Real Estate Sector Deep Dive

The best stocks in a bad sector

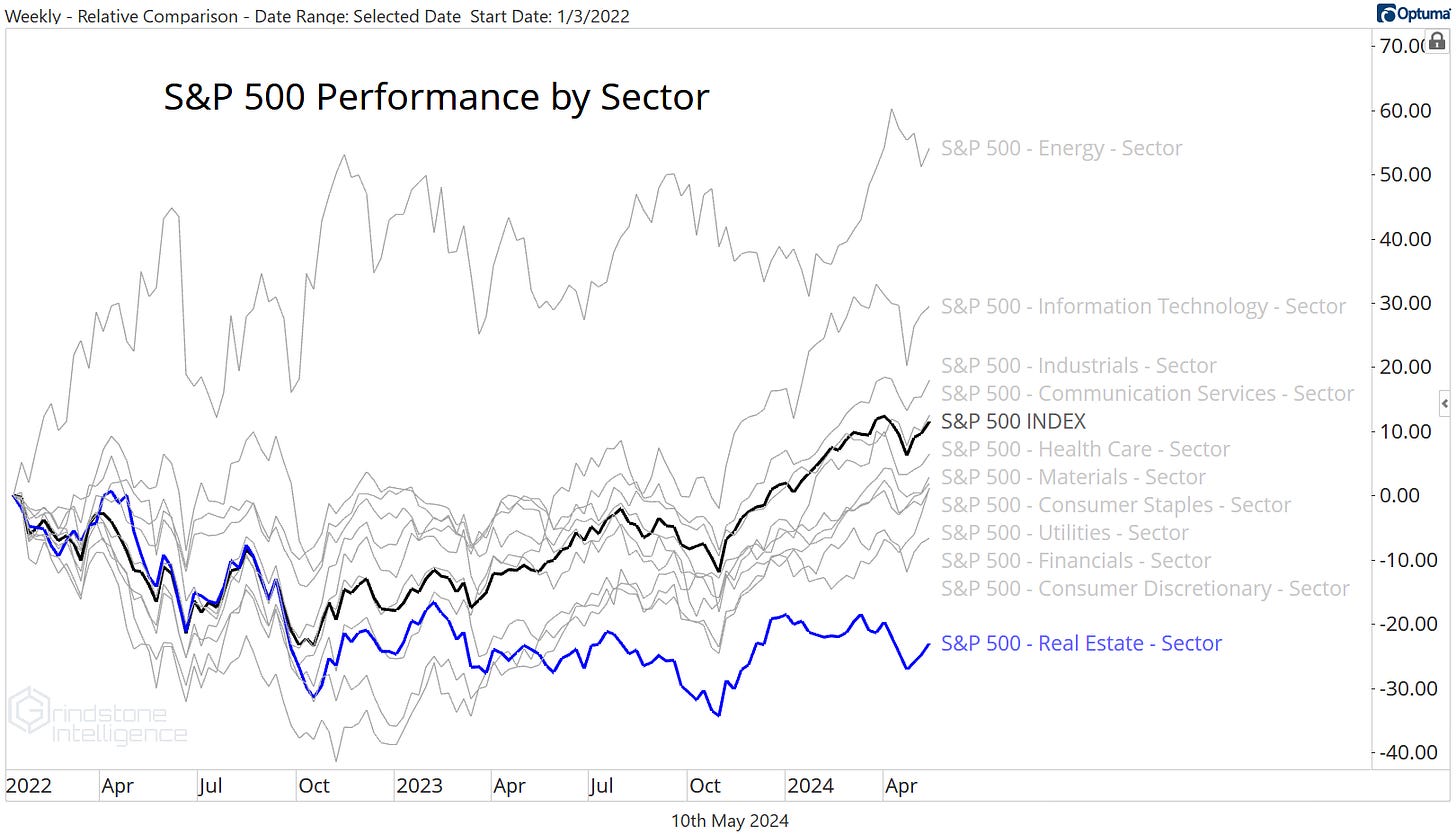

It’s been a little more than two years since stocks kicked off the most extended bear market since the Great Financial Crisis. Today, 9 of the 11 S&P 500 sectors are higher than they were back at those January 2022 highs, and so is the overall index.

Not every area of the market is feeling the love - Real Estate is still down in the dumps. From the start of the 2022 bear market to today, the S&P 500 Real Estate sector has fallen 23%. The next worst sector is Consumer Discretionary, down just 7% from its highs by comparison.

