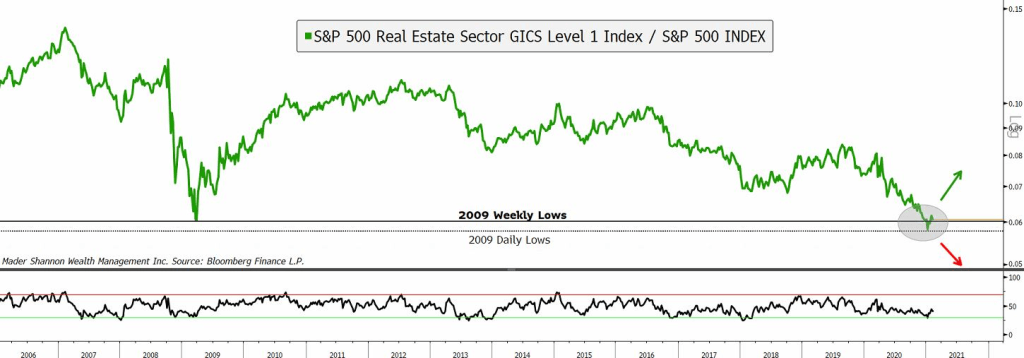

Real Estate Challenges Its 2009 Lows

Amid an astonishing rally from the coronavirus induced lows last March, the Real Estate sector has largely been left behind. The group is still 8% below it’s pre-pandemic highs, and on a relative basis has fallen to its lowest level vs. the index since 2009.

It’s hard to think of a worse time for U.S. Real Estate than the years surrounding the Great Financial Crisis. Needless to say, it’s a time and price level that hold meaning. If there was ever a time for this sector to outperform on a relative basis, it would make a lot sense for that outperformance time start here, at the 2009 lows. Granted, this is a sector mired in a long-term downtrend. We need to be careful when looking for reversals since, by definition, trends are more likely to continue in their existing direction than reverse. Still, this is likely a level that prices respect. Real Estate could easily keep pace with the broader stock market index, or even outperform it, for a year or more without changing the longer-term downtrend. They’ve done so more than once over the last 15 years.

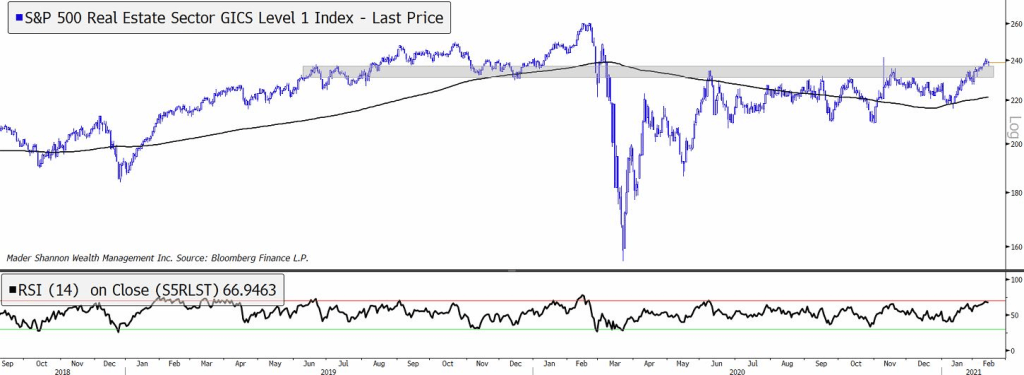

At the same time, the sector on an absolute basis just managed to reach it’s highest level since the March lows. Resistance near $240 had been trouble since it was first reached in June 2020, and prices consolidated below it for 6 months. But the action in early February was enough to finally break through the overhead supply. A few more days of strength and momentum could reach bullish overbought territory.

