March Technical Market Outlook

February lived up to its reputation as one of the worst months of the year. Since the inception of the S&P 500 Index in 1950, stocks have averaged a negative return during the month. Only September has a worse track record. This year, stocks followed their seasonal pattern, as the S&P 500 dropped 2.6%, the Dow Jones Industrial Average fell 4.2%, and the NASDAQ Composite fell just more than 1%. Let’s take a look at how things are shaping up for March.

US Equities

Each month, we start our journey from the top, looking at the market from 30,000 feet up and focusing only on the biggest indexes. In just a handful of charts, we can see exactly the type of investment environment we’re in. Are stock prices rising or are they falling? Should we be erring on the side of buying or selling stocks?

Last month, our view was that stocks had made significant progress toward ending the bear market that began in 2022. Here’s how we put it:

We aren’t out of the woods yet, but we think we see the light at the edge of the forest.

The beauty of technical analysis is that prices offer us clear risk levels – we know exactly where we’re right and where we’re wrong. We entered the month with a clear view of what we needed to keep an eye on:

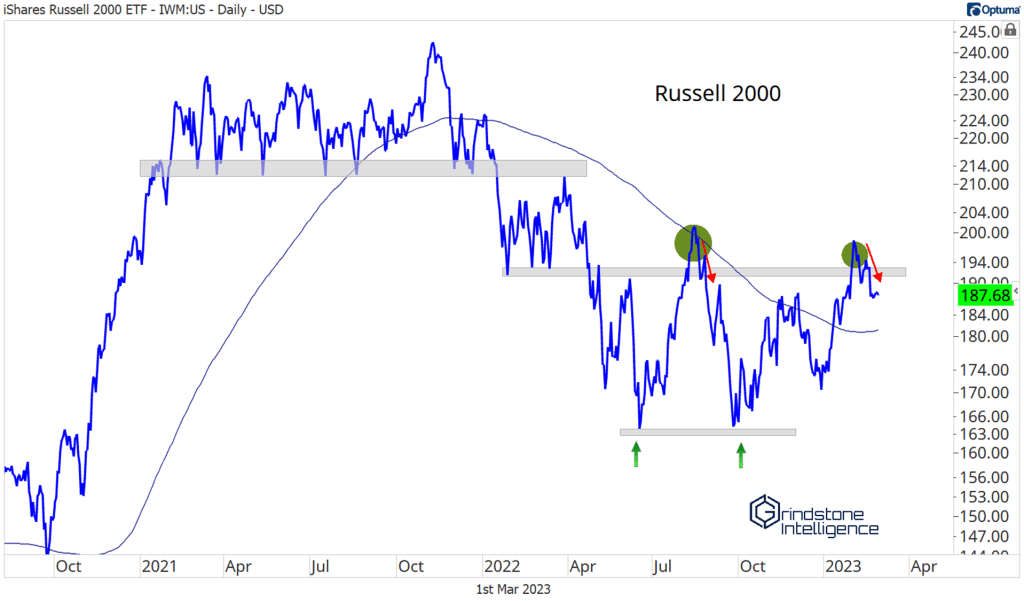

Small Caps are the ones to watch. With the last few days of gains, the Russell 2000 is above its own key area of resistance. That’s a good sign – small caps were the first to find a bottom last year and could very well lead us higher in 2023. But if IWM is back below 190, expect the rest of the major US indexes to be failing, too.

Well, the IWM fell back below 190. And the rest of the major indexes fell, too.

(Editor’s note: If you’re having trouble seeing any chart in this report, click on it to view a larger version)

We still aren’t out of the woods.

For months, we’ve been talking about resistance near 4100 for the S&P 500. That was our line in the sand – if prices were above that, we wanted to be buying stocks. If they weren’t, we believed a cautious approach was more appropriate.

Nothing changed during February. Stocks failed once again at 4100, and the bears still have the upper hand.

It’s the exact same situation for the NASDAQ. The level here is 12000.

These aren’t just numbers we’re pulling out of a hat. 12000 is the 161.8% Fibonacci retracement from the entire COVID selloff. The market respects these Fib levels, so we do, too.

But it’s not just weird rabbit math that has us watching that level. It’s also where growth stocks peaked relative to value. In September 2020, growth stocks ended a near 15-year run of outperformance. The NASDAQ, which is dominated by those same growth names, is paying attention.

There’s no reason to be aggressively buying stocks as long as we’re below those key levels. We know exactly where we want to be more bullish. So what would it take for us to shift from neutral to outright bearish on US stocks?

We’d need to see more indexes acting like the Dow.

The Dow Jones Industrial Average did more than just fail at overhead supply during February: it ended the month by breaking its December lows. This chart is the biggest threat to the bull case for stocks. If the index that’s been the leader for more than a year is now setting new lows, how can we be buying stocks?

The Dow needs to get back above 33000 in a hurry. If it does, that failed breakdown could be the catalyst that sends prices through that tough overhead resistance near 34500. The longer we’re below 33000, though, the more likely it is that stock prices overall will retest their October lows.

Premium members can log in to see our sector ratings and US Equity Model Portfolio below.

or

View the rest of our March outlook:

March Technical Market Outlook Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector Financials Sector Health Care Sector Industrials Sector Information Technology Sector – Unlocked Materials Sector Real Estate Sector Utilities Sector

Playbook and Model Portfolio

Sector Outlook

The Grindstone Intelligence Sector Outlook is based on our top-down technical approach. These ratings are based on our views over the next month but are subject to change with incoming data. If we feel the need to adjust our ratings before the next scheduled newsletter, we will notify subscribers via email with updated views and our justification.

We’re downgrading the Health Care sector to Equalweight and maintaining the rest of our ratings.

Grindstone Model Portfolio

The Grindstone US Equity Model Portfolio is a hypothetical allocation designed to align with our Sector Outlook and seeks to outperform the S&P 500 Index over the long-term. Our positions are chosen with investment horizons ranging from a few weeks to several months. The Model will invest only in exchange-traded funds that track sectors, industries, or categories of stocks. No individual stocks or cash positions will be used in the Grindstone US Equity Model Portfolio. Changes to the model portfolio will be communicated via email to subscribers, and official ‘trades’ will be executed at the next closing price. Fund performance will cause portfolio weights to drift between updates.

We’re making a handful of changes to the model portfolio to reflect the sector ratings change and to take advantage of relative strength we’ve seen in select industries and factors. The changes will be effective at the closing print on March 2nd. The table below details the adjustments and the new positioning.

Please reach out with any questions. We’re happy to clarify any of our opinions, but the nature of our publication prevents us from providing personalized advice. For those questions, please contact your financial advisor.

The post March Technical Market Outlook first appeared on Grindstone Intelligence.