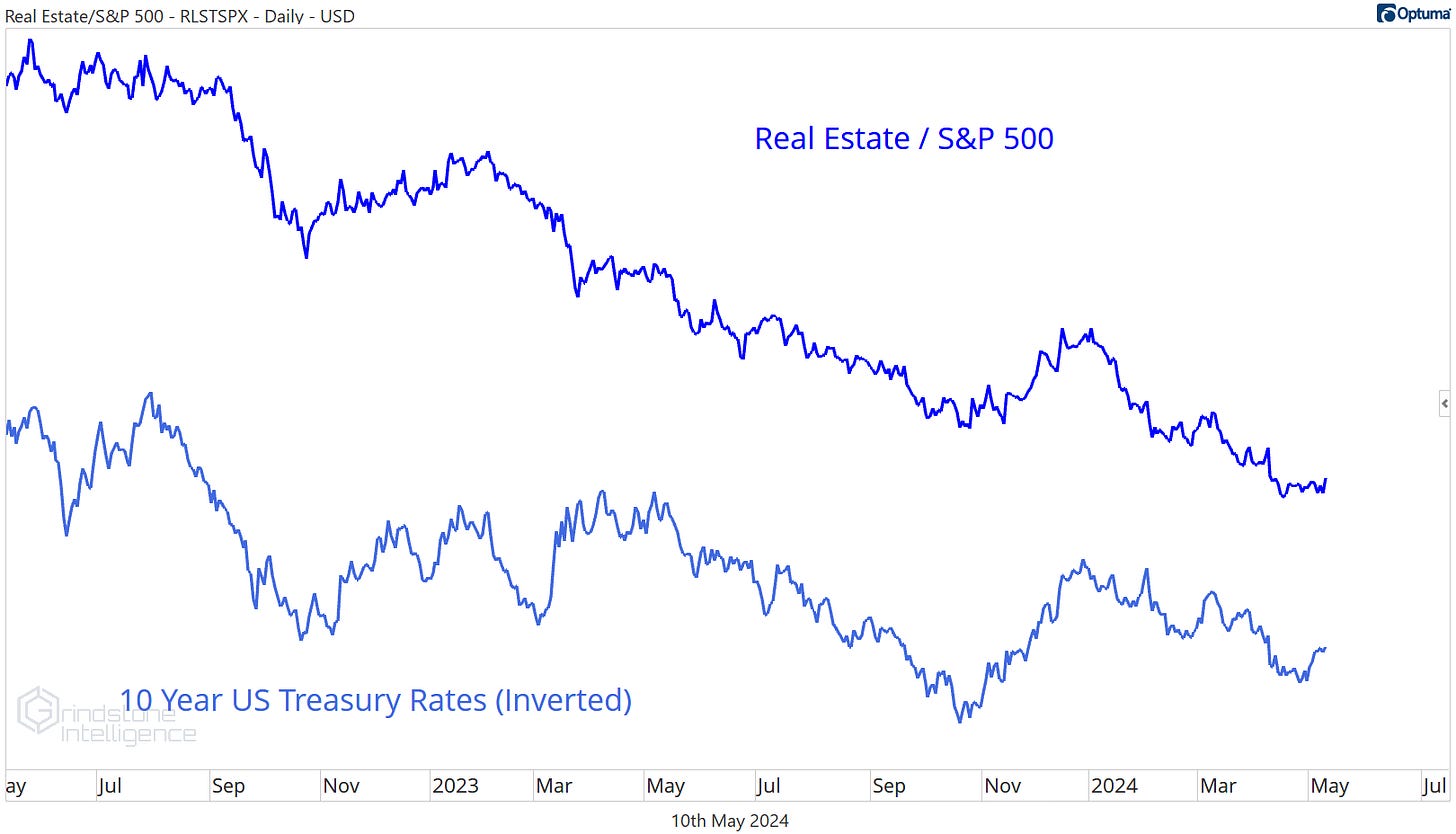

If you’re looking for a reason for Real Estate’s troubles, blame the rise in interest rates. Take the trend of the sector vs. the rest of the market, then overlay that with Treasurys. The relationship speaks for itself.

When interest rates go up, Real Estate underperforms.

Higher interest rates are a two-fold headwind. One, they make fixed income more attractive to investors and lower the relative appeal of stocks with high dividend yields. Consider this: Two years ago, 10- year Treasury rates were just 1.5%, while the dividend yield on Real Estate stocks was among the highest in the S&P 500 at about 3%. Today, the risk-free Treasury yield is above 4.5%, while Real Estate pays the highest dividend yield of any sector at just 3.5%. For income-focused investors, there’s little comparison.

Second, rates are a problem for the business activities of real estate stocks, which tend to have high debt loads. Real Estate has just a 2% market cap share of the S&P 500, but it has a 6% share of net interest expense. By that measure, Real Estate stocks are already paying 3x more interest than the average S&P 500 company. Only the Utilities compare, and they’re even worse, with a ratio of interest expense to market cap share of 8x.

The Utilities have one distinct advantage, though. The average maturity of debt for Utilities stocks is more than 10 years - double that of Real Estate at about 5 years. That means Real Estate companies will be repricing their large debt loads at higher interest rates at a much faster pace.

