(Premium) March Financials Outlook

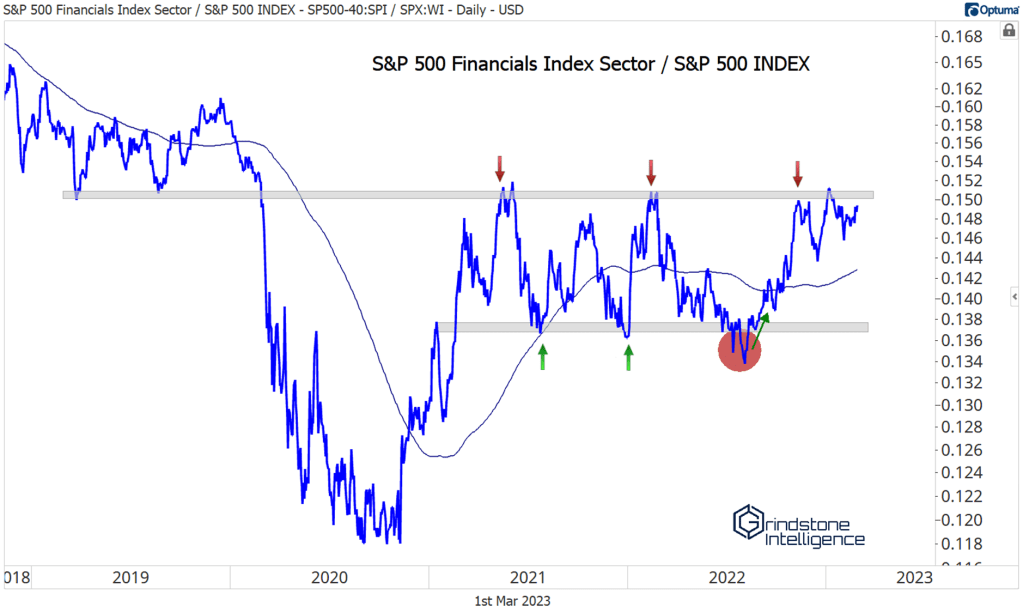

For months, we’ve been watching Financials and waiting for a breakout.

Our view is simple: if Financials are breaking out on a relative basis, we want to be overweight the sector. But they still just aren’t there yet.

The equally weighted sector is right there, too. We think a breakout is imminent, and we’ve got a finger on the trigger, ready to upgrade our view.

It would just make sense for Financials to be a leader after successfully backtesting the 2007 peaks. What better level to start a new, multi-year rally from?

Arch Capital is doing its part. It blew past our target of 65. That’s now level we can treat as support, with a new target above 90.

