(Premium) Industrials Searching for Support

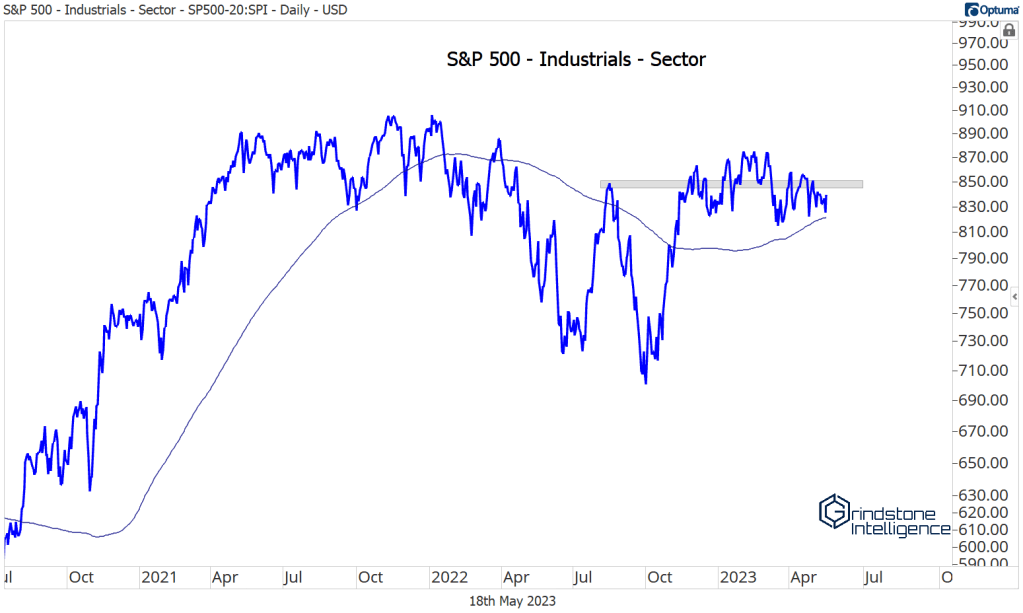

In a world that’s been dominated by large cap growth as of late, the Industrials are struggling to keep up.

It’s not that the sector is falling apart. It’s just that it isn’t doing much of anything. The Industrials bottomed last September, 2 weeks before the rest of the market did. Then they led the move higher, jumping more than 20% by the start of December. In the six months since, the sector has gone nowhere fast.

The rest of the market, though, led by large cap growth names, has continued to rise. On a relative basis, that means Industrials have dropped quite a bit. The first red flag was a bearish momentum divergence in January. Things have only gotten worse since that divergence was confirmed in March. Now, we’re watching to see if Industrials can find some support near that initial October relative breakout.

Momentum hasn’t confirmed the most recent low, which is encouraging. But is it just that momentum hasn’t confirmed yet? We’ll have to wait and see.

Sector bulls can continue to hang their hat on one chart: the equally weighted Industrials sector is still outpacing the equally weighted S&P 500 index. We’ve been using this ratio to highlight the underlying strength within the group and that underlying strength has only grown in recent weeks.