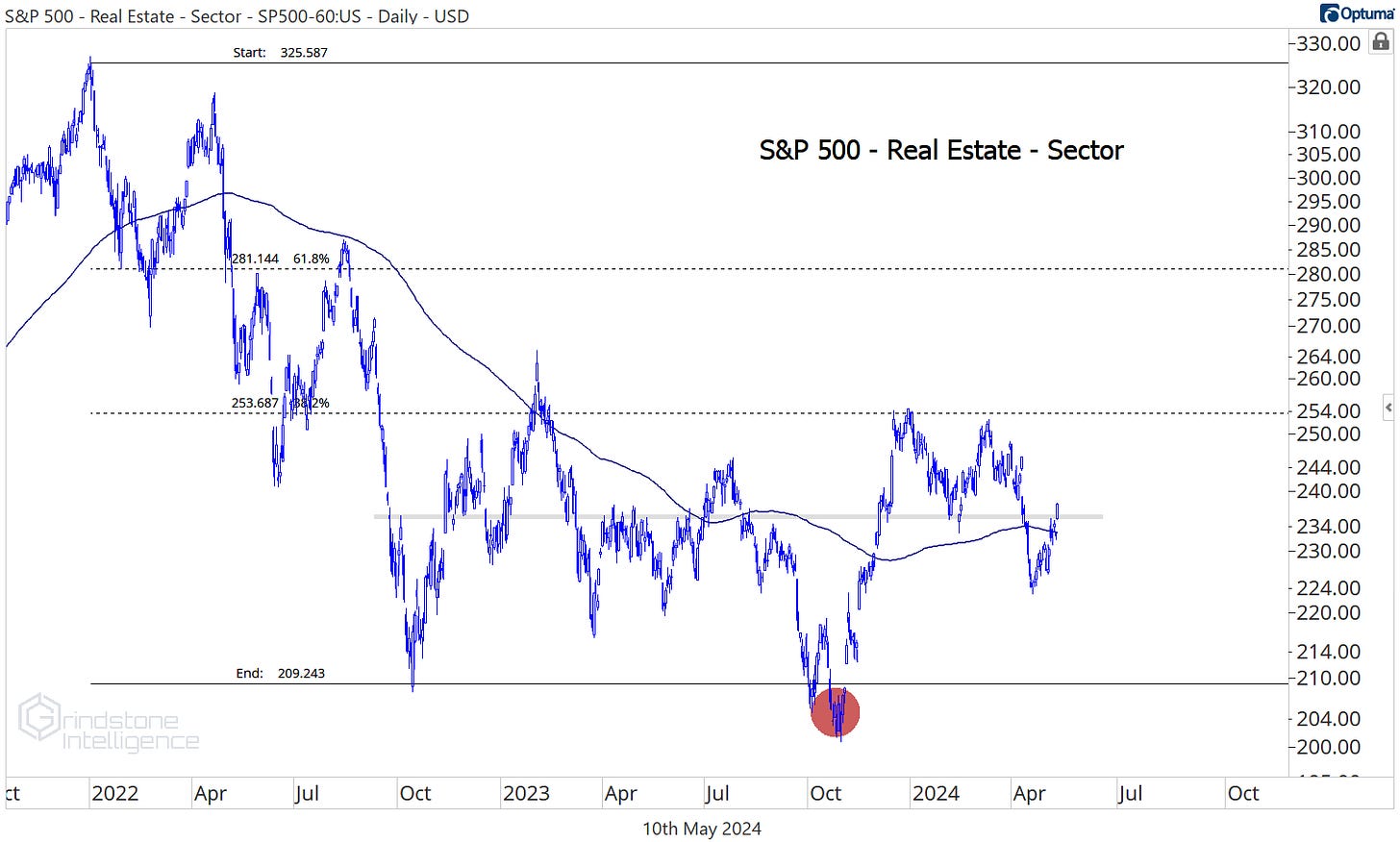

Things could be worse. Even though they were among the worst performers in 2022 and failed to participate during most of the 2023 rally, Real Estate is making progress on reversing this multi-year downtrend. Last fall’s failed breakdown below the October ‘22 lows was a start, but now we’ve yet to see a series of incremental new highs. The sector is a rangebound mess - that’s not good, but it isn’t so bad either.

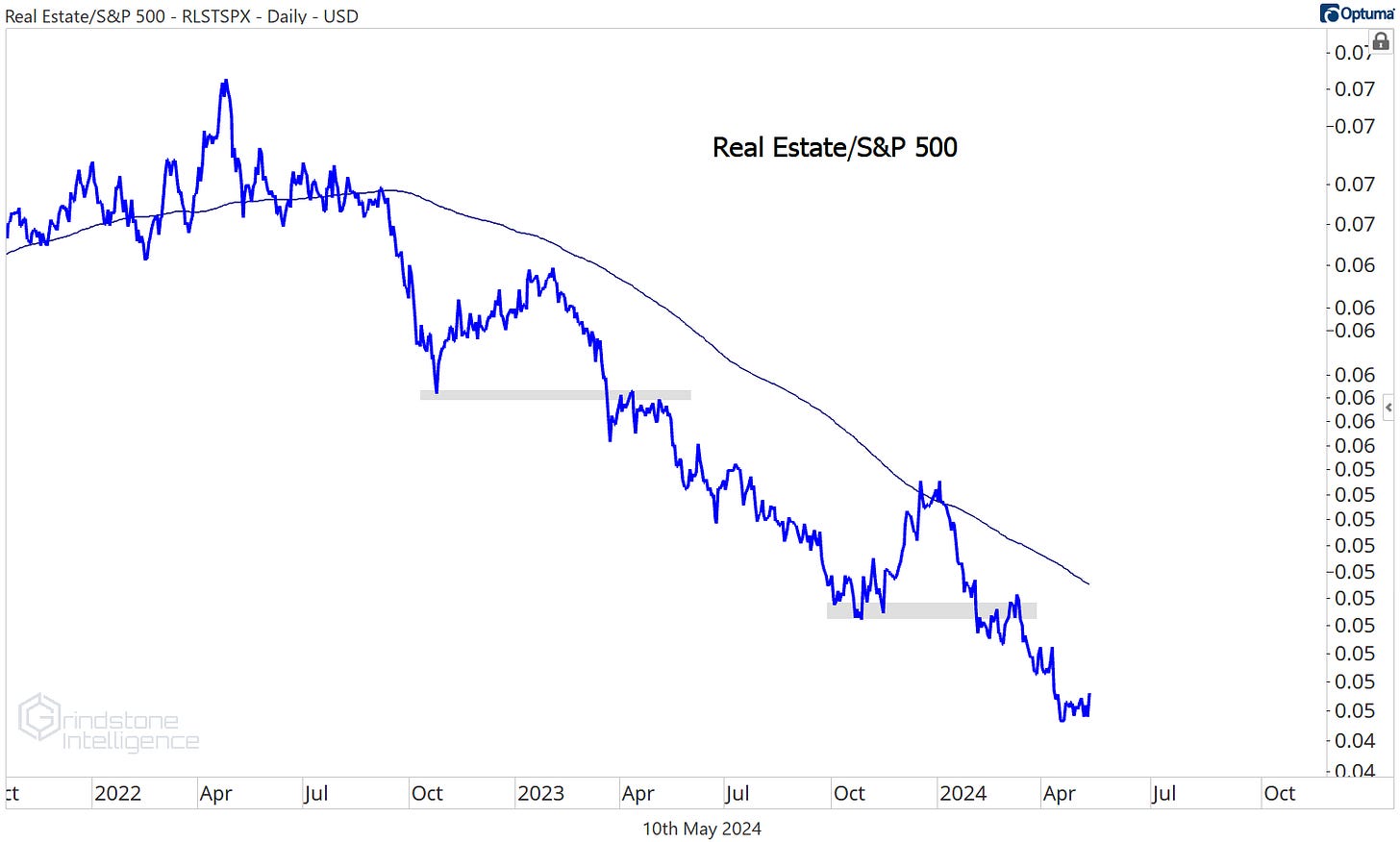

Unfortunately, waiting around for new highs while the rest of the market is screaming higher doesn’t make for a compelling investment opportunity. Compared to the S&P 500, the Real Estate sector has been trending steadily lower throughout this bull market.

