(Premium) Information Technology Sector Deep Dive – August

The tide is turning.

We touched on the risks in yesterday’s market outlook for the month of August. Interest rates are back on the rise, and the US Dollar is finding renewed strength. It’s much to early to tell how long these shifts can last, but one thing is clear: a more cautious outlook toward stocks over the coming weeks is appropriate.

We’ve turned especially cautious on growth-oriented sectors, including Information Technology. Yesterday, we downgraded our rating on the Tech sector to Equalweight, from Overweight – a rating we’d had in place since early April. To be clear here, we haven’t turned negative on Tech. This is still a bull market, and risk-on sectors tend to outperform during secular market advances. But the near-term prospects for Tech leadership have darkened. Here’s what we’re seeing:

Relative to the S&P 500, the sector broke out to new all-time highs in the middle of July after spending the prior month-and-a-half digesting the huge year-to-date runup from. That breakout should have led to further gains for Tech. Instead, we quickly reversed the breakout.

From failed moves tend to come fast moves in opposite directions. Sometimes they even lead to outright trend reversals. In either case, we don’t want to be aggressively loading up on Tech right here, because the odds have shifted out of our favor.

We’ve got potential for the same thing to happen for the sector on an absolute basis. Prices just broke out above the prior bull market highs last month. But now we’re threatening to drop back below that key level. Again, we don’t want to be overweight the sector if this means a big reversion to the middle of last year’s range.

One additional reason to be cautious is that we still haven’t seen the outperformance in Tech broaden past the mega caps. Yes, Information Technology can be a leader with just handful of names doing the heavy lifting. But throughout the entire period from 2012-2020 (when stocks like Apple and Microsoft were already being blamed for driving too much of the outperformance) the equally weighted sector was also outperforming the equally weighted S&P 500. It wasn’t just the big guys.

This time around, we’re just not seeing the average Tech stock catch a bid.

Here’s a closer look. We tried to get a breakout, but we’re not quite there yet. We can afford to be patient and see what happens.

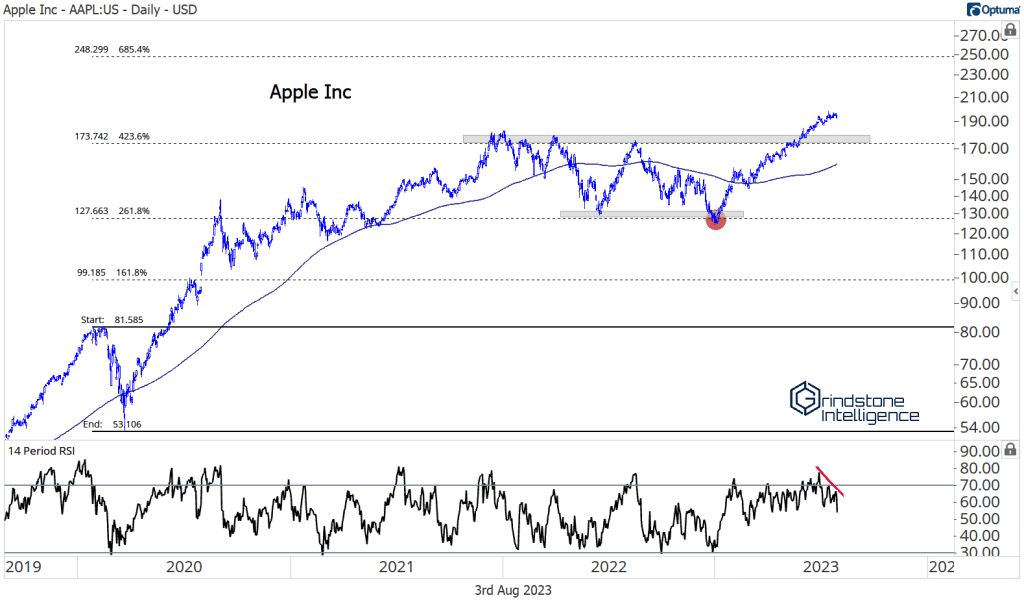

Whether Tech completely falls apart or not will depend on how its largest components respond to the pressure. Apple is still hanging up near all-time highs, but momentum has deteriorated over the last month. On the most recent high, the stock was well short of reaching overbought conditions (and contrary to how the word sounds, that’s not a good thing – getting overbought is clear evidence that buyers are aggressively pushing prices higher).

Microsoft has a more concerning look. That failed breakout most likely puts Microsoft’s rally on hold. At worst, it’s the start of a nasty correction.

Broadcom is consolidating below resistance. It surged out of an 18-month base last month, rising 40% in just a few days before peaking at the 423.6% retracement from the COVID decline. Since then, we’ve been taking a wait-and-see approach to see how the stock responds. Momentum has definitely tailed off, but we haven’t seen any deterioration from price yet, as the stock is still near its highs. It could just be that momentum hasn’t confirmed the move yet. Or it could be that AVGO is about to mean revert. We just don’t know which. On a resolution above $910, though, we want to be long with a target of $1368, which is the next key Fibonacci retracement level from the COVID selloff.

NVIDIA is similarly stuck below a key Fibonacci level, the 161.8% retracement from last year’s decline. We want to wait and see what happens next – further consolidation seems most likely.

Those four stocks comprise a whopping 55% of the XLK (the SPDR Technology Sector ETF), so their reactions will ultimately decide the path of the sector overall. But beneath the surface, a few other names are catching our eye, and have the potential to buck any weakness in the mega caps.

ON Semi has done its own thing for the last year – you can’t even tell that stocks were in a bear market in 2022 based on their chart. The risk/reward isn’t great for new positions, but we still believe it can go to $128, with support down at $82.

One thing we love to see is a stock that’s showing strength on both an absolute and a relative basis. ON Semiconductor has been doing that for several years now. Look how it’s steadily stair-stepped higher when compared to the S&P 500 Index.

Microchip just broke out of a big, multi-year base. We want to be buying it with a target of $121, which is the 423.6% Fibonacci retracement from the 2018 selloff. That’s a trade that could take some time to play out. In the near-term, we don’t want to own it if it falls back below $86.

Motorola was one of the first to breakout earlier this year, then briefly pulled back to the initial breakout level, just above $270. Most impressive, we think, is how momentum has never even approached oversold territory this year. That’s something you don’t see in a downtrend. We like it long above the 2021 highs with a target above $360. Those who want to see more confirmation might want to wait until it breaks through 6-month resistance at $300.

KLAC is still trekking higher after breaking out of a multi-year consolidation, with easily identifiable support. We want to own KLAC above $420 with a target up above $600, which is the next key Fibonacci retracement level from the COVID selloff.

HPE is newly on our radar as it tries to break out of a big multi-year base. This one’s failed at this $17.55 level a handful of times now, so we don’t want to be buying in anticipation of a breakout – we’d rather wait and see it actually happen before pulling the trigger. Even then, we think there will be plenty of upside left – there’s 30% to our initial target of $23.70.

PTC is trying to break out, too. It’s taken a looong time to develop, but we’re finally back to the 2021 highs at $150. If we’re above that, we want to be targeting a move above $200.

So we’ve shown all these bullish setups, but let’s say you’re more negative about the outlook than we are. You think Tech is about to get roasted. Where should you be looking for shorts? How about the stocks that are showing relative weakness?

Like SolarEdge. It just broke down to multi-year lows relative to the S&P 500.

It did the same on an absolute basis. The risk/reward setup is great here on the short side below $200.

The post (Premium) Information Technology Sector Deep Dive – August first appeared on Grindstone Intelligence.