(Premium) Strength Beneath the Surface in Consumer Discretionary

Consumer Discretionary has been a laggard since January, but don’t let that fool you. There are plenty of opportunities in this diverse sector.

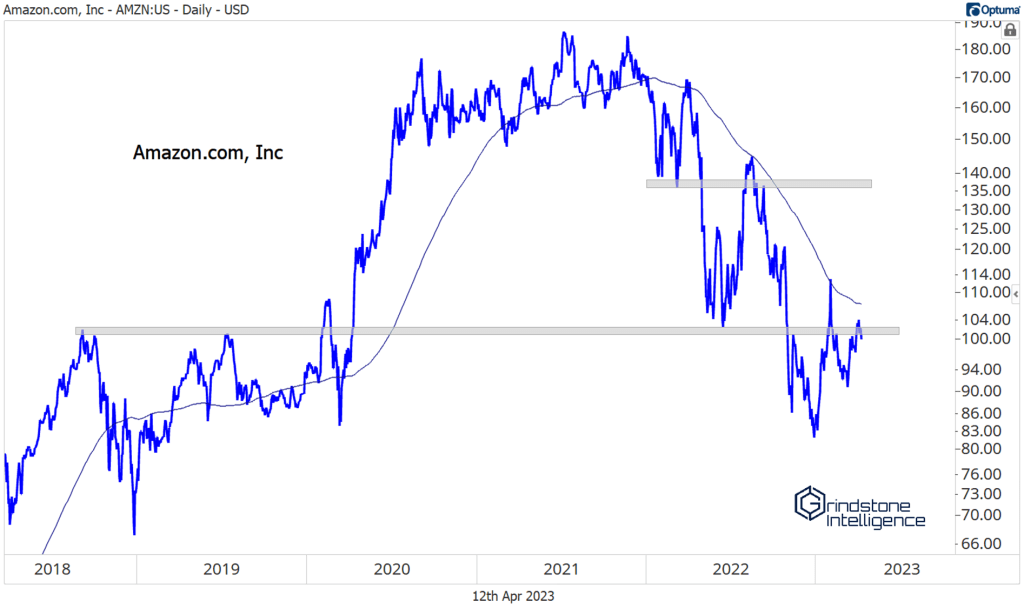

Let’s address the elephant in the room. Amazon alone accounts for nearly a quarter of the sector. Without the participation of this retail behemoth, Discretionary as a whole isn’t going anywhere. And frankly, there’s not much to get excited about when it comes to AMZN.

It’s been below the 200-day for the last year, it’s 13% below the year-to-date highs, and it’s even below the 2018-2019 highs. The stock is in a sideways range at best, and a downtrend at worst. An uptrend is the one thing we can rule out.

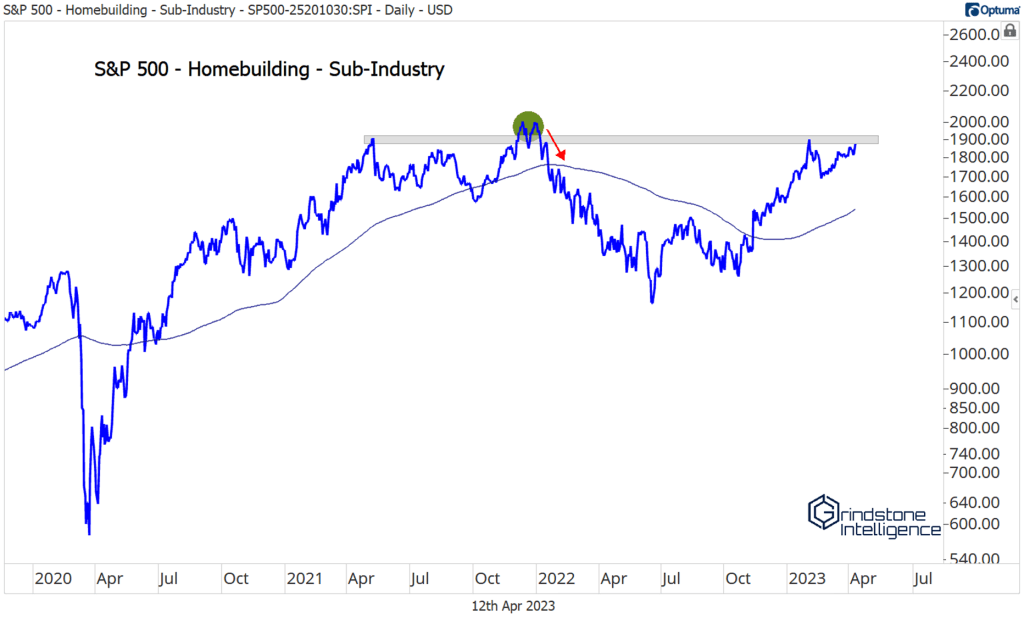

Luckily, we as investors aren’t limited to investing in indexes or holding just the largest stocks. We can dig beneath the surface. The S&P 500 Homebuilders Sub-Industry is nearing a breakout to new highs.

