(Premium) Materials Sector Deep Dive – September

The Materials sector is set to battle tough seasonality. September is its weakest month of the year, underperforming the S&P 500 index by an average of 1.4% since 1990.

Stocks don’t always follow seasonal patterns, of course, but Materials’ historical weakness is worth keeping in mind, especially since the sector has been a laggard for most of the year. And while we believe the S&P 500 is in the midst of a bull market, the S&P 500 Materials sector is best described as a hot mess.

Here it is rangebound, stuck near a flat 200-day moving average.

Member trends are equally messy. Roughly the same number of constituents are in long-term technical uptrends as downtrends. And shorter-term trends don’t indicate a meaningful shift in those numbers.

Because the trends are less than compelling and the sector is so small (it represents just 2.5% of the benchmark index), there aren’t too many charts worth highlighting.

Linde continues to trend the right direction. Comprising more than a quarter of the sector’s market cap, that’s propped up the price cap weighted sector index. Linde has moved steadily higher since breaking out above its January 2022 peak, a level that’s also the 261.8% Fibonacci retracement from the 2020 selloff. We’ve had a long-term target up near $470, which is the 423.6% retracement from that decline.

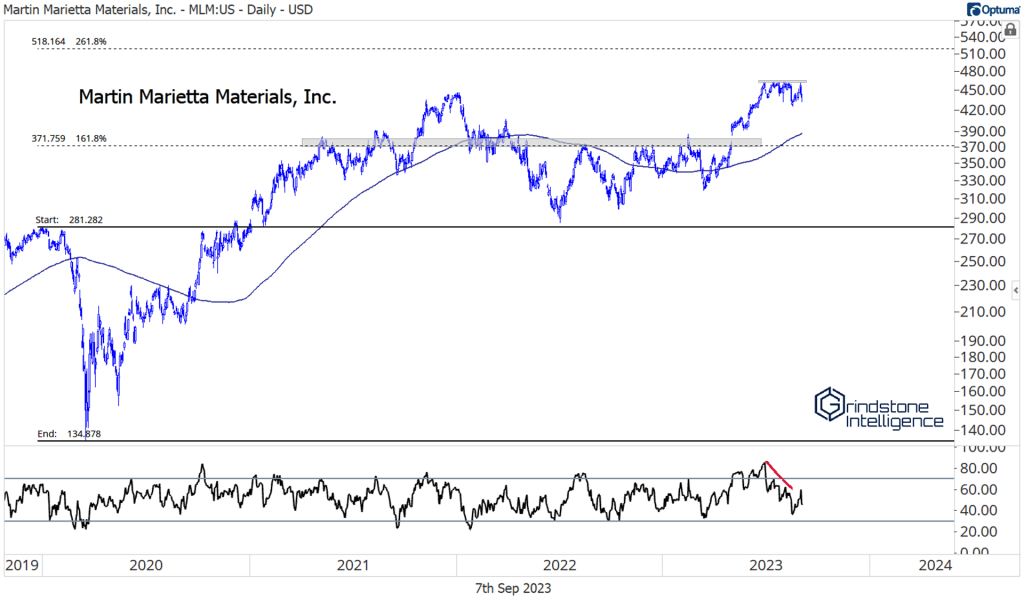

We like Martin Marietta even more as it consolidates near its former all-time highs, the 2022 peak at $450. Momentum has certainly weakened over the past few weeks, but this one looks like it wants to work that divergence off with time, rather than price. Our target for MLM is $520, which is the 261.8% retracement from the COVID decline.

We really like the relative strength profile of Marietta. Here it is in a clear uptrend vs. the S&P 500, after breaking out of a multi-year base over the summer.

Celanese is working on completing a bearish-to-bullish reversal. It’s been setting higher lows since October, and all that’s left to do is break above resistance from the February 2023 peak. If it does. we think CE can go to $160.

On the flip side, FMC and Newmont are both in breakdown territory. (Hint: New lows aren’t something you see in uptrends.)

The post (Premium) Materials Sector Deep Dive – September first appeared on Grindstone Intelligence.