(Premium) Industrials Sector Deep Dive – September

It’s make-or-break time for the Industrials sector.

All year, we’ve applauded the relative strength for the group. They were the first to break out above the January 2022 highs, and even now, the Industrials are hanging above support.

Sector breadth is still quite strong, too. Three-quarters of constituents in the Industrials sector are in new high regimes on a 3, 6, and 12-month basis (meaning they’ve set a new highs more recently than a new low). Those readings are on par with the Energy and Technology sectors.

Bullish trends are starting to weaken, though, and that’s something the sector will need to correct sooner, rather than later. The chart below details the issue. More than half of Industrials stocks are still in long-term technical uptrends, but we’re seeing growing numbers of short-term downtrends and weakening short-term uptrends. Without stabilization, that short-term weakness will bleed into long-term structural issues.

We’re also seeing signs of relative weakness. If you’re not familiar with Julius de Kempenaer and his Relative Rotation Graphs®, you can learn about them here. The basic idea is that the relative strength and momentum of stocks and sectors are normalized against a benchmark to show which stocks or sectors are Leading (upper right), Weakening (lower right), Lagging (lower left), or Improving (upper left).

The Industrials have been in the improving quadrant for several weeks now, but they took a sharp turn lower in recent days as they approached the leading quadrant.

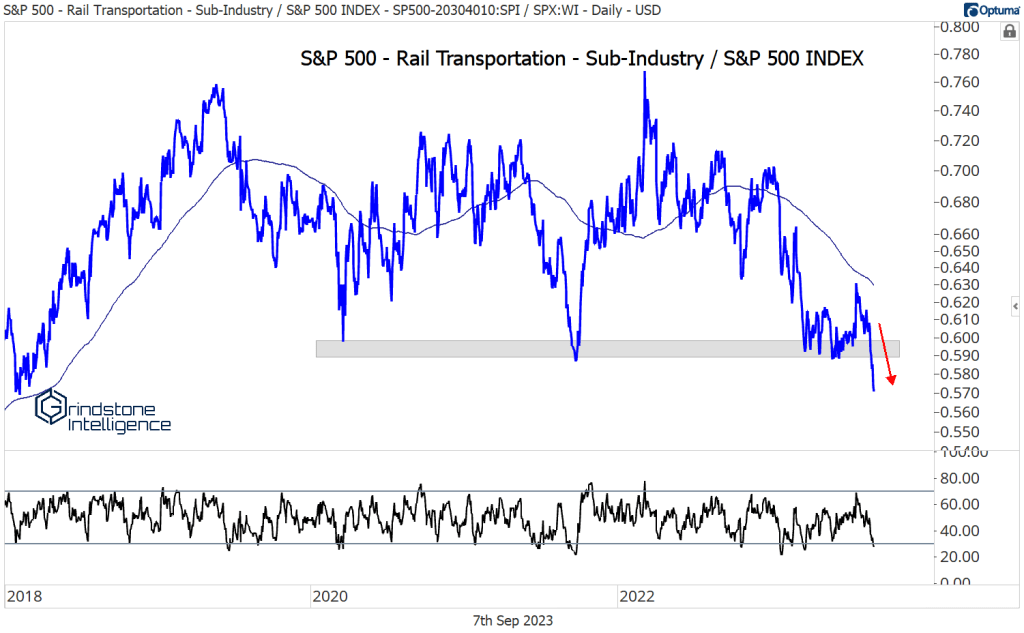

Weakness in defense and transportation stocks are largely to blame. The S&P 500 Rail Transportation Sub-Industry just broke down to 5-year relative lows.

Meanwhile, Lockheed Martin just cratered to its lowest level of the year.

And contractor L3Harris is at new lows of its own:

Lucky for us, we don’t have to buy defense and transportation stocks. We can focus on the names that are showing relative strength.

