(Premium) Health Care Stocks Out of Breadth

Much like action within the overall market, we’re seeing a handful of stocks performing well within the Health Care sector. Most names, though, are struggling to gain traction.

In this week’s Means to a Trend blog, we talked about how the majority of S&P 500 stocks are still in technical downtrends, despite last week’s index breakouts. The biggest and baddest stocks are driving gains this year, while everything else has gone nowhere. Health Care is facing the same dynamics – increasingly, we’re seeing weakness below the surface.

We pointed out the breakdown in Danaher in last month’s sector update. Things haven’t improved any since then.

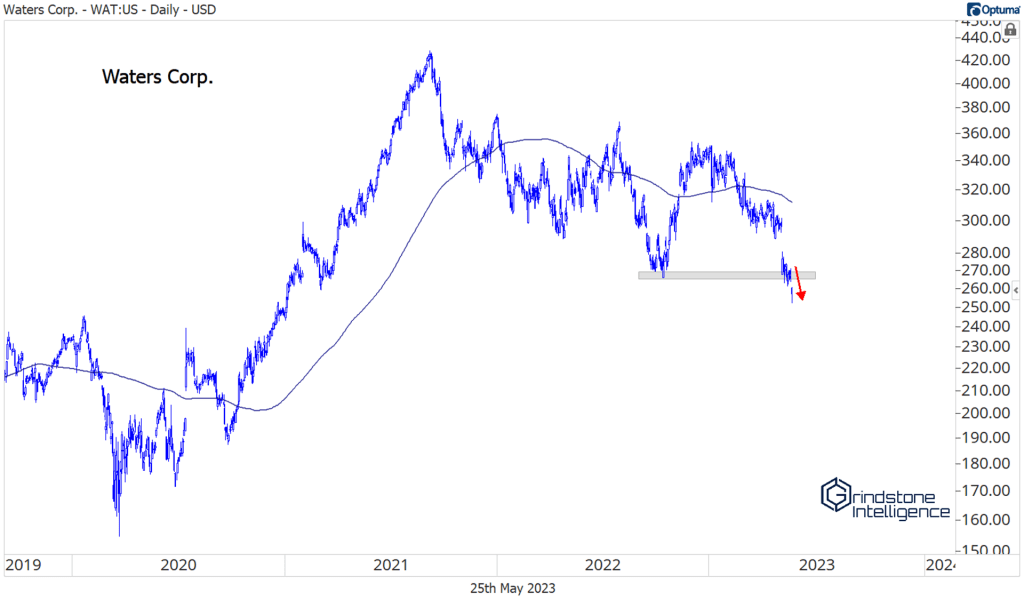

Waters Corp joined the breakdown party yesterday.

CVS and Catalent have both been setting new 52-week lows as well.

Gimmicky as it may sound, it bears saying anyway: New lows are not something you see in uptrends.

Yes, it’s quite possible that the indexes set their bear market lows last October. But that doesn’t mean we’re in the midst of a new bull market. At least not yet. There are simply too many stocks going down.

Even names that had shown relative strength are acting poorly.

Stryker is back below our risk level of 280 after failing to hold a multi-year breakout above the 161.8% retracement from the COVID selloff.

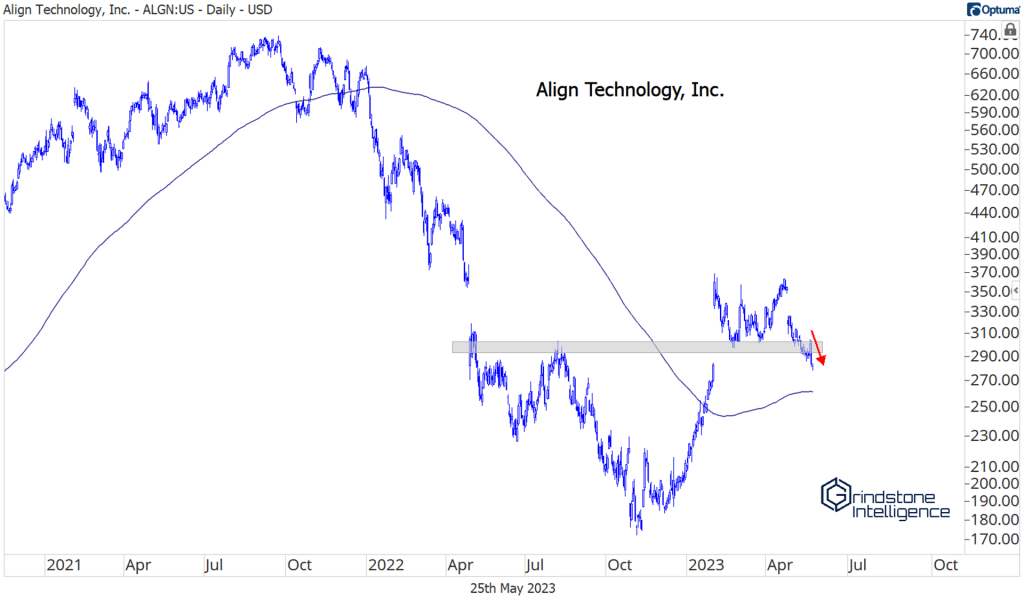

And Align Technology dropped below the neckline of a backwards cup and handle reversal pattern.