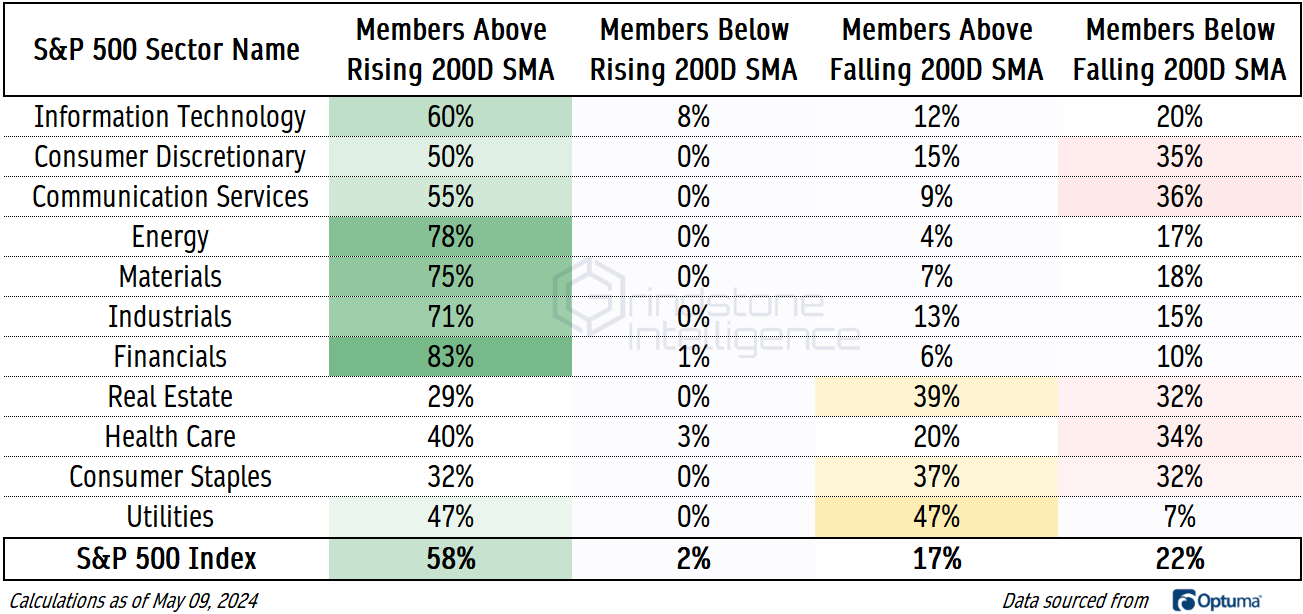

And Real Estate still has the weakest breadth characteristics of any sector in the market. Just 29% of the sector’s constituents are in long-term uptrends - defined as trading above a rising 200-day moving average.

Relative weakness and poor breadth makes the Real Estate sector a place we’d rather not visit - at least not until we see clear and convincing evidence of a change in the trend.

