Real Estate Stocks Continue to Depress

Sector outlook and trade ideas

It’s been a little more than two years since stocks kicked off the most extended bear market since the Great Financial Crisis. Today, 7 of the 11 S&P 500 sectors are higher than they were back at those January 2022 highs, and the index itself has been setting new highs for most of the last 3 months.

Not every area of the market is feeling the love - Real Estate is still down in the dumps. From the start of the 2022 bear market to today, the S&P 500 Real Estate sector has fallen 22%. The next worst sector is Consumer Discretionary, down just 8% from its highs by comparison.

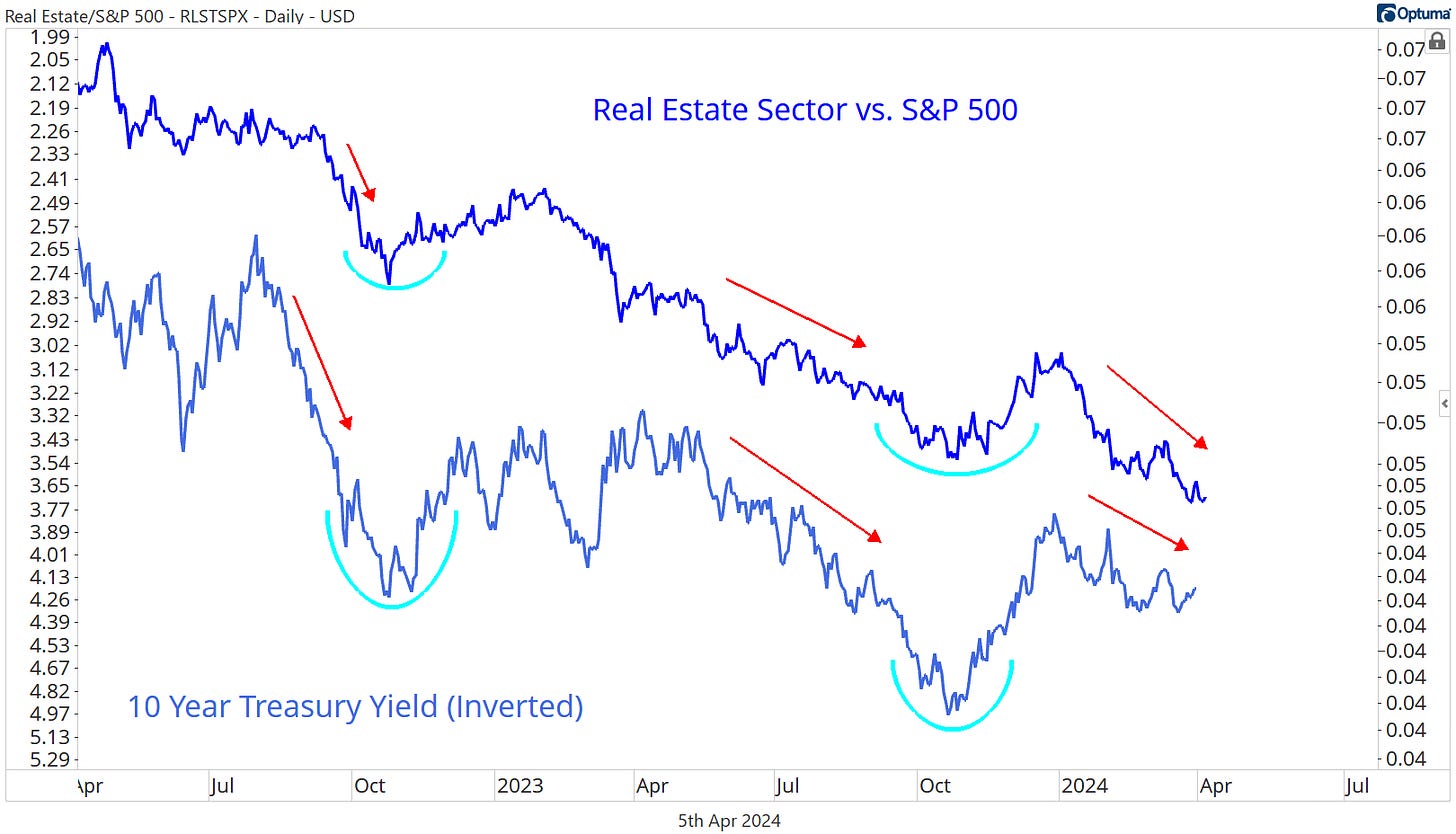

If you’re looking for a reason for Real Estate’s troubles, blame the rise in interest rates. Take the trend of the sector vs. the rest of the market, then overlay that with Treasurys. The relationship speaks for itself.

