(Premium) Real Estate Sector Update – June

Do you remember when Real Estate was just another growth sector?

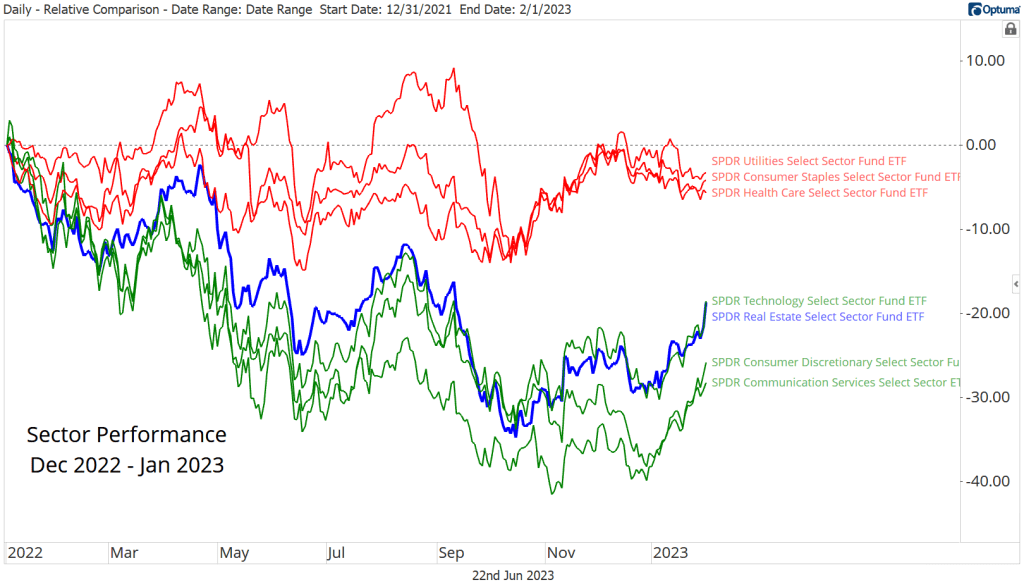

We’ve traditionally categorized Real Estate as a boring, ‘risk-off’ sector, akin to Health Care, Utilities, and Consumer Staples, but all throughout 2022, Real Estate was indistinguishable from large cap growth. It was one of the more interesting relationships of the year.

As we turned our calendars to 2023, market leadership took a sharp turn in favor of growth stocks, as Information Technology, Consumer Discretionary, and Communication Services surged.

Real Estate tagged along for the ride.

A popular meme comes to mind:

Just like when Steve Buscemi’s 30 Rock character attempted to infiltrate a school, Real Estate was clearly out of place. A sharp reset over the following months has the sector right back where it belongs.

The reason Real Estate looked so much like growth in 2022 was because of interest rates. Rising interest rates impact growth stock valuations and their future growth trajectories. For heavily indebted Real Estate stocks, higher rates threaten financing capabilities and debt service costs.

Interest rates stopped rising last year, though, removing much of the overhang for growth stocks. Stable interest rates, even high ones, can be managed by growth-focused business managers and investors. Unfortunately, elevated rates are still a problem for debt-laden Real Estate stocks, even if rates are stable.

That reality has the sector hitting multi-year relative lows when compared to the S&P 500.

Real Estate is in a clear technical downtrend on a relative basis. More concerning is that the sector has made little effort to reverse its absolute downtrend. We’re in a bull market, yet this sector is still below a falling 200-day moving average, and hasn’t even broken the downtrend line from last year’s highs.

The underperformance isn’t a market cap problem – Real Estate is breaking down on an equally weighted basis, too.

