Real Estate vs. Interest Rates

Top charts and trade ideas from the smallest S&P 500 sectors

The Real Estate sector has been down in the dumps for most of the last two years. From the start of the 2022 bear market to today, Real Estate has fallen 20%. By comparison, the next worst sector is Utilities, down just 12% from its highs. And 5 sectors - Energy, Information Technology, Industrials, Health Care, and Communication Services - are all higher than they were back then.

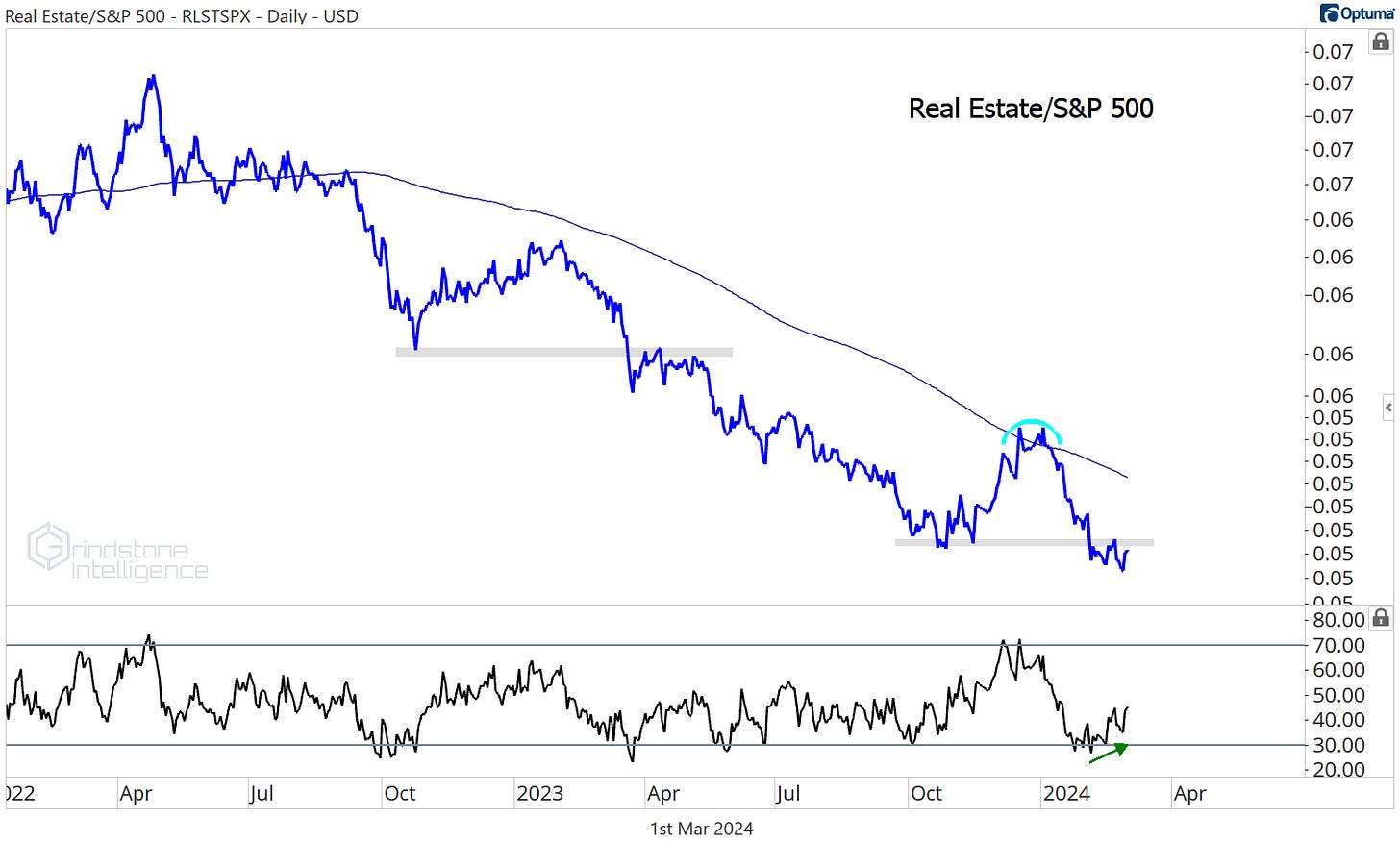

If you’re looking for a reason for Real Estate’s troubles, blame the rise in interest rates. Take the trend of the sector vs. the rest of the market, then overlay that with Treasurys. The relationship speaks for itself.