Digging Deeper - The Best Houses Stocks in a Bad Neighborhood Sector

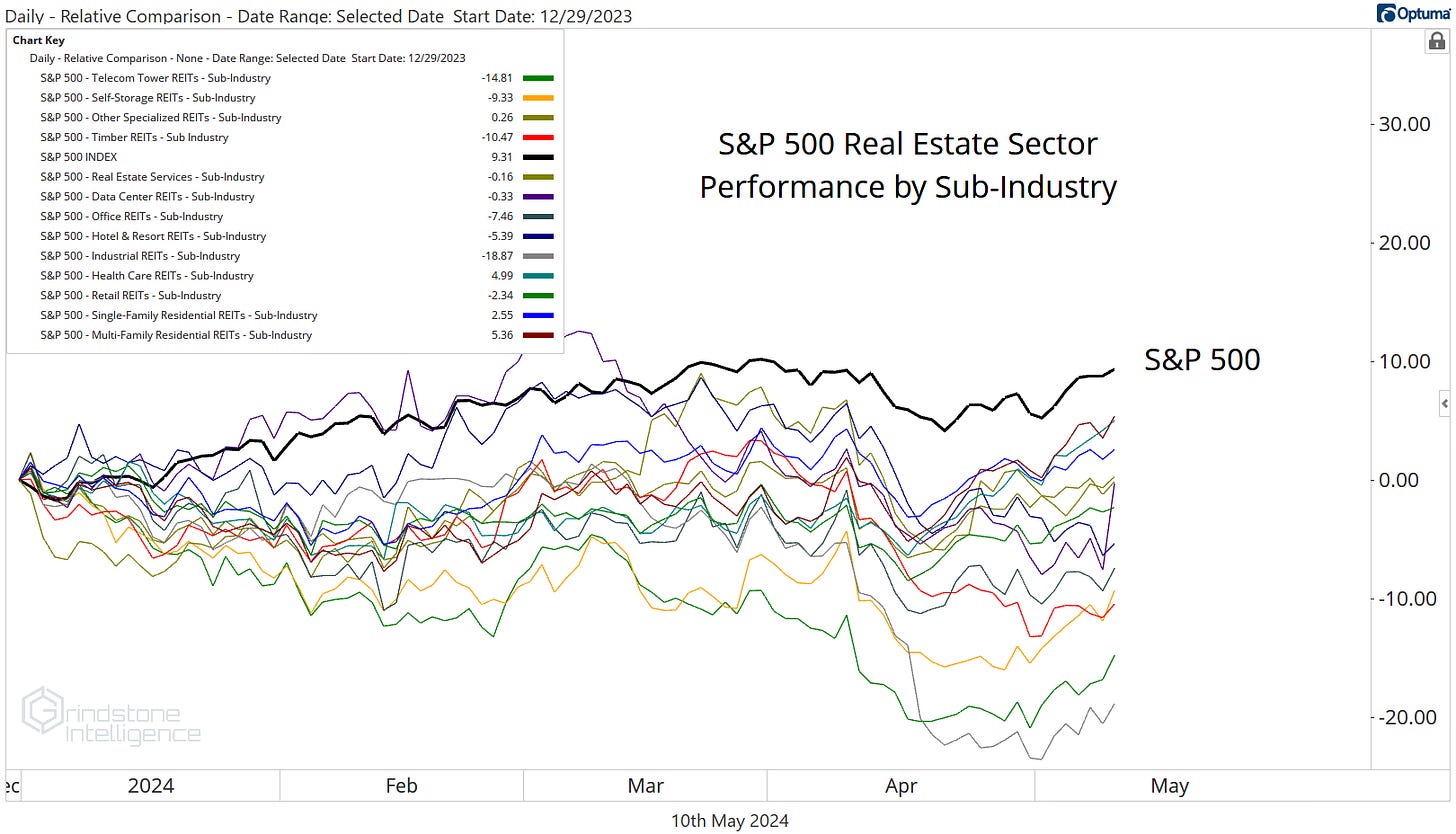

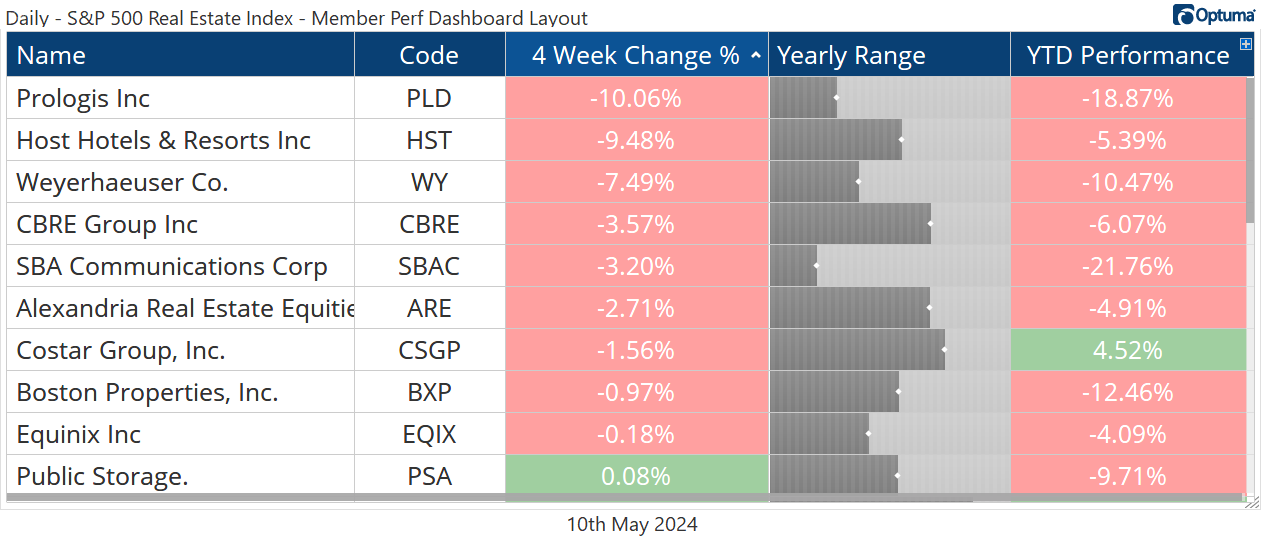

The underperformance within Real Estate this year isn’t limited to a handful of names. Every single sub-industry has lagged the S&P 500 in 2024, and 9 of the 13 are in negative territory.

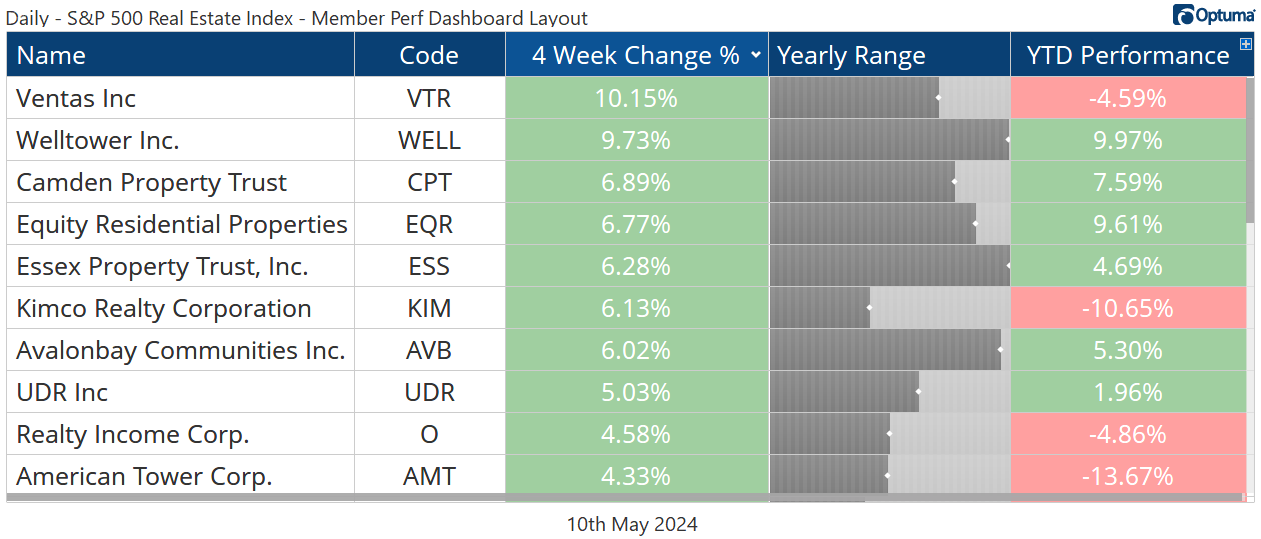

Leaders

Welltower was one of the best-performing stocks in the sector over the last month, rising nearly 10%. That also makes it one of the best performers of the year.

