(Premium) March Industrials Outlook

The Industrials sector continues to show relative strength.

And it’s doing it no matter how you chart it. Here’s the sector compared to the S&P 500 successfully backtesting the 2021 highs.

Things are even stronger on an equally weighted basis, where the sector just set new highs relative to the SPX.

And if you’d rather compare apples to apples and compare the EW sector to the EW S&P 500, the story is the same. New highs.

There’s no getting around it. If there’s one sector we want to own, it’s the Industrials. That’s been our view since we upgraded them at the start of the year.

Transdigm has worked well for us since breaking out of a multi-year base. It’s almost halfway to our target of 930.

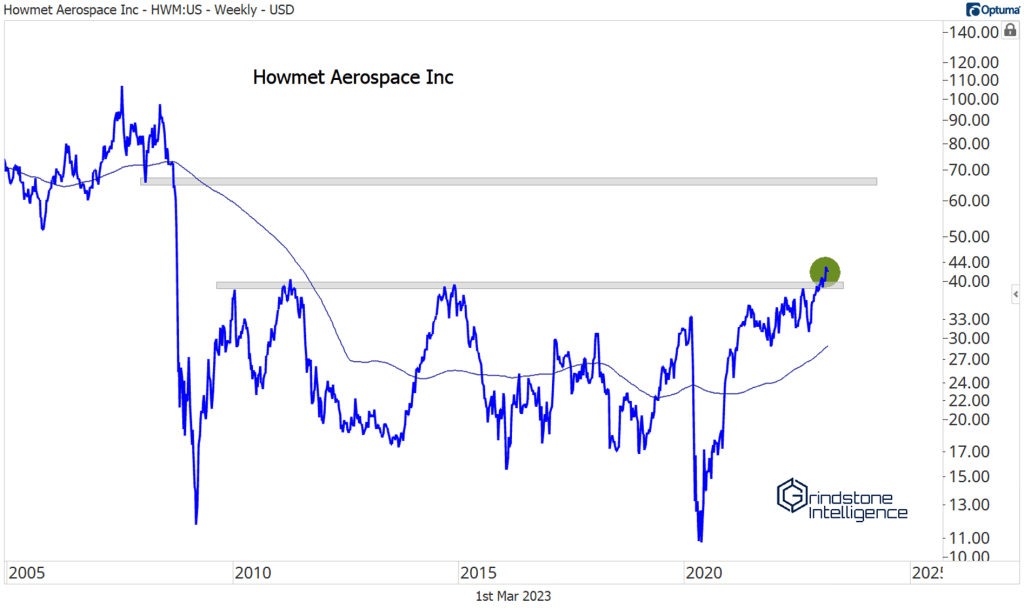

Howmet Aerospace is coming out of a 10-YEAR(!) base. The bigger the base, the higher in space, as they say. We’re looking at a target of 65 as long as it holds this breakout above 40.

We still like a lot of names in the machinery space as well.

Caterpillar is currently testing our risk level of 240. We like it long above that with a target of 335.

Deere is challenging former highs at 440. If it’s above that, we want to target the next Fibonacci retracement level from the 2018-2019 range, which is up at 635.

Old Dominion Freight failed to hold its breakout earlier this year, but we’re watching for a retest of those highs. Our target is 440 if it’s above 360.

The next big breakout could come from General Electric. GE has been a great place to underperform for most of the last 6 years, but we can’t ignore favorable setups like this with such clearly defined risk levels. If it gets above 90 it could double.

View the rest of our March outlook:

March Technical Market Outlook Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector Financials Sector Health Care Sector Industrials Sector Information Technology Sector – Unlocked Materials Sector Real Estate Sector Utilities Sector

The post (Premium) March Industrials Outlook first appeared on Grindstone Intelligence.