When interest rates go up, Real Estate underperforms.

Higher interest rates are a two-fold headwind. One, they make fixed income more attractive to investors and lower the relative appeal of stocks with high dividend yields. Consider this: Two years ago, 10- year Treasury rates were just 1.5%, while the dividend yield on Real Estate stocks was among the highest in the S&P 500 at about 3%. Today, the risk-free Treasury yield is about 4.25%, while Real Estate pays the highest dividend yield of any sector at just 3.5%. For income-focused investors, there’s little comparison.

Second, rates are a problem for the business activities of real estate stocks, which tend to have high debt loads. Real Estate has just a 2.5% market cap share of the S&P 500’s, but it has a 5.5% share of net interest expense. By that measure, Real Estate stocks are already paying 2.5x more interest than the average S&P 500 company. Only the Utilities compare, and they’re even worse, with a ratio of interest expense to market cap share of 6x.

The Utilities have one distinct advantage, though. The average weighted average maturity for Utilities stocks is more than 13 years - double that of Real Estate at 6.7x. That means Real Estate companies will be repricing their high debt loads at higher interest rates at a much faster pace.

Underperformance is different from falling outright, though. Taken on its own, the Real Estate sector isn’t so bad. Even though they were among the worst performers in 2022 and failed to participate during most of the 2023 rally, Real Estate is making progress on reversing this multi-year downtrend. Last fall’s failed breakdown below the October ‘22 lows was the catalyst we needed for a big rally higher.

The ensuing breakout above the above the summer highs confirmed that it was more than just a mean reversion. As long as the XLRE is hanging above $38-39, we can call this a new uptrend in the Real Estate sector.

But an uptrend is exactly what we should be seeing in Real Estate. This is a bull market after all - almost everything goes up in a bull market. That’s the definition of a bull market.

We don’t have the capacity to buy every uptrend we see, though, so instead we have to focus on relative strength. When everything is going up, we want to own the things that are going up the most. And that’s not Real Estate. Compared to the S&P 500, the Real Estate sector has been stuck below a falling 200-day moving average for most of the last 18 months.

It’s not that we want to be shorting Real Estate (we just saw that the sector is in the early stages of a new uptrend), it’s just that we don’t want to be buying them.

That is, not unless this potential bullish momentum divergence in the ratio of Real Estate stocks vs. the S&P 500 gets confirmed by price. If this turns into a failed breakdown, we’d need to be prepared for a mean reversion higher in Real Estate at the very least. It could even be the start of a major trend reversal.

But we don’t need to be making that bet unless and until we see it happen. Remember, trends are always more likely to continue than reverse. They don’t hand out medals for predicting bottoms - we can wait for the evidence to pile up and then react and adjust if needed.

Digging Deeper

Just two Real Estate sector sub-industries have outperformed the benchmark S&P 500 over the last six months: Hotel & Resort REITS and Data Center REITS.

