(Premium) Materials Sector Update – July

At this point, we’re not even sure why Materials is its own sector. It comprises just 2.5% of the S&P 500, and a quarter of that is attributable to one stock. Until the powers that be decide to merge the constituents with the Energy or Industrials sector, though, we’ll just have to stifle our complaints.

Linde, the juggernaut of the Materials sector keeps setting new highs, propping up the sector index. It’s moved steadily higher since breaking out above its January 2022 peak. That level is also the 261.8% Fibonacci retracement from the 2020 selloff. We’ve had a long-term target up near $470, which is the 423.6% retracement from that decline. We see no reason to change that as long as LIN is above $350.

Aside from Linde, we see two areas of the sector that investors can get excited about. Construction Materials stocks are breaking out of a 4 year base when compared to the S&P 500 index.

We love to see stocks that are showing absolute strength and relative strength. That’s exactly what we’ve got here. Martin Marietta just broke out to new all-time highs, surpassing the 2022 peaks at $450. The next stop for MLM is $520, which is the 261.8% retracement from the COVID decline.

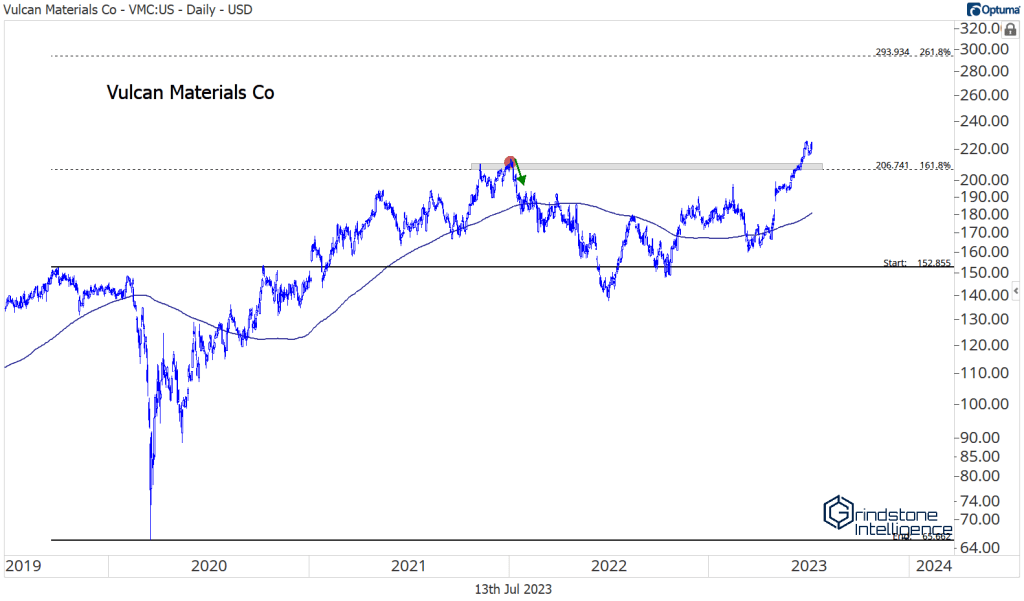

Vulcan Materials just broke out, too, finally getting past the 161.8% retracement from the 2019-2020 selloff. Now we think it can go all the way to $300.

We’re also watching for a big reversal in Specialty Chemicals. The sub-industry when compared to the S&P 500 is working on a potential failed breakdown, which could spark a move above the multi-year downtrend line.

PPG has been leading the way. It put in a big rounded bottom for most of 2022, then surged above resistance in the spring. After a successful retest of the breakout level, it’s now headed toward our target of $170.

Sherwin Williams isn’t far behind. it Just broke out above the 161.8% retracement from the 2020 decline, hitting new 52-week highs along the way. The risk/reward setup is better here than it is for PPG – we want to own SHW above $260 with a target of the former highs at $350.

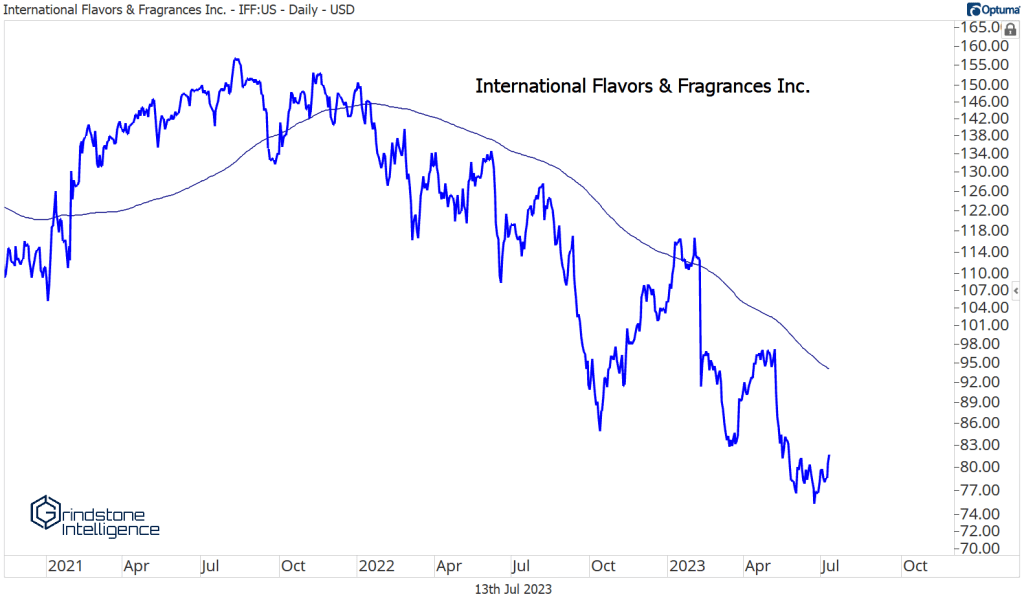

Specialty Chem isn’t moving higher in a broad way, though. International Flavors is still down near its lows and hasn’t made much of an attempt to rally.

Unfortunately, that’s a pretty common theme within the sector.

The post (Premium) Materials Sector Update – July first appeared on Grindstone Intelligence.