(Premium) Stocking Up on Stability: Consumer Staples Nearing New Highs

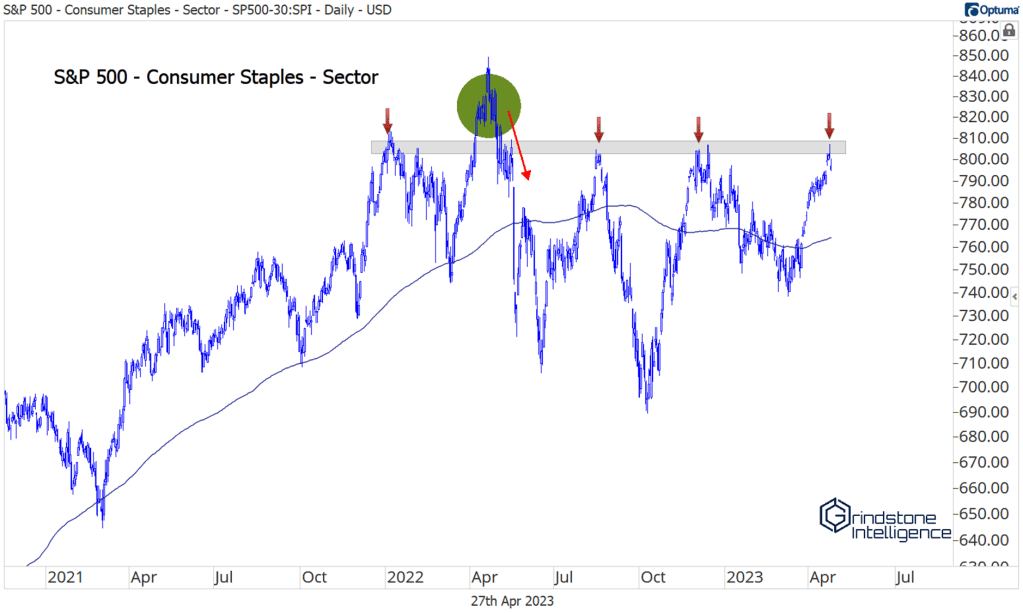

It’s near the middle of the pack when it comes to year-to-date returns, but don’t let the Consumer Staples sector slip under your radar. It’s closer to new all-time highs than any other group.

(click charts to enlarge)

We’re watching this resistance level around 810 on the chart very closely. If Consumer Staples are above that level, we can’t be anything but bullish on the sector.