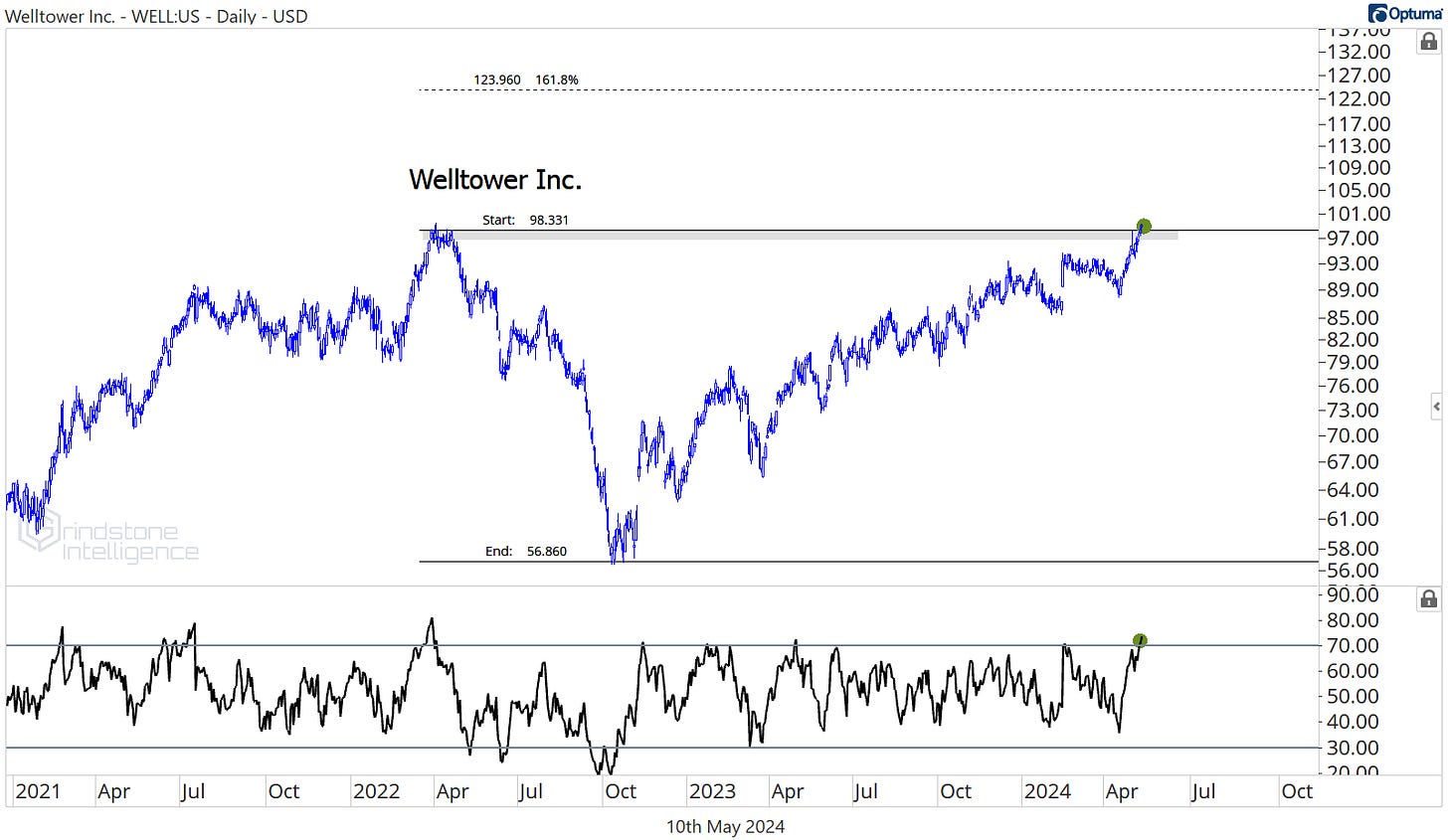

The most interesting thing about WELL is that it just broke out to new all-time highs, showing a ton of relative strength by surpassing its 2022 highs well before the sector as a whole.

New highs are a characteristic of uptrends, and this uptrend was just confirmed by momentum hitting its highest level since those prior cycle highs. We like the risk/reward opportunity here with WELL just now breaking out, and we can own it above $98 with a target of $123, which is the 161.8% retracement from the bear market decline.

