(Premium) Watch Out for a Mean Reversion in Big Tech

A reckoning is coming.

Information Technology is the top-performing sector year-to-date, thanks in large part to surges by some of the sector’s biggest constituents: Apple, Microsoft, and Nvidia.

Now the bill is coming due.

To be clear, we aren’t forecasting big price declines. Instead, the mean reversion we see coming is in sector leadership. Here’s why:

For all of 2022, it was big tech that was lagging, and the equally weighted index outperformed by a handsome margin. But the equal weight relative uptrend line was broken in the first week of March, and things fell apart. Now, that ratio has found support at last year’s lows. Not only did we get a big bullish momentum divergence (RSI set a higher low while the ratio was setting a lower low), we also got a failed breakdown. And from failed moves come fast moves in the opposite direction.

Microsoft has the second largest weight in the sector, and it just ran into resistance at its August highs. After rising 18% in less than a month, this is a pretty logical level for the stock to take a breather.

We aren’t losing faith in Tech’s longer-term prospects, though, because the sector is back above its relative monthly highs from the dotcom bubble. Ever since this chart peaked back in September 2020, taking a cautious approach towards tech was the right approach. Now after two years of absorbing overhead supply, this consolidation has resolved higher.

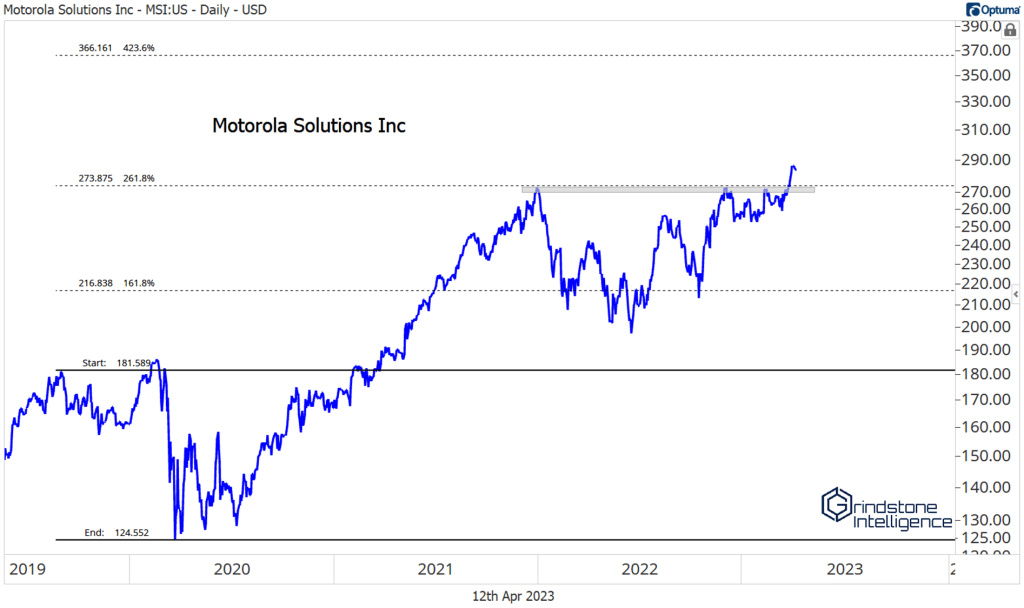

Motorola Solutions is one we like. It’s setting new 52-week highs after spending more than a year stuck below the 261.8% Fibonacci retracement from the 2019-2020 decline. Only a handful of names in the sector are above their 2022 peak, and I challenge you to find one that’s cleaner than this one. If MSI is above $275, we want to own it with a target of $365.

Analog Devices is another one that’s breaking out above last year’s peak levels. It failed to hold the initial breakout in February, but instead of a big reversal after the failed move, prices moved sideways and are now making another run. Momentum is our one red flag. RSI failed to even get overbought on the most recent breakout attempt. So is that a bearish momentum divergence that should keep us away from ADI? Or is it simply that RSI hasn’t gotten overbought yet?

We’re leaning towards the latter. We like it long with a target of $216 if ADI is above $190. If it’s below $190, though, we don’t want any part of it.

Same thing with Synopsys. This one’s been a big leader within software, and it’s knocking on the door of another big breakout. The 423.6% retracement from the COVID decline has been the ceiling since late 2021. If it’s above those former highs near $380, we’re targeting the next Fibonacci retracement level from the 2020 decline, which is up at $519. But keep an eye on that potential bearish momentum divergence. If the SNPS breakout fails to hold, things could fall apart in a hurry.

Here’s the thing about SNPS and ADI: If they’re putting in failed breakouts, they’re probably doing so in a world where Tech as a whole is moving lower. In that world, we want to be looking for stocks to sell – and we don’t want to be selling the names that have been showing relative strength.

Micron is one that offers opportunity on either side. If it’s above the October 2021 lows near $68, we think it can go all the way back to $95. But that’s not happening if Information Technology is in the toilet. If we start seeing failed breakouts among the leaders, we want to be short MU below $63.

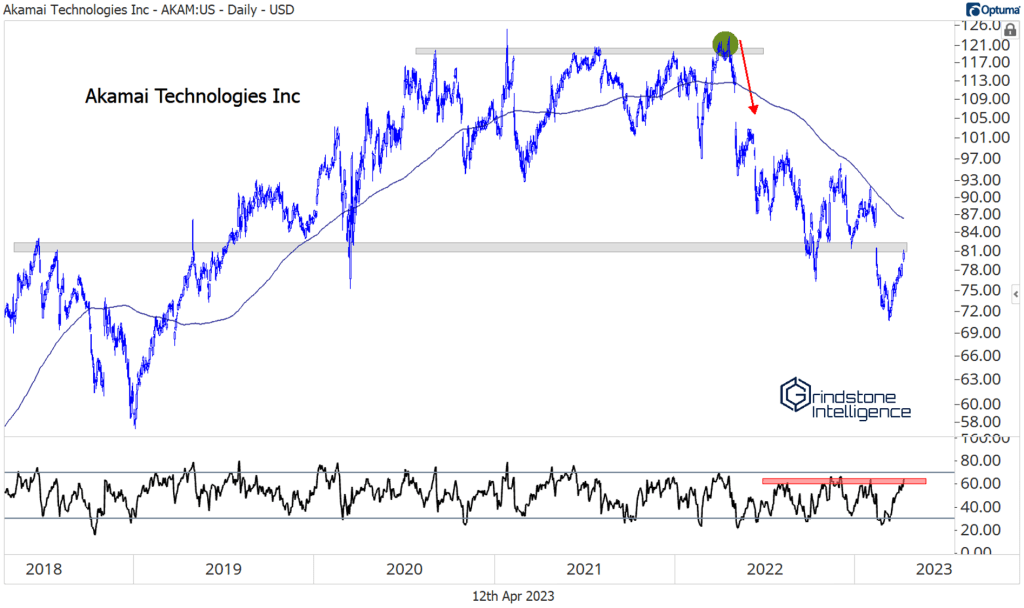

Akamai is an even better setup for bears. It’s stuck below resistance from the 2018 highs, momentum is in a bearish range, and it’s been stuck below a falling 200-day moving average for the better part of a year. In other words, it’s in a downtrend.

Based on the weight of the evidence we have right now, we want to err towards buying Tech. But if that evidence changes, we want to be short Akamai below $80 with a target back near $70.

The post (Premium) Watch Out for a Mean Reversion in Big Tech first appeared on Grindstone Intelligence.