(Premium) March Consumer Discretionary Outlook

The Consumer Discretionary sector is dominated by a handful of huge names, but if you look beneath the surface, things look quite a bit different.

Consumer Discretionary remains in a downtrend on a relative basis, despite the December/January failed breakdown. The Discretionary/S&P 500 ratio is stuck below a falling 200-day moving average, and the point of identifying trends is because trends are more likely to persist than reverse.

But the market cap weighted index is dominated by Tesla and Amazon, which together comprise 38% of the sector. Things are better beneath the surface. If you compare the equally weighted group to the cap weighted one, you’ll see the equally weighted sector hovering near multi-year highs, even after the year-to-date pullback.

And if you compare EW Discretionary to the EW S&P 500 index, (which itself has shown strength relative to the cap weighted version) Consumer Discretionary is at worst in a sideways trend vs. the rest of the market.

The auto industry is one place that stands out (and we’re not just talking about Tesla). Aptiv PLC broke out above the 112 level we identified last month, and we still think it’s headed to 135.

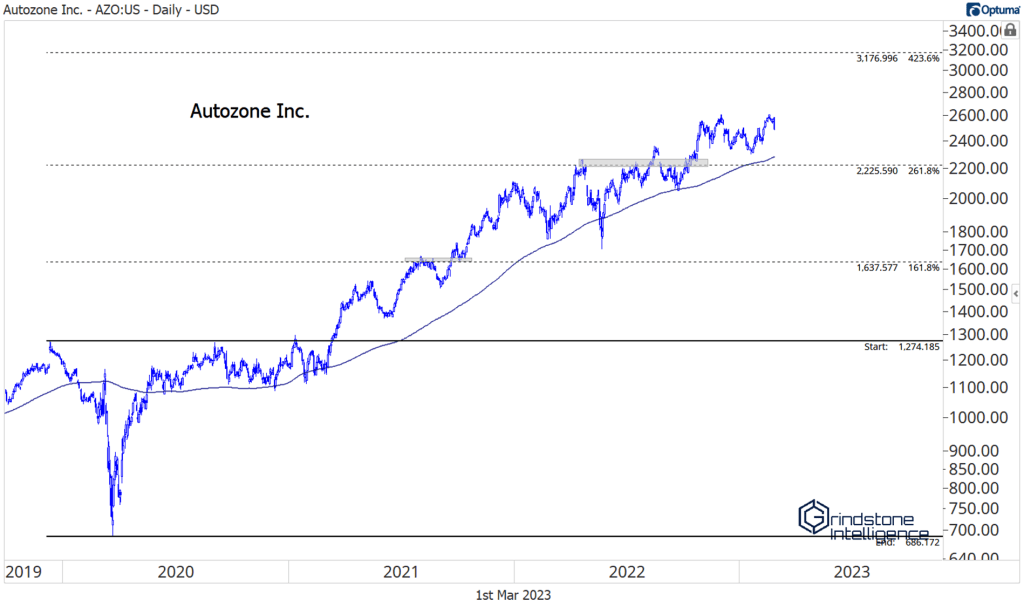

Auto parts dealers also still look great. O’Reilly Automotive, AutoZone, and Genuine Parts are each in healthy, long-term uptrends.

Here are some other favorable setups to keep an eye on. Tractor Supply is working on getting above last year’s highs at 240. A breakout would have us targeting the 685.4% Fibonacci retracement from the 2015-2018 trading range, up near 360.

Caesars Entertainment and Carnival Corp have identical setups, and most likely will have the same resolution. Pick your poison. We’re looking at a potential inverse head-and-shoulders reversal pattern, with the potential for +30% upside moves in each. However, We need to be careful. Often, what looks like a head-and-shoulders reversal is really just a consolidation pattern before the existing trend resumes. It’s always the higher likelihood that the trend continues, not reverses.

We only want to be long if we’re above those necklines.

View the rest of our March outlook:

March Technical Market Outlook Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector Financials Sector Health Care Sector Industrials Sector Information Technology Sector – Unlocked Materials Sector Real Estate Sector Utilities Sector

The post (Premium) March Consumer Discretionary Outlook first appeared on Grindstone Intelligence.