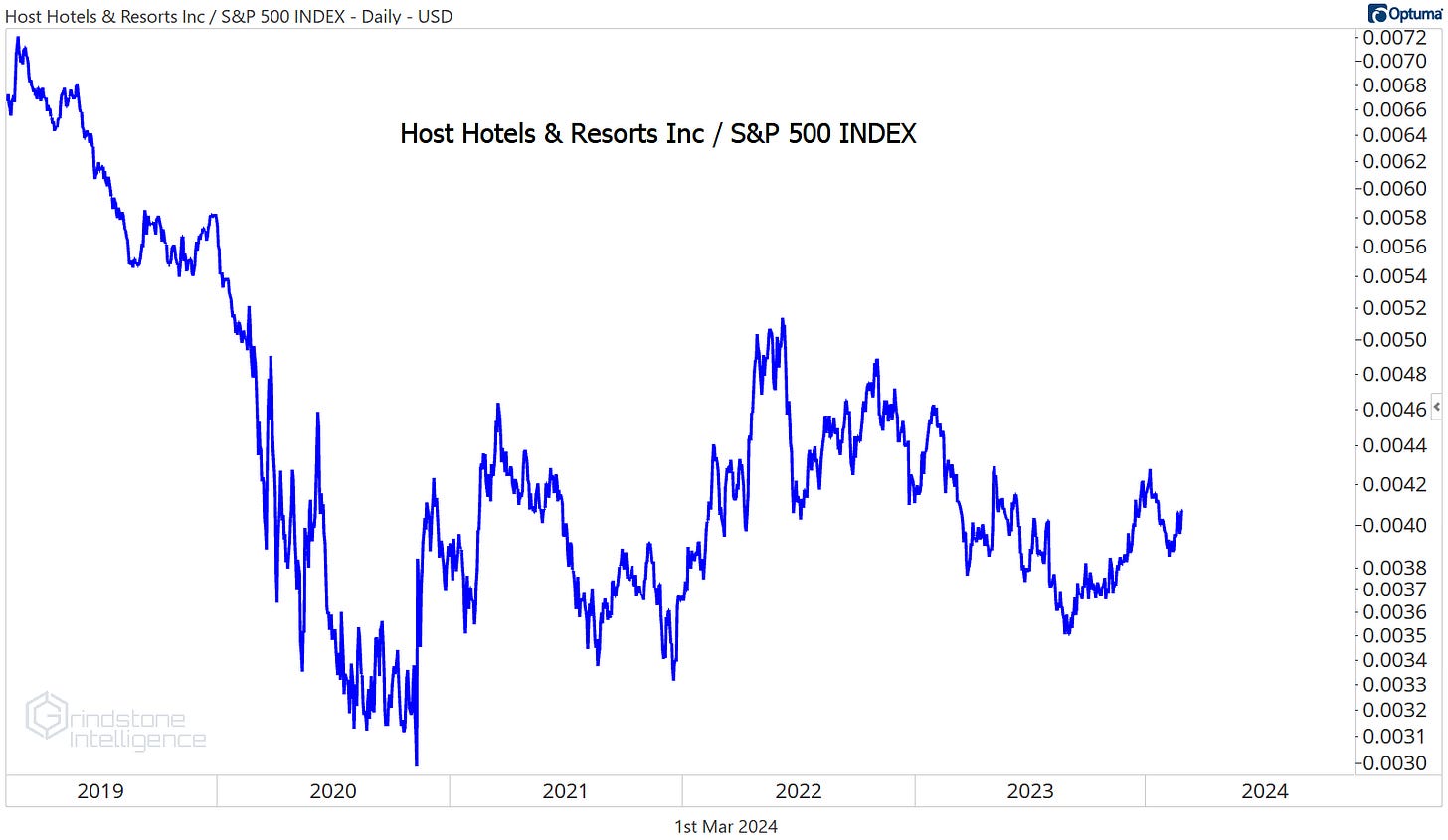

Check out the relative strength here in Host Hotels when compared to the rest of the Real Estate sector.

Outperforming what’s arguably the worst sector isn’t that impressive in the grand scheme of things, though. Compared to the market overall, HST still has some work to do.

If Real Estate as a whole starts to outperform, then this is one we want to be keeping a close eye on. Until then, we’re better off focusing our attention elsewhere.

Digital Realty is one we can be looking at right now. Relative to the SPX, DLR is above a rising 200-day and is consolidating above support from the fall 2022 - spring 2023 highs.

We like DLR here as long as it’s above $140 with a target back at the former highs of $175.

