(Premium) Utilities Sector Deep Dive – August

There is perhaps no sector which exemplifies ‘risk-off’ more than Utilities. No sector has more consistent earnings, thanks to business which are highly regulated and rely heavily on long-term contracts. The Utilities also tend to pay large, stable dividends. These characteristics make them attractive places for investors to hide during economic turbulence (real or imagined).

Unsurprisingly, the sector outperformed during 2022, when US stocks were in the midst of their first extended bear market in more than a decade. The Utes were actually setting new all-time highs back in September, while the rest of the market was still drifting downward toward the ultimate lows in October.

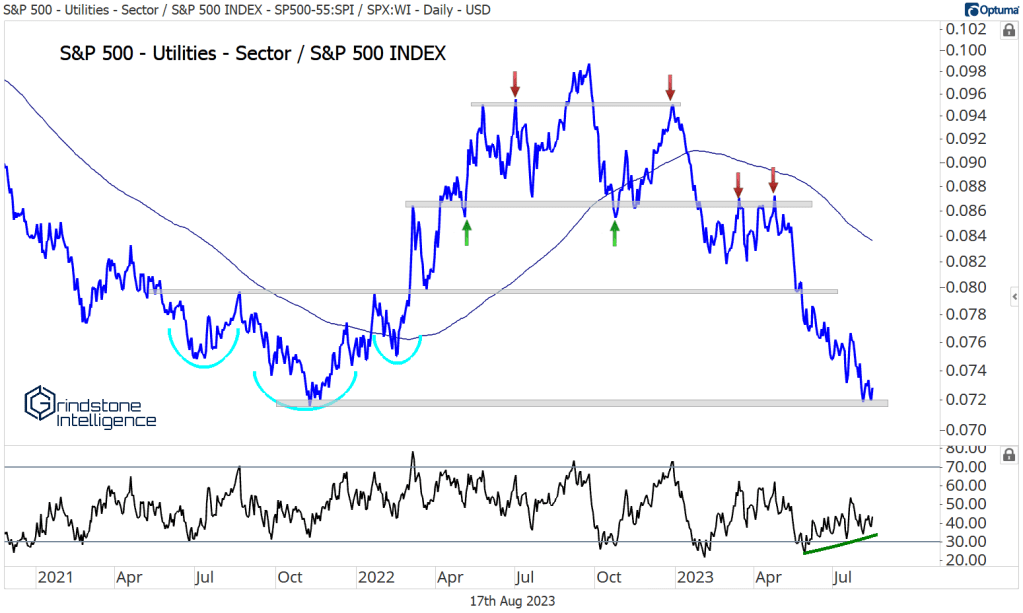

The sector has been left behind since then, though. This week, the group dropped to its lowest level of the year, breaking a key level of support that’s been in place since 2021.

The trends are ugly, but there’s some reason to believe the worst is over for the group, at least for now. Check out the sector compared to the S&P 500 index:

Since the relative peak last fall, the Utilities have now given back all of the outperformance from the lows set in late 2021. This is the level that sparked a 10-month, 40% rally in the ratio last time we were here, and momentum has been diverging bullishly all summer. Is it so hard to believe that we could get another bounce?

We aren’t betting the farm on it, but in our August 2 Sector Ratings Update, we did decide to remove the Underweight rating we’d had on the sector since the beginning of February. At the time we saw interest rates on the rise and the Dollar finding renewed strength, both which were headwinds in 2022 and have been headwinds for stocks again in August. But we’ve yet to see risk-off sectors really catch a bid – at least not yet. Unless and until we do, our Equalweight rating on Utilities feels appropriate.

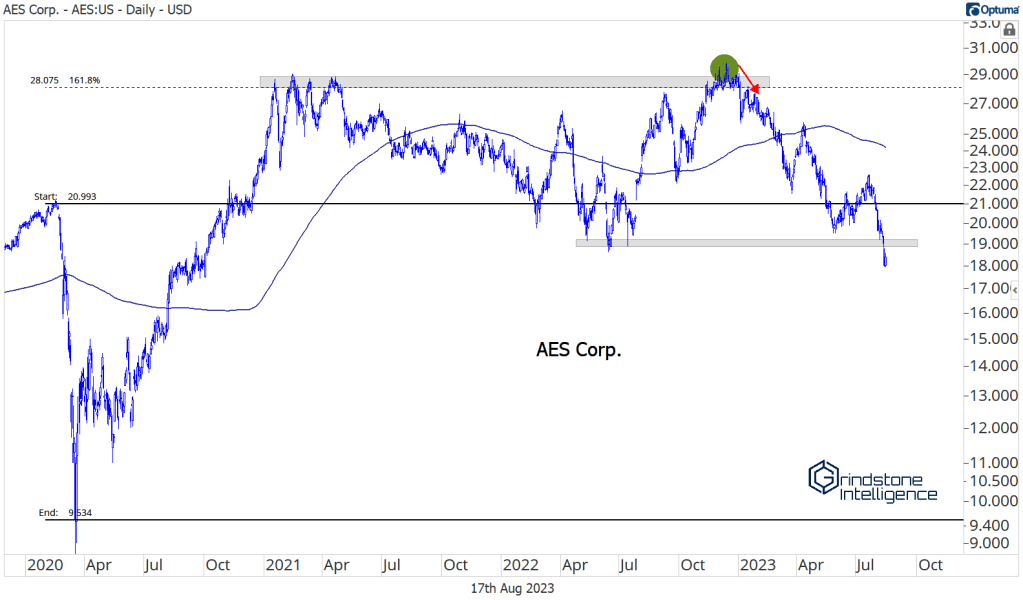

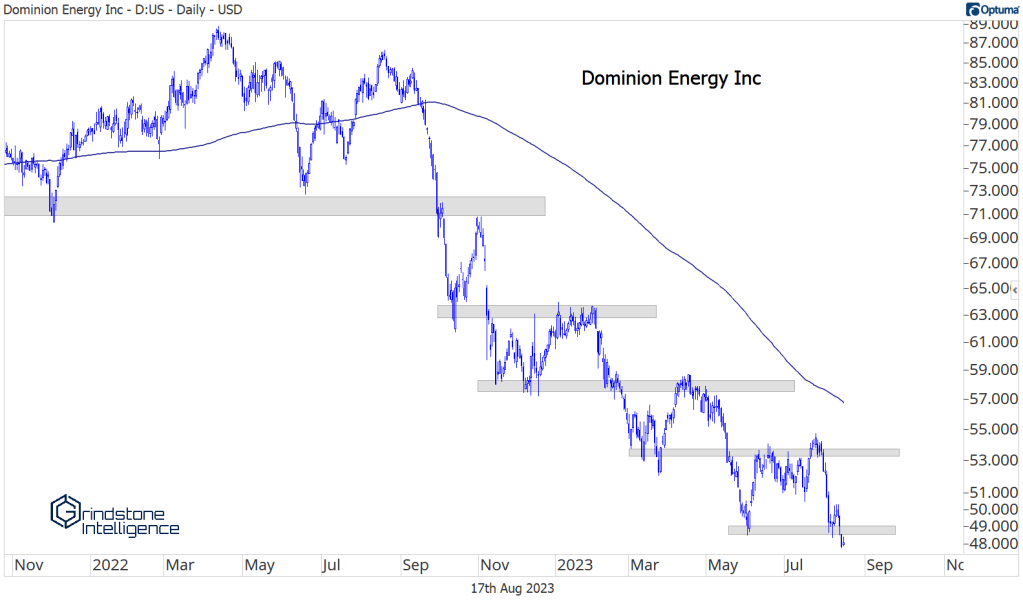

Unsurprisingly, given the absolute breakdown we highlighted at the sector level above, we’re seeing a lot more bad than good beneath the surface.

Check out all these names breaking down to new lows:

Downtrends in the Utilities sector are widespread. In fact, they’re the most widespread of any sector in the index.

Given all that weakness in the sector, you’re probably wondering why we would remove our Underweight rating.

Perhaps we should clarify how we feel about our rating and the potential for a relative bounce in Utilities: If the Utes are outperforming the S&P 500 index, there’s a good chance they’re doing so because the SPX is falling faster, not because the Utes are rising.

We’re not making the bet that all these breakdowns and downtrends reverse. They could, sure. But that’s the lower probability outcome.

The one stock in the sector that we continue to like is Atmos Energy as it tries to successfully break out from this big, three-year range. We got a failed move in July, but that move looks more like a false start, rather than the beginning of a trend reversal.

In any case, we can’t own it unless it gets back above the former highs near $120. From there, we can target a move to $145, which is the 161.8$ retracement from this big trading range.

The post (Premium) Utilities Sector Deep Dive – August first appeared on Grindstone Intelligence.