care.

They’re especially strong in the Health Care Equipment space. Check out the sub-industry, which has completed a bearish-to-bullish reversal and just successfully backtested former resistance.

The Medical Devices ETF (IHI) has a similar look, except this time we’re looking at it compared to the rest of the Health Care sector. The ratio is back near 52-week highs and just completed a successful backtest of its own breakout level. This is what relative strength looks like.

Boston Scientific has been one of our favorites since it broke out last fall, and we’ve had a target of $60 since then. It’s stalled out in recent weeks at the 138.2% retracement from the 2020 decline near $55. That offers a new level to manage risk against for new entrants. Longer-term, the uptrend is intact as long as BSX can stay above $46.

Stryker has been another leader. It briefly dropped below its former highs last month, but news of rebounding elective procedures at a recent health care conference helped the stock gap higher. We want to own SYK above $280 with a target of $380, which is the 261.8% retracement from the COVID decline.

Hologic could follow – it’s been bumping up against its 2021 highs all year. If HOLX closes above $85, we think it quickly goes to $100. That $100 level is both the 161.8% Fib retracement from the 2021-2023 range and the 261.8% retracement from the 2020 selloff. Those clusters tend to have importance. If the stock breaks above that, our next target would be $125.

Idexx Laboratories is much further from setting new all-time highs, but it has consolidated above a key rotational level for most of 2023 after a big bottoming process last summer. If it can break the downtrend from the year-to-date peak, we can be long with a target of $700, near the former all-time highs. If it’s below $450, though, we need to avoid it.

The distributors continue to be dominant. Amerisource Bergen is nearing our target of $190, and McKesson just set new highs as it treks toward our target of $466. We definitely don’t want to be betting against such strong uptrends, though it may be tough to justify new long positions with both nearing potential resistance.

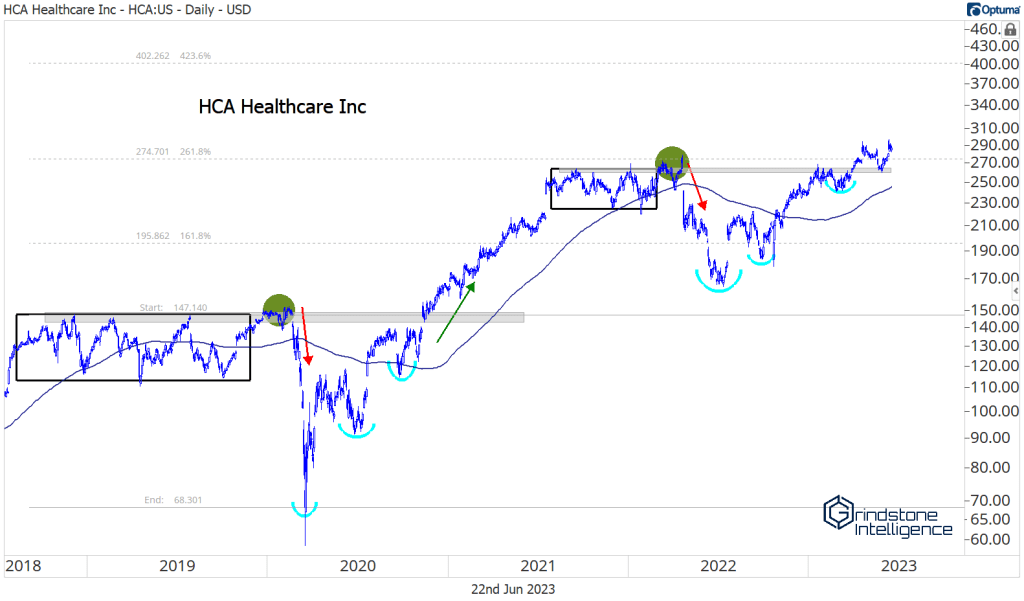

HCA Healthcare is one of our favorite charts out there. Call us crazy, but price action over the last 18-months looks identical to the price action from a couple years ago. Check it out: an earnings rally into consolidation, a failed breakout followed by a huge selloff, then stair steps higher to challenge the former highs. Last time, HCA rose another 70% after the breakout. Why can’t it do so again? We’re targeting $400 for now, which is 40% higher from here. We only want to be long if the stock is above $260.

So with all these groups breaking out, why isn’t the sector playing along? One reason is Biotech. The iShares Biotech ETF (IBB) has gone nowhere for over a year. If it can complete this potential cup and handle reversal pattern, though, things could change.

The post (Premium) Health Care Sector Update – June first appeared on Grindstone Intelligence.