(Premium) Real Estate Stocks in a World of Hurt

There’s not much to like about Real Estate stocks these days.

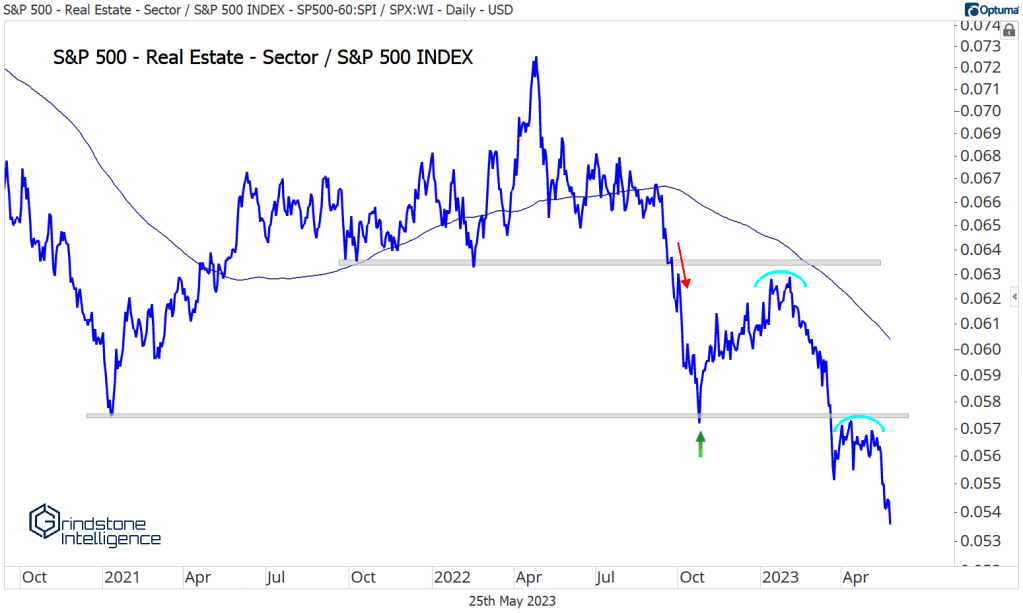

Unless you’ve been short, we suppose. The group failed to surmount resistance created by the 2021 and 2022 relative lows, and we’re well below a falling 200-day moving average. Real Estate is in a long-term relative downtrend.

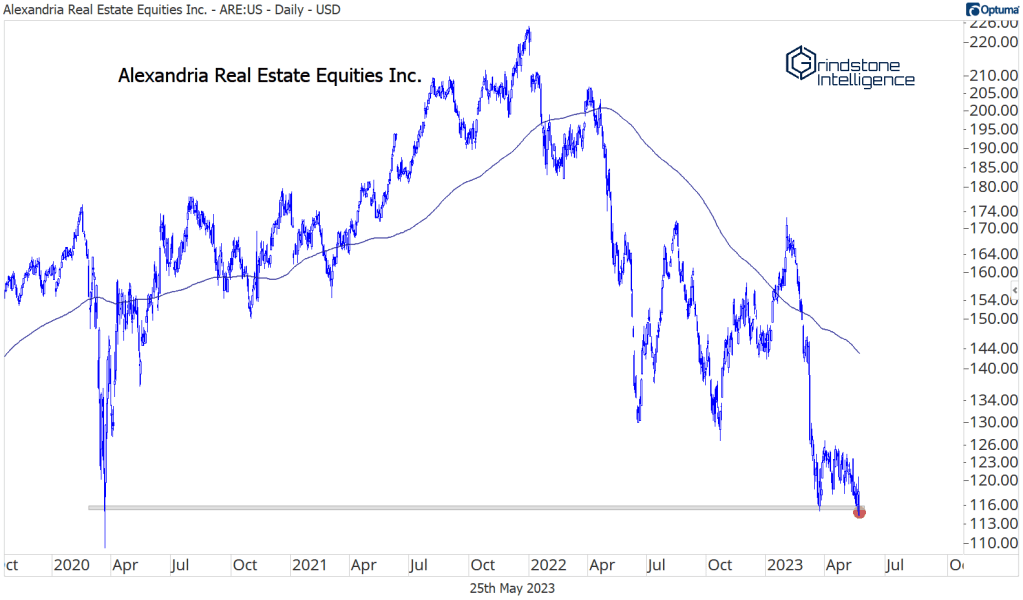

Unsurprisingly, the list of new lows far outweighs the list of new highs. Rather than try to tell you. we’ll just show you.

There’s no need to try and wrap words around those charts. They speak for themselves. If betting on reversals of strong, long-term trends is your idea of a good time, have at it. We’ll continue avoiding Real Estate like the plague until we see a sign – any sign – that this string of declines has run its course.

We try to find at least one attractive setup in each sector every month. In the case of Real Estate, there really is just one. Iron Mountain is threatening to break out to new all-time highs even as the rest of its peers fall apart. It’s near a flat 200-day moving average, which often just leads to frustration and heartbreak. But the setup improves considerably if IRM is above 56, which is the 261.8% retracement from the COVID selloff. If we’re above that clear resistance level, we can be long IRM with a target of 76, which is the next key Fibonacci retracement level.

The post (Premium) Real Estate Stocks in a World of Hurt first appeared on Grindstone Intelligence.