(Premium) Materials Sector Update – June

The Materials sector is the second smallest of all the 11 sectors in the S&P 500 index. At just a 2.5% weighting, it’s worth less than each Apple, Amazon, Microsoft, NVIDIA, and Alphabet. And if you stripped out the Materials’ largest component, which makes up one-fifth of the 29 member sector, you’d be left with a group that’s setting new multi-year lows when compared to the rest of the large-cap equity market.

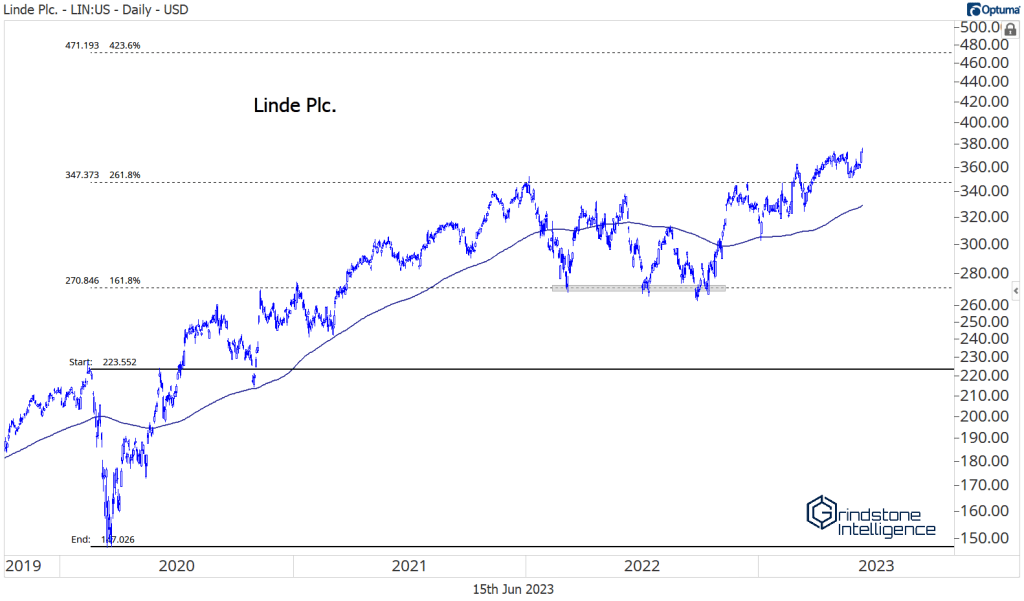

Fortunately, that juggernaut of the Materials sector keeps setting new highs, propping up the sector index. Linde has moved steadily higher since breaking out above its January 2022 peak. That level is also the 261.8% Fibonacci retracement from the 2020 selloff. We’ve had a long-term target up near 470, which is the 423.6% retracement from that decline. We see no reason to change that as long as LIN is above 350.

We’ve also seen relative strength in Construction Materials. Here’s the sub-industry when compared to the SPX. It keeps pushing past former resistance areas and setting higher and higher highs.

Martin Marietta Materials recently broke out above 380, which is the 161.8% retracement from the COVID decline. Now we think this aggregates company can blow past those former all-time highs at 440 and get all the way to our longer-term target above 500, which is the next key Fibonacci retracement level.