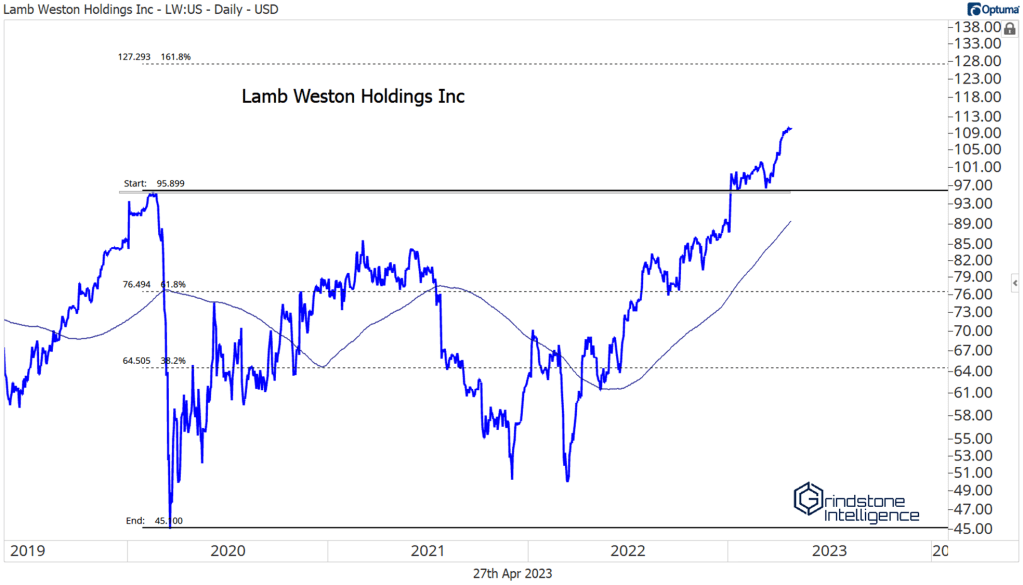

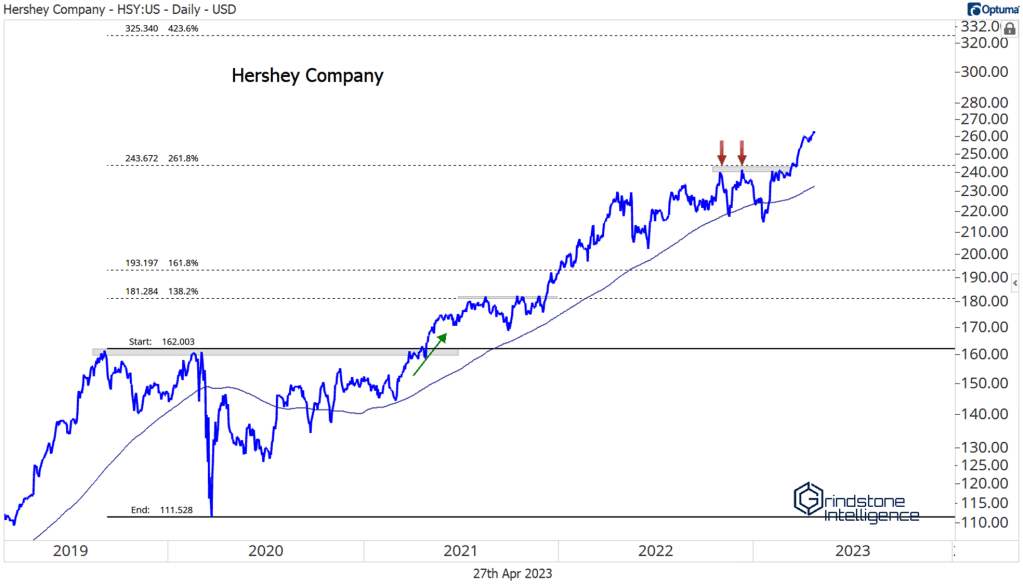

We’ve already been watching a handful of breakouts within the space. Lamb Weston, Hershey, and Monster Beverage all continue to progress toward our targets.

None of those offer attractive entry levels for new positions, but with the sector as a whole attempting to break out, more opportunities are shaping up.

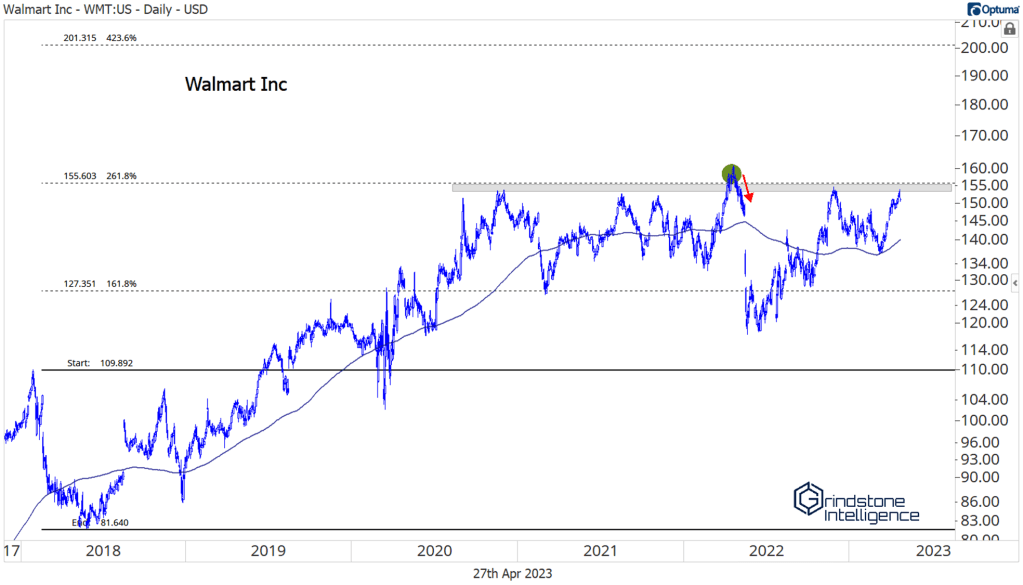

Walmart is nearing the top end of a 3-year trading range, the top of which is the 261.8% retracement of the 2018 decline. We want to be buying breakouts from this big base with a target of 200. In that scenario, expect the entire sector to be moving to new highs as well. If WMT is below 155, though, we need to leave it alone.

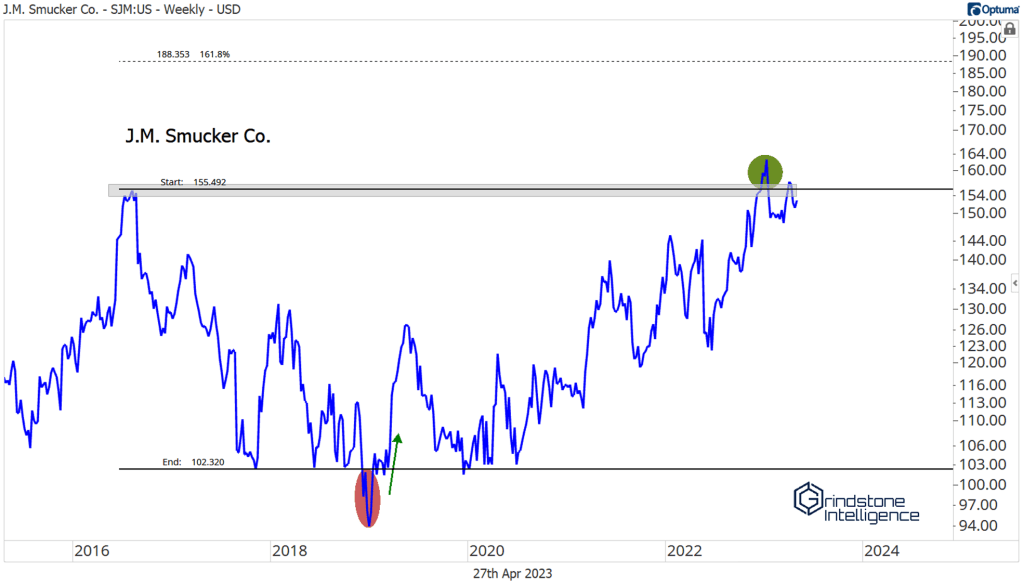

J.M. Smucker is trying to come out of an even larger base. It’s gone absolutely nowhere since 2016.

The bigger the base, the higher in space. We want to own SJM above 155 with an initial target of 190, which is the 161.8% retracement from the 2016-2017 decline. Longer-term, the 261.8% retracement is up near 240 per share.

The post (Premium) Stocking Up on Stability: Consumer Staples Nearing New Highs first appeared on Grindstone Intelligence.