All we hear about in the news and is how higher mortgage rates have crushed the housing market, and home prices are set to crash. Meanwhile, the homebuilders bottomed last June. Prices are more important than narratives – narratives don’t pay the bills.

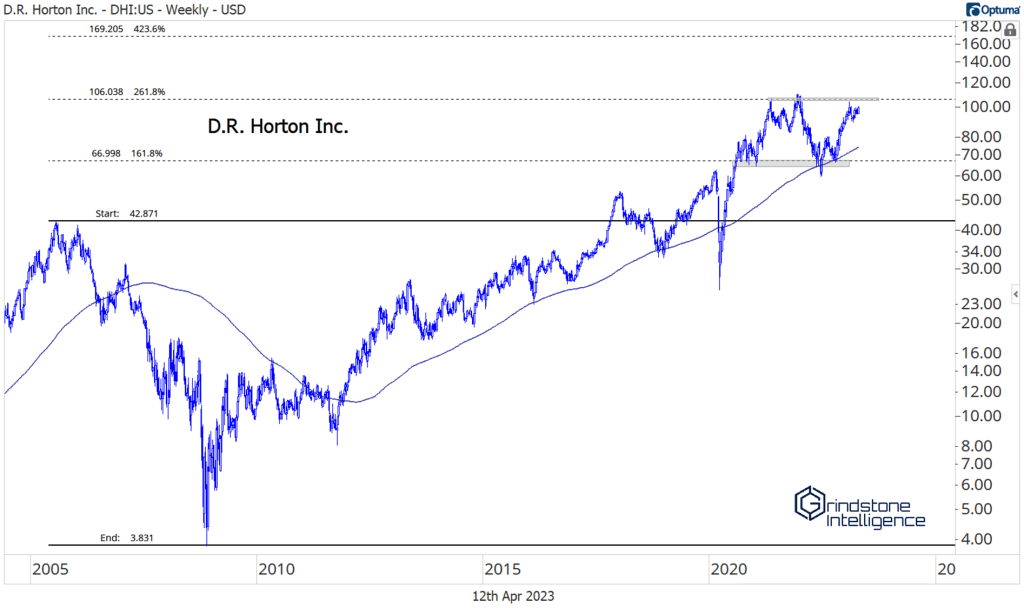

The multi-year consolidation in the homies started at a pretty logical level. For D.R. Horton, the nation’s largest homebuilder, the 2021 peak coincided with the 261.8% retracement from the entire 2005-2008 decline. The stock then bottomed last June at the 161.8% retracement. Ever wonder why we use these Fibonacci levels? This is why. The market respects them. It doesn’t really matter whether we believe in the merits of ancient math. The market does.

Longer-term, that puts our target for D.R. at $170 if the stock is above $106. That target is the 423.6% retracement from the housing crisis selloff.