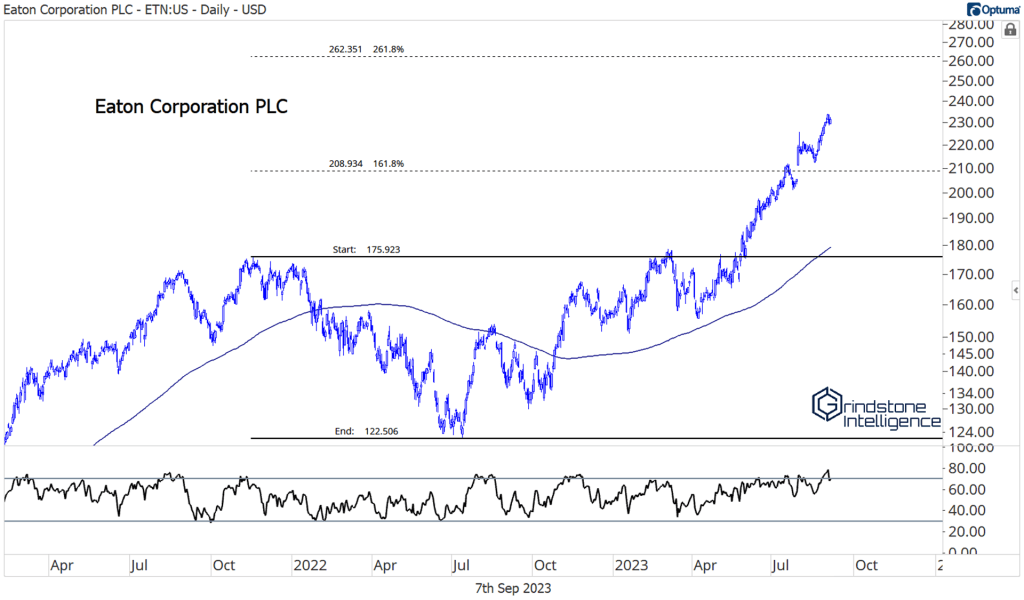

Like Eaton Corp. It’s up at all-time highs relative to the S&P 500 index and has been outperforming steadily for several years now.

It’s doing just fine on an absolute basis, too. After briefly responding to potential resistance at the 161.8% retracement from the 2022 decline, ETN gapped to new highs. We still want to be buying any pullbacks towards $210 with a target of $260.

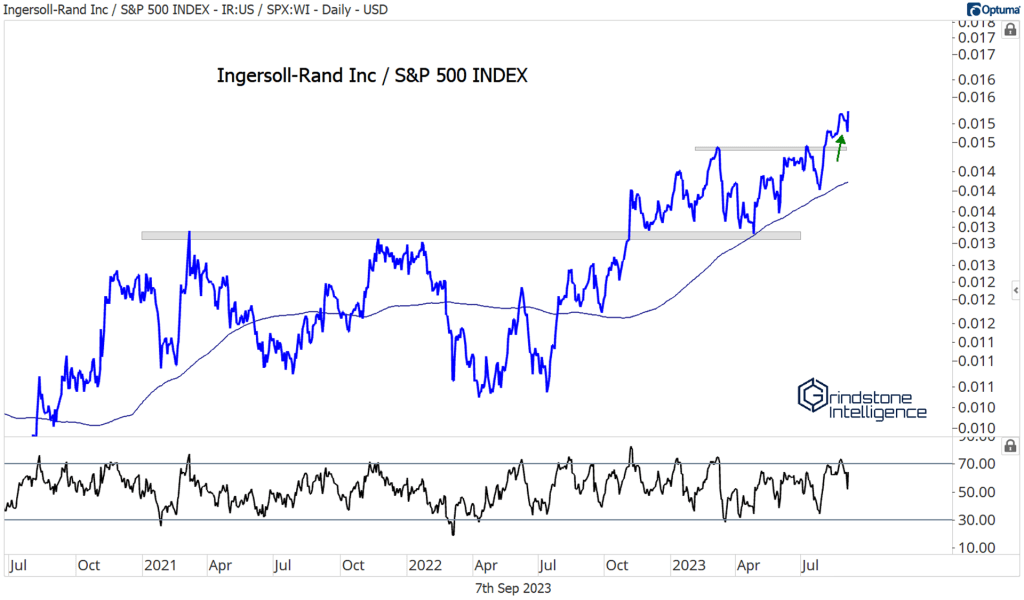

Ingersoll-Rand is at new highs, too, on both a relative and an absolute basis.