Losers

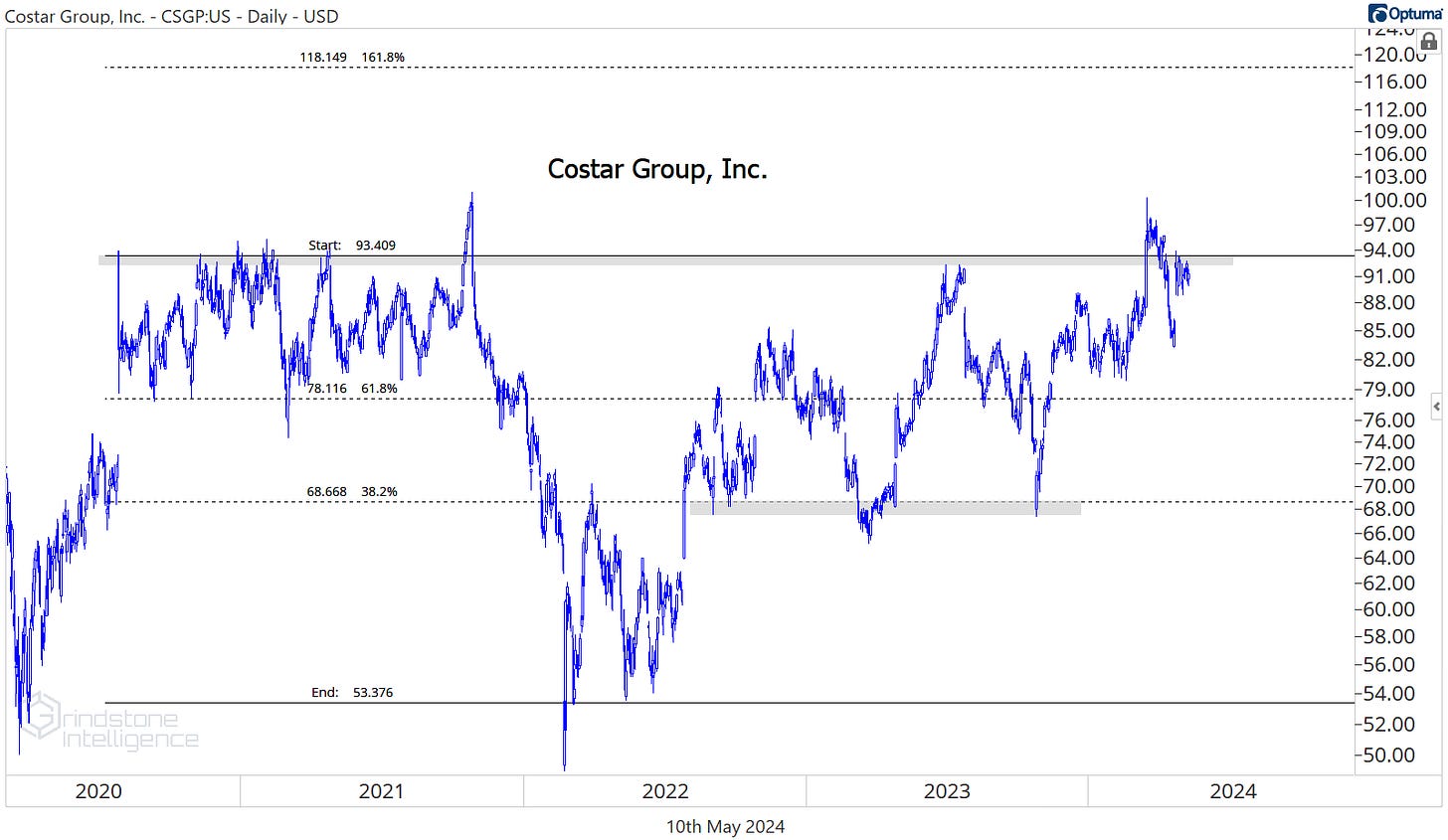

Costar Group found itself on the ‘Losers’ list for the last month, but it stands out because it’s the only one of the Losers that’s put in a positive performance year-to-date.

The recent weakness followed a failed breakout from multi-year highs earlier this year, and CSGP has been trying to regain its footing ever since.

Sometimes failed moves are the start of trend reversals, but more often than not, they just delay the next leg of the existing trend. We think that’s what’s going on here. There’s no reason to be involved if the stock is below $94, but on a renewed breakout we think it goes to $118.

We continue to like CBRE above $87 - which is the 161.8% retracement from the COVID decline and an important high in 2022 and 2023 - with a target of $122. While the Real Estate sector as a whole has been messy and rangebound for the past year, CBRE has been consolidating above its prior range. That’s a sign of relative strength to us.

