(Premium) Real Estate Sector Deep Dive – August

All is right in the world.

We’ve traditionally categorized Real Estate as a boring, ‘risk-off’ sector, akin to Health Care, Utilities, and Consumer Staples, but all throughout 2022, Real Estate was indistinguishable from large cap growth. It was one of the more interesting relationships of the year.

As we turned our calendars to 2023, market leadership took a sharp turn in favor of growth stocks, as Information Technology, Consumer Discretionary, and Communication Services surged. Real Estate tagged along for the ride.

Today, things are right back where they belong.

Real Estate is down at the bottom of the barrel on the year-to-date performance derby, along with the other risk-off sectors.

In fact, Real Estate is even worse than that. It’s down more than 30% since the end of 2021, the worst-performing S&P 500 sector by a wide margin. And yesterday, it closed at new all-time lows relative to the benchmark index.

Fears of a recession have mostly faded from investors’ minds. Inflation is falling faster than just about everyone expected, and the path to a ‘soft-landing’ seems a lot clearer. Somehow, we even managed to shake off a banking panic earlier this year, thanks to aggressive ring-fencing actions and deposit backstops by policy makers.

But commercial real estate remains a key risk, where mass defaults have the potential to cause shockwaves throughout the economy. The epicenter is in office real estate, where remote work policies and evolving urban populations have pushed vacancy rates higher and property values lower. Those occupancy issues are mostly limited to office, but other issues like higher interest rates and tightening lending policies are more widespread.

Rising interest rates impact growth stock valuations and their future growth trajectories. For heavily indebted Real Estate stocks, higher rates severely threaten financing capabilities and debt service costs. You can see how closely the relative performance of Real Estate has tracked the path of long-term Treasury notes (barring a reset during the March banking panic, when the concern for Real Estate was more about tightened lending standards and the potential firesale of assets by banks looking to raise liquidity).

Rates stalled out for awhile, but now they’re back on the rise. Both 10 and 30-year Treasury yields are on pace for their highest close in over a decade. With that headwind in place, Real Estate will have a hard time outperforming going forward.

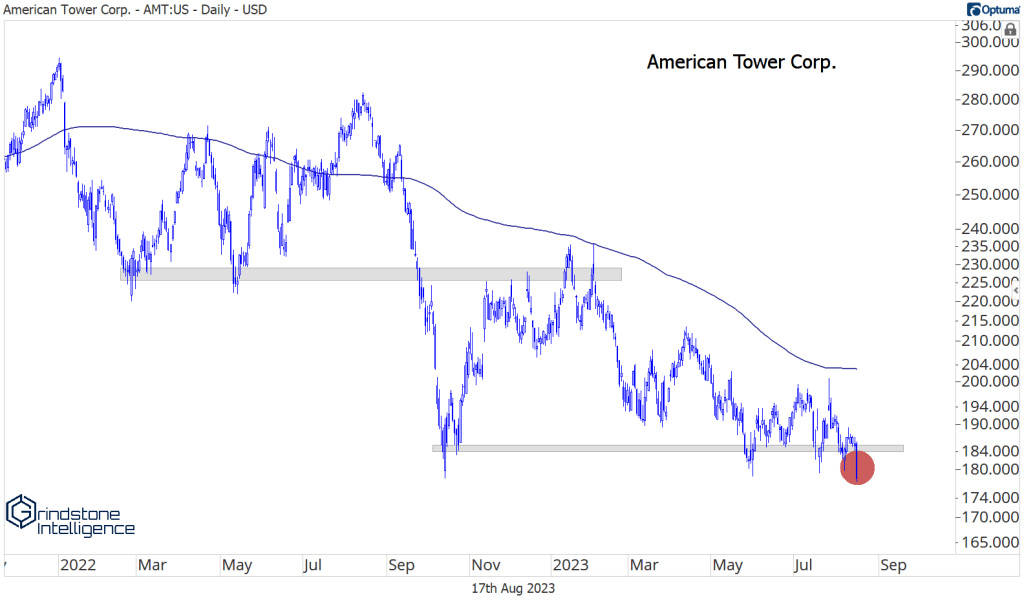

The tower stocks continue to get hammered. American Tower yesterday closed at the lowest levels since before the COVID collapse. It’s also at the lowest level vs. the S&P 500 since 2011.