The risk-reward for IR isn’t very attractive with the stock trading midway between the 2022 highs and the 161.8% retracement from last year’s selloff, but we can appreciate the strength nonetheless.

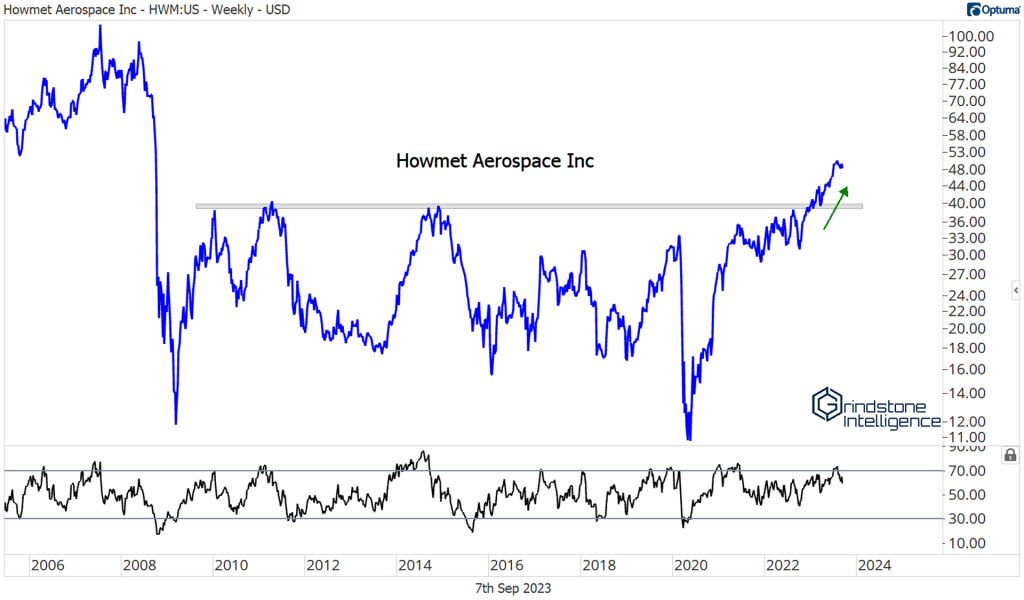

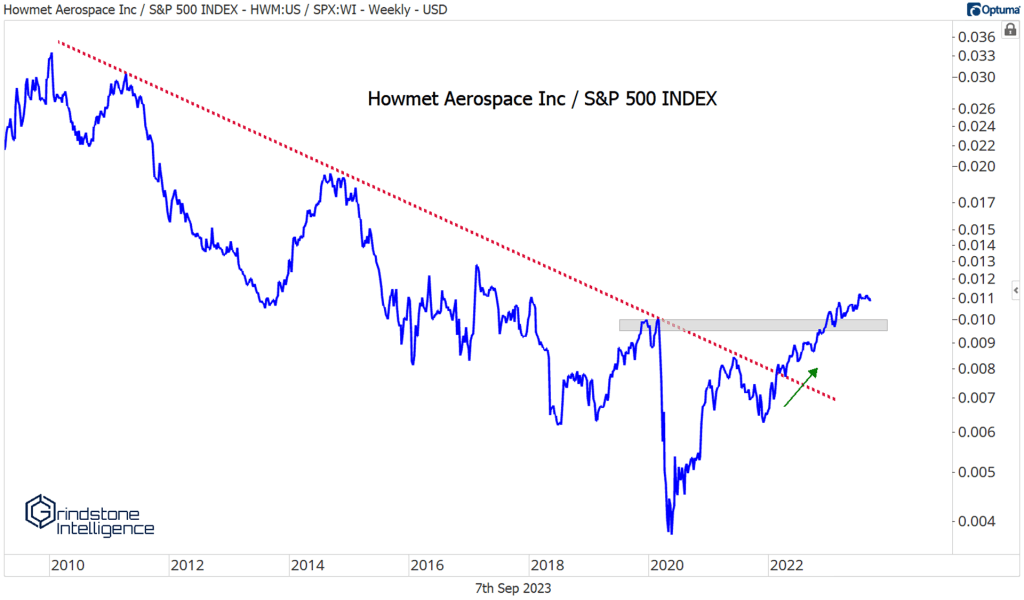

How about Howmet Aerospace? It doesn’t have the same issues as peers Lockheed and L3. Our target for this one has been $70, which is the initial breakdown area from 2008.

That’s as it continues to solidify its new uptrend against the S&P 500. It started with higher lows, then a break of the decade-long downtrend line, and confirmed the reversal by setting new multi-year highs. This isn’t the type of chart we want to be betting against.