When interest rates go up, Real Estate underperforms.

Higher interest rates are a two-fold headwind. One, they make fixed income more attractive to investors and lower the relative appeal of stocks with high dividend yields. Consider this: Two years ago, 10- year Treasury rates were just 1.5%, while the dividend yield on Real Estate stocks was among the highest in the S&P 500 at about 3%. Today, the risk-free Treasury yield is about 4.4%, while Real Estate pays the highest dividend yield of any sector at just 3.5%. For income-focused investors, there’s little comparison.

Second, rates are a problem for the business activities of real estate stocks, which tend to have high debt loads. Real Estate has just a 2% market cap share of the S&P 500, but it has a 6% share of net interest expense. By that measure, Real Estate stocks are already paying 3x more interest than the average S&P 500 company. Only the Utilities compare, and they’re even worse, with a ratio of interest expense to market cap share of 8x.

The Utilities have one distinct advantage, though. The average maturity of debt for Utilities stocks is more than 10 years - double that of Real Estate at about 5 years. That means Real Estate companies will be repricing their high debt loads at higher interest rates at a much faster pace.

Underperformance is different from falling outright, though. Taken on its own, the Real Estate sector isn’t so bad. Even though they were among the worst performers in 2022 and failed to participate during most of the 2023 rally, Real Estate is making progress on reversing this multi-year downtrend. Last fall’s failed breakdown below the October ‘22 lows was a start, but now we’re waiting to see some incremental new highs.

Unfortunately, waiting around for new highs while the rest of the market is screaming higher doesn’t make for a compelling investment opportunity. Compared to the S&P 500, the Real Estate sector has been trending steadily lower throughout this bull market.

And even though more than half of S&P 500 Real Estate stocks are in long-term uptrends (if you define an uptrend as a stock trading above its 200-day moving average), Real Estate still has the weakest breadth characteristics of any sector in the market. That’s true whether you’re looking at the short, intermediate, or long-term.

Relative weakness and poor breadth makes the Real Estate sector a place we’d rather not visit - at least not until we see clear and convincing evidence of a change in the trend.

Digging Deeper - The Best Houses Stocks in a Bad Neighborhood Sector

The underperformance within Real Estate this year isn’t limited to a handful of names. Every single sub-industry has lagged the S&P 500 in 2024, and 10 of the 13 are in negative territory.