Crown Castle has been even worse since breaking down at the end of April. Momentum is clearly in a bearish range, and the stock hasn’t challenged its 200-day moving average since dropping below it exactly one year ago.

Avalonbay had been working on a bearish-to-bullish reversal, but now it’s back below a key level of former support. The uptrend is on hold until it can get back above $185.

We could waste our time looking at every bearish chart in the sector, but we really don’t need to. A quick glance at the list of new highs will tell us what we need to know. When it comes to new 6-month and 52-week periods, Real Estate stands alone – and not in a good way. The vast majority of constituents have set new lows more recently than new highs.

On the brighter side, CBRE is trying to set new 52-week highs as it challenges the 161.8% retracement from the 2020 decline. On a breakout, we can target the 261.8% retracement, which is up at $122.

Digital Realty is trying to move past resistance of its own, near the 38.2% retracement from the 2022 decline. This rally started (like so many rallies do) with a failed move. DLR broke the downtrend line, then the 200-day, and now it’s working on the final step of a new uptrend: setting a higher high.

We’re watching the relative chart for DLR even more closely. Compared to the S&P 500, it’s challenging resistance from highs it set last fall. That follows a bullish momentum divergence at the June lows. We love stocks that are moving higher and outperforming other assets. We’d feel a lot more comfortable with the stock if it completed this bearish to bullish-reversal-pattern vs. the index.

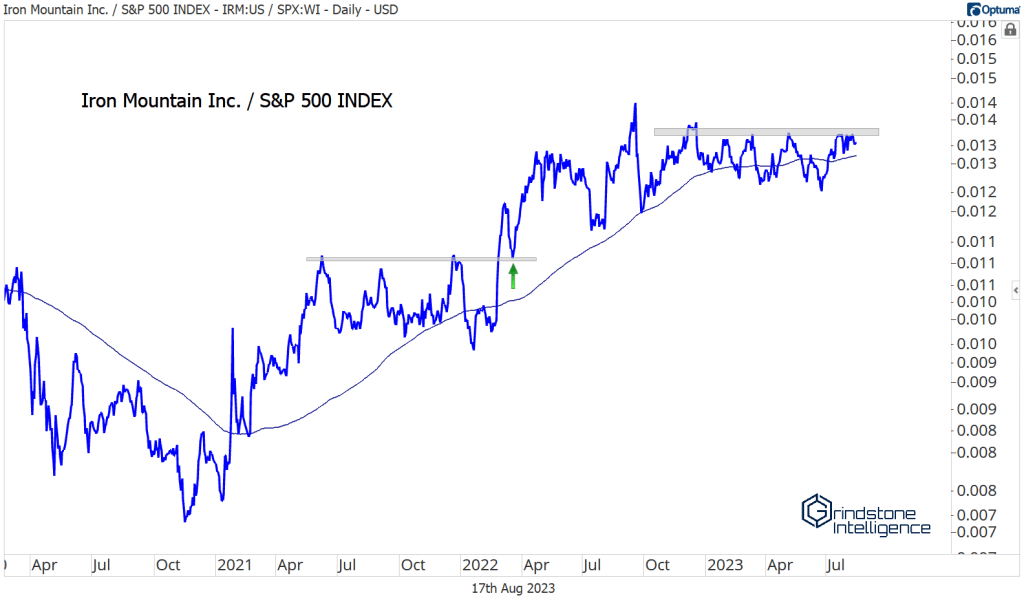

Iron Mountain is just below all time highs while most of the sector is falling apart. That’s the type of relative strength we like to see. Now that the stock is above $56, which is the 261.8% retracement from the COVID selloff, we can be long IRM with a target of $76, which is the next key Fibonacci retracement level.

We’d like it even more if it can resume its uptrend relative to the S&P 500, after being rangebound for the last year.

The post (Premium) Real Estate Sector Deep Dive – August first appeared on Grindstone Intelligence.