(Premium) Information Technology Sector Update – July

The Information Technology sector has jumped 40% to start the year. It’s outpaced every other sector and more than doubled the performance of the S&P 500 Index. Along the way, Tech surpassed a record level that had been in place since the dotcom bubble. It’s been so dominant that every other area of the market has lagged the benchmark since 2018.

The extreme level of dominance can last for a long time, and it has.

But it can’t go on forever – not without taking a break now and again. Big tech is due for a breather, and there are signs that one is shaping up.

We’ve been cautiously watching for signs of a Tech pullback over the last month, ever since some of the big drivers of the rally started hitting our targets. Over the last month, though, a new leader emerged. Apple ignored former resistance and surged to a new high, surpassing a market cap of $3T along the way.

Comprising nearly a quarter of the entire sector, Apple’s strength was enough to keep Tech moving higher even without much help from May’s leaders. So long as Apple is pushing forward, we can’t be too pessimistic about the sector’s prospects.

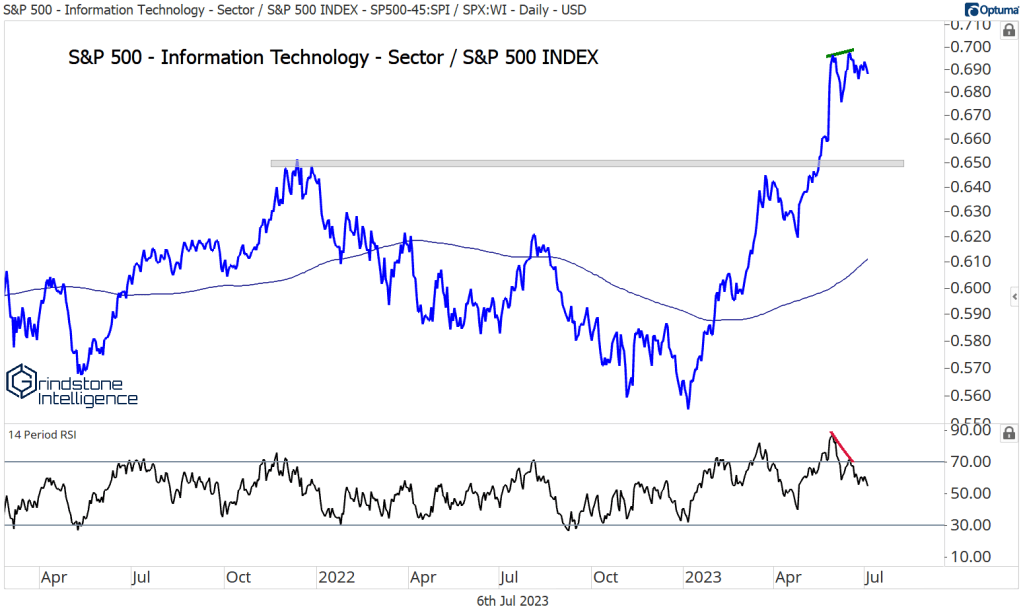

That said, Information Technology has found some resistance at its former all-time highs. There’s no more logical level for the group to stall out, as they try to absorb overhead supply.

On a relative basis, too, there are storm clouds brewing. Momentum put in a bearish divergence at the most recent high. Structurally, Tech is still in a long-term relative uptrend, but that doesn’t preclude the group from going back to test the breakout level. Remember, those highs from 18 months ago were also the dotcom bubble highs, so there’s plenty of memory there.

Similarly, the ratio of equally-weighted tech vs. the cap-weighted sector is working on a bullish momentum divergence after breaking the September 2020 lows. We’ve seen these types of momentum divergences get ignored before (see March and April), but a move back above resistance from those 2020 lows would be good confirmation that a larger mean reversion in this ratio underway.

Microsoft, the second-largest stock in the sector, is stuck below its 2021 highs, acknowledging the resistance that Apple ignored. MSFT will be a good indicator for the rest of the sector. If it’s above the former peaks, expect Tech to be leading. If not, that would be consistent with Tech taking a break and telling us we need to look elsewhere for the time-being.