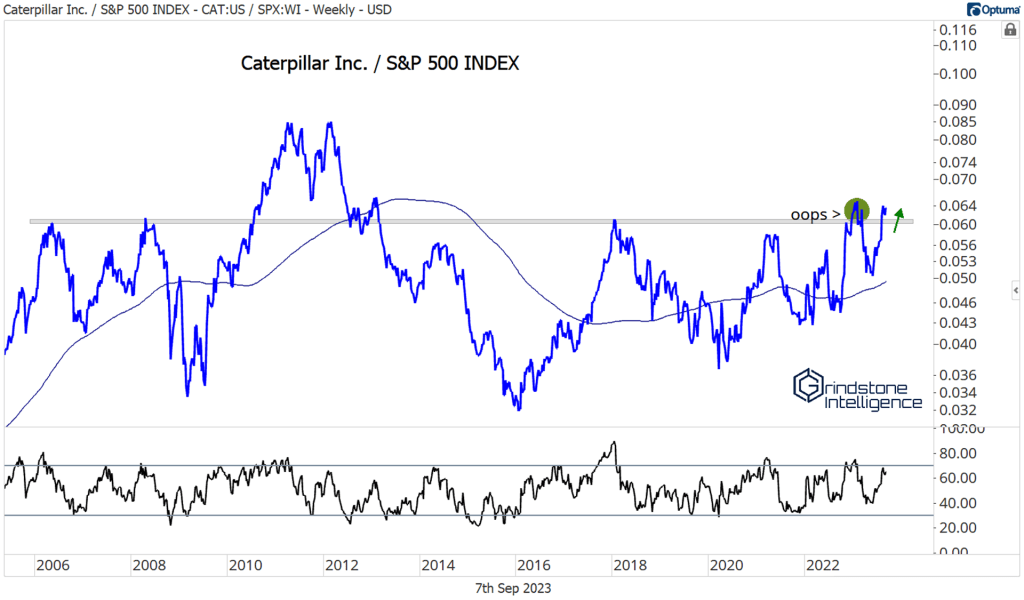

Caterpillar has our eye, too. It resolved higher from a 6-month consolidation, and now we think it can continue on toward our target of $335, which is the 423.6% retracement from the 2019-2020 selloff.

We like CAT’s relative strength even more. After a false start earlier this year, the ratio is back above a key 15-year rotational level. How can we not like Caterpillar if we’re above 15-year resistance?

There’s plenty to like within the sector. The question is, will recent weakness spread?

The post (Premium) Industrials Sector Deep Dive – September first appeared on Grindstone Intelligence.