Leaders

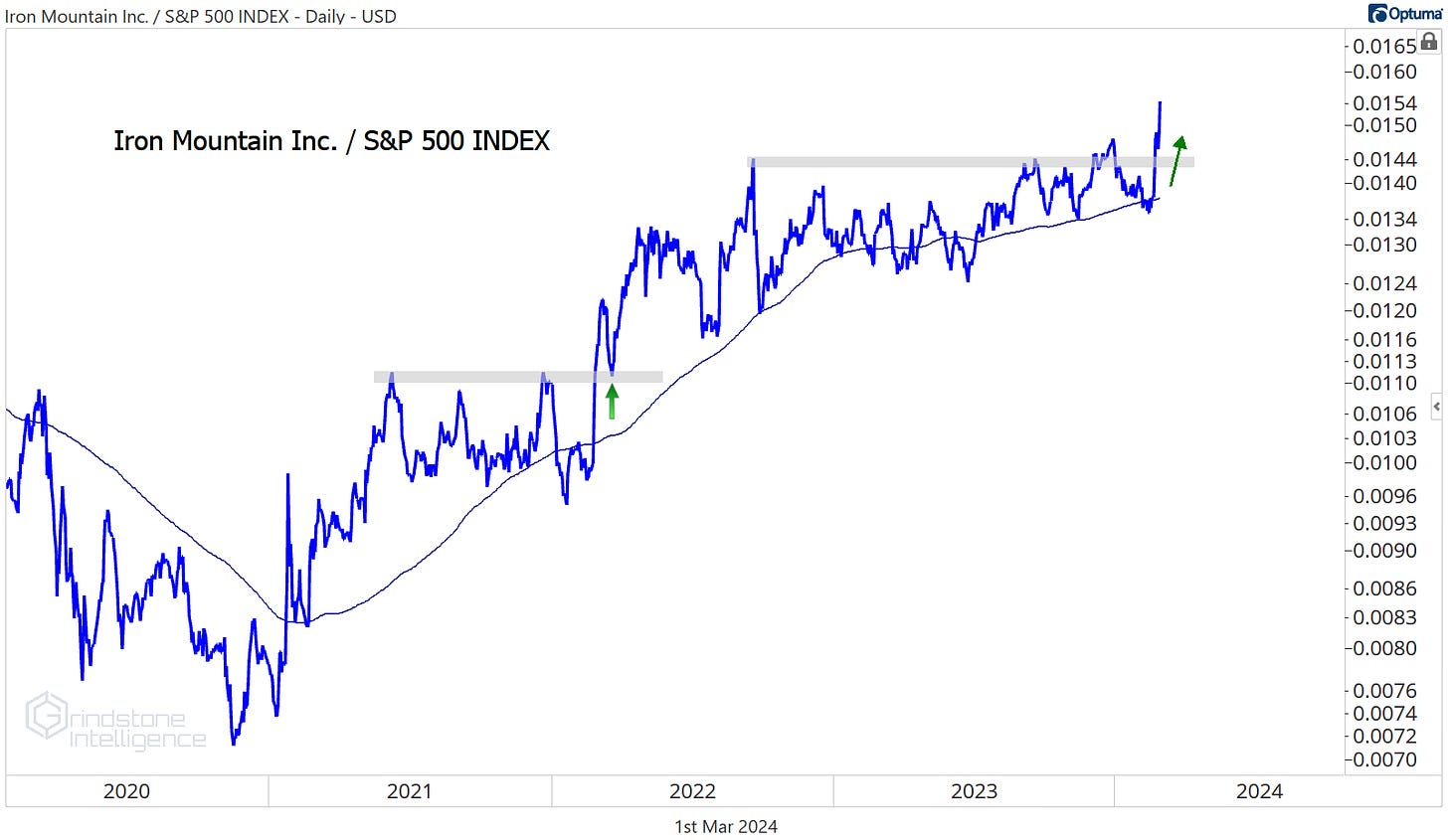

Iron Mountain was the top performing stock in the sector over the last month as it surged up to - and past - our $76 target.

We want to see how IRM responds to this potential resistance area near the 423.6% retracement from the 2020 decline, but it needs to remain at the top of the watchlist. Why? Check out the relative strength vs. the rest of the market. It just hit multi-year highs against the S&P 500 after an 18-month consolidation.

We can approach IRM from the long side as long as it remains above $75, with a target of $110.

CBRE has been our other favorite in the Real Estate space, and the risk/reward setup here is still very clean. We want to own CBRE above $87 with a target of $122.

Especially as it hits all-time highs relative to the rest of the Real Estate sector.

Equinix is another one to keep a close eye on as it challenges the all-time highs set back in mid-2021:

If it’s above those highs, we can be long with a target of $1120, which is the 161.8% retracement from the entire 2021-2022 decline.