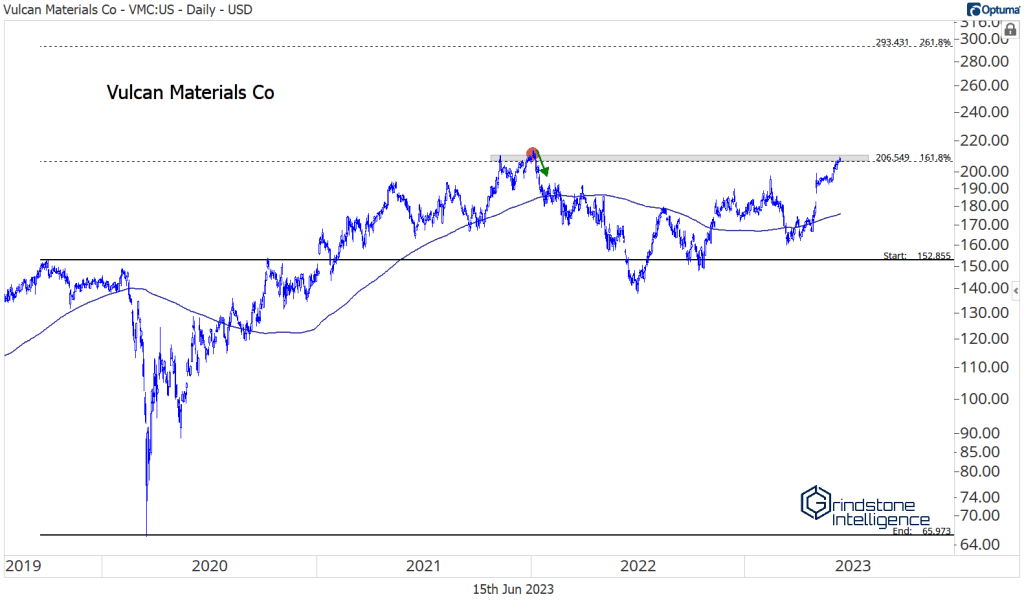

For Vulcan Materials, the biggest player in that space, we only want to be long if it gets above the former highs at 206. Last time VMC was here, it put in a failed breakout that kicked off a 30% decline and marked the start of an 18-month consolidation. ON a successful breakout, we think it goes to 300.

Ecolab is an interesting setup, and one that’s shown lots of relative strength this year. It’s testing a former level of support-turned-resistance, and we only want to be long if it’s above that. We can buy it above 184 with a target of 220.

And there’s still a great setup for PPG, which is consolidating above 138 after challenging that level five times over the last year. The more times a level is tested, the more likely it is to break, so we’d been watching closely for the move. With PPG now above former resistance, we want to own it with a target above 170, near the former highs.

Aside from that handful of stocks, though, it’s tough to get excited about what we’re seeing in the Materials sector. Westrock has stair-stepped lower for two years now. This is a prime example of why we avoid buying things that are in downtrends. During each of those consolidations, we could have tried to convince ourselves that the bottom was in. And each time, the consolidation resolved in the direction of the underlying trend. There are better places to be!

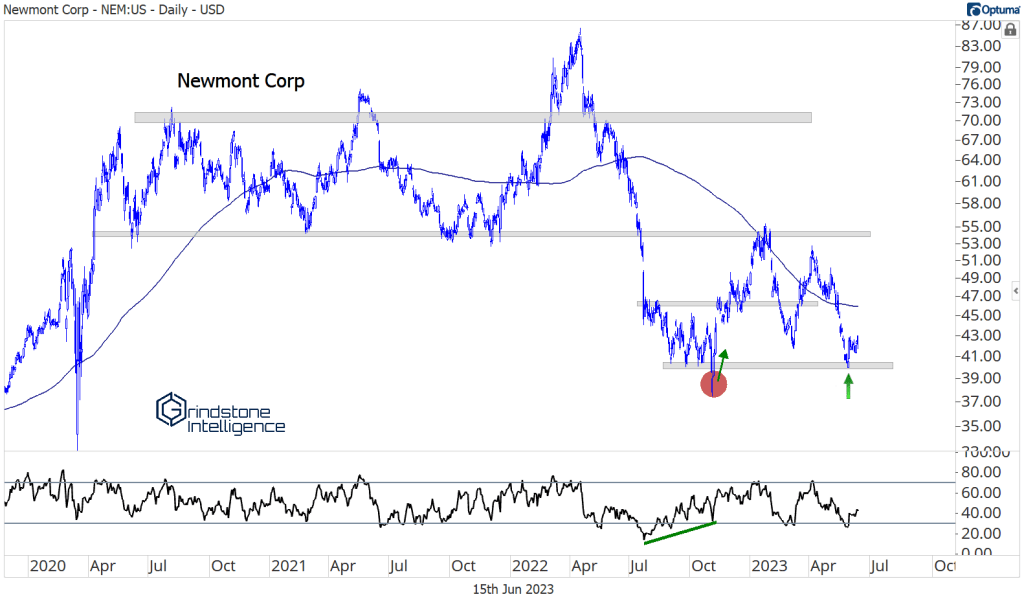

Should we get excited about Newmont, which is retesting its lows from last year? Last time we were here, the stock put in a failed breakdown that sparked a 35% rally. It could absolutely do so again. But when we’re hoping that support holds, we’re playing a losing game.

The same goes for Avery Dennison. Hopefully this support level holds, and then we can start talking about a big bottoming process. But the opportunity cost of trying to catch the bottom in stocks that are showing relative weakness is huge when so many other sectors around us are in a bull market.

The post (Premium) Materials Sector Update – June first appeared on Grindstone Intelligence.