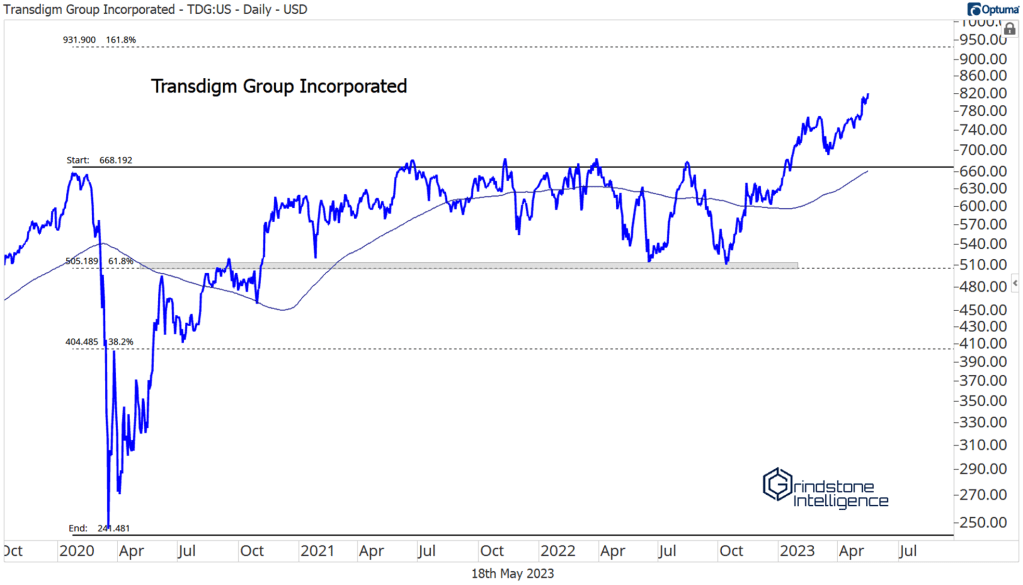

There continue to be plenty of opportunities on the long side. We like what we see within some of the Aerospace & Defense names. Transdigm is one we’ve liked for awhile and it’s still working. We wanted to be buying above 670 with a target of 930, which is the 161.8% retracement from the COVID collapse. That’s still our view.

Howmet Aerospace looks great, too. This isn’t a short-term idea (we’re looking at weekly bars on this chart), but above 40, we like it all the way up to 70. Of course, after 10 years of going nowhere, 70 could just be the start.

We haven’t missed anything in Raytheon. It failed to hold above the pre-COVID highs at $100, but it didn’t fall apart. Instead, it’s coiling up for another attempt at a clean breakout. We still want to be long RTX if it’s above 100 with a target of 132. That’s the 161.8% retracement from the COVID selloff.

General Electric is another that’s been on our list for several months, and it’s done nothing but trek higher. The risk-reward isn’t what it used to be, as we’re well above support at $90, but we still think it can go all the way back to that initial breakdown level of $145.

Snap-On is coming out of a multi-year base as well, the top end of which has been the 161.8% retracement from the 2018-2020 decline. We want to own this one above 260 with a target of 340, which is the next key retracement level.

Here’s one that hasn’t been on our radar in awhile. Rollins is knocking on the door of new all-time highs. It’s been stuck below $43 for almost 3 years, which is the 261.8% retracement from the 2019-2020 consolidation range. On a breakout, we think it goes to $55.

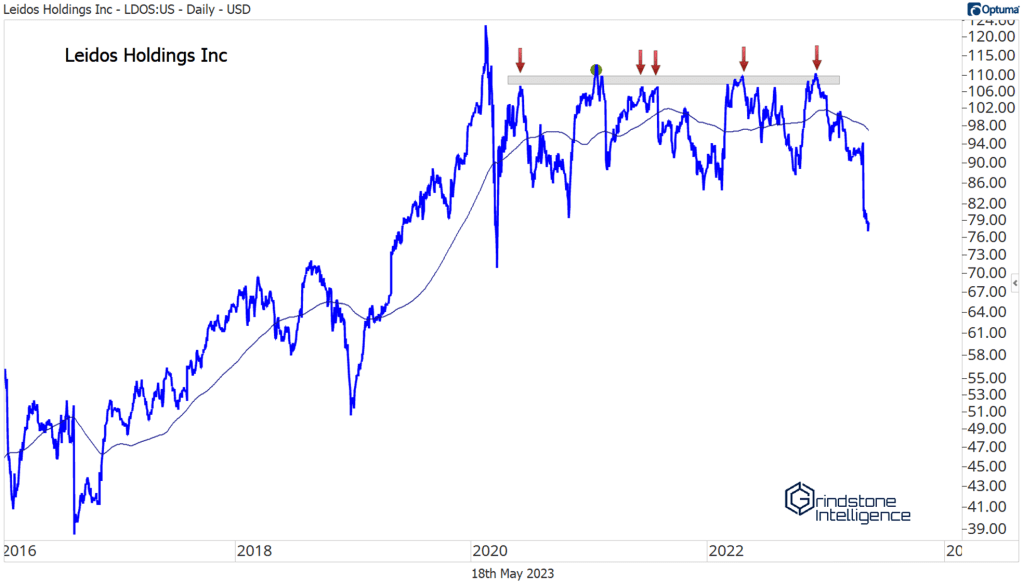

We have seen one concerning change within the sector over the last month: an expansion in new 52-week lows. Take a look at these breakdowns:

Not only are these names we want to avoid, but if they don’t show signs of stabilization, they could end up leading the whole sector lower. And because Industrials is the sector that has the highest correlation with the S&P 500, weakness in this group could be a precursor to overall market weakness.

The post (Premium) Industrials Searching for Support first appeared on Grindstone Intelligence.