Losers

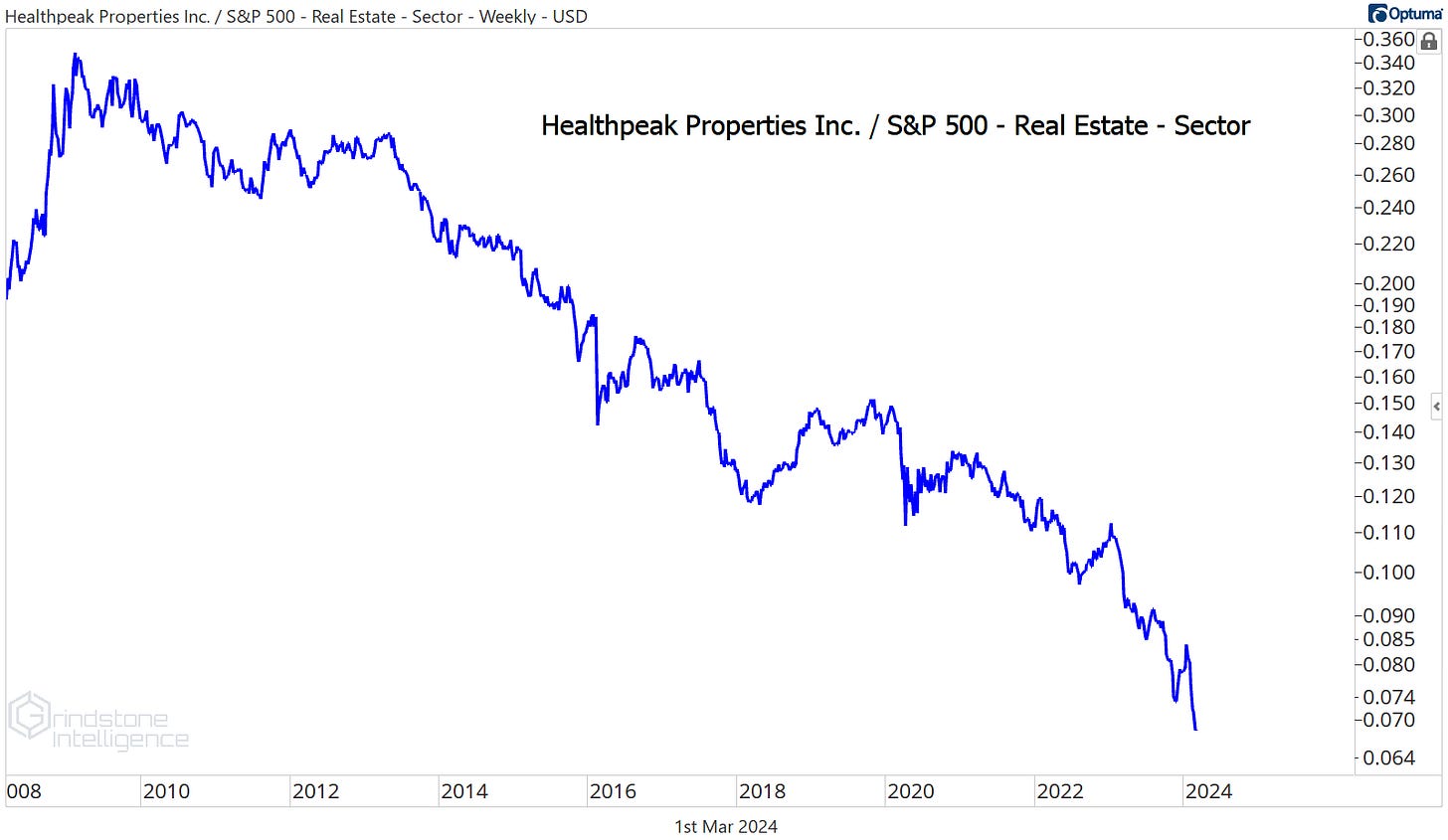

We try not talk about too many short ideas when stocks are in a bull market, but the setup in Healthpeak Properties was too clean to ignore last month. It fell 11% over the last 4 weeks to near last year’s lows.

Maybe the bottom is in here, but we don’t want to be trying to catch a falling knife. Weakness begets more weakness, and this one is at all-time lows compared to both the overall market and the lagging Real Estate sector.

There’s no reason to be involved with garbage like that.

More Charts to Watch

The Real Estate sector makes up just a few percent of the S&P 500, so there aren’t as many things to look at. The same goes for the Utilities and Materials sectors. Since they just aren’t that big or meaningful, we don’t want to devote an entire writeup to either of them right now. But we do want to point out a few of the most interesting setups in those groups.

