(Premium) Running Out of Gas

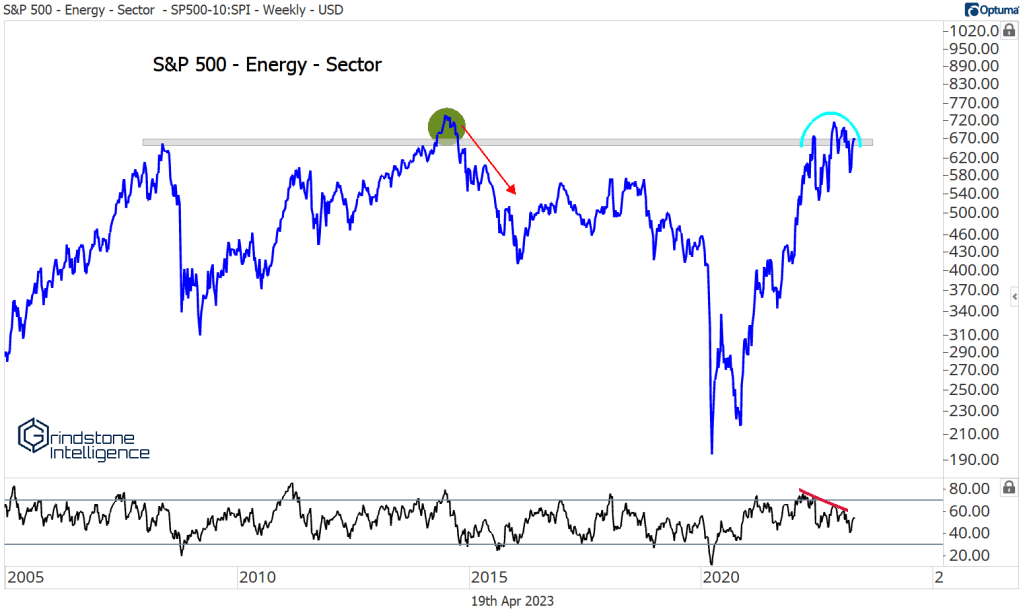

Energy stocks have gone nowhere for 15 years.

Since its 2008 peak, the S&P 500 Energy sector has experienced 12-month declines of 48%, 38% and 63%. In other 12-month periods, the group has doubled. It’s by far the most volatile of the eleven S&P 500 sectors, yet if we look past all the noise of huge gains and devastating selloffs, Energy has done nothing for the past 15 years.

At some point, it may be able to absorb all this overhead supply and break out to fresh highs. In that case, we’ll be looking at big bullish implications. After all, what could be better than breaking out of a multi-decade base? Unfortunately, that time has not yet come.

We’ve been underweight the Energy sector since early February, when it became clear that this resistance was too much to overcome quite yet. Weekly momentum had tailed off in the final months of the rally, and the catalyst for more highs was lacking. Since our downgrade, Energy stocks have gone precisely nowhere – fitting, given the situation.

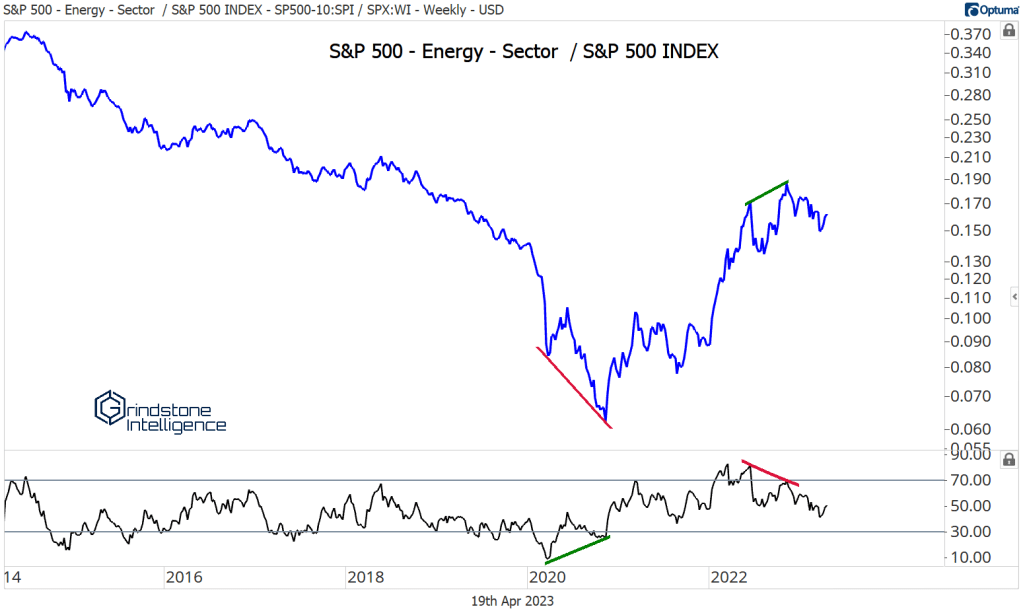

There was more to our downgrade. We also saw a big bearish momentum divergence in Energy relative to the rest of the market. A bullish momentum divergence in 2020 sparked one of the best periods of outperformance for any sector that we’ve ever seen. Why shouldn’t we expect a bearish divergence to have the opposite effect?

There are two ways for a stock to work off a momentum divergence: through price, or through time. So far, we haven’t seen either, but the longer we go without a corrective selloff, the more likely it is that we see renewed strength and outperformance. We’ve kept our underweight rating because the lowest probability outcome is higher prices, but we fully recognize that the sector could continue to move sideways, rather than down. A divergence worked off through time is the most bullish scenario. We’re keeping our negative outlook in place, but we stand ready to reverse course should the stars align.

The outcome could very well depend on the trajectory of oil prices. Crude oil so far has been unable to make it into overbought territory on this rally – or on any other rally over the last year. The recent failed breakdown put the bear case on hold, but bulls aren’t doing much with the opportunity.

In the bearish scenario for oil and Energy stocks, Coterra Energy offers an attractive risk-reward opportunity on the short side. It’s below a falling 200-day moving average and stuck below overhead supply from a couple of swing lows in 2022. Momentum is stuck in a bearish range as well. If CTRA is below $25, we think it goes back to the year-to-date lows in a hurry, and that could be just the start.

On the flip-side, Schlumberger hasn’t shown much sign of weakness. It found support at a rising 200-day moving average, which coincided with the 2019 and the summer 2022 highs. We can be long SLB above 45, with a target all the way up at 80.

The post (Premium) Running Out of Gas first appeared on Grindstone Intelligence.