(Premium) March Consumer Staples Outlook

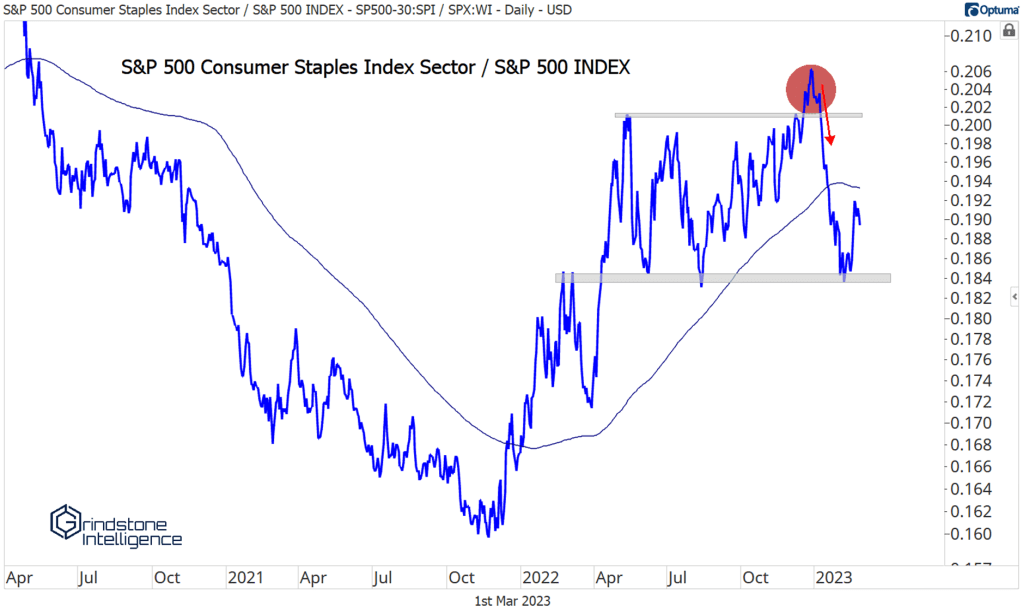

The Consumer Staples sector outperformed in February after finding support at last year’s relative lows.

We reduced our equal weight rating on the sector in January after it became clear that December’s breakout was a fake out. From failed moves come fast moves in the opposite direction, and Consumer Staples was no exception. Last year’s lows should offer ample support for now, and we’d consider reducing our rating if those lows fail to hold.

A sideways pattern isn’t out of the question, though. On an absolute basis, the sector hasn’t suffered significant damage. All-time highs are well within striking distance,

There’s good reason to believe that new highs are on the way, too, judging by price action in some of the underlying names.

General Mills never fell back below those 2016 highs, and we still think it can go all the way to 95.