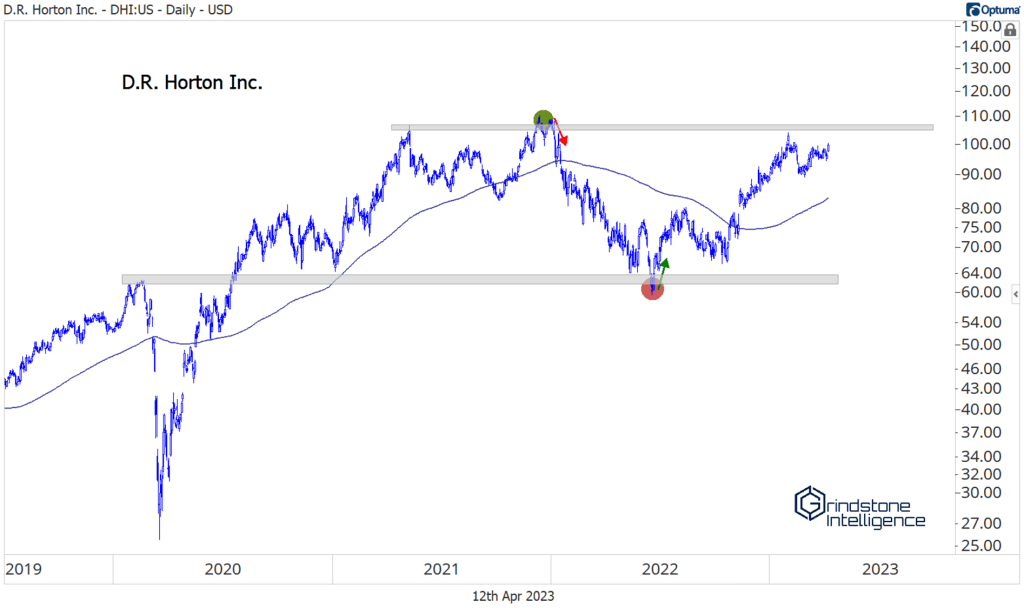

Here’s a shorter term look at the stock:

DHI tested those 2021 highs on February 2, then spent the next two months building up momentum for another push higher. We think a breakout is coming sooner rather than later.