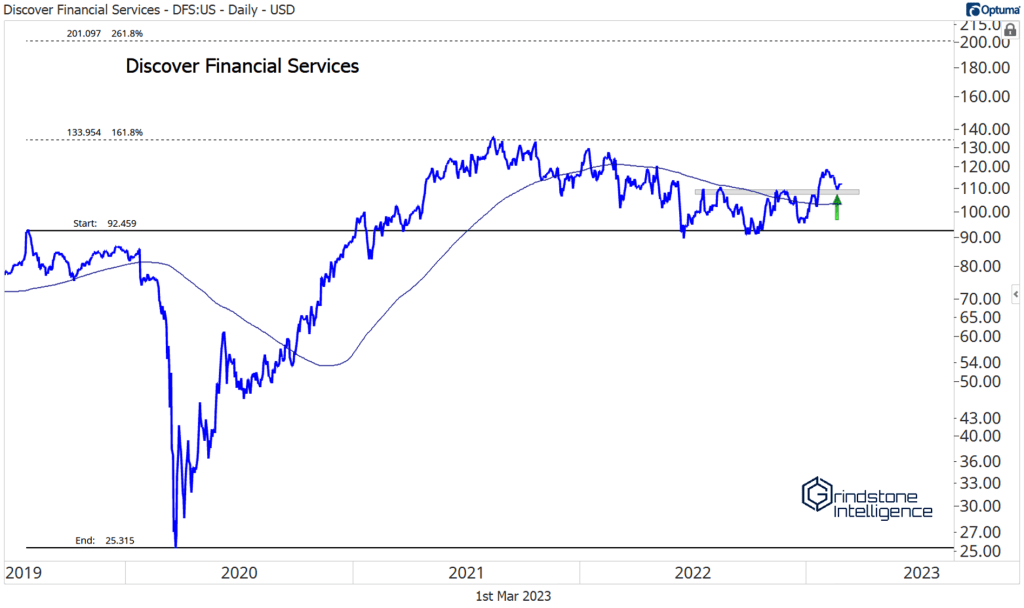

Credit card lenders have some great setups with clear levels, and we expect them to be leaders if the sector overall continues moving higher.

For Discover, we’re targeting the all-time highs of 135 with a risk level at 110.

Synchrony is a long with a target of 53 if it’s breaking back out above those pre-COVID highs.

And Capital One is holding above it’s own pre-COVID highs. We want to be long above 105 with a target of 175.

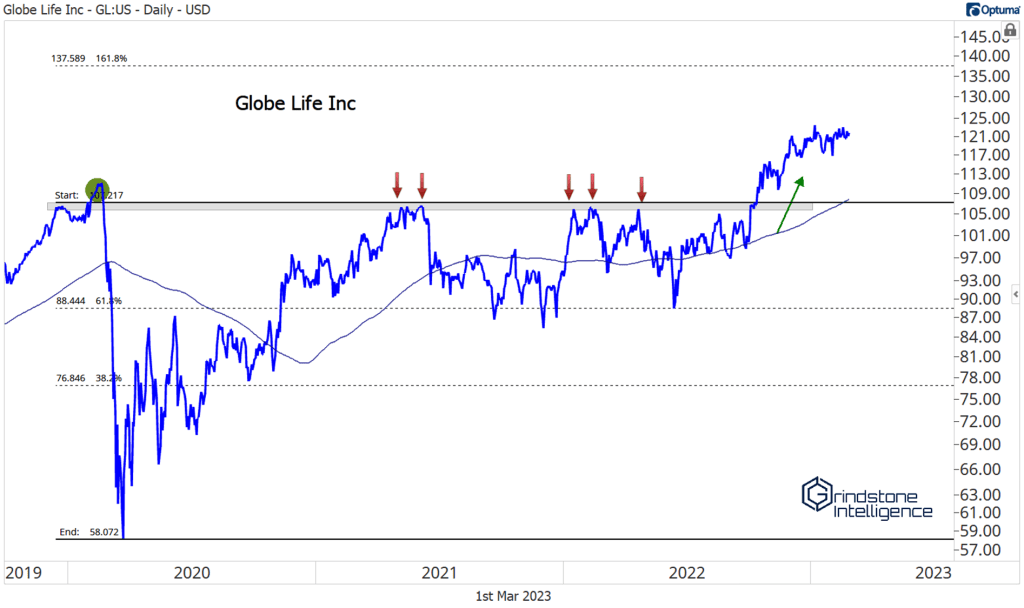

Insurance stocks didn’t get too much damage during the month.

Globe Life is still tracking toward our target of 138

And Everest Re is consolidating above our 375 target. That level is now our risk level, and we want to be long with a new target all the way up above 500.

MSCI broke out above its highs from last fall and now it needs to hold above that former resistance level. If it does, we want to be long with a target back at those all-time highs of 670.

View the rest of our March outlook:

March Technical Market Outlook Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector Financials Sector Health Care Sector Industrials Sector Information Technology Sector – Unlocked Materials Sector Real Estate Sector Utilities Sector

The post (Premium) March Financials Outlook first appeared on Grindstone Intelligence.