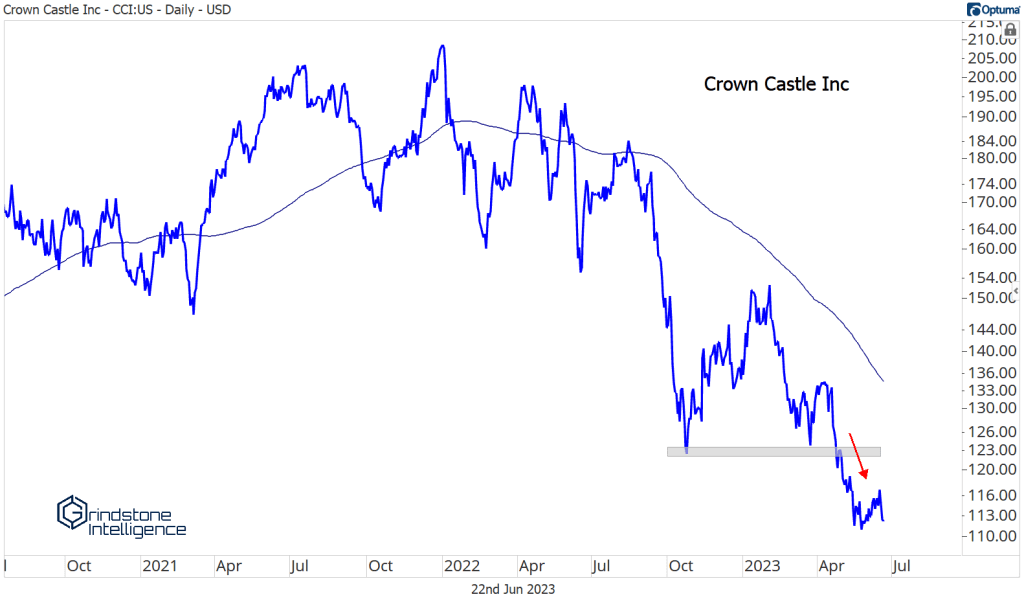

Our concerns about the sector are justified, given the weakness below the surface. If you have the time, go through the whole sector yourself. You’ll see a lot that looks like this: Crown Castle is in breakdown mode.

Peer SBA Communications broke to new lows as well, and was rejected at former support on a bounce attempt.

The third musketeer, American Tower, put in a failed breakdown last month, setting the stage for a potential reversal rally that could have led its peers higher. Instead, it didn’t even break the downtrend line.

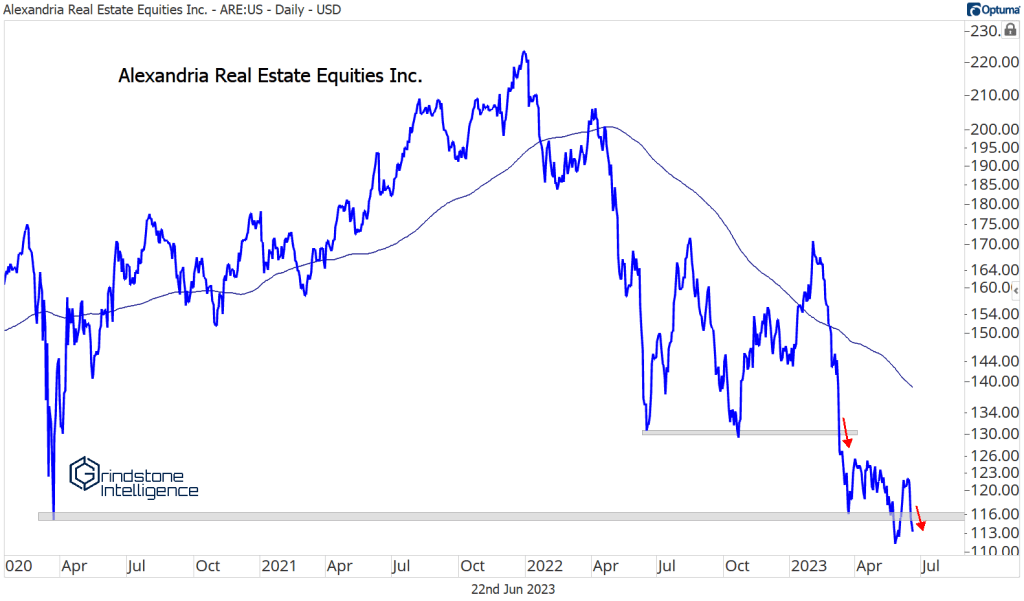

Other failed breakdowns in the sector have been similarly short-lived. Healthpeak Properties and Alexandria Real Estate are both back below support.

We can’t think of a good reason to own any of these. Could they bottom tomorrow? Sure. But why would we waste time with clear downtrends and relative weakness when we’re in a bull market?

On the brighter side of things, Avalonbay is working on a bearish to bullish reversal, and the risk is very clearly defined. We can own it above $185.

And Iron Mountain is threatening to break out to new all-time highs even as much of the sector fall apart. That’s relative strength. It’s near a flat 200-day moving average, which often just leads to frustration and heartbreak. But the setup improves considerably if IRM is above 56, which is the 261.8% retracement from the COVID selloff. If we’re above that clear resistance level, we can be long IRM with a target of 76, which is the next key Fibonacci retracement level.

The post (Premium) Real Estate Sector Update – June first appeared on Grindstone Intelligence.