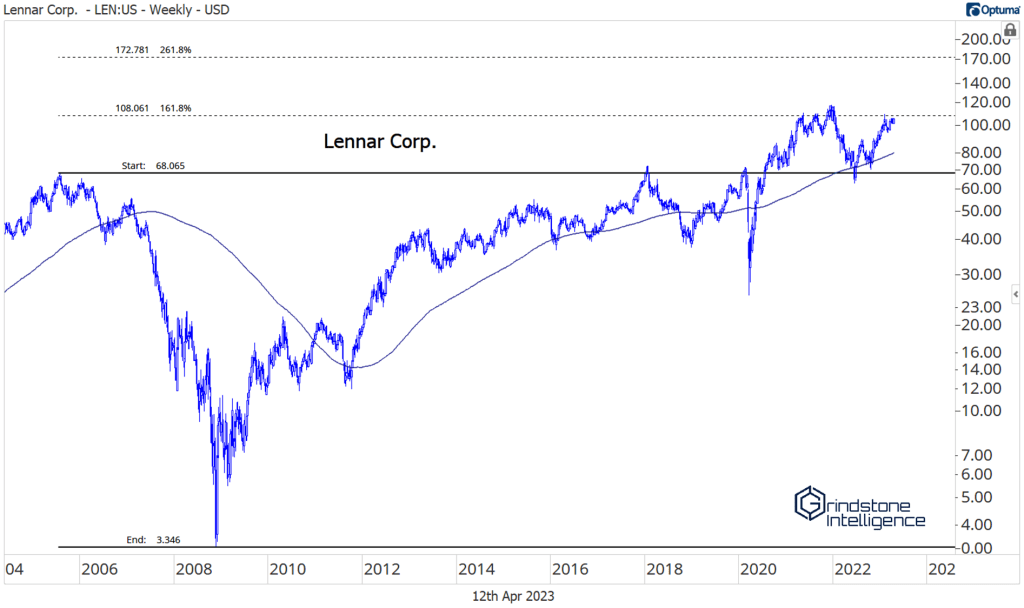

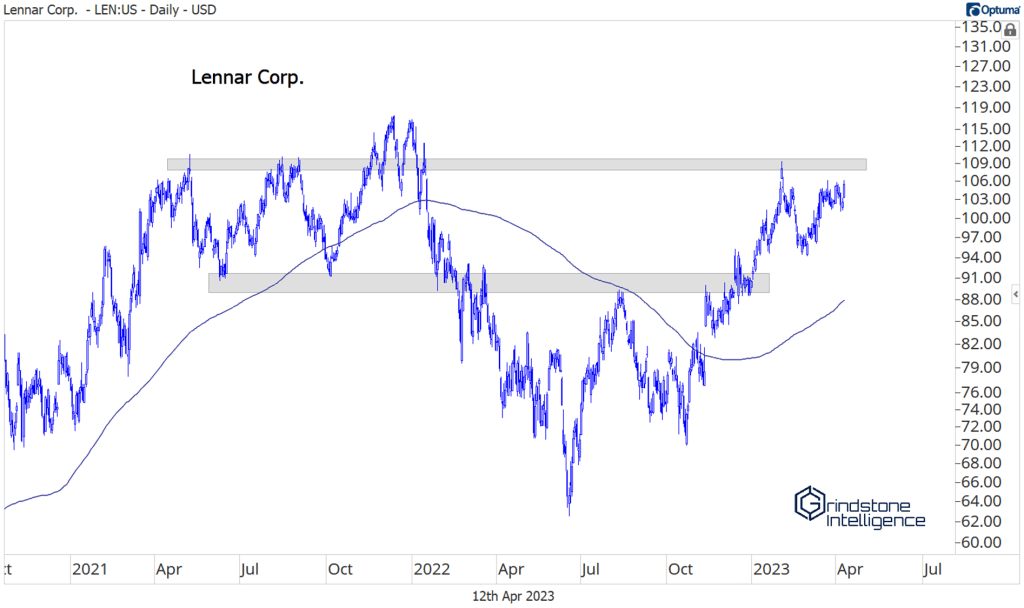

Lennar is in the same position. Its 2021 peak also occurred at a key Fib retracement level, and the ensuing selloff bottomed at those 2005 highs.

Just like DHI, LEN set a year-to-date peak on February 2, then spent the last 2 months gearing up for another test of the 2021 highs. Again, we think a breakout here is imminent. On a move above $110, we want to be buying with a target of $170, which is the 261.8% retracement from the 2005-2008 decline.

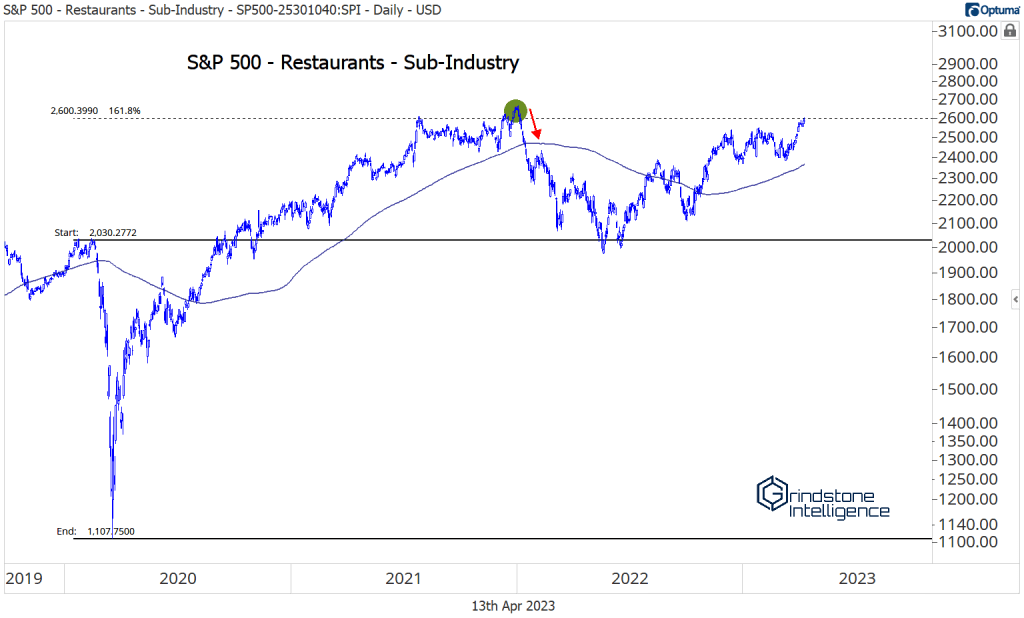

If we zoom back out to the sub-industry level, we’re also seeing a lot of strength within Restaurants. This group peaked in 2021 at the 161.8% retracement from the COVID selloff, and it’s spent the last two years trying to absorb that supply.