Leaders

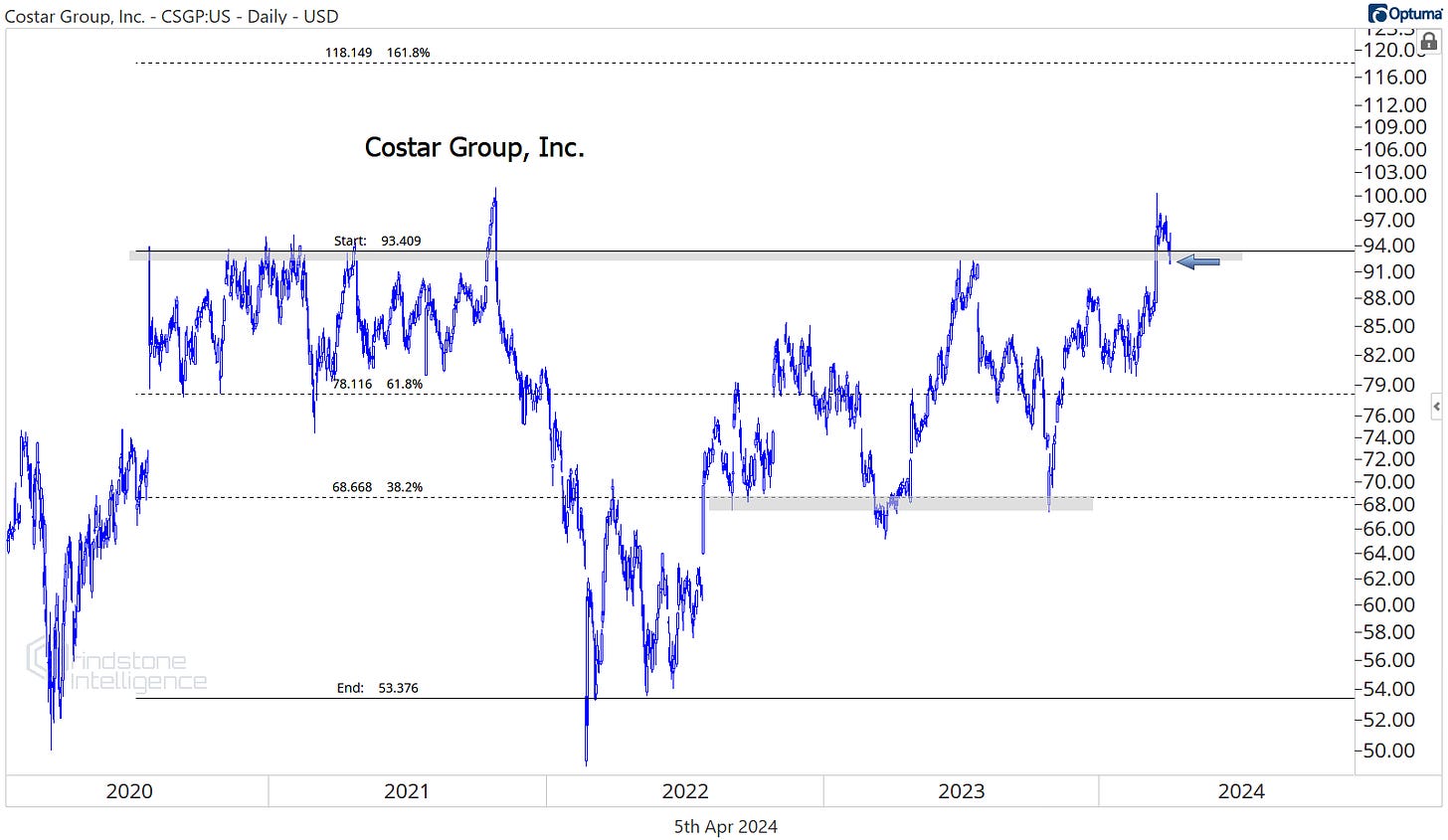

Costar Group was the best performing sector constituent over the last month, gaining 7.5%. That move briefly had CSGP trading at multi-year highs. The last few days of price action are concerning, though, and now the breakout is starting to look more like a failed move. We can’t be long if Costar is below $94.

If that failed moves turns out to be a false start and not the beginning of a trend reversal, CSGP could end up being a big winner. It’s working on a multi-year base relative to the rest of Real Estate:

On a renewed breakout, we can target $118 on CSGP.

We’ve got the same setup with Weyerhaeuser. It’s spent the last 2 years setting higher and higher lows, but it keeps getting rejected at the 2022 relative highs. We’re on breakout watch here.

But just like CSGP, we’ve got a failed breakout to deal with in the near-term. There’s no reason to be involved with WY if it’s below last year’s highs.

There’s no failed breakout to worry about with CBRE Group. It’s already setting new highs versus the rest of the sector. If we want relative strength, this is where it’s at.

We continue to like CBRE above $87 - which is the 161.8% retracement from the COVID decline and an important high in 2022 and 2023 - with a target of $122.

We spend most of our time looking for clear uptrends, rather than looking for downtrends that may or may not reverse. Remember, trends are always more likely to continue than reverse. That’s why they call them trends.

But we can still keep an eye on the potential reversals at hand, because often those reversals result in the biggest gains. Alexandria Real Estate outperformed over the last 4 weeks, and it’s making a lot of progress on reversing multi-year absolute and relative downtrends. Check out these inverse head and shoulders patterns:

We can’t touch this one unless we the neckline of those patterns break. If both of them do, though, we can be approaching ARE from the long side.

Losers

Most of the Real Estate stocks on the Losers list are there for a reason. They’re best left alone until further notice. Host Hotels is worth keeping an eye on, though. It’s showing some relative strength compared to the rest of the sector, despite lagging over the last 4 weeks.

Right now, HST is stuck below resistance at the 2022 highs. If we see the buyers able to absorb all that overhead supply at $21.50, we can own it with a target of $25, which is the 161.8% retracement from the 2020 decline.

