(Premium) March Communication Services Outlook

The Communication Services sector reversed some of its year-to date gains, causing us to wonder: Is the group set to resume its multi-year downtrend, or is this just a digestion of the rally?

Frankly, we aren’t sure what the answer is. On a relative basis, failure hang above last summer’s support level is concerning. At the same time, there’s still a clear pattern of higher highs and higher lows since the October bottom. A neutral approach makes the most sense for now, given the uncertainty.

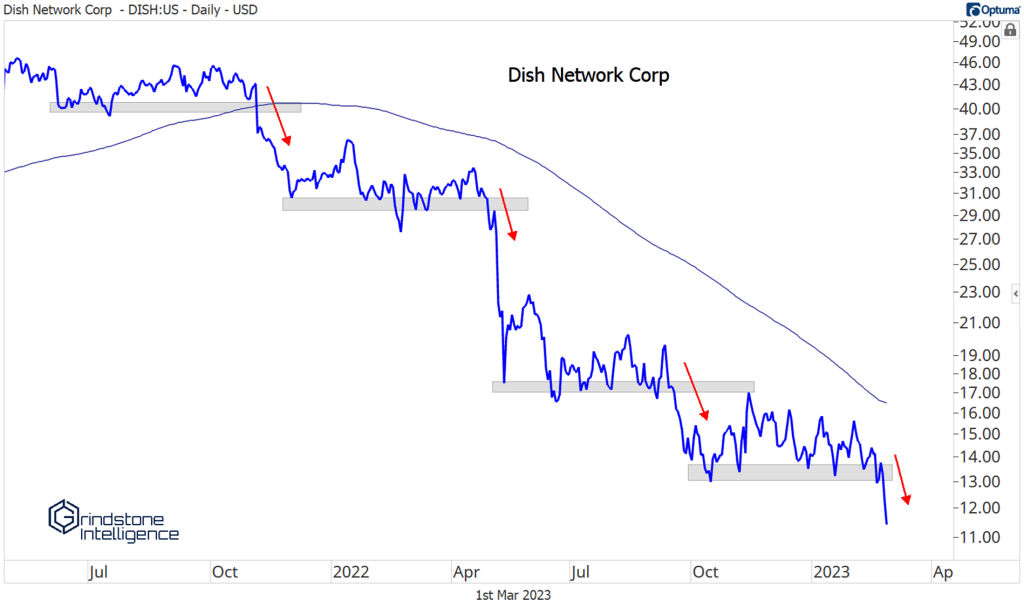

There are some good reasons to be bearish – namely, the new lows we’re seeing in the sector. Check out Dish Network. Consolidation. Breakdown. Rinse. Repeat.

And Lumen Technologies appears to be broken. Just gross.

Those two have been laggards for a long time though. Electronic Arts hasn’t. And still it’s breaking to new multi-year lows.

So why not approach the whole sector from the short side? Because not all stocks look the same.

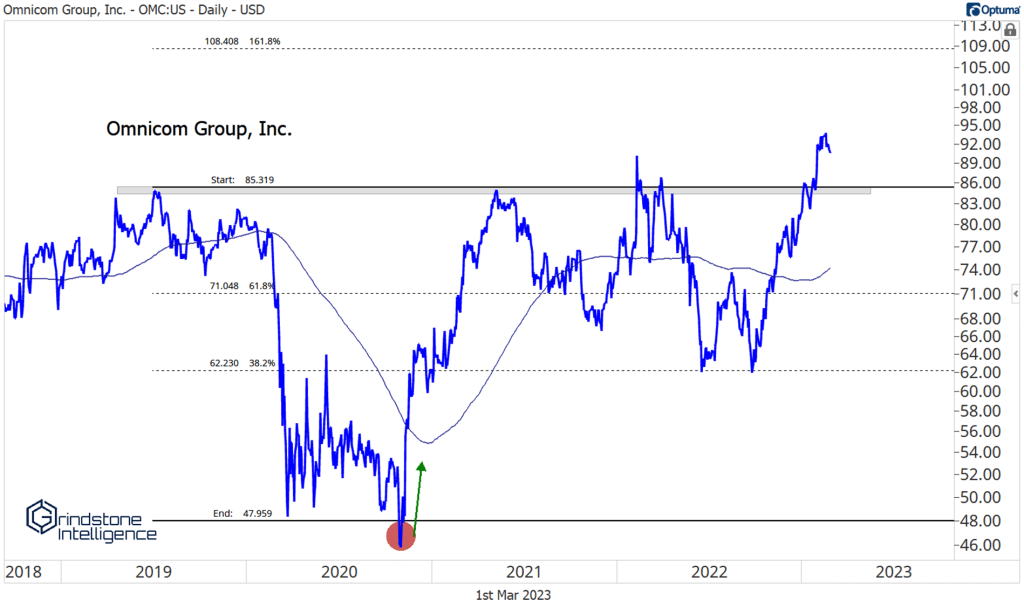

Omnicom is moving toward the 108 target we laid out last month.

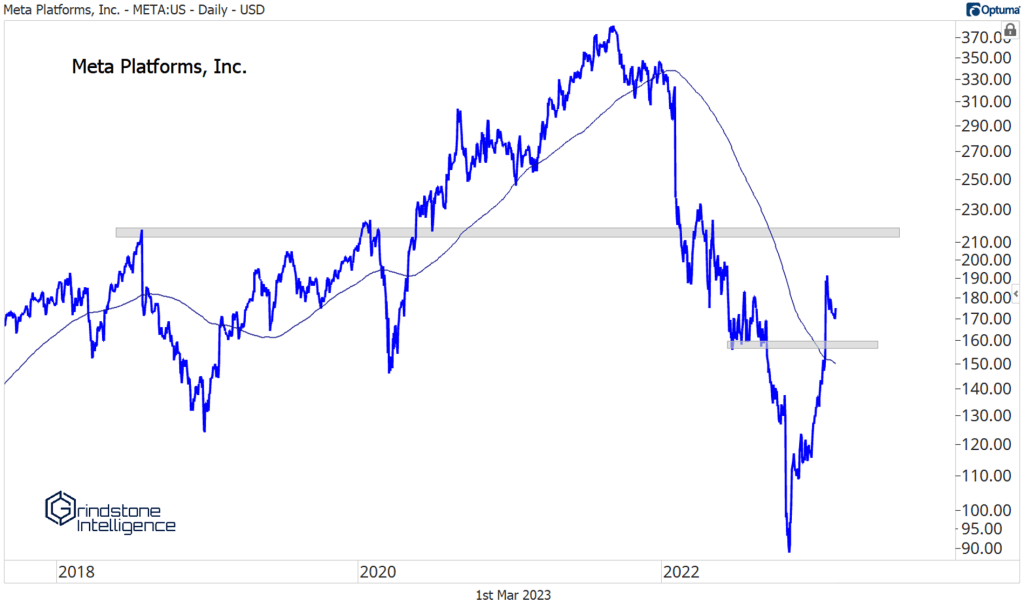

And Meta is hanging above last summer’s lows at 160, which should offer support on any further pullbacks. Even in a rangebound market, Meta could get up to 220, which is 25% higher from here.

View the rest of our March outlook:

March Technical Market Outlook Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector Financials Sector Health Care Sector Industrials Sector Information Technology Sector – Unlocked Materials Sector Real Estate Sector Utilities Sector

The post (Premium) March Communication Services Outlook first appeared on Grindstone Intelligence.