(Premium) Real Estate in No Man’s Land

It’s difficult to get excited about the Real Estate sector these days.

The group is stuck below resistance created by the 2021 and 2022 relative lows, and we’re well below a falling 200-day moving average. Real Estate is in a long-term relative downtrend.

(click charts to enlarge)

In the event that the ratio can reclaim those former lows, tactical investors may be able to capitalize on a mean reversion – just know that any long or overweight position will be in conflict with the primary trend.

It’s easy to find stocks setting new lows in the space. Here’s Crown Castle breaking down – that’s not something you see in uptrends.

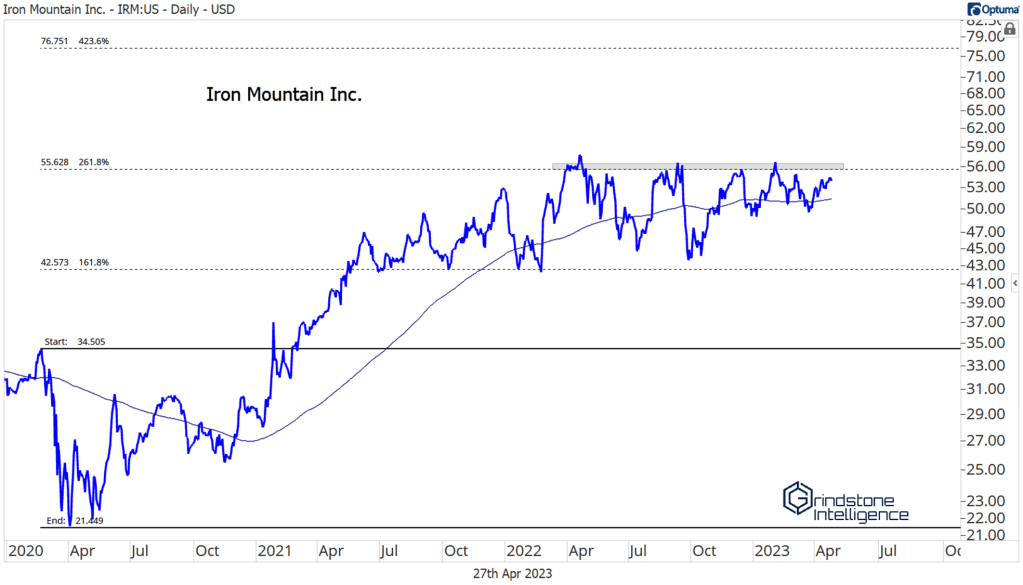

One name that stands out from the long side is Iron Mountain. It’s near a flat 200-day moving average, which often just leads to frustration and heartbreak. But the setup improves considerably if IRM is above 56, which is the 261.8% retracement from the COVID selloff. If we’re above that clear resistance level, we can be long IRM with a target of 76, which is the next key Fibonacci retracement level.

The post (Premium) Real Estate in No Man’s Land first appeared on Grindstone Intelligence.