One stands apart

All these other names we’ve looked at are showing relative strength within the sector, but remember that the sector we’re comparing to is literally the worst sector in the index. It’s not hard to do better than that.

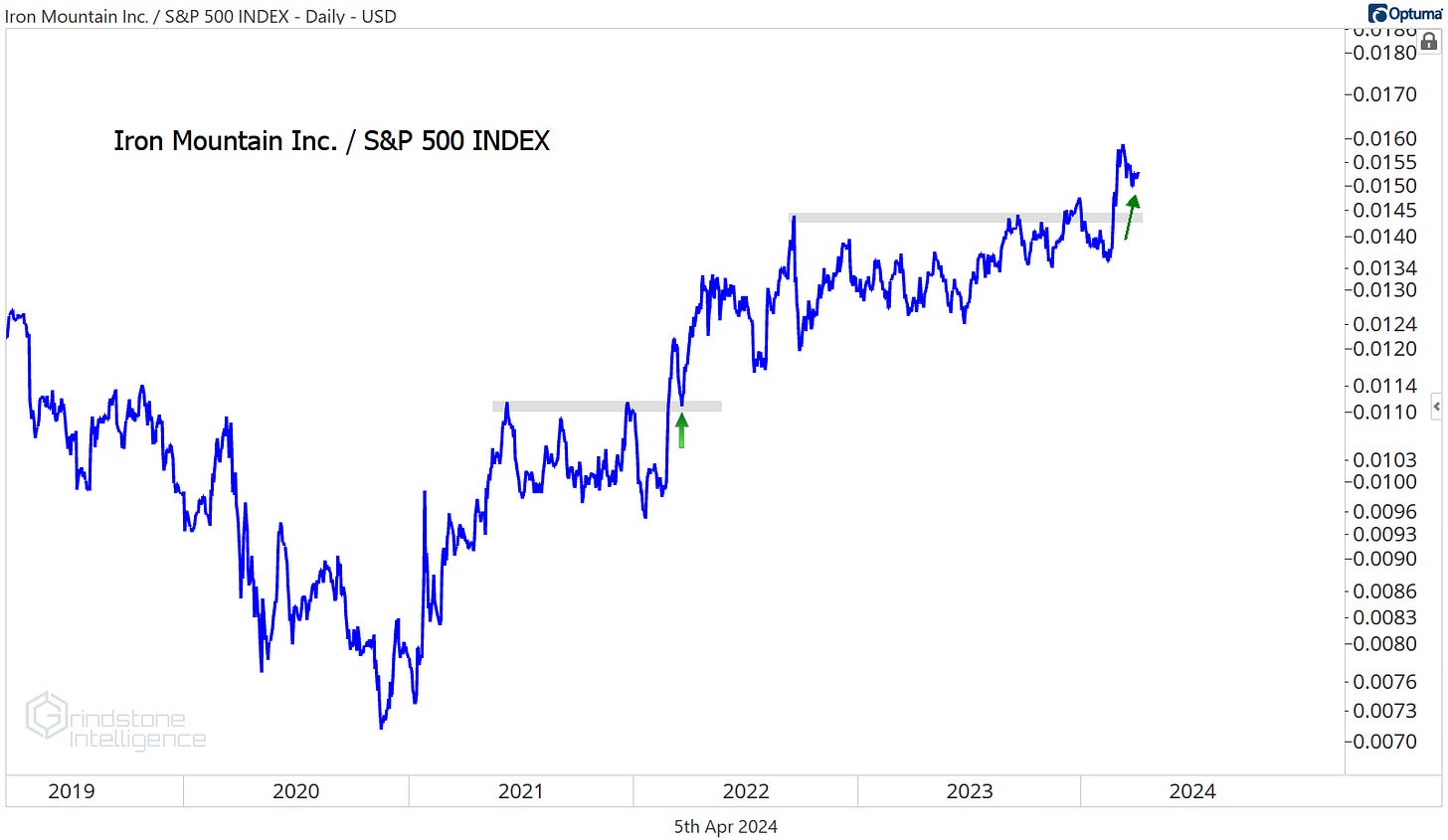

Only one Real Estate stock is showing relative strength vs. the S&P 500 as a whole, and that’s Iron Mountain.

We love this setup as IRM consolidates above the 423.6% retracement from the 2020 decline. As long as it’s above $76, we want to be buying it with a target up at $110.

That’s all for today. Until next time.