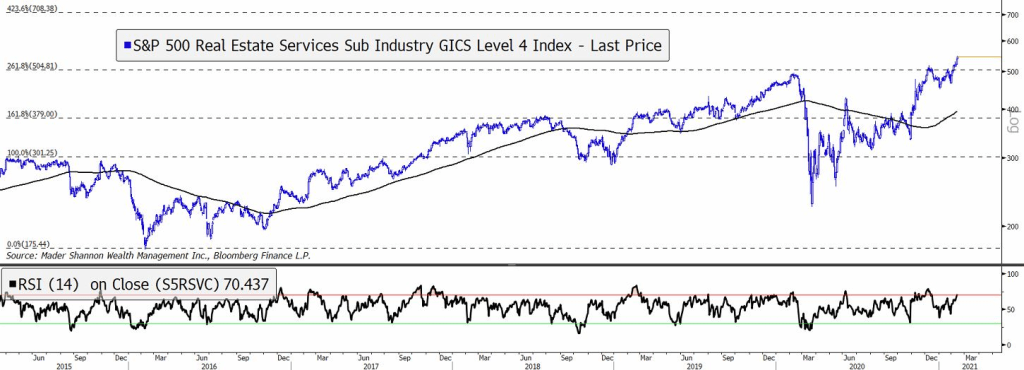

A handful of breakouts in Real Estate sector sub-industries have fueled the recent strength. The Real Estate Services sub-industry just hit new all-time highs. Prices in 2020 were rejected at $500, the 261.8% extension from the 2008-2009 decline. With that level now acting as support, the next key overhead extension lies near $700.

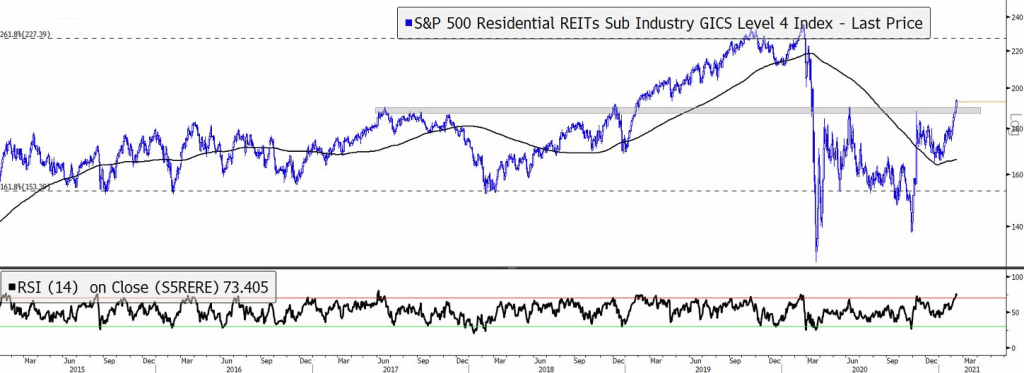

Residential REITs rallied above a key level, too. The area near $190 first became resistance in 2017, and gave the group trouble again in 2020. Following the breakout, with momentum in a bullish range, the 2019 highs are in focus.

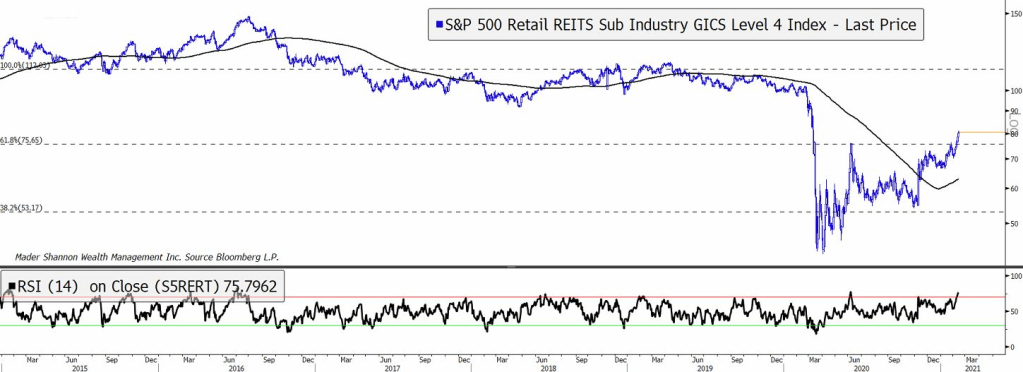

Retail REITs have been among the weakest sub-industries in recent years, having trended lower since 2016, but this month they’re among the leaders. Momentum is in a bullish range, and support is clearly defined. That should set them up to challenge the 2008 highs near $110.