Similarly, Broadcom is consolidating below resistance. It surged out of an 18-month base last month, rising 40% in just a few days before peaking at the 423.6% retracement from the COVID decline. Now we’re taking a wait-and-see approach to see how the stock responds. In any case, it appears the rally has stalled out for now.

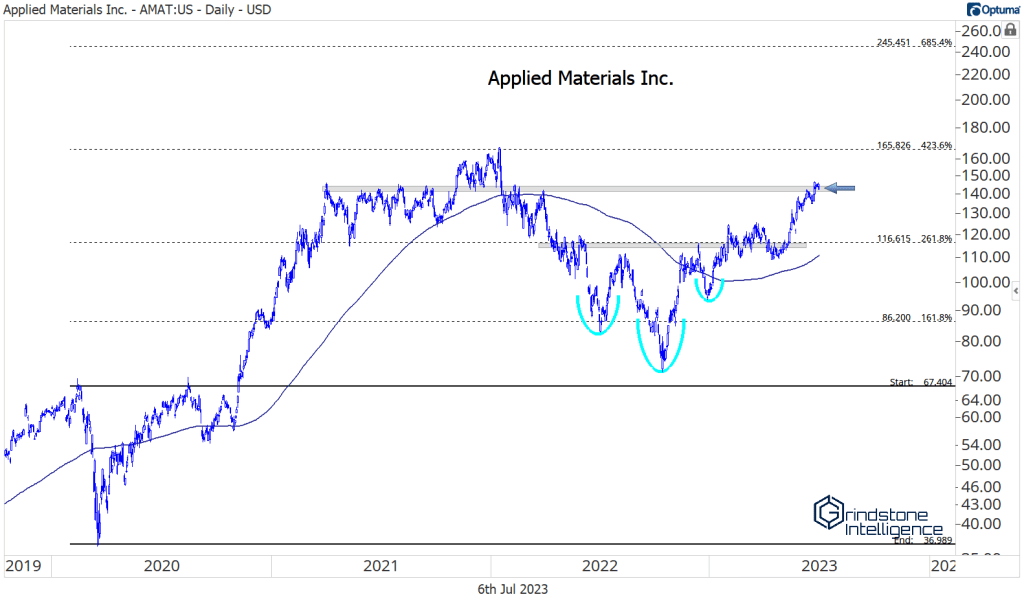

Applied Materials is another. It hit our target of $145, and now it’s battling a key former resistance level. We want to be buying the eventual breakout with a longer-term target of $245, which is the 685.4% retracement from the 2020 decline. For now, though, a neutral position is best on the stock.

Instead, look at peer KLA Corp. KLAC is just breaking out of a multi-year consolidation, with easily identifiable support. We want to own KLAC above $420 with a target up above $600, which is the next key Fibonacci retracement level from the COVID selloff.

KLAC isn’t the only one. There are plenty of stocks to like in the space, even if the sector as a whole faces some headwinds. And rotation out of the mega caps and into some less popular names would be healthy, bull market action.

Microchip just broke out of a big, multi-year base. We want to be buying it with a target of $121, which is the 423.6% Fibonacci retracement from the 2018 selloff. That’s a trade that could take some time to play out. In the near-term, we don’t want to own it if it falls back below $86.

Motorola was one of the first to breakout earlier this year, then briefly pulled back to the initial breakout level, just above $270. Most impressive, we think, is how momentum has never even approached oversold territory this year. That’s something you don’t see in a downtrend. We like it long above the 2021 highs with a target above $360.

One thing we love to see is a stock that’s showing strength on both an absolute and a relative basis. ON Semiconductor has been doing that for several years now. Look how it’s steadily stair-stepped higher when compared to the S&P 500 Index.

And when you take the stock on it’s own, you can’t even tell that we were in a bear market last year. ON Semi just kept on moving higher. It hasn’t stopped in 2023.

With the stock above support at $82, we want to be buying it with a target of $128, which is the 685.4% Fib retracement from the 2020 decline. That’s 30% higher from here.

The post (Premium) Information Technology Sector Update – July first appeared on Grindstone Intelligence.