Those failures don’t bode well for other stocks that have been on our radar. Medtronic is barely hanging above the neckline from its own reversal pattern. We can still be long above 87 with a target of 99, but we need to be prepared to step away if MDT follows the example of ALGN.

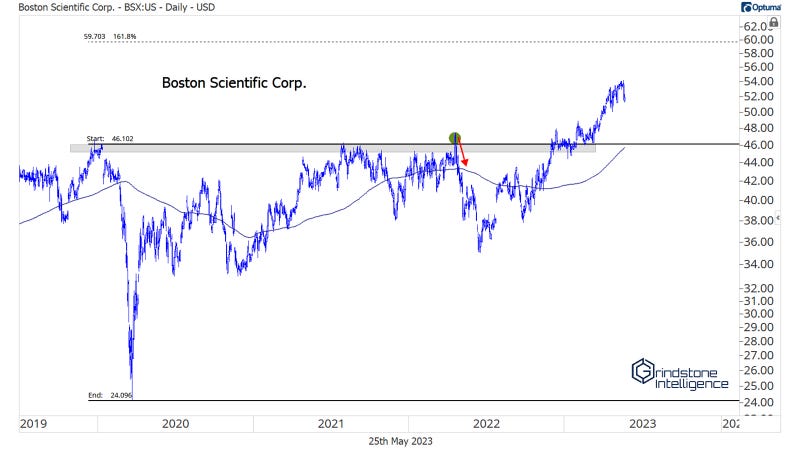

The long-term trend in Boston Scientific is still very much intact, and we still believe it can reach our target of 60. But it could take longer to get there if the rest of Health Care is falling. This isn’t the place to be initiating new positions in what has been one of our favorite stocks in the space.

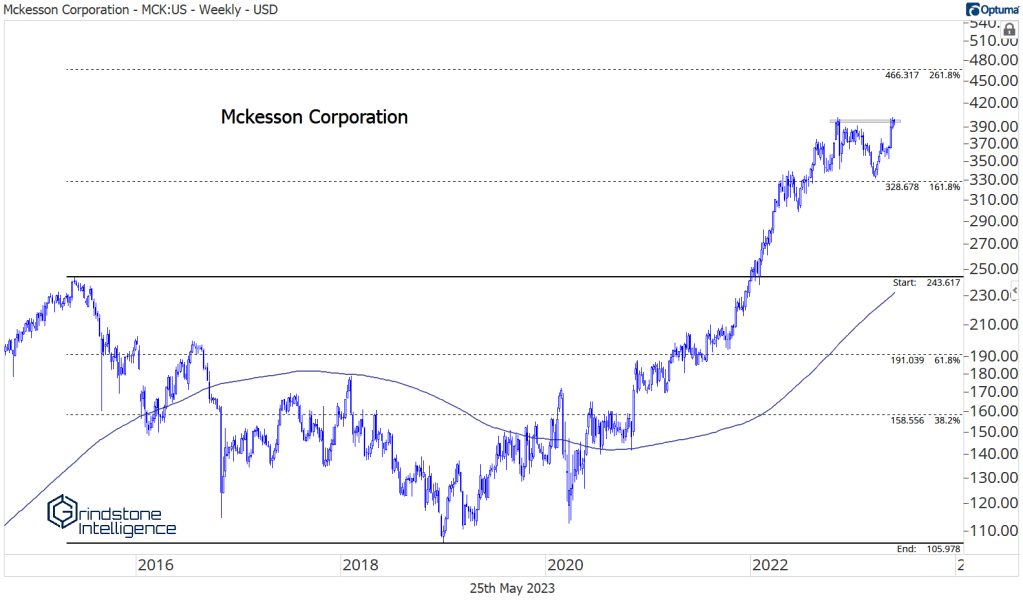

One place we haven’t seen much deterioration is in the Health Care Distributors, where McKesson, Amerisource Bergen, and Cardinal Health are all near new 52-week highs.

In McKesson, we’re targeting the 261.8% retracement from the entire 2015-2018 decline, which is up at 466. We can use 400 as a tighter risk level, but structurally, this trend is intact as long as the stock is above 330.

In Amerisource, we’ve got the exact same setup. The 261.8% retracement is at 190, and we can be long with the stock trading above 165, which is the high from last April.

The post (Premium) Health Care Stocks Out of Breadth first appeared on Grindstone Intelligence.