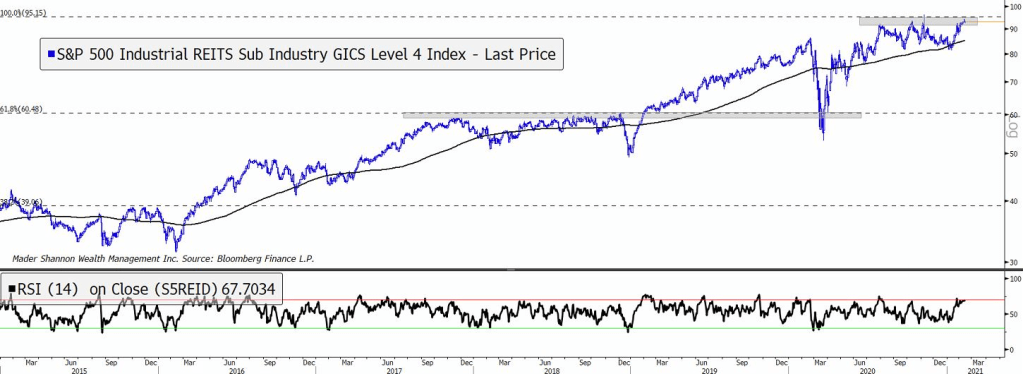

The Industrial REITs, on the other hand, have been among the strongest sub-industries. They’re in a multi-year uptrend, and completely recovered from the pandemic before the end of June. Prices have subsequently been stuck below $95, which also happens to be the 2008 all-time high. If the sector continues higher, Industrial REITs will almost certainly be breaking out.

We can likely say the same about Specialized REITs. This group led its peers for most of the last decade and quickly recovered from last spring’s selloff, but they’ve failed to make progress over the last few months. Clearing resistance at $300 will be key to reclaiming a leadership role.

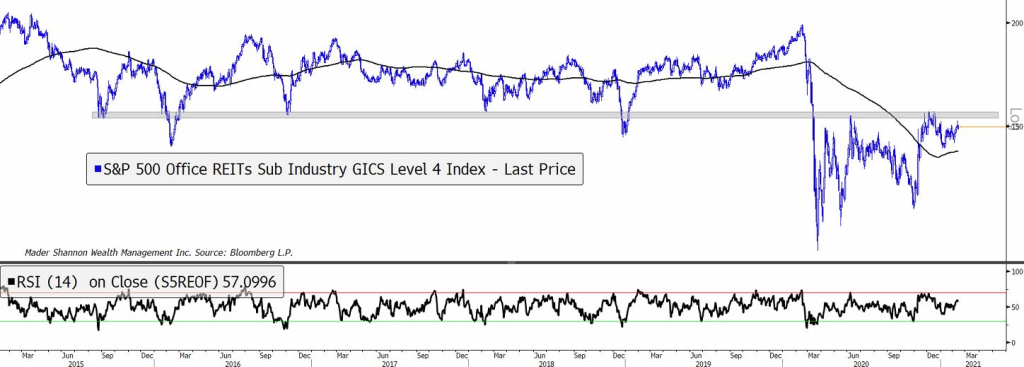

The Office REITs have not been leaders in any environment over the past 5 years. They’re stuck below $155, a level that acted as support from 2015-2019, and then as resistance over the last 12 months. Laggards tend to lag. It shouldn’t surprise us to see the weakest groups struggle to move higher.

But Office REITs may provide a clue as to whether the Real Estate sector can rally from its 2009 relative lows. If Office REITs fail to absorb overhead supply, then the sector as a whole will struggle to outperform. Alternatively, Office REITs above $155 would be a sign of strength. When even the weakest groups can rally higher, it’s hard to be negative.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Real Estate Challenges Its 2009 Lows first appeared on Grindstone Intelligence.