(Premium) March FICC Outlook

Currencies

By the middle of January, the US Dollar Index was down than 10% from its September peak. The move pushed the index below its 2016 and 2020 peaks for the first time in nearly a year – a heartening development for equity market bulls, who watched Dollar strength wreak havoc on returns in 2022. The downtrend continued as we moved into the second month of the year, and the first trading day of February brought with it new lows for the index. All seemed well.

Then a month of declines were erased in the next 72 hours.

A few familiar foes have returned.

The relationships between currencies, interest rates, and equities was the only thing that mattered in 2022, but day-to-day correlations began to fade as the year came to a close.

Now they’re back with a vengeance, and with rates and the Dollar back on the rise, that’s a problem for stocks.

Here’s how things look for the US Dollar Index. We spent the better part of 6 years trading between 90 and 100, but then the index broke out to new highs last spring. After temporarily dropping back below those former highs, the Dollar then ripped another 12% from June to September.

Look at how similar this year’s price action has been. Failed breakdown, followed by a sharp reversal higher. If this is just “new year, same story”, stocks are in for a rough time.

Fixed Income

A lot of the Dollar’s rise can be explained by inflation expectations and interest rates. I talked about it in depth here, but here are the key points:

Higher than expected inflation readings released during February have forced market participants and Fed members to rethink how much policy tightening it will take to bring prices under control.

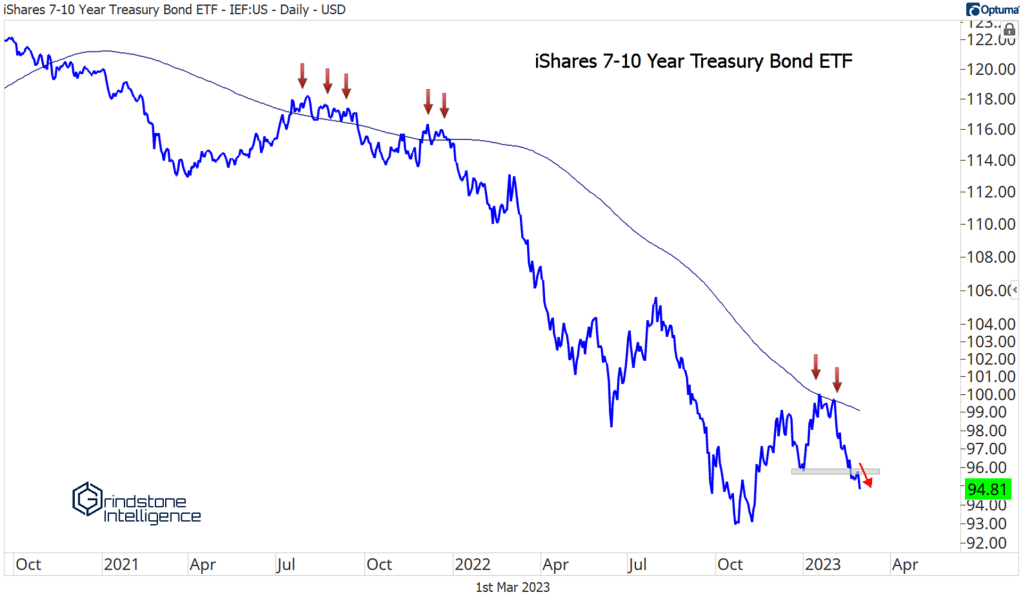

The futures markets’ implied terminal rate is nearly 0.50% higher than it was a month ago, and rates across the yield curve have risen, too. Bond prices are breaking their December lows (see IEF below).

Higher interest rates relative to the rest of the world, coupled with the continued economic growth that we’ve seen, increases the attractiveness of the Dollar.

If inflation keeps surprising to the upside, rates will continue to reprice to the upside. That’ll be a headwind for investment returns.

Bitcoin

The outlook for Bitcoin is unchanged since last month. The surge above 20000 to start the year made us shift to a neutral approach on the cryptocurrency, but we have yet to see evidence of a new trend beginning.

That’ll change when prices are either above 30000 or back below 20000.

Precious Metals

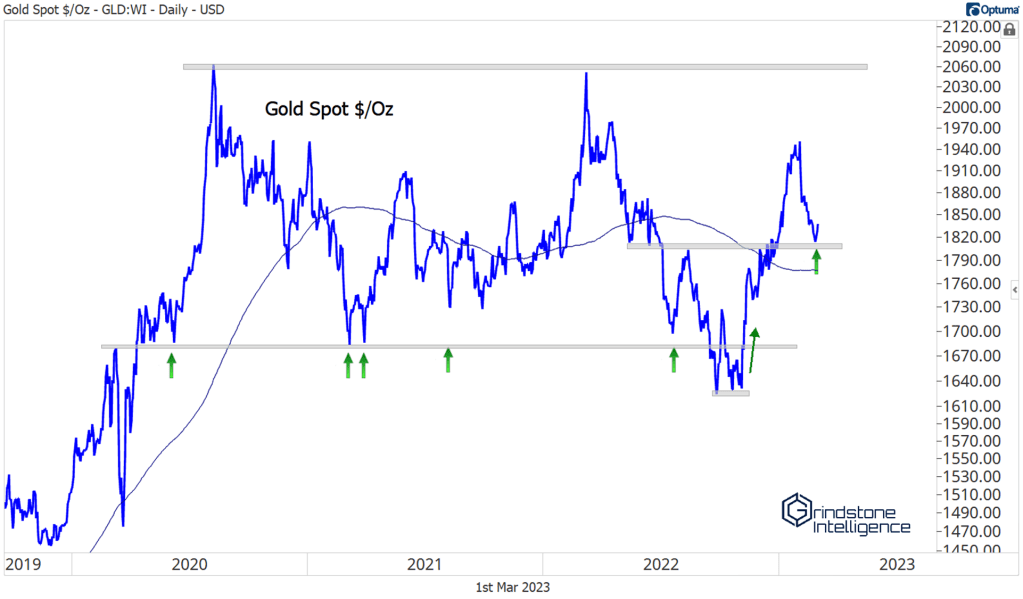

Precious metals weren’t spared from the pain in February, an outcome we were concerned about even after gold’s strong performance in January. Here’s why we were cautious:

Silver just isn’t playing along. The intermediate-term trend is higher, so we should expect this little consolidation to resolve higher. If it doesn’t, you’re going to have a hard time convincing us that gold prices are moving materially higher.

Silver and gold tend to be highly correlated, but silver tends to move in greater magnitudes. As such, when the precious metals space is under pressure, silver tends to lag, but it outperforms during bull markets.

Instead of resolving higher from that tight consolidation, silver broke down instead, and kept falling. Structurally, we believe that silver is well positioned to continue higher. But a neutral approach is best until it’s back above 22.50.

Gold had a tough month thanks to silver’s weakness, but it’s showing relative strength by holding above 1800, the level that we’ve been watching since early December. A bounce here is likely, but without silver’s participation, upside is limited.

The long-term bull case for the yellow metal is easy to make. We just spent a decade digesting a decade-long 600% rally, which itself began after a decade-long consolidation. Wouldn’t it make sense for the 2020s to be the decade that gold returns to the forefront of investor returns? First, we need to see it surpass $2000/oz.

View the rest of our March outlook:

March Technical Market Outlook Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector Financials Sector Health Care Sector Industrials Sector Information Technology Sector – Unlocked Materials Sector Real Estate Sector Utilities Sector

The post (Premium) March FICC Outlook first appeared on Grindstone Intelligence.