(Premium) March Health Care Outlook

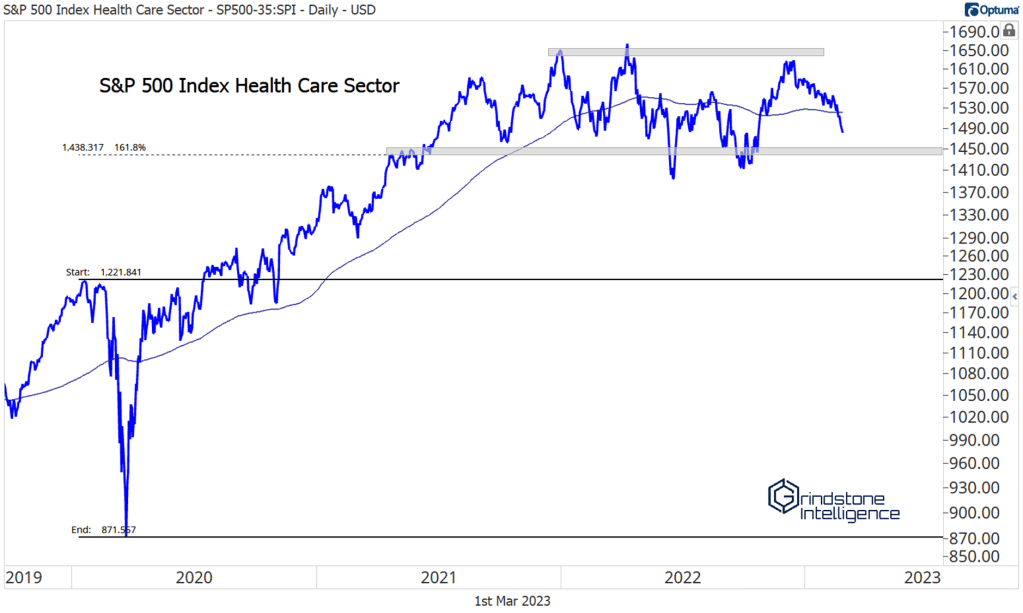

Rather than act as a safe haven during February’s decline, Health Care stocks were some of the worst performers during the month.

The sector’s troubles started with a failed relative breakout in December. From failed moves come fast moves in the opposite direction, and Health Care was no exception.

For the sector overall, there’s not much reason to be bearish. In fact, the relative strength it showed all throughout 2022 has left the group in a structurally better position than most of the market. But prices are decidedly rangebound.

Since December, we’ve described the sector as ‘one industry away’ from being a leader. Medical equipment and supplies stocks were showing relative weakness, and if only they could begin performing as well as the rest of the sector, we believed that Health Care would be among the best places to invest.

In the last few months, medical equipment has improved. But now other areas of the sector are faltering.

CVS Health is setting new 52-week lows

So are Pfizer and Johnson & Johnson.

We definitely don’t want to be touching any of those names, and as long as new lows keep popping up in the sector, it’s hard to see Health Care overall becoming a leader.

That said, there are plenty of names with fantastic setups. Boston Scientific is our favorite. If it’s holding this multi-year breakout above 46, we want to be long with a target near 60.

We still like HOLX, too, if it stays above 80. Near-term we’re looking at a target above 90.

Stryker initially failed to get above resistance at those 2021 highs, but the higher probability outcome here is still that we’ll see a breakout. If we do, we’re looking at a target of 378.

The most fun chart in the sector is HCA. Call me crazy, but price action over the last 18-months looks identical to the price action from a couple years ago. Check it out: an earnings rally into consolidation, a failed breakout followed by a huge selloff, then stair steps higher to challenge the former highs. Last time, HCA rose another 70% after the breakout. Does it do so again?

View the rest of our March outlook:

March Technical Market Outlook Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector Financials Sector Health Care Sector Industrials Sector Information Technology Sector – Unlocked Materials Sector Real Estate Sector Utilities Sector

The post (Premium) March Health Care Outlook first appeared on Grindstone Intelligence.