(Premium) March Energy Outlook

The Energy sector turned in a modest performance during February, outperforming during the first half of the month, and then lagging during the final weeks.

We haven’t wavered in our negative outlook for the sector. A surge to new relative highs seems the least probably outcome, given the existence of a massive bearish momentum divergence, and the significant overhead supply for the sector on an absolute basis.

We’d have even more confidence in our view if the sector dropped below those 2008 highs. Then the action would be a mirror image of the 2014 failed breakout.

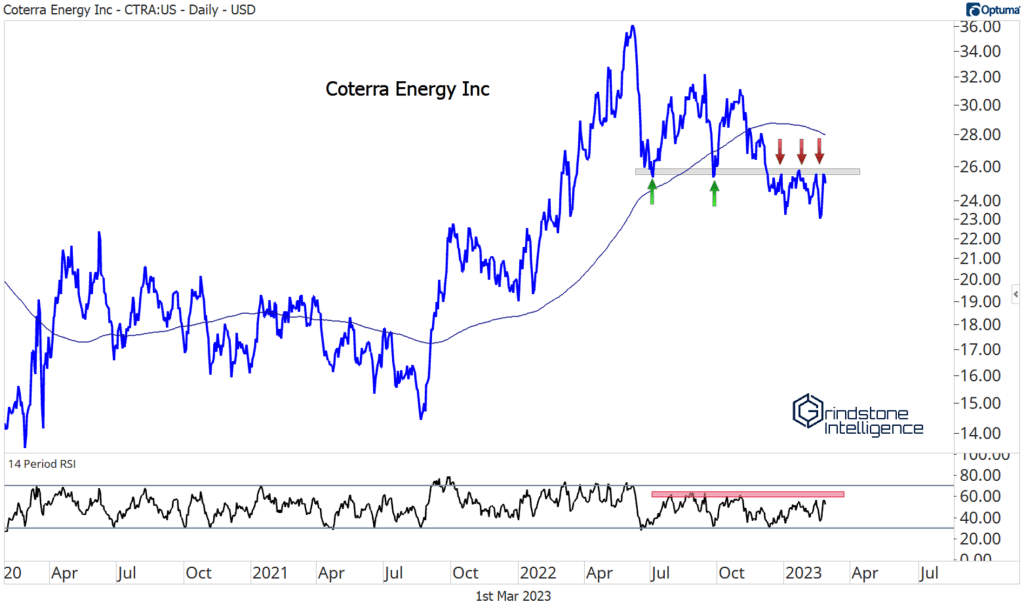

Coterra Energy is stuck below resistance, and momentum is in a bearish range. This multi-month consolidation can be expected to resolve in the direction of the underlying trend. That’s down.

Pioneer Resources just dropped below a significant support level. If it’s above 210, this is a different story. But right now it’s not.

Where could we be wrong on our bearish outlook for the sector? What if we never break below those 2008 highs? Then maybe we work off this bearish momentum divergence via time, not price, and it looks like this:

In that scenario, we want to be buying the names that have held up better.

SLB (formerly Schlumberger) is setting higher highs and is comfortably above support. If Energy isn’t breaking down, we think SLB goes to 80.

Exxon has also shown a ton of relative strength. It’s already well above its 2014 highs. We can have a long-term target of 150 above support at 105.

View the rest of our March outlook:

March Technical Market Outlook Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector Financials Sector Health Care Sector Industrials Sector Information Technology Sector – Unlocked Materials Sector Real Estate Sector Utilities Sector

The post (Premium) March Energy Outlook first appeared on Grindstone Intelligence.