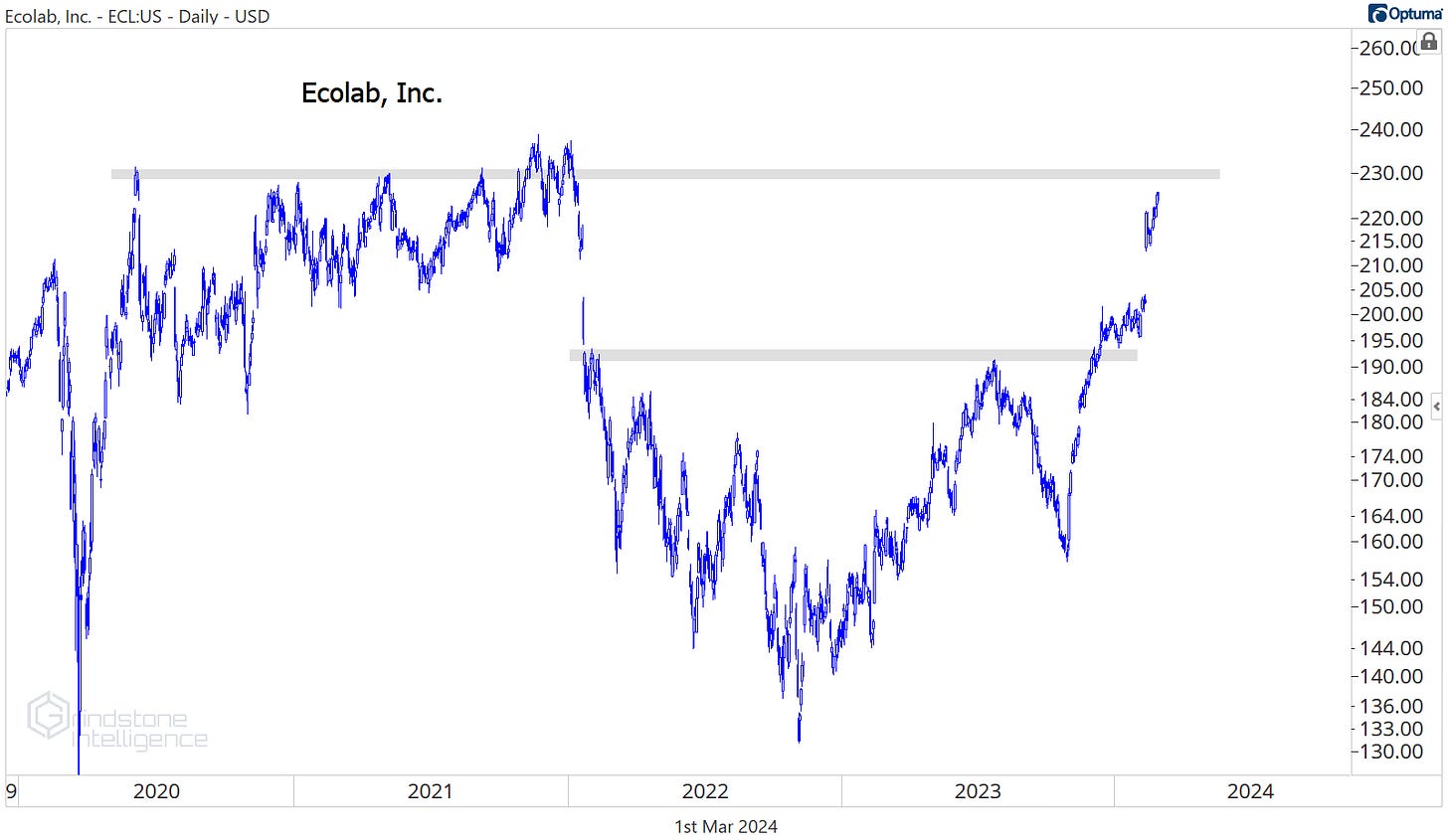

Within the Materials space, check out Ecolab coming out of a multi-year inverse head and shoulders reversal pattern when compared to the S&P 500. Just beautiful.

All the gaps make this a tough one to manage risk for, especially as it approaches the former highs. On a breakout above those highs, though, we’ll be looking for ways to get on the long side.

Martin Marietta we’ve liked for a long time, and we still think it goes to $750.

The relative strength is what pushed it to the top of our radar. Compared to the S&P 500, it came out of a 4-year base in the middle of 2023, then broke to new relative highs over the past few weeks following an 8-month consolidation. New highs aren’t bearish.

Nucor could be the next to see a big breakout on a relative basis. Compared to the SPX, it’s gone nowhere for the past 2 years, but it’s challenging those 2022 highs again right now.