The One to Watch

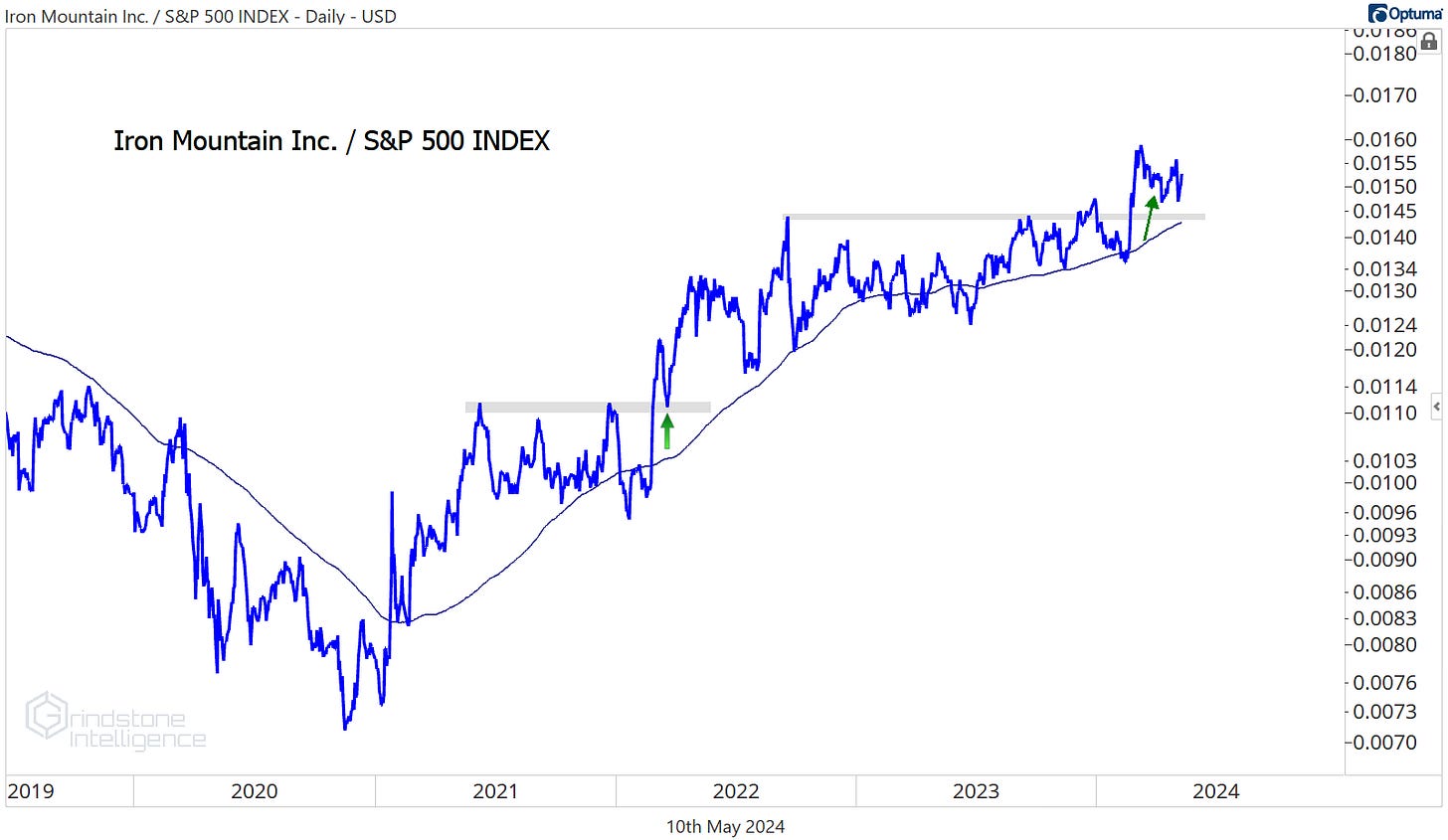

All these other names we’ve looked at are showing relative strength within the sector, but remember that the sector we’re comparing to is literally the worst sector in the index. It’s not hard to do better than that.

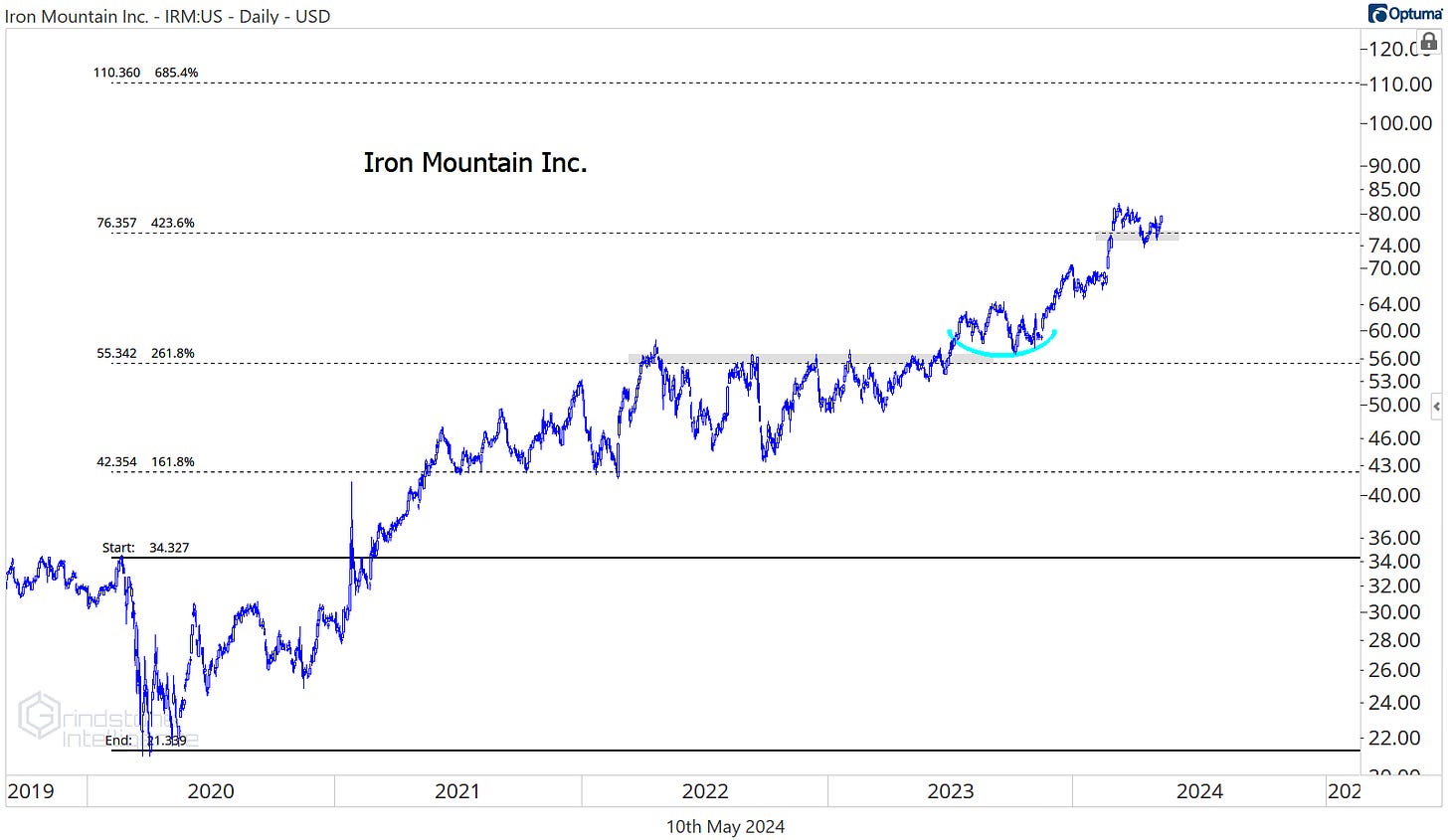

Only one Real Estate stock is showing relative strength vs. the S&P 500 as a whole, and that’s Iron Mountain.

We love this setup as IRM consolidates above the 423.6% retracement from the 2020 decline. As long as it’s above $76, we want to be buying it with a target up at $110.

That’s all for today. Until next time.