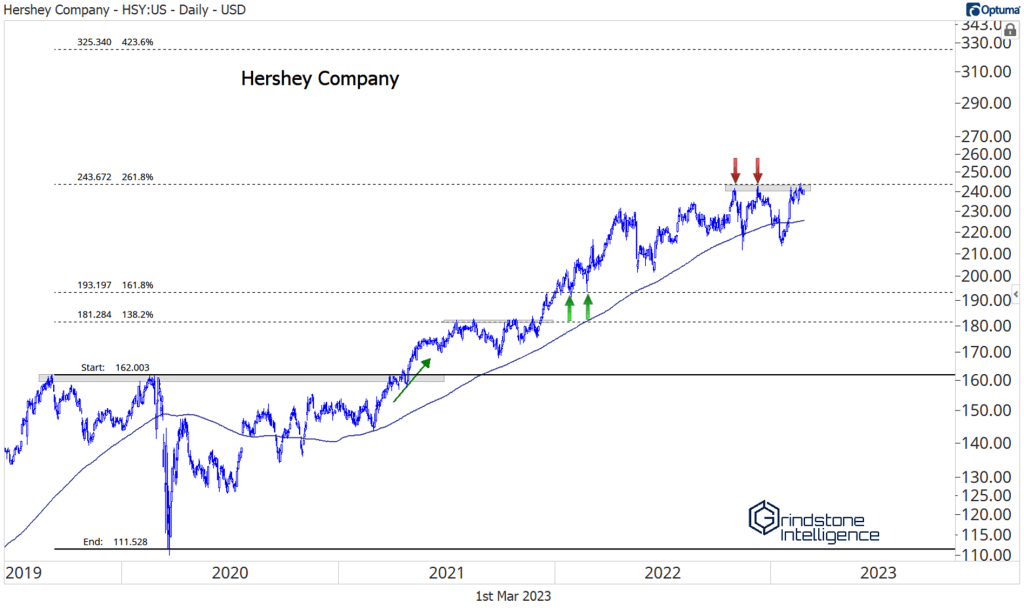

Hershey Company has been a relative leader over the last few weeks, and it’s on the verge of all-time highs. That’s not bearish. If it breaks out above 245, we want to be long with a target of 325.

Both Lamb Weston and Monster Energy are consolidating above former highs. For LW, we want to be long with a target of 125 if it’s above 96.

We’re targeting 115 near-term for MNST, with a risk level at 98.

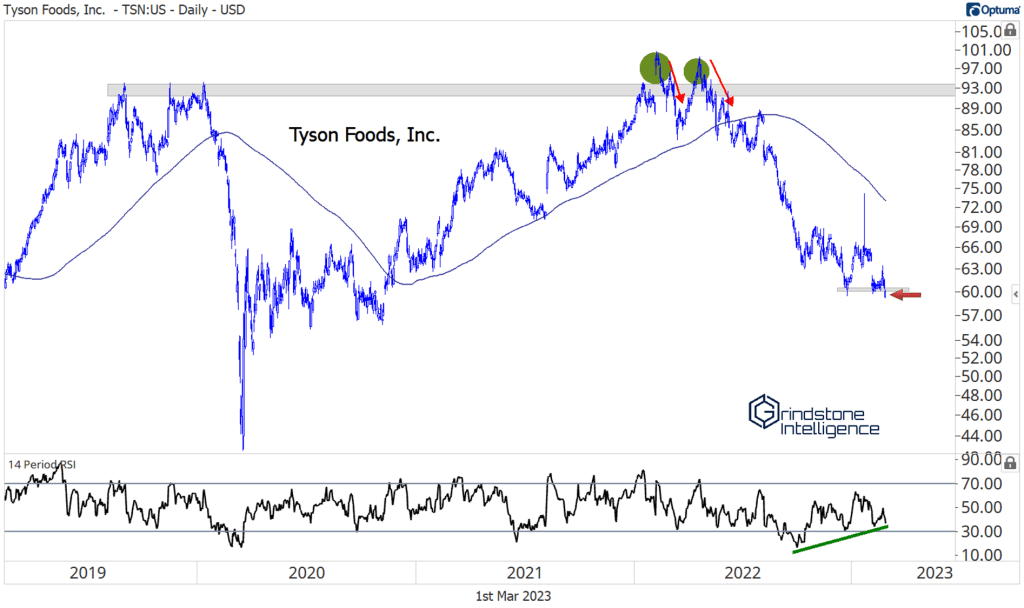

If catching falling knives is your thing (admittedly, it isn’t ours), keep an eye on Tyson. It just set new multi-year lows. The risk here is clearly defined – we absolutely do not want to own it below 60. But momentum has yet to confirm the breakdown, and a mean reversion isn’t out of the question.

View the rest of our March outlook:

March Technical Market Outlook Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector Financials Sector Health Care Sector Industrials Sector Information Technology Sector – Unlocked Materials Sector Real Estate Sector Utilities Sector

The post (Premium) March Consumer Staples Outlook first appeared on Grindstone Intelligence.