We’ve already gotten the breakout for NUE on its own. We want to be buying it as long as it’s above the 2022 highs with a target of $220, which is the 161.8% retracement from the 2022 decline.

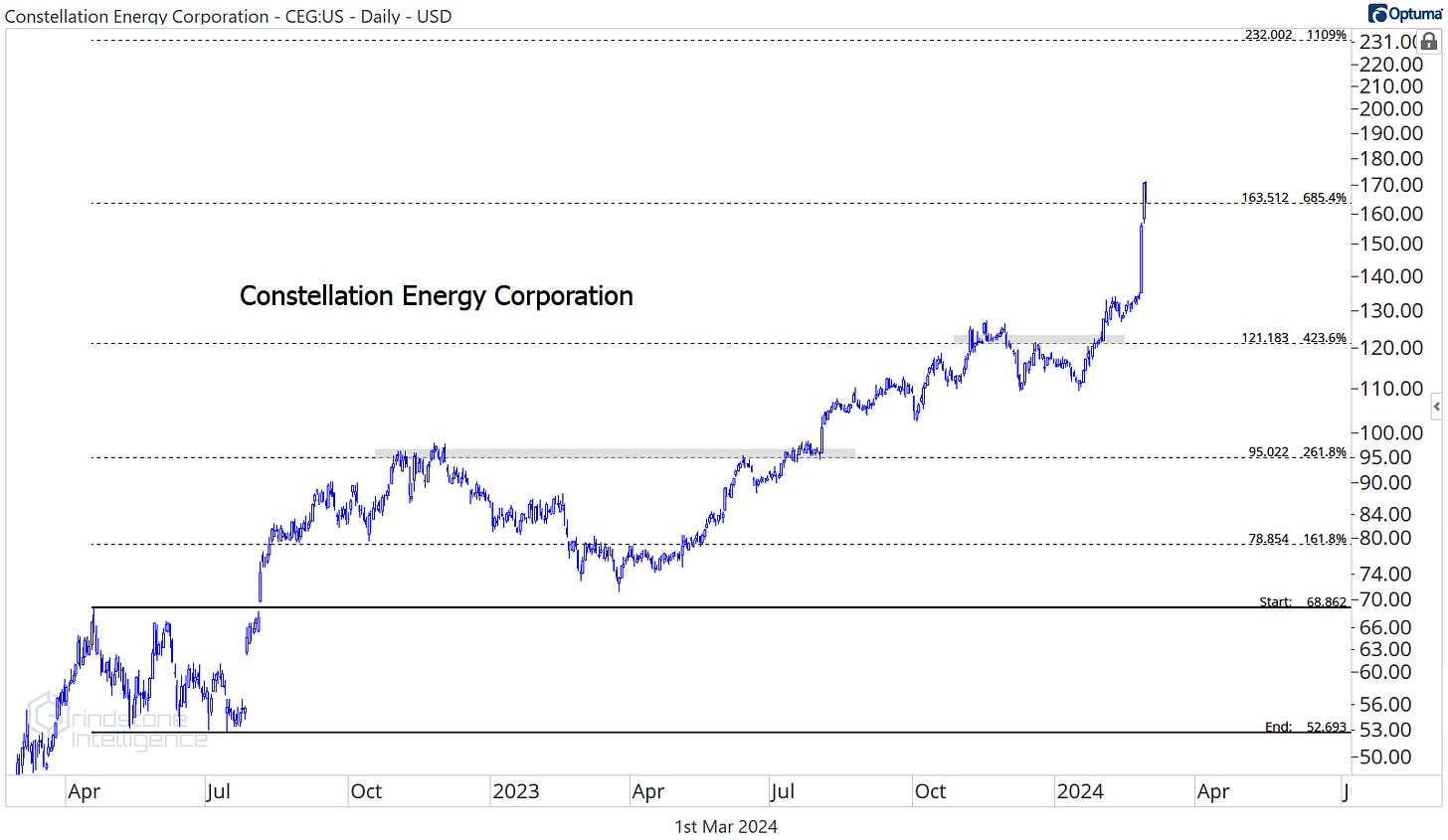

Within the Utilities, Constellation Energy hit our target of $165, albeit a lot more quickly than we expected it would.

A neutral approach is best on the stock for now as it digests the huge gains, but after some consolidation, we like it long above $165 with a target of $230.

Until next time.