(Premium) Near Term Headwinds for Communications

A bullish momentum divergence at the November lows helped jumpstart a bearish to bullish trend reversal in the Communication Services sector. Now we’re eyeing another momentum divergence.

And this one’s not quite so bullish.

Communications relative to the S&P 500 is running into resistance from last April’s lows. On its most recent attempt move higher, RSI set a much lower high. After outperforming the S&P 500 by more than 18% since the November lows, this is a pretty logical place for the sector to take a breather.

The sector’s largest component, Alphabet, is struggling to absorb overhead supply as well. Last fall, GOOGL found support at the September 2020 highs (which we’ve covered extensively in these letters as a significant turning point for Growth vs. Value). Now, its price is capped at $108, which has been a key rotational area since early 2021. In addition, momentum hasn’t yet risen to levels consistent with a new uptrend.

Could GOOGL break higher in the coming days? Sure. But that seems the lower probability outcome for now. Further consolidation is the better bet.

We’re seeing similar action in on of the market’s strongest performers. RSI momentum has deteriorated over the last few weeks in Meta, even as the stock has continued to rise. Now, Meta is running into its 2018 and 2020 highs, which previously sparked some big selloffs. Given the bearish momentum divergence, a mean reversion in META is likely, which could take the stock back down to $170.

Meanwhile, we’re seeing a bullish momentum divergence in Dish Network. Dish has been one of the worst stocks out there. From a trend following perspective, though, it doesn’t get much better. Check it out – consolidation, breakdown, consolidation, breakdown, rinse, repeat. Momentum is in a bearish range (it’s getting oversold on declines and never rises into overbought territory on rallies), and the stock has been below the 200-day moving average for more than a year. So even though we’ve got a bullish divergence over the past few weeks, we aren’t excited about getting long. As we often remind ourselves, “The strongest trends don’t care about your momentum divergence.” For DISH, we’ll most likely be seeing another consolidation that matches what we’ve seen after divergences in the past year. A big rally is possible, but it’s not the most likely scenario.

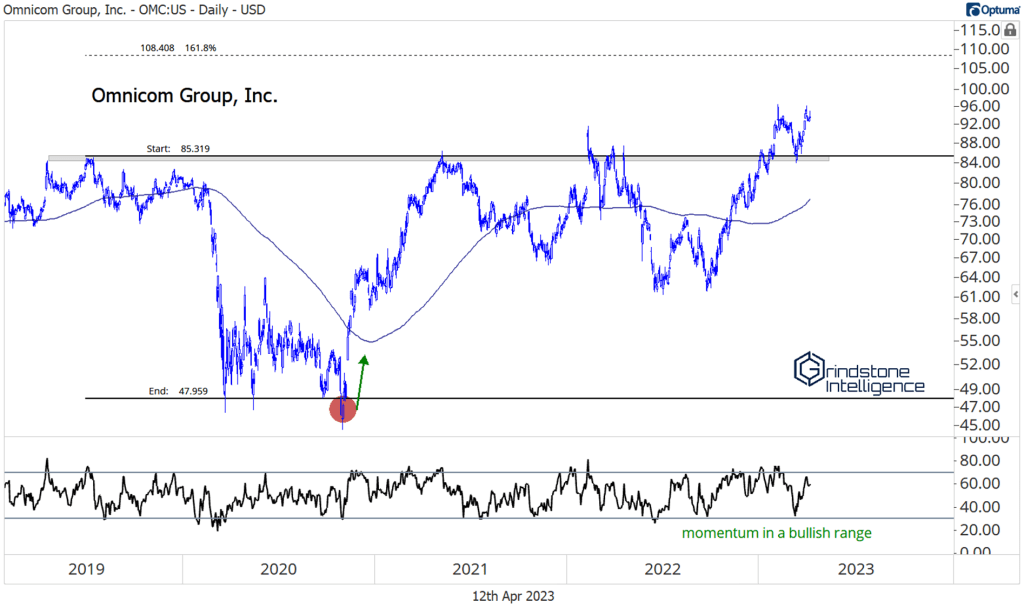

For longs, we’re still more excited about stocks showing relative strength AND near new highs. Omnicom is one. It’s a bit far from $85 risk level that we first laid out in our February note, but we still like it long with a target of $108.

T-Mobile offers a better risk reward, as it makes another run at the 2021 highs. Last fall, momentum put in a bearish divergence as the stock tried to break out from a multi-year base. There are two ways a stock can work off a bearish momentum divergence – through price or through time – and time is the more bullish of the two. That’s exactly what TMUS has done. If T-Mobile is above $150, we want to be long with a target of $177, which is the 161.8% retracement from the 2021-2022 decline.

The post (Premium) Near Term Headwinds for Communications first appeared on Grindstone Intelligence.