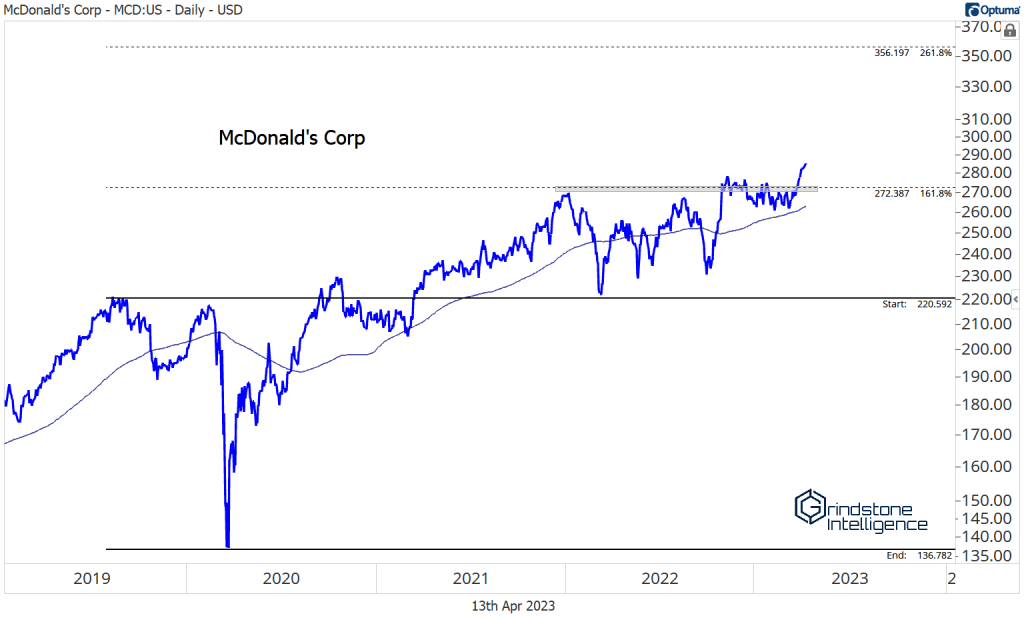

McDonald’s has already succeeded. It’s setting new all-time highs, and we like it long with a target up near $356, which is the 261.8% retracement from the 2019-2020 selloff. Support is at $270.

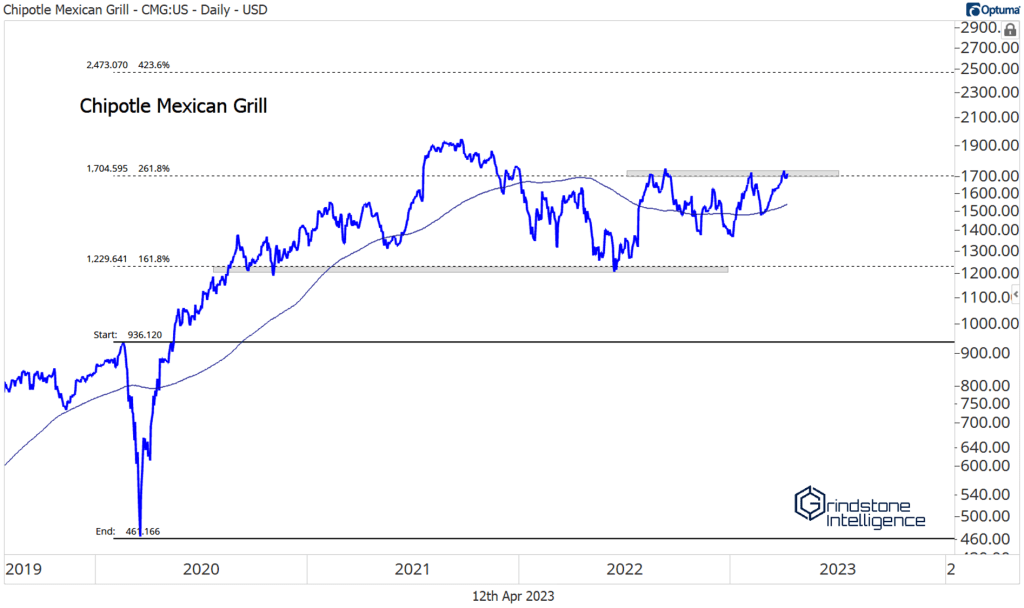

Chipotle is nearing a breakout above $1700, which has been the ceiling for the last year and coincides with the 261.8% retracement from the 2020 decline. On a move above that resistance level, we’re targeting a move all the way up to $2,470, which is the next key retracement level.

