(Premium) Insuring Against Bank Weakness

Financials have been a top-performer since we last checked in on the sector.

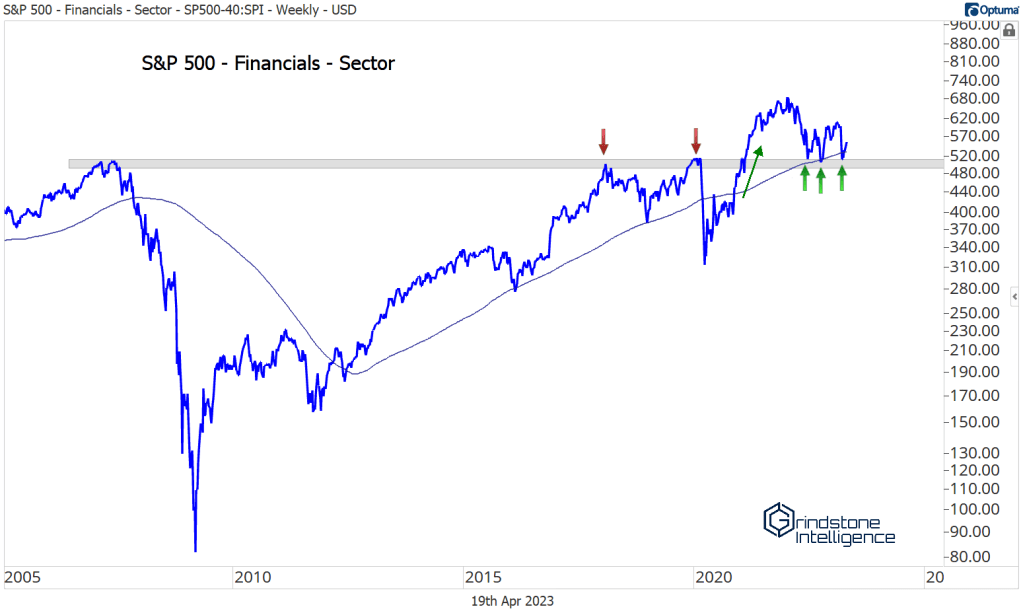

After all the banking turmoil in March, it wasn’t hard to make a bear case for Financials. On a relative basis, the group went from breakout watch to new 52-week lows in less than a week. Relative momentum reached oversold levels not seen only twice over the last 20 years. Rumors of a credit crunch-fueled recession swarmed the headlines.

A negative outcome could very well be on the horizon. But that outcome won’t arrive as long as Financials are still above their 2007 highs. It really is that simple for us. If Financials are below those highs, look for trouble. Otherwise, how bad could things really be?

In the near-term, we’re watching for potential relative strength within the average Financial stock. When we compare the equally weighted sector to the equally weighted S&P 500 index, we’re back down at the 2011 and 2020 lows. This level sparked big rallies twice before – why can’t it do so again? If this level fails to hold, though, we need to be stepping to the side.

Nimble traders may want to look at regional banks if they want to catch that potential rally. We don’t have to swing for the fences here, though, especially with the sector in a longer-term relative downtrend. We’d rather focus our attention on names showing relative strength.

Insurance stocks stand out in that regard.

Arthur J Gallagher & Co. is setting new all-time highs. I don’t see a banking crisis in this chart.

With AJG, we want to be long above last year’s highs of 200. We’re targeting the 423.6% retracement from the 2020 decline, which is up near 250.

We’ve gotten a nice pullback in Globe Life, which greatly improves the risk/reward opportunity for this setup. If GL is above 107, we can be long with a target of 137. But we don’t want to be involved if it’s below the January 2020 highs.

Marsh & McLennan is making another run at 18-month resistance here. While a bunch of Financial stocks were setting new 52-week lows, MMC was busy building up for a breakout. We want to be buying a move above 175 with a near-term target of 195.

Outside of the insurance space, Cboe is thriving during the volatility of the past month – they’re trying to break out of a 5 year base. If this stock is above 130, we like it with a target of 160, which is the 161.8% retracement of the 2020 decline.

The post (Premium) Insuring Against Bank Weakness first appeared on Grindstone Intelligence.