(Premium) Tech Stocks Leading the Way

What a month for big Tech!

We did it!

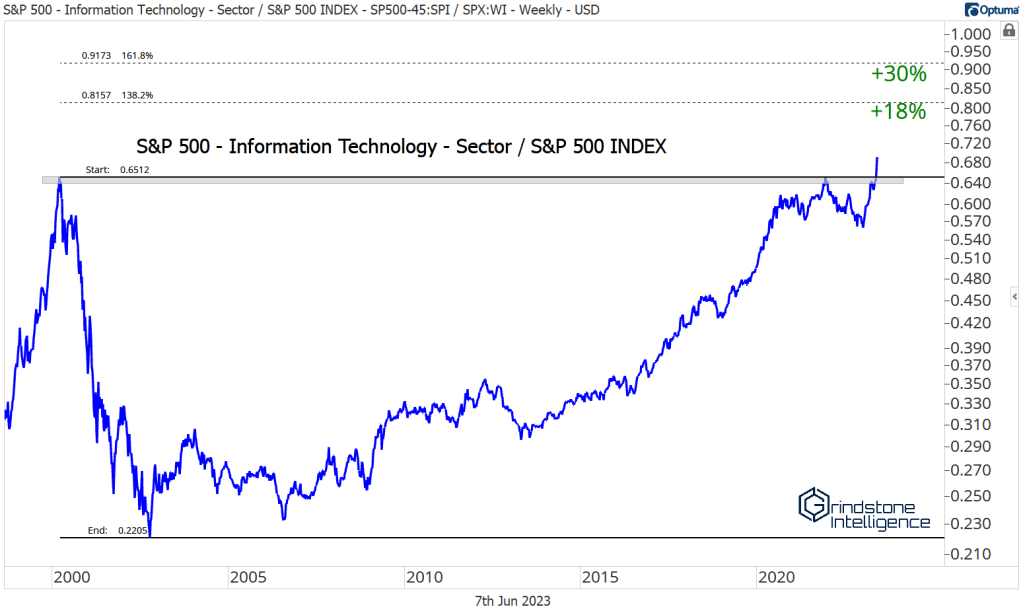

More than 23 years ago, the Information Technology sector peaked relative to the S&P 500 index. From its dotcom bubble highs in 2000 to its lows in the fall of 2002, Tech dropped 80% and lost two-thirds of its value relative to the rest of the market. Two decades later, we’re finally setting new all-time highs.

It wasn’t easy, especially over the last 3 years. Those former highs acted as stiff resistance on every rally attempt. First it was the 2000 monthly highs, then the weekly highs, then the monthly highs again. Each time it looked like things might be turning the corner, sellers stepped in and pushed Tech back lower. But a failed breakdown in the first weeks of this year was the catalyst needed to finally find fresh air.

The bigger the base, the higher in space. And 23 years seems like a pretty big base to us. We think Tech is structurally positioned to be a leader for the months and years to come.

True, AI-fueled speculative frenzy in May might have pushed things a bit far in the near-term, but Tech isn’t ‘stretched’. It’s gone nowhere for two decades! This ratio has another 18% to the 138.2% Fibonacci retracement from the dotcom collapse. We’ve got 30% to the 161.8% retracement. Those are our intermediate term targets for the sector. (Remember, since we’re talking about a ratio, those are gains relative to the S&P 500, not on an absolute basis.)

Those are lofty targets, and we don’ think we’ll go there in a straight line. Though we’re quite bullish on the sector longer-term, we believe rotation is the life-blood of bull markets, and we’re poised for some flows back into some un-loved spaces of the market.

The equally-weighted tech sector relative to the equally-weighted S&P 500 index just found resistance at its former highs. This would be a pretty logical place to see tech overall start to pull back.

Of course, that won’t happen if the mega caps keep dominating the way that they did in May. That could happen, and to some extent we’ll need the mega caps to keep leading if we expect tech to keep outperforming longer-term. But we doubt the same playbook is going to work all the time. A broadening of the rally would be healthy.

We’ve been cautiously watching for a rotation out of the mega caps that have dominated since February and back into the equally weighted sector. Here’s how that setup looks today:

The ratio of equally-weighted tech vs. the cap-weighted sector is working on a bullish momentum divergence after breaking the September 2020 lows. We’ve seen these types of momentum divergences get ignored before (see March and April), so we aren’t backing up the truck here. But a move back above resistance from those 2020 lows would be good confirmation that a larger mean reversion is underway.

A stalling out in the mega caps would make some sense on an absolute level, too. Check out Apple running into its former all-time highs. Could Apple blow right past them? Sure. But some consolidation here shouldn’t surprise anyone.

It’s the same thing for Microsoft, stuck just below its former highs after a gap-and-go at the end of April. It could take some time to digest those previous peaks.

Broadcom went up and found some sellers, too. It surged out of an 18-month base last month, rising 40% in just a few days before peaking at the 423.6% retracement from the COVID decline. Now we’re taking a wait-and-see approach to see how the stock responds. In any case, it appears the rally has stalled out for now.

And we can’t leave out NVIDIA, which was the biggest winner of them all. It stalled out at the 138.2% retracement from its 2021-2022 decline – another reasonable place to take a break.

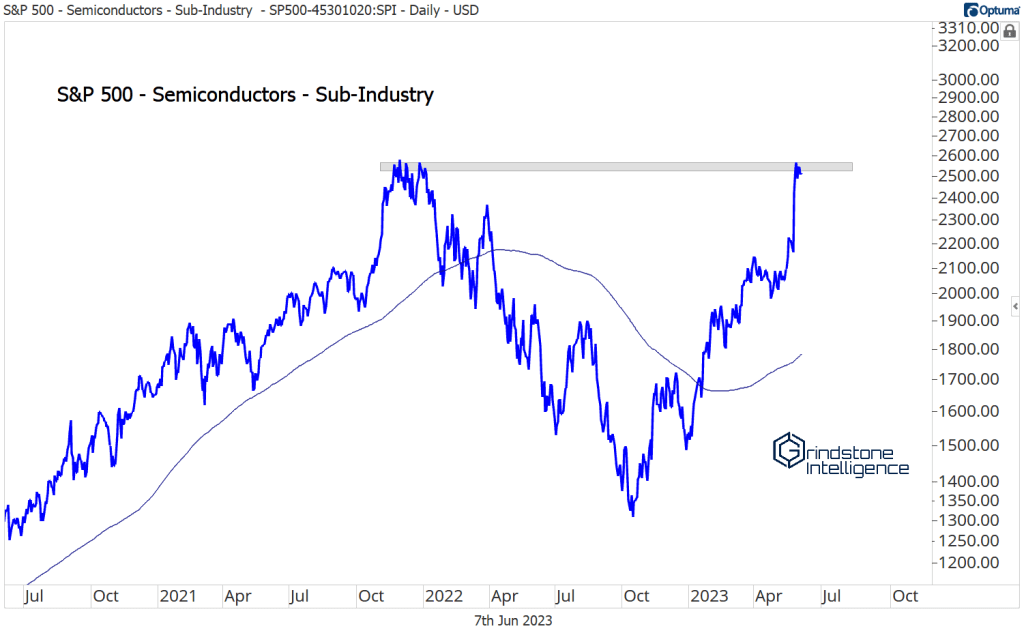

Here’s more evidence pointing to a pause: the Semiconductors sub-industry is running into resistance from the 2021 highs.

After doubling from the October lows, taking a breather here would make sense.

Remember, though, rotation is good. There are plenty of other names that were forgotten in May that still have great setups.

Motorola has pulled back to the initial breakout level, just above $270. We love how neat the risk-reward is here, and we like it long above the 2021 highs with a target above $360.

ON Semiconductor has been showing relative strength for more than a year, and now it’s setting new highs. With the stock above support at $82, we want to be buying it with a target of $128, which is the 685.4% Fib retracement from the 2020 decline. That’s more than 40% higher from here.

Micron wasn’t completely left behind in May, but it’s still got plenty of catching up to do. We’d been watching Micron to see how it would respond to the neckline of last year’s base, and now we’ve gotten our bullish resolution. With the $65 level acting as support, we’re eyeing the former highs up near $100.

Longer-term, there’s potential for more in MU. A whole lot more. The 2021 peak for the stock was also where Micron peaked back in 2000, before kicking off an 8-year decline. If it’s breaking out of a 23-year base, how can we not be excited about this stock? The first Fibonacci target in that scenario would be above $150.

What about PTC? This is another huge, multi-year base that has a ton of potential upside. If it breaks out above $150, which is the 161.8% retracement from the entire 2018-2020 selloff and also the 2021 highs, we think PTC goes to $210.

Synopsys has been one of our favorites for awhile, and it’s well on its way to our $520 target. The risk-reward isn’t great here for new positions, though.

The same goes for Applied Materials, which is nearing our initial target of $145. It’s worked well, but the setup isn’t great for new entries.

Instead, look at peer KLA Corp. KLAC is just breaking out of a multi-year consolidation, with easily identifiable support. We want to own KLAC above $420 with a target up above $600, which is the next key Fibonacci retracement level from the COVID selloff.

We’re seeing more great setups now than we’ve seen in awhile. That should tell us something. The broadening breadth we’ve all been waiting for is starting to show up.

The post (Premium) Tech Stocks Leading the Way first appeared on Grindstone Intelligence.