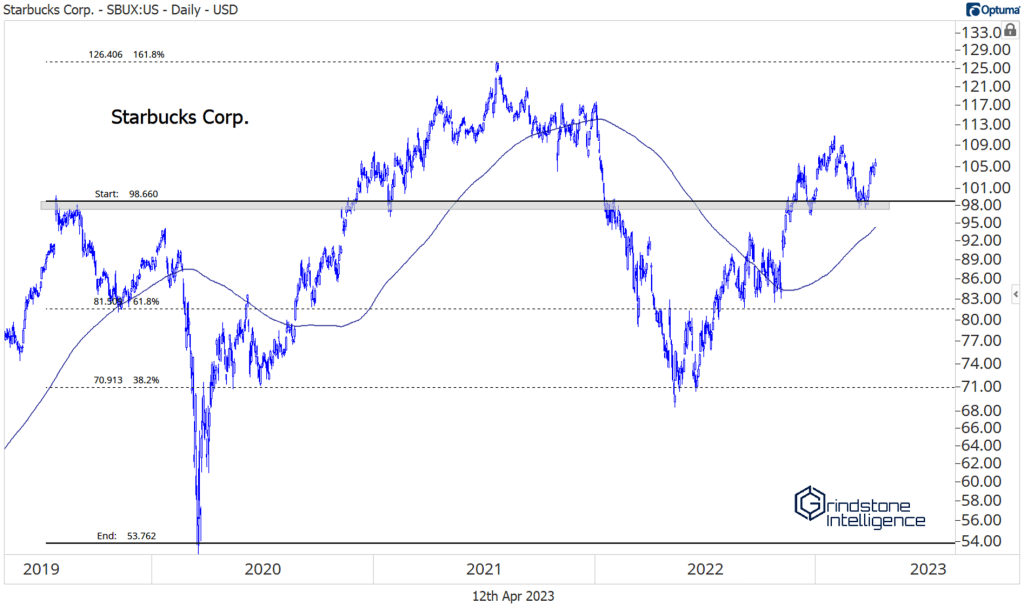

And for Starbuck’s, we see a move back to the 2021 highs at $125, but we only want to be long if it’s above $98.

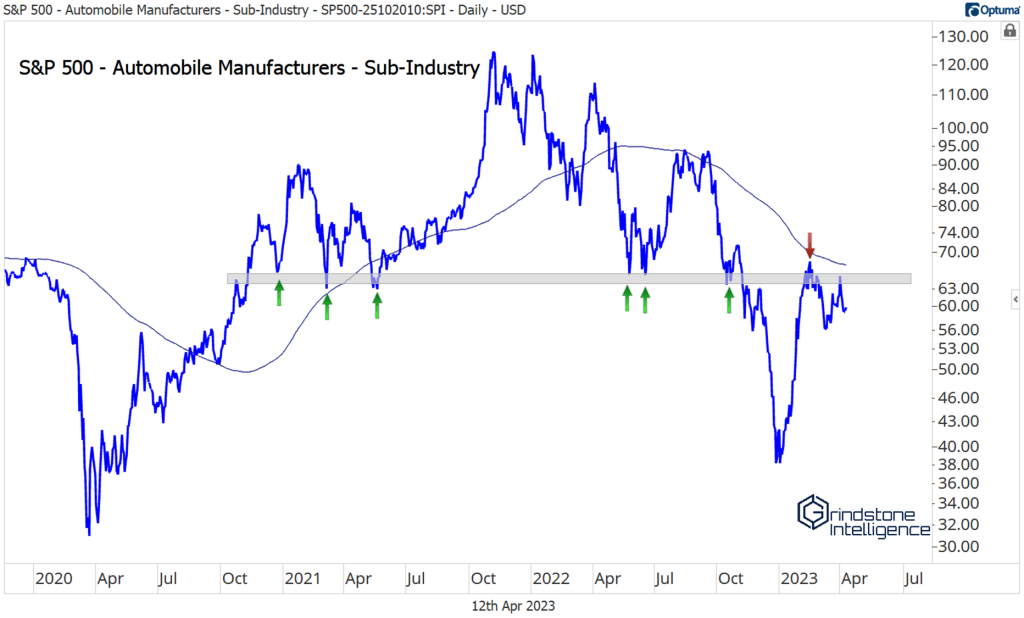

Where we don’t see a lot of strength is in the Auto Manufacturers. The chart for that sub-industry belongs in a textbook as an example of polarity. For most of 2021 and 2022, $65 was support. In November, that support finally gave out, and the group fell to multi-year lows. Now, $65 is acting as resistance. We don’t want to own any auto manufacturers as long as the sub-industry is stuck below that level.

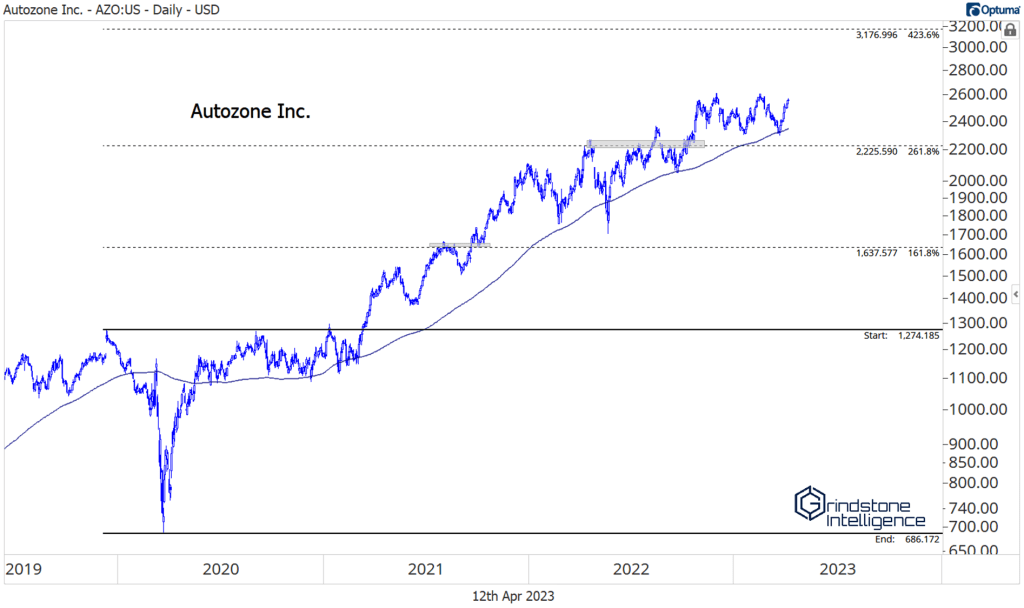

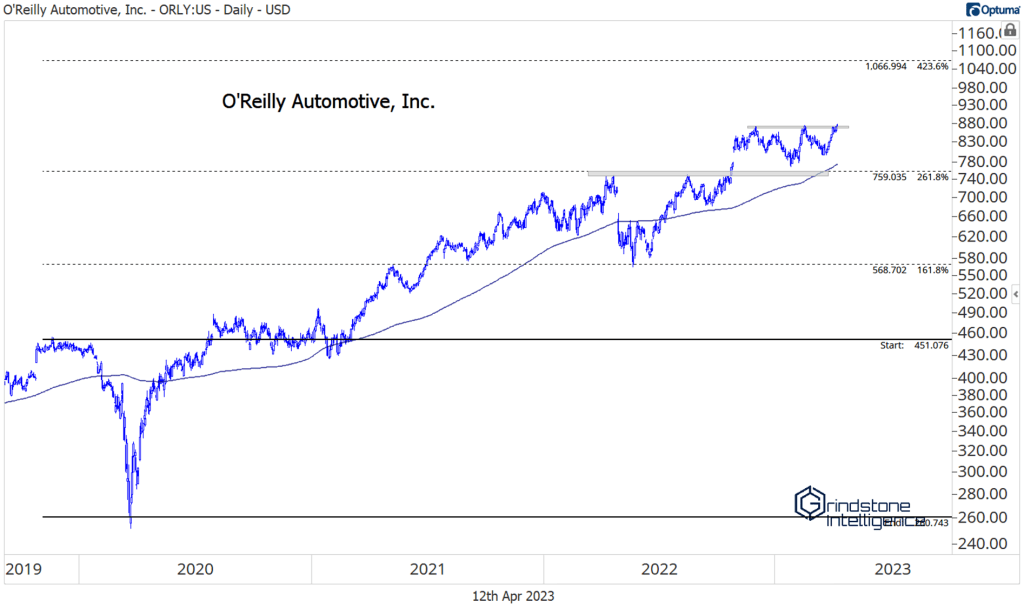

If you absolutely must have exposure to autos, check out the auto parts retailers. Autozone and O’Reilly have been on our radar for awhile, given the overwhelming amount of relative strength they’ve shown. Both have spent most of the last 3 years above rising 200-day moving averages, and now both are nearing new highs again after a few months of healthy consolidation. For both, we’re using the 423.6% retracement from the COVID selloff as a longer-term target. For AZO, that level is $3,176. For O’Reilly, $1,066.

The post (Premium) Strength Beneath the Surface in Consumer Discretionary first appeared on Grindstone Intelligence.