(Premium) Utilities Sector Deep Dive – October

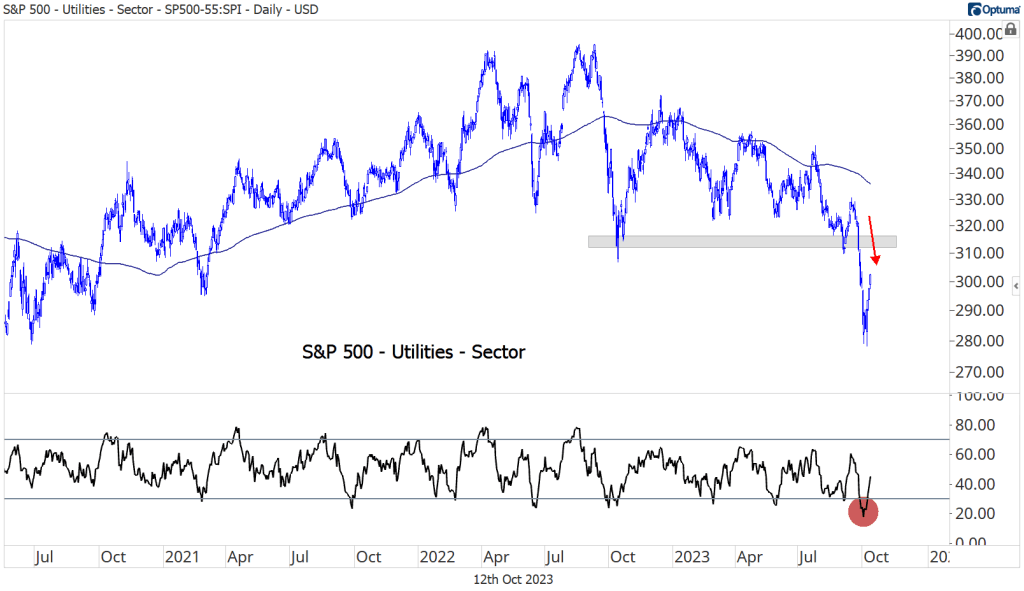

The Utilities have been the worst-performing sector in the S&P 500 for most of the year. Even after a 6% bounce from their lows, the group is still down 15.7% for the year, nearly double the next worst sector (Consumer Staples, 8.9%).

Are the Utes finally turning the corner?

We doubt it.

The Utilities broke to new 3-year lows in September, capping off a decline of more than 25% from their September 2022 peak. Along the way, 14-day RSI reached oversold levels that have only been seen a handful of times over the last 20 years. And in each of those cases, prices went on to set more lows.

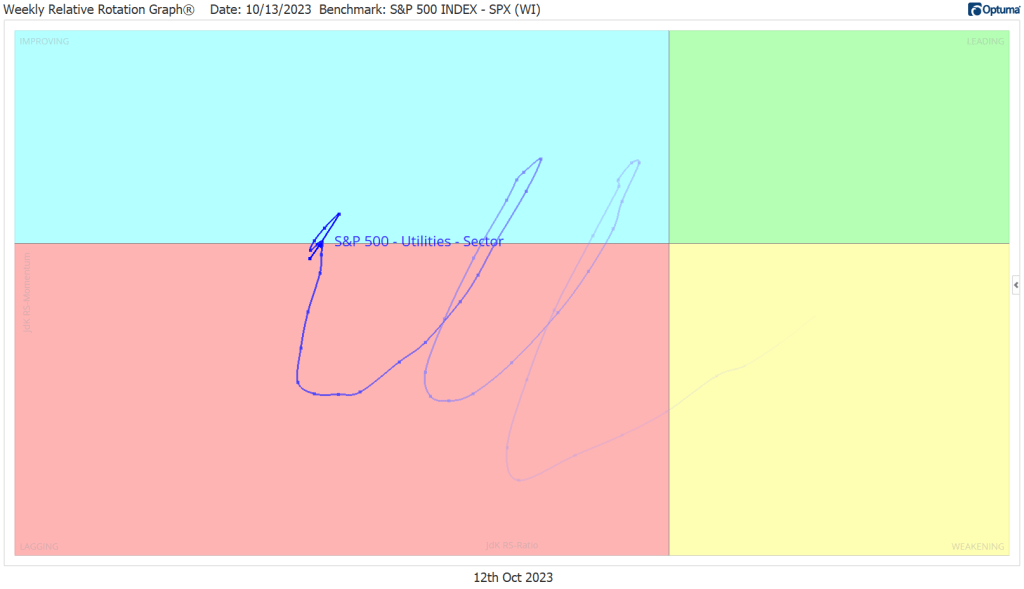

This is more than just broad market weakness rearing its head. The Utes are clear laggards. They’ve been on the left-hand side of the RRG for the entire year, and they keep getting worse.

The relative weakness is equally apparent when you look at index breadth. More than 80% of Utilities stocks are below a falling 200-day moving average – that’s the worst of any of the S&P 500’s 11 sectors.

The short-term picture isn’t much better: just 17% of the sector is above a 50-day average, and only 7% are above a 100-day average price.

Seasonality isn’t favorable, either. The Utilities sector has lagged by more in November than any other month. On average, they’ve underperformed the S&P 500 index in that month by 2% since 1990.

In short, we see little reason to own, let alone overweight, the Utilities sector right now. As we put it last month, they’re guilty until proven innocent.

Leaders

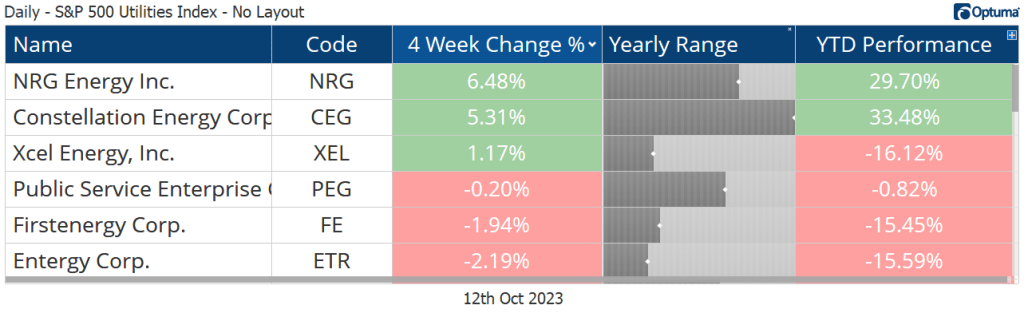

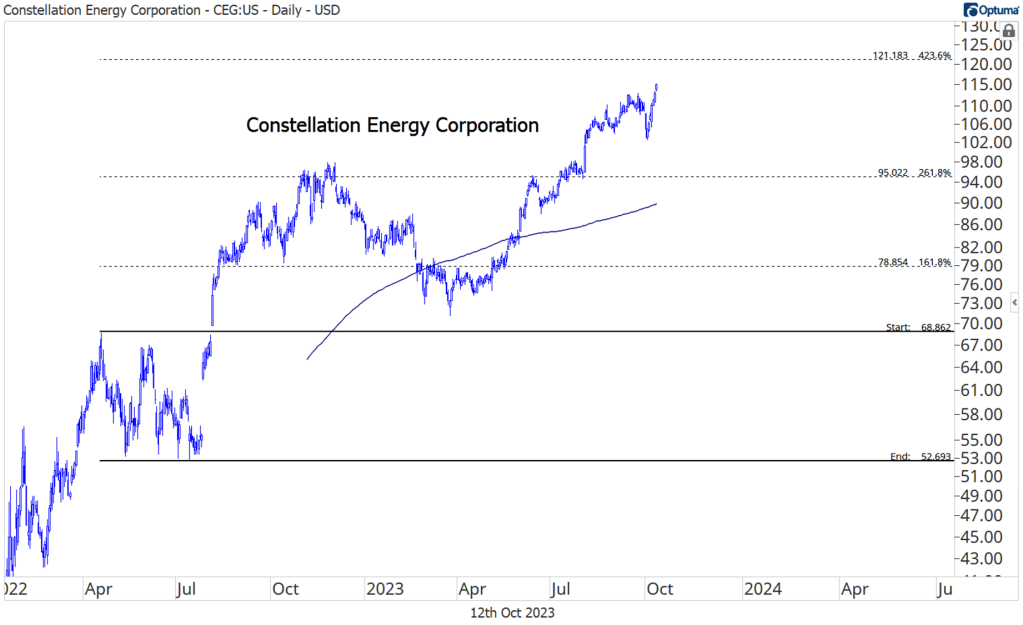

There aren’t many bright spots in the sector, but there are a few. Constellation Energy hasn’t been around too long – it spun out from Exelon early last year – but the stock has already made a name for itself. It’s the top-performing stock in the sector so far this year.

What’s more is that CEG is showing relative strength not just against the sector, but the S&P 500 as a whole. It just broke out to new relative highs.

We want to own CEG with a target of $121, which is the 423.6% retracement from last summer’s selloff.

NRG is another that’s shown impressive relative strength. Here it is resolving higher out of an 8-month base when compared to the S&P 500.

On an absolute basis, though, the outlook is a little cloudy. We’d expect NRG to digest the recent run-up now that it’s filled the gap from last year’s nasty drop.

Losers

Looking for the Utilities sector’s worst offender? Look no further than NextEra Energy. No, NextEra’s 36% year-to-date decline isn’t the worst you can find. But given that NEE is the sector’s largest component by far, no other stock is more responsible for the drawdown. Excluding NextEra, the Utes would be down just 10% for the year, rather than 15.7%.

The picture wasn’t so bad for the first half of the year. NEE was stuck in a multi-year trading range between the pre-COVID highs and the 161.8% retracement from the 2020 selloff. When those former highs stopped acting as support, though, things got out of hand in a hurry.

Growth Outlook

The fundamental growth outlook for the Utilities sector isn’t too compelling. Then again, it rarely is. Revenues over the next two years are expected to grow at an average of about 3%. The consensus estimate for earnings implies 8% annual EPS growth through 2025. Both numbers are below that of the overall S&P 500 index.

The post (Premium) Utilities Sector Deep Dive